There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

A complete guide on how these #Option Greeks impact option price.

A complete guide on how these #Option Greeks impact option price.

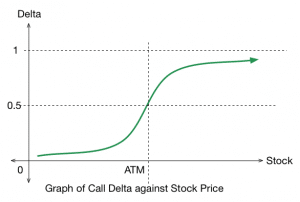

1/ Delta:

Delta is a measure of the sensitivity of an option’s price changes relative to the changes in the underlying asset’s price. In other words, if the price of the underlying asset increases by 1 points, the price of the option will change by delta amount.

Delta is a measure of the sensitivity of an option’s price changes relative to the changes in the underlying asset’s price. In other words, if the price of the underlying asset increases by 1 points, the price of the option will change by delta amount.

Call option has positive delta, and put option has a negative delta.

As the options become ITM, the value of delta tends towards +1 for call and -1 for put.

Delta is important greeks to determine the hedge ratio for investors who want to hedge their portfolio.

As the options become ITM, the value of delta tends towards +1 for call and -1 for put.

Delta is important greeks to determine the hedge ratio for investors who want to hedge their portfolio.

2/ Gamma:

Gamma (Γ) is a measure of the delta’s change relative to the changes in the price of the underlying asset.

If the price of the underlying asset increases by 1 points, the option’s delta will change by the gamma amount.

Long options (call/put) have positive Gamma.

Gamma (Γ) is a measure of the delta’s change relative to the changes in the price of the underlying asset.

If the price of the underlying asset increases by 1 points, the option’s delta will change by the gamma amount.

Long options (call/put) have positive Gamma.

Gamma decreases as options move away from ATM, i.e. as options become OTM/ITM.

Think like this, Delta is basically the velocity and gamma is acceleration as taught in the physics.

Think like this, Delta is basically the velocity and gamma is acceleration as taught in the physics.

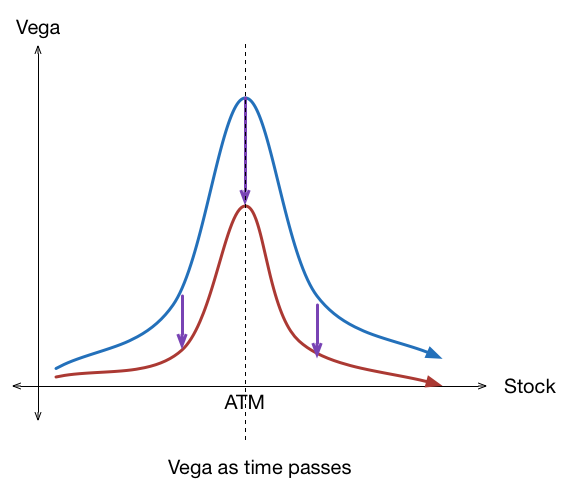

3/ Vega:

Vega (ν) is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset. If the volatility of the underlying asset increases by 1%, the option price will change by the vega amount.

Vega (ν) is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset. If the volatility of the underlying asset increases by 1%, the option price will change by the vega amount.

An increase in vega generally corresponds to an increase in the option value (both calls and puts) and a decrease in vega means a decrease in the option value for both calls and puts.

Rising vega is a friend of option buyers and falling vega is a friend of option sellers.

Rising vega is a friend of option buyers and falling vega is a friend of option sellers.

4/ Rho:

Rho (ρ) measures the sensitivity of the option price relative to interest rates and it is least significant Option Greeks because option price are less sensitive to interest rate. If an interest rate increases by 1%, the option price will change by the rho amount.

Rho (ρ) measures the sensitivity of the option price relative to interest rates and it is least significant Option Greeks because option price are less sensitive to interest rate. If an interest rate increases by 1%, the option price will change by the rho amount.

If the interest rate rises, then the value of the call option will rise and the value of put option will fall.

Similarly, if the interest rate decrease, then the value of the call option will fall and the value of the put option will rise.

Similarly, if the interest rate decrease, then the value of the call option will fall and the value of the put option will rise.

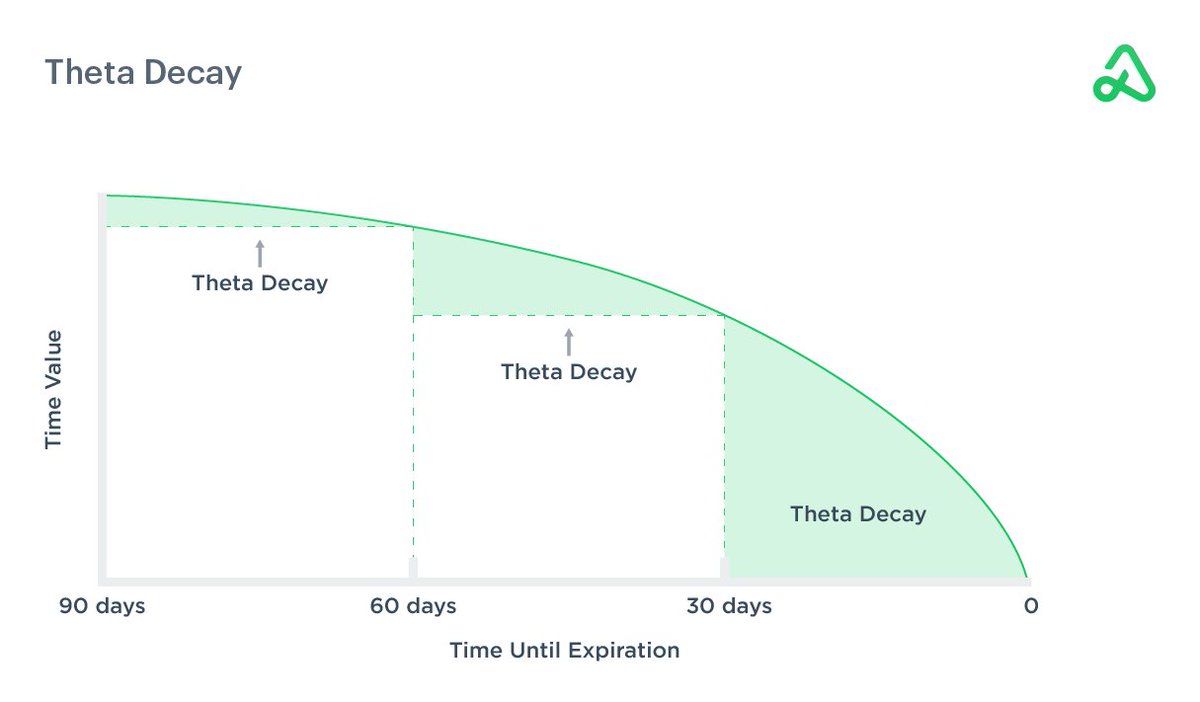

5/ Theta: Most important Option Greeks for Option Seller.

Theta (θ) is a measure of the sensitivity of the option price relative to the option’s time to maturity. If the option’s time to maturity decreases by one day, the option’s price will change by the theta amount.

Theta (θ) is a measure of the sensitivity of the option price relative to the option’s time to maturity. If the option’s time to maturity decreases by one day, the option’s price will change by the theta amount.

Theta is negative for both call and put options. As the expiry date is fixed and as options move closer to the expiry, the premium will go down or melt.

Also, the value of the option for far expiry will be more than near expiry as it has more time left for expiry.

Also, the value of the option for far expiry will be more than near expiry as it has more time left for expiry.

This is the complete digest for the Options Greeks.

For me, the most important Greeks are Theta and Vega, as I am an option seller.

If you found this useful, please do RT the first tweet.

Follow @YMehta_ for more such learning related to trading.

For me, the most important Greeks are Theta and Vega, as I am an option seller.

If you found this useful, please do RT the first tweet.

Follow @YMehta_ for more such learning related to trading.

https://twitter.com/YMehta_/status/1566282416326463488

• • •

Missing some Tweet in this thread? You can try to

force a refresh