Leading Newsletter solely focused on nuclear energy & uranium equities. Inception-to-Date Performance: 530.5% ($100,000 on August 1, 2019 now worth $630,500).

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/newuraniumhope/status/1964064867691671976I also believe that we won’t see reactors unable to be fueled. But certain industry veterans don’t necessarily agree with me. We’ll have to see how it all plays out, but high-level, @NewUraniumHope is right. Higher prices are inevitable.

https://twitter.com/quakes99/status/1888619338359595091production. They have produced an average of just over 8mlbs./yr over the past six years. Our S/D model (and others I've seen) imputed closer to a 3-4% CAGR for the next decade. At the now expected ~1% CAGR, OD's production will remain <9mlbs./yr out to 2035. Importantly...

https://twitter.com/uraniuminsider/status/1663942924395225090While there is plenty of historical precedent for market appreciation based on improving fundamentals – and especially related equities to a rising commodity price – it STILL is no guarantee that your position(s) will move "as they should," ESPECIALLY in the short term.

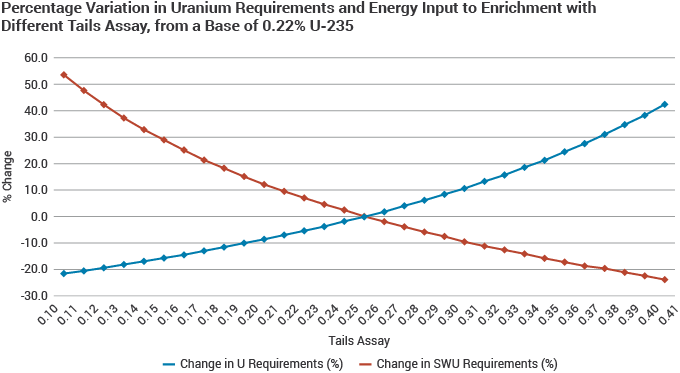

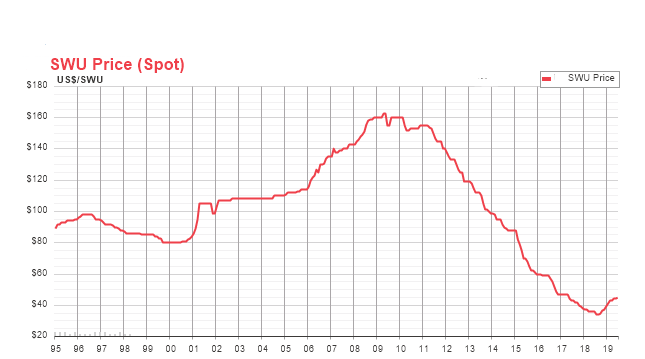

https://twitter.com/PauloMacro/status/1613009339530334208Overfeeding, by definition, is enrichers purchasing UF6 or U3O8 + conversion (both are happening now) in order to produce more enriched uranium (EUP), faster, by raising the operational tails higher than what was dictated in the enrichment contract.

https://twitter.com/quakes99/status/1430876227691159555

2) My understanding is that wellfield development is what is primarily impacted with employee shortages (Covid), though this does not take into account potential supply chain problems.

2) My understanding is that wellfield development is what is primarily impacted with employee shortages (Covid), though this does not take into account potential supply chain problems.