1/ With less than seven days until the Merge, crypto natives and protocols are preparing.

What recent events and trends have shaped the past couple of weeks?🧵

What recent events and trends have shaped the past couple of weeks?🧵

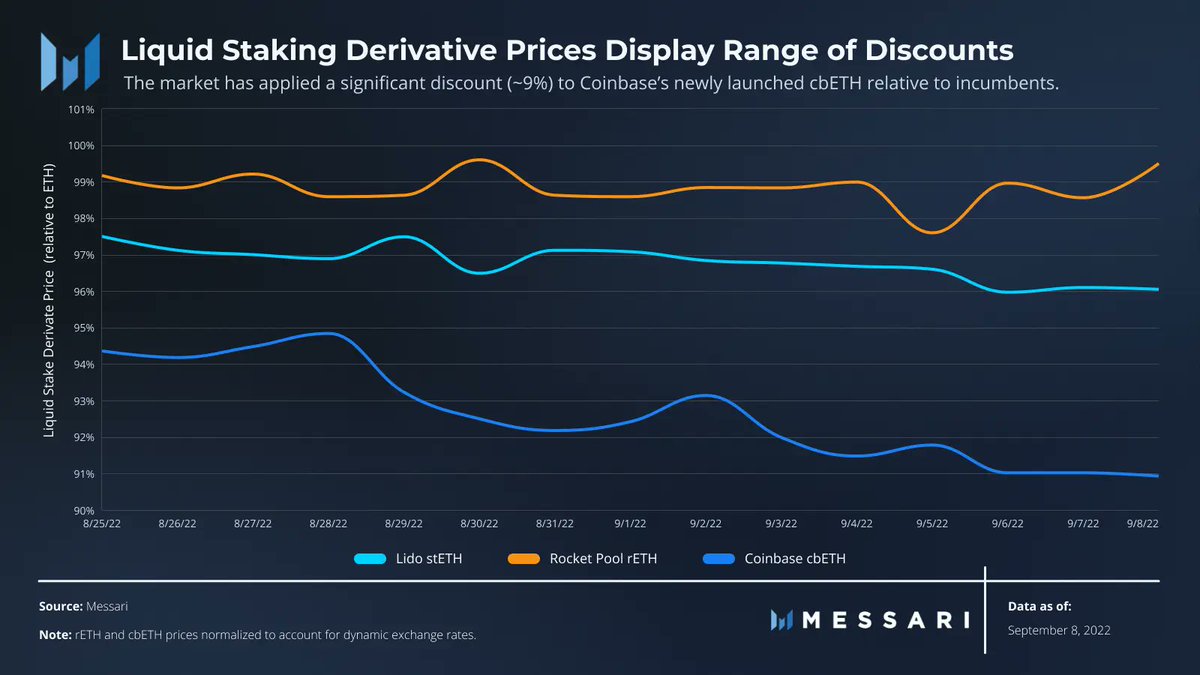

2/ Since the unwind of #3AC and @CelsiusNetwork in June, #Ethereum liquid staking derivatives have traded on secondary markets at a material discount to the price of $ETH.

@LidoFinance's $stETH, reached a 6.6% discount during the forced selling.

@LidoFinance's $stETH, reached a 6.6% discount during the forced selling.

3/ @solana NFTs have made a strong comeback over the last two weeks following a summer of low interest.

Daily NFT sales volume and unique buyers recently spiked back to all-time-high levels set in May.

Daily NFT sales volume and unique buyers recently spiked back to all-time-high levels set in May.

4/ Stay up to date with context on the events and trends that shaped the recent weeks in crypto.

Explore the full Bi-Weekly Recap: August 26 - September 8 from @chasedevens.

messari.io/article/bi-wee…

Explore the full Bi-Weekly Recap: August 26 - September 8 from @chasedevens.

messari.io/article/bi-wee…

• • •

Missing some Tweet in this thread? You can try to

force a refresh