1/9. At this time of yr, 6 wks before Q3 #s start being published, firms with funny FYs are a good source of information. While John Lewis is not a listed company, it does give you a wonderful insight into the well-heeled UK shopper: who is not happy.

johnlewispartnership.co.uk/media/press/y2…

johnlewispartnership.co.uk/media/press/y2…

2/9. John Lewis is the owner of the high-end department stores of the same name & posh supermarket Waitrose. For those not familiar with the UK's cultural landscape, Waitrose woman is a solidly middle or upper-middle class icon of achievement.

3/9. And every estate agent trying to pitch a UK property on the merits of the neighbourhood (to justify an inflated asking price) would never fail to mention if the house were close to a Waitrose.

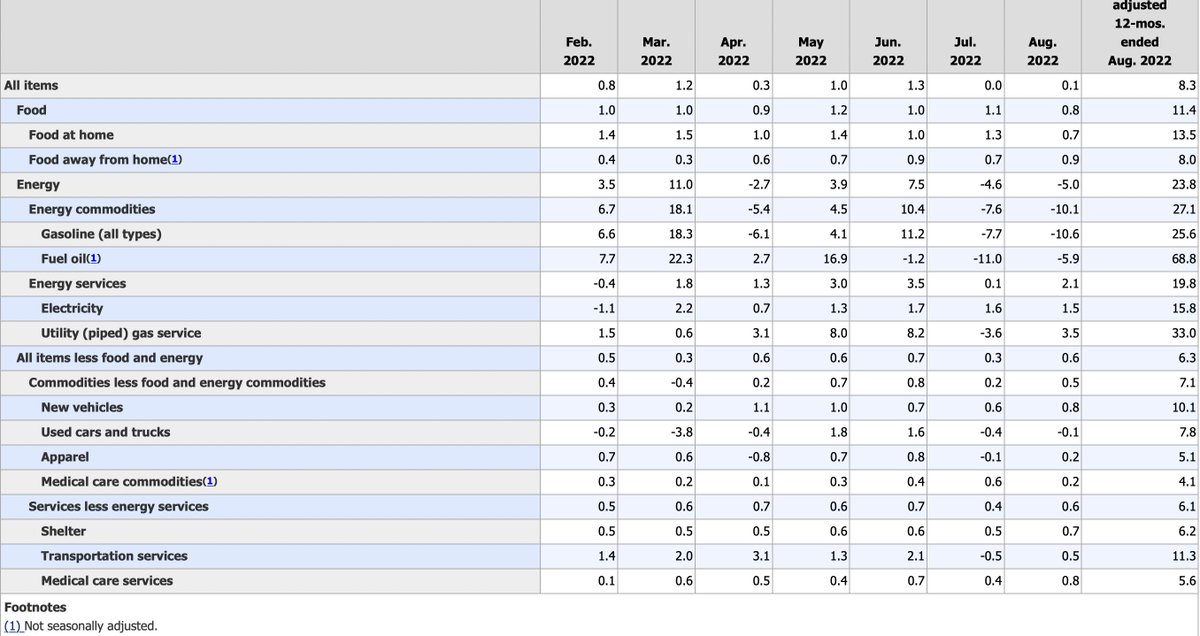

4/9. Unfortunately, for any firm trying to sell to John Lewis' particular market segment, the H2 (ended July) news is not good:

"Inflation has affected consumer spending: We have more customers year-on-year in both brands (up 6% in Waitrose and 4% in John Lewis)...."

"Inflation has affected consumer spending: We have more customers year-on-year in both brands (up 6% in Waitrose and 4% in John Lewis)...."

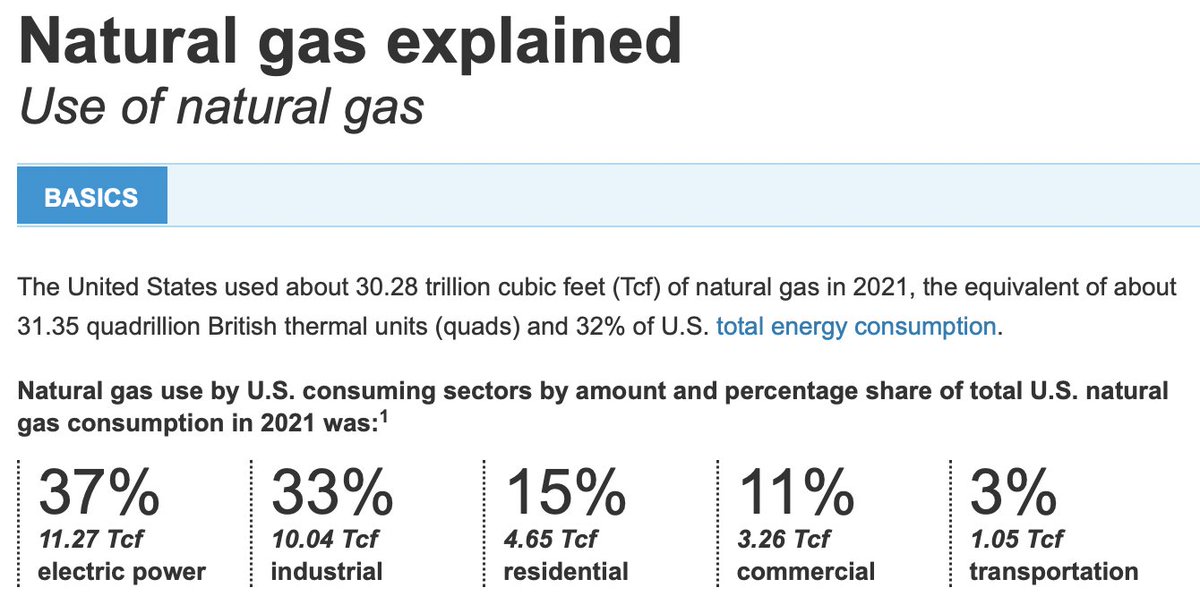

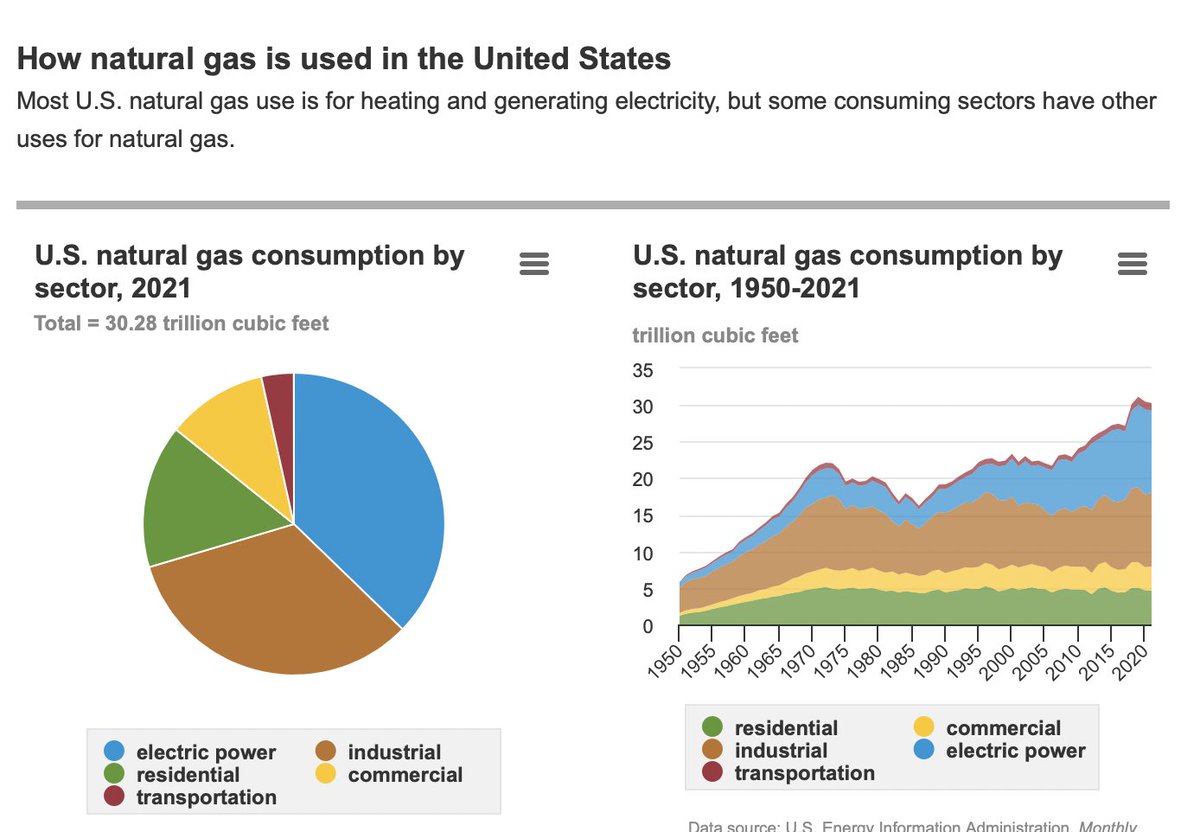

5/9. "....but they are spending less. Inflation has increased our costs, which means we have to do more to meet our original efficiency targets because we have not passed on all of the increased costs to our customers;..."

6/9. "....Post-pandemic customer trends: We have seen in-store spending rebound compared to last year. Online remains elevated compared to pre-pandemic levels; we believe this shift is permanent...."

7/9. ".....We have seen customers move their discretionary spending from high margin, big ticket household items to restaurants and holidays - from dining room furniture to dining out."

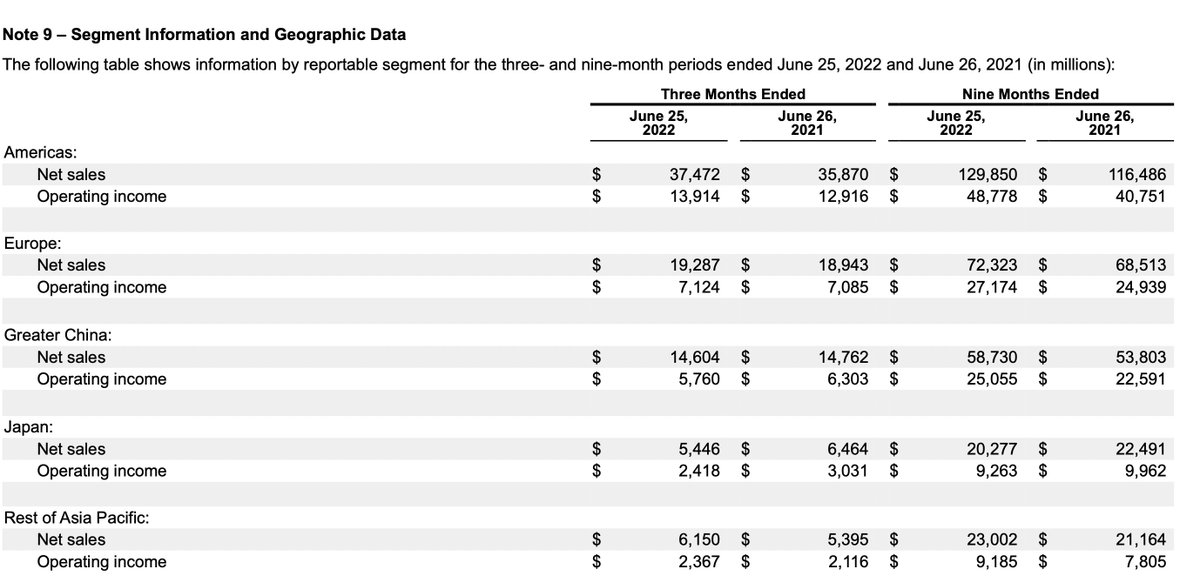

8/9. Note that John Lewis is one of the largest sellers of Apple products in the UK, and its customer profile is very much that of a potential iPhone 14 buyer.

9/9. And if John Lewis' customers are now on the back foot financially, upmarket peers across continental Europe will be in exactly the same position; that is, hunkering down in the face of the approaching economic hurricane.

• • •

Missing some Tweet in this thread? You can try to

force a refresh