The more I think about all of the moving parts of the #uranium sector and the various factors affecting this investment, the more difficult it is to summarize into a concise tweet.

Hour-long interviews that feel like they could go for three and still not cover it all...

Hour-long interviews that feel like they could go for three and still not cover it all...

In an attempt to put a finer point on what I see now and what is incoming for this trade, the primary fundamental development that is underpinning a complex set of variables is the rapid change in Western fuel cycle fundamentals and the resultant shift in utilities' behaviors...

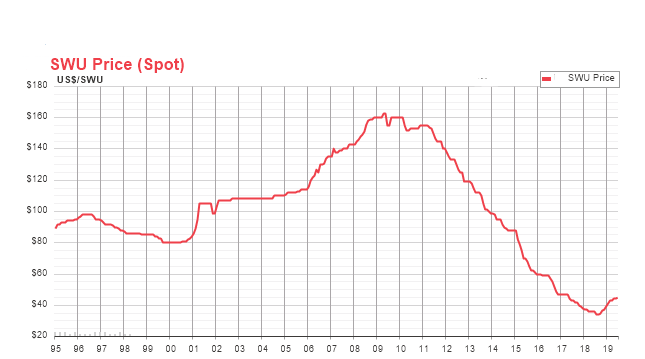

We have to first frame a generalization of utilities' behaviors over the last decade or so, during which all elements of the fuel cycle saw declining price action due to an over-abundance of supply...a veritable "buyers' market." This was a very lengthy directional trend...

...during which time excess enrichment capacity led to falling SWU prices and persistent underfeeding that reduced the need for both mined U3O8 and UF6 – hence the mine closures and conversion facility closures.

This lengthy trend led to significant recency bias,...

This lengthy trend led to significant recency bias,...

...an expectation that the present and recent-past conditions will persist...and if you were a fuel buyer that only paid attention to the publications from the nuclear fuel consultants, you had no reason to believe otherwise.

As a fuel buyer you work with a budget, and are...

As a fuel buyer you work with a budget, and are...

...not paid to predict the future nor "take one for the team" by paying significantly higher than market prices to secure long-term contracts with producers that need incentive prices (eg: LTC w/ Cameco in 2019 ~$40+/lb. fixed vs. a mid-term carry trade contract ~$30/lb.).

In a strange way – despite the persistent warnings to utilities from certain producers and the investment community (@SachemCove, @SegraCapital) – the market was destined to pan out in this manner, IMO. Carry trades, abundant SWU & UF, cheap spot U3O8 & UF6, all do not point...

...to a "looming supply shortage" – for utilities or nuclear consultants.

But, the investment community could see it, and the price response for all elements of the fuel cycle in the past few years have proven it.

What is happening now is a monumental shift in how Western...

But, the investment community could see it, and the price response for all elements of the fuel cycle in the past few years have proven it.

What is happening now is a monumental shift in how Western...

...utilities are and will be procuring nuclear fuel going forward in this newly bifurcated uranium and services (conversion, enrichment) market. Importantly, Western utilities make up ~70% of the global nuclear mix.

The surplus of uranium was a temporary phenomenon...

The surplus of uranium was a temporary phenomenon...

...as surpluses and deficits typically are in commodities markets. However, the complacency of many Western nuclear utilities with regards to topping-up inventories with short & mid-term spot purchases and carry trades in-place of securing long-term uranium contracts has led ...

...us to this pivotal moment that – unfortunately for the utilities – happens to be coinciding with a newly-bifurcated market, limited Western enrichment capacity relative to Western enrichment demand, and insufficient long-term U3O8 contracts as feedstock for conversion and...

...enrichment.

So, now we have Western utilities securing critical enrichment contracts ex-Russia...contracts that have MUCH higher tails assays than we have seen for many years, and that require significantly larger amounts of feedstock (#uranium).

The double-whammy of...

So, now we have Western utilities securing critical enrichment contracts ex-Russia...contracts that have MUCH higher tails assays than we have seen for many years, and that require significantly larger amounts of feedstock (#uranium).

The double-whammy of...

...higher tails assays is the slowing/stopping of underfeeding by Western enrichers – a major, reliable source of secondary supply.

To paraphrase all of the above, the nuclear fuel market that typically moves at a glacial pace is shifting in an instant...and the resultant...

To paraphrase all of the above, the nuclear fuel market that typically moves at a glacial pace is shifting in an instant...and the resultant...

...increase in demand for uranium going forward will put large and consistent upward pressure on the price of spot and long-term U3O8.

A multi-year long-term contracting and inventory re-stocking cycle has now begun.

A multi-year long-term contracting and inventory re-stocking cycle has now begun.

Demand for conversion and enrichment = demand for #uranium – it cannot be any other way. The gasoline on the fire is the 30+ million lb. swing in supply/demand due to underfeeding shifting to overfeeding and higher TA for Western enrichers.

One last thought – the global energy crisis and multi-country support of operating reactors is likely to positively influence the primary concern for utilities: security of supply.

We are about to find out what U3O8 price discovery really looks like.

We are about to find out what U3O8 price discovery really looks like.

• • •

Missing some Tweet in this thread? You can try to

force a refresh