Has inflation peaked, or is this only the very beginning of a period of structurally higher inflation?

Time for a thread🧵 on globalization, inflation, deflation, and hyperinflation👇

1/

Time for a thread🧵 on globalization, inflation, deflation, and hyperinflation👇

1/

Nobody in macroeconomic circles knows what's coming next.

Will the central banks save us from a recession?

Or will they crush the demand too much and send us into an economic depression?

Are we gonna see a $50 barrel of oil, or are we gonna see a $200 barrel of oil?

2/

Will the central banks save us from a recession?

Or will they crush the demand too much and send us into an economic depression?

Are we gonna see a $50 barrel of oil, or are we gonna see a $200 barrel of oil?

2/

Has inflation peaked?

What if the inflation we’re seeing today could actually be some of the lowest levels of inflation that we’re going to see this decade!

Most think that's IMPOSSIBLE, but ''deglobalization'' might have something to say about this!

3/

What if the inflation we’re seeing today could actually be some of the lowest levels of inflation that we’re going to see this decade!

Most think that's IMPOSSIBLE, but ''deglobalization'' might have something to say about this!

3/

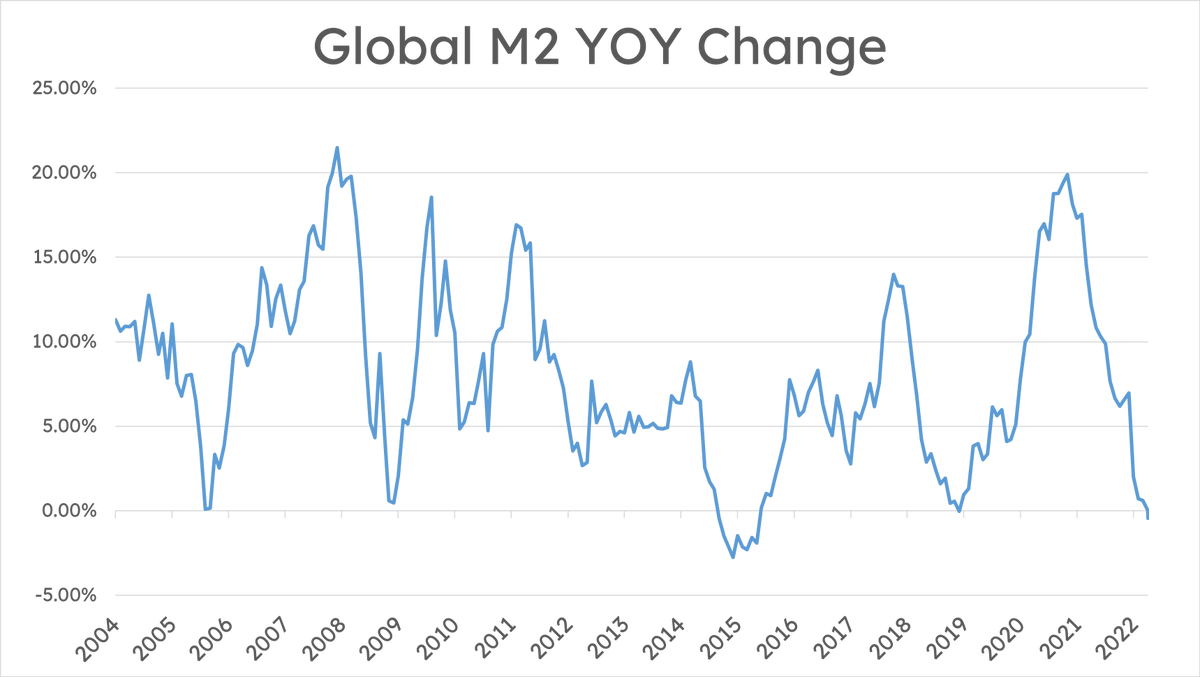

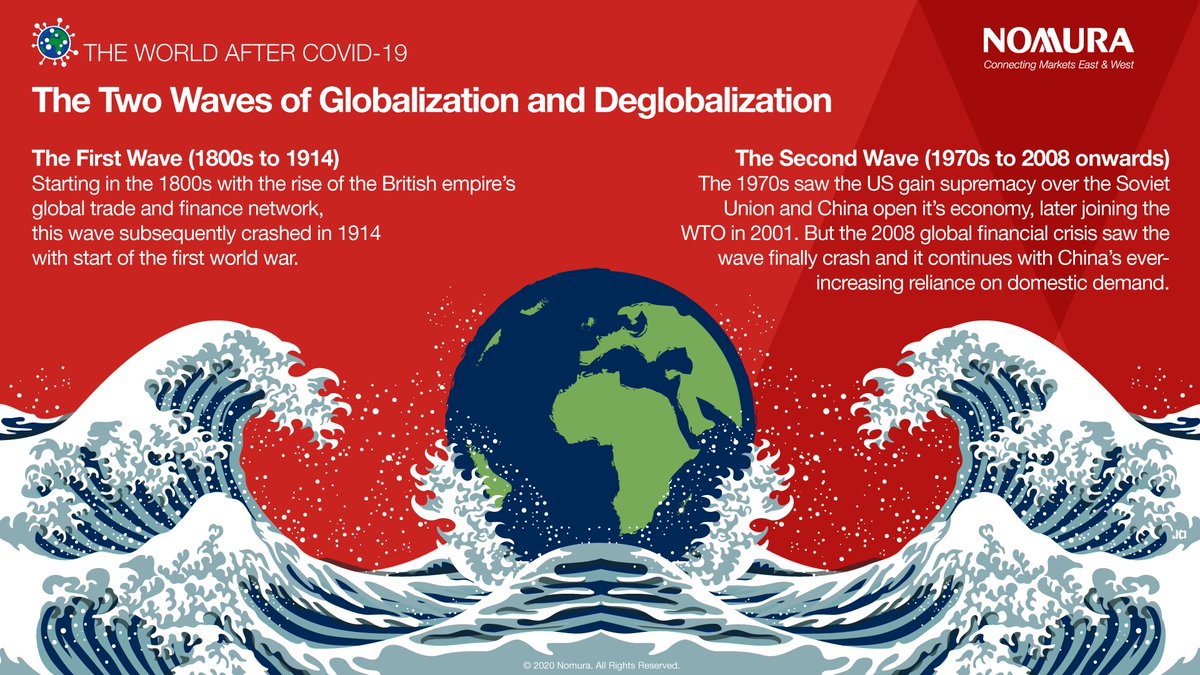

What we're seeing all around the world today, is the end of a long-term secular trend of globalization and centralization.

Globalization has been able to hide the effects of the massive monetary expansion central banks have created over the past 15 years.

5/

Globalization has been able to hide the effects of the massive monetary expansion central banks have created over the past 15 years.

5/

Since the 80s interest rates have been in a long-term secular decline, while our world was becoming more globalized and interconnected.

This resulted in deflation and acted as a gravitational pull that kept the cost of goods and services artificially low.

This era is over.

6/

This resulted in deflation and acted as a gravitational pull that kept the cost of goods and services artificially low.

This era is over.

6/

Now, that's all reversing, and we're going through a paradigm shift.

Globalization has ended, and interest rates can’t go much below 0.

The phase shift that's coming is something we've never seen before...

Phase shifts typically happen VERY rapidly.

7/

Globalization has ended, and interest rates can’t go much below 0.

The phase shift that's coming is something we've never seen before...

Phase shifts typically happen VERY rapidly.

7/

Hyperinflationary events are great examples of ''phase shifts.''

Trust can be lost in the currency rapidly, and once it's gone there's no coming back!

For example, in Germany, a loaf of bread cost only 1 German mark in 1918

5 years later, it was 200 Billion marks!

8/

Trust can be lost in the currency rapidly, and once it's gone there's no coming back!

For example, in Germany, a loaf of bread cost only 1 German mark in 1918

5 years later, it was 200 Billion marks!

8/

Volatility is also always very high when we go through these transitions.

The red line measures the monthly percentage swings in the gold price during the 1920s

On 8 seperate occasions there was a 50% drawdown in the price of gold between the years between 1917 and 1923

9/

The red line measures the monthly percentage swings in the gold price during the 1920s

On 8 seperate occasions there was a 50% drawdown in the price of gold between the years between 1917 and 1923

9/

Volatility always comes with new eras!

I also think we can learn a lesson from a very interesting period of time in the 1990s in Zimbabwe.

In 1987, Robert Mugabe became the president of Zimbabwe.

At the time Zimbabwe was known as the ‘’breadbasket’’ of Africa.

10/

I also think we can learn a lesson from a very interesting period of time in the 1990s in Zimbabwe.

In 1987, Robert Mugabe became the president of Zimbabwe.

At the time Zimbabwe was known as the ‘’breadbasket’’ of Africa.

10/

In only 13 short years Robert Mugabe destroyed the economy, food supply and currency.

He started wars, racked up lots of debt, and tried to control the food supply...

Sound familiar to our governments today?

He essentially cut Zimbabwe off from the rest of the world...

11/

He started wars, racked up lots of debt, and tried to control the food supply...

Sound familiar to our governments today?

He essentially cut Zimbabwe off from the rest of the world...

11/

This wasn't the only similarity between the west today, and Zimbabwe in the 1990s!

Make sure you catch my full video linked below, where I break all of this down and show you where I think deglobalization will take us.

12/

Make sure you catch my full video linked below, where I break all of this down and show you where I think deglobalization will take us.

12/

That's a wrap!

If you enjoyed this thread:

1. Follow me @1MarkMoss for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @1MarkMoss for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1MarkMoss/status/1567659630792265728

• • •

Missing some Tweet in this thread? You can try to

force a refresh