@CFASocietyIndia had a very interesting session at Chennai on Sep 2, 2022 on "Art of Investing" by @safalniveshak with @arun_kumar_r interacting with him with a great set of questions.

(1/n)

(1/n)

He started sharing a slide on how a portfolio of stocks (mostly consumer) picked by his teenage daughter o/p broader markets.

For a moment, I thought I should do a wapsi of my CFA charter and the other degrees!

(2/n)

For a moment, I thought I should do a wapsi of my CFA charter and the other degrees!

(2/n)

Even as I was contemplating, he mentioned about Beginners luck and introduced Dunning-Kruger effect that comforted me a bit

(3/n)

(3/n)

He went on to explain the #Feynman technique and how he worked on it to explain various ideas to his daughter when she was in middle & high school

(My biggest take away was this - as I struggle to explain some stuff)

(4/n)

(My biggest take away was this - as I struggle to explain some stuff)

(4/n)

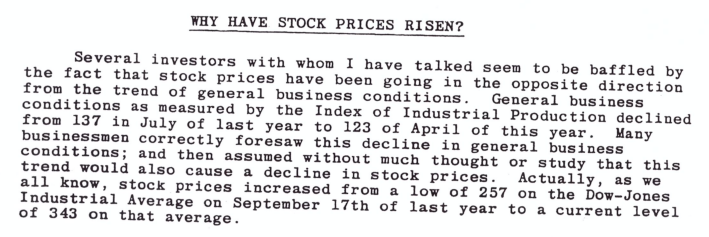

He used a variant of this chart (Fake Value Investors disappear) to explain why value investing works in the long run

My take away - markets will remain inefficient in pockets with participants that have misunderstood the idea! [Be it value or growth or cyclical investing]

(5/n)

My take away - markets will remain inefficient in pockets with participants that have misunderstood the idea! [Be it value or growth or cyclical investing]

(5/n)

The core of his talk was on 3 things

(a) Patience

(b) Humility &

(c) Rationality

(6/n)

(a) Patience

(b) Humility &

(c) Rationality

(6/n)

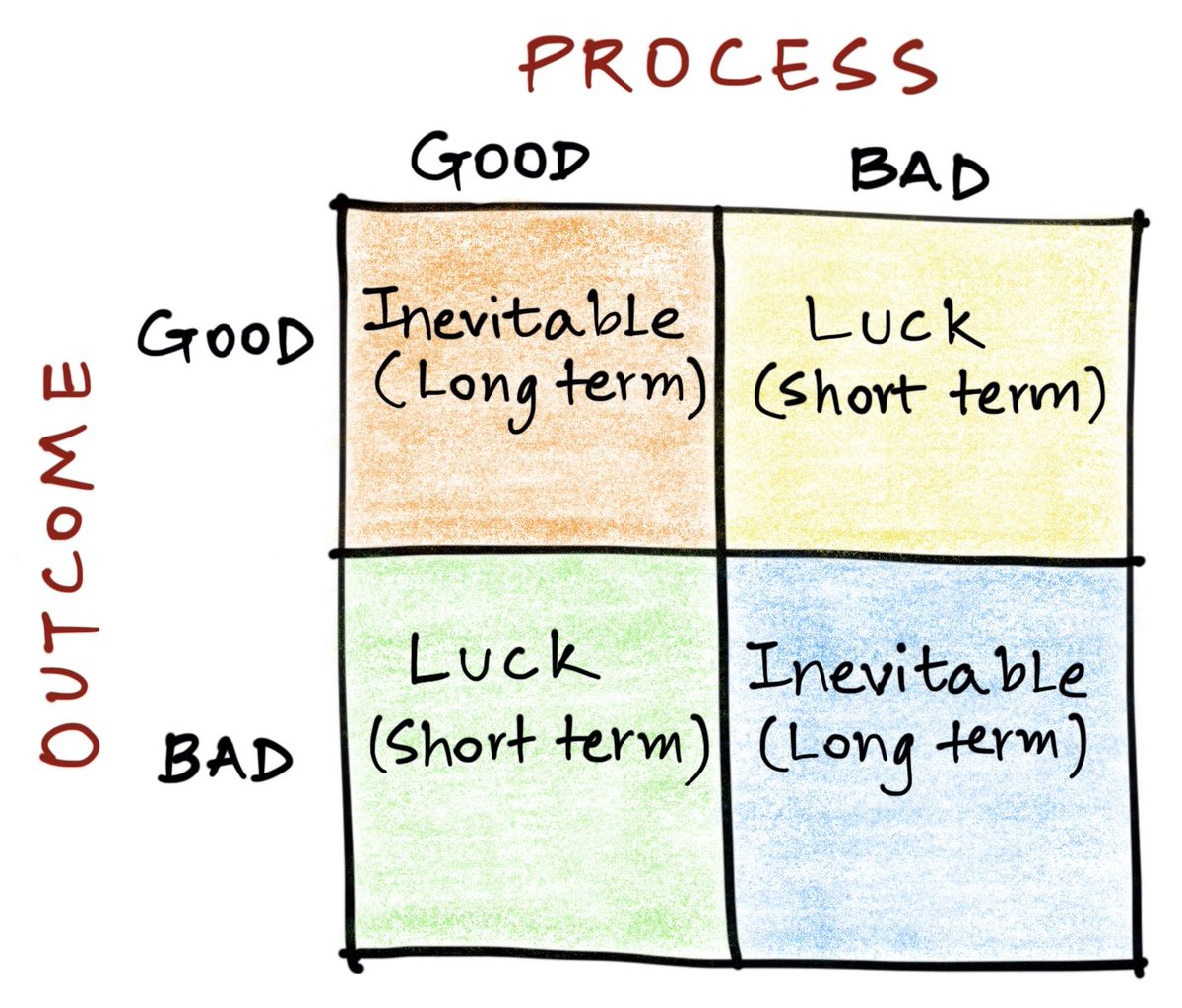

Patience is not just waiting, but what you do and how you act when you wait.

Having the right process helps you to wait out during periods of -ve or zero returns to hold on to convictions

A good process leads to good outcome in long run!

(7/n)

Having the right process helps you to wait out during periods of -ve or zero returns to hold on to convictions

A good process leads to good outcome in long run!

(7/n)

Humility is knowing what you do not know.

The more you know, you realise the more you do not know.

A great explanation on how an expanding circle of competence leads to an expanding "shoreline" of ignorance.

(8/n)

The more you know, you realise the more you do not know.

A great explanation on how an expanding circle of competence leads to an expanding "shoreline" of ignorance.

(8/n)

Made a very interesting point on reading - You read not to know more, but to know that you do not know a lot [not his exact statement, but what I made of his point]!

This was an interesting take on reading for me. I practice "tsundoku" this resonated with me!

(9/n)

This was an interesting take on reading for me. I practice "tsundoku" this resonated with me!

(9/n)

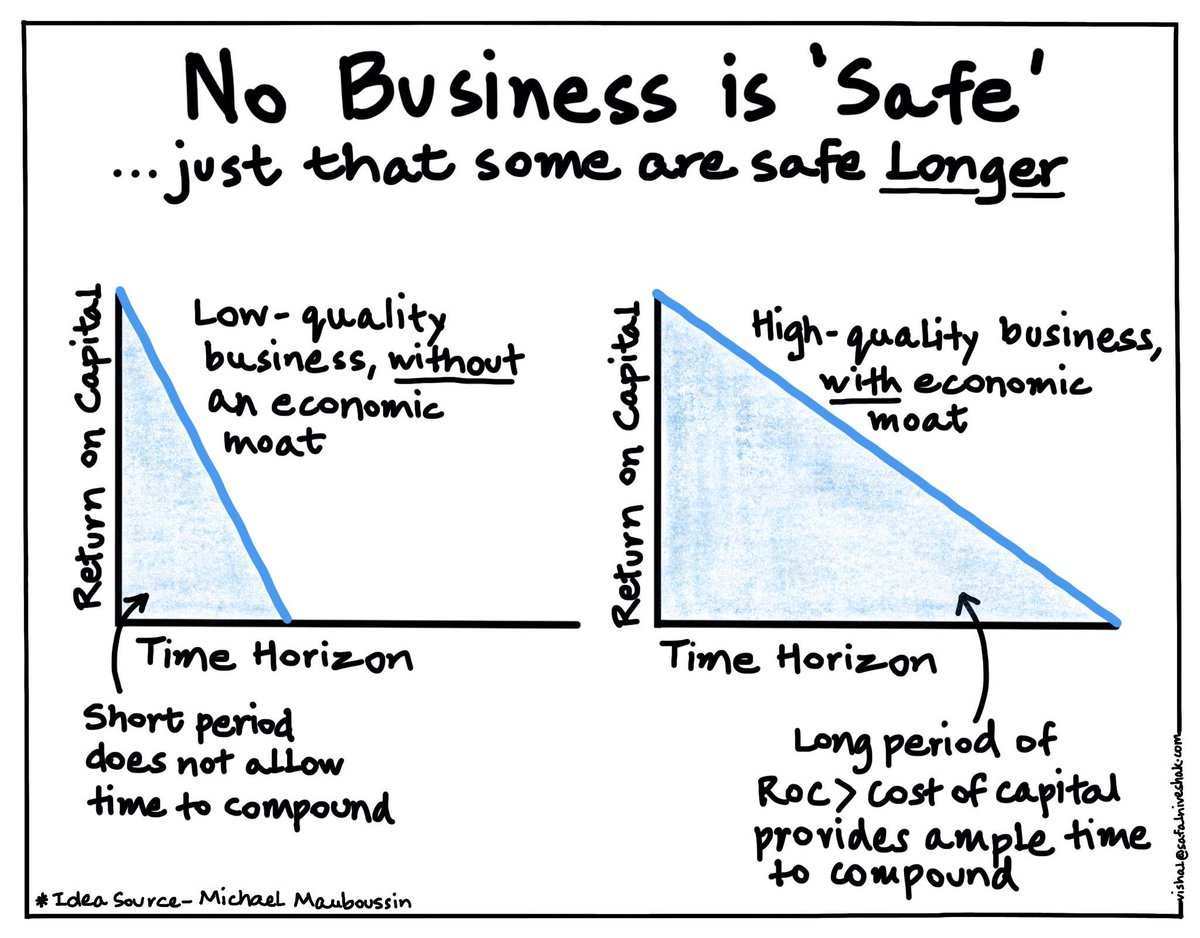

The 3rd point on Rationality - the business survival periods are getting shorter. So watch out.

Having a moat increases the period a business has to compound and create wealth

(11/n)

Having a moat increases the period a business has to compound and create wealth

(11/n)

Then he dwelled on having a process to understand businesses, valuation (How a good business at high valuation is not buy, but watch) etc.

Finally that I have some ability to do all these over my teen daughter made me realise that my training (and CFA) is helpful!

(12/n)

Finally that I have some ability to do all these over my teen daughter made me realise that my training (and CFA) is helpful!

(12/n)

Follow @safalniveshak for more gems.

And @arun_kumar_r

Arun's magnum opus here

eightytwentyinvestor.com/2018/01/26/sea…

(14/n - end)

And @arun_kumar_r

Arun's magnum opus here

eightytwentyinvestor.com/2018/01/26/sea…

(14/n - end)

Vishal's illustrations here

safalniveshak.com/wall/

Vishal's articles here

vishalkhandelwal.com/articles/

safalniveshak.com/wall/

Vishal's articles here

vishalkhandelwal.com/articles/

• • •

Missing some Tweet in this thread? You can try to

force a refresh