OK, talked about this a little last month, and outlined some thoughts on a Spaces last night, but it's time to revisit the "China will save commodities" thesis.

I'll use the #steel & #coal space because that's what I know best, but there are analogs to other industries too...1/x

I'll use the #steel & #coal space because that's what I know best, but there are analogs to other industries too...1/x

For better or worse, I've always relied on China credit impulse to give me a sense of where we are in the #steel cycle...3 out of the past four cycles, prices peaked 12-24 months after a peak in credit.

Except for 2013/14...2/x

Except for 2013/14...2/x

The reason? China was dumping steel into the export market. That happened to be the year I moved from the coal team to steel at WoodMac, and it was just about all clients were talking about...so it kind of left an imprint.

Well guess what? Exports at highest level since then 3/x

Well guess what? Exports at highest level since then 3/x

That increase makes sense, as current China #steel inventories are just about as high (they *were* higher!) relative to the same point in the cycle last time. 4/x

The overarching concern is China real estate, of course...I'm no expert on it, but property sales declining like 40% YoY in July was not exactly a good number.

And as many folks smarter than I have commented, almost all new credit is focused on SOEs rather than privates. 5/x

And as many folks smarter than I have commented, almost all new credit is focused on SOEs rather than privates. 5/x

So if real estate is down ~40% YoY, and it constitutes ~30-40% of steel demand, that's a ~12-16% overall haircut.

Yikes. 6/x

Yikes. 6/x

But that illustrates why #iron ore futures have been behaving the way they have - with prices for lower quality material holding up comparatively better than higher quality material.

That way, BFs can reduce output while maintaining capacity utilization figures. 7/x

That way, BFs can reduce output while maintaining capacity utilization figures. 7/x

Sry for pause - had to take a phone call.

The slowdown in productivity managed to put a floor under China #steel prices, but with demand getting cut and margins barely positive, just not a great short-term outlook for raw mats prices.

The slowdown in productivity managed to put a floor under China #steel prices, but with demand getting cut and margins barely positive, just not a great short-term outlook for raw mats prices.

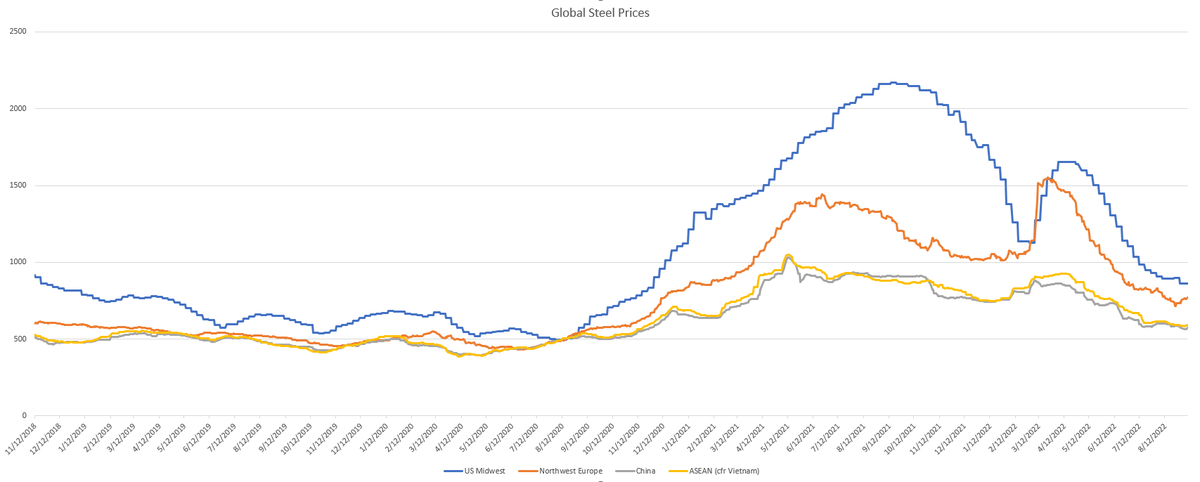

US #steel prices themselves are supported by 25% tariffs for now...that should keep prices ~$800 or so. NW Europe production cuts also supportive of prices in the low-to-mid $700's.

But China px down in the low-to-mid $500's too big of a delta to ignore for importers. 9/x

But China px down in the low-to-mid $500's too big of a delta to ignore for importers. 9/x

Hard to imagine significant China import penetration in current state of global demand with GDP's decelerating, etc, but can't rule it out, and there are some potential positives.

1) EU could import a little to offset lost production

2) US oil bros could use some tube/pipe! 10/x

1) EU could import a little to offset lost production

2) US oil bros could use some tube/pipe! 10/x

So near term probably not great for met #coal - a slowdown in demand in China (who are almost certainly taking longer coking times w/lower quality coals atm) and in EU w/plants idled means more downside than upside...wouldn't be surprised to see a 1-handle return in 4Q/1Q. 11/x

BUT - the low point of the cycle here is likely to be MUCH HIGHER than previous cycles...more like $150 than $100.

Believe it or not, that's a GOOD thing...it means rail costs to port will decline and producers will still be profitable.

It also means the LT price is higher!

Believe it or not, that's a GOOD thing...it means rail costs to port will decline and producers will still be profitable.

It also means the LT price is higher!

And don't forget that thermal #coal markets remain strong, so HVA/HVB tons in the US that can cross over are going to have a floor underneath them that is much higher than that $150 number...likely a softer landing for $ARCH $AMR and other HV producers. 13/x

So bottom line is that this #steel/ raw mats cycle isn't like any previous one in my career...if China "dumps" stockpiles this year, there's a chance they'll find good homes and mkt lands softly in early '23.

Next cycle starts w/EU industrial stimmy in '24...gon' be LIT!😉 14/14

Next cycle starts w/EU industrial stimmy in '24...gon' be LIT!😉 14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh