1/ The successful @Ethereum #Merge has everyone singing The Merge Song.

Let's check out some highlights tied to one of the biggest events in crypto history.🧵

Let's check out some highlights tied to one of the biggest events in crypto history.🧵

https://twitter.com/songadaymann/status/1570296572541554688

2/ In an attempt to squeeze out extra profits from GPU mining rigs, miners and speculators migrated hashrate en masse to @eth_classic.

The peak hashrate of $ETC at almost 315 TH/s (Terrahashes per Second) is close to half of @Ethereum’s pre-merge hashrate.

The peak hashrate of $ETC at almost 315 TH/s (Terrahashes per Second) is close to half of @Ethereum’s pre-merge hashrate.

3/ In contrast, the $ETHW Proof of Work fork hasn’t been able to sustain high levels of hashrate post-merge.

It isn’t likely to recover.

It isn’t likely to recover.

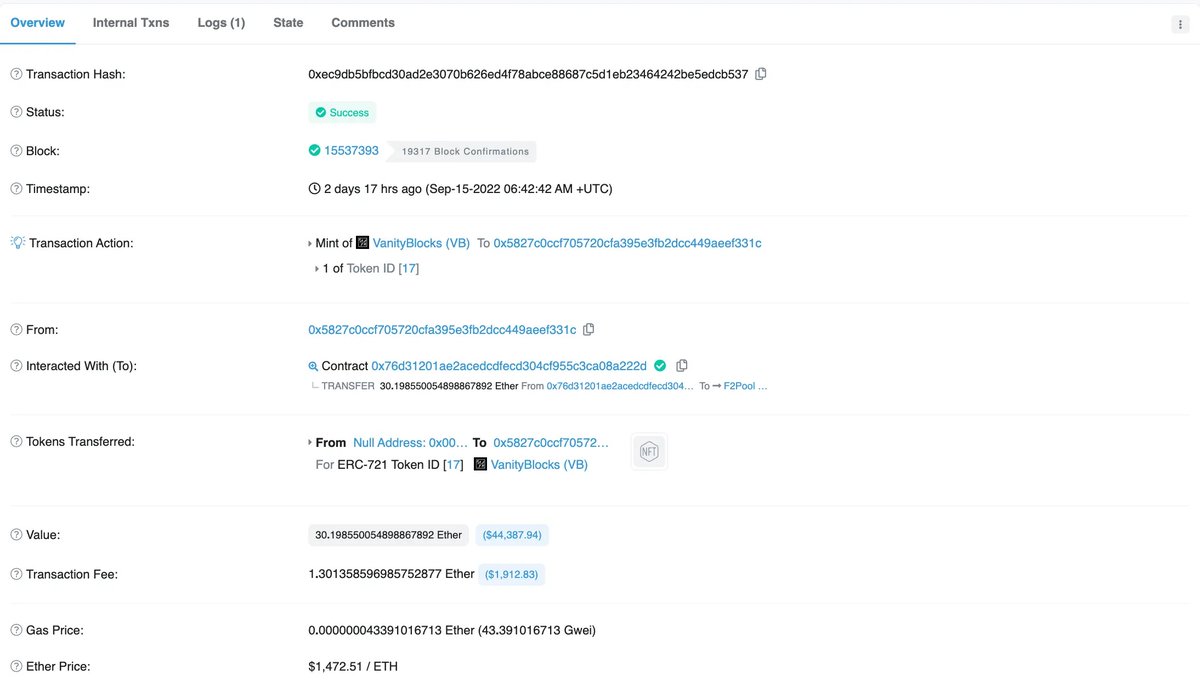

4/ The final PoW block, block 15537393, only recorded 1 transaction - a mint call by art project Vanity Blocks @VanityBlocks.

By paying such a high fee, they were able to exclude any other transactions from being included within the block.

By paying such a high fee, they were able to exclude any other transactions from being included within the block.

5/ With the Merge in the rearview mirror, @Ethereum developers look to the next items on the roadmap, or as Vitalik put it, the Surge, The Verge, The Purge, and The Splurge.

Explore @kelxyz_'s full Pro report, Bi-Weekly Recap: The #Merge Succeeds.

messari.io/article/bi-wee…

Explore @kelxyz_'s full Pro report, Bi-Weekly Recap: The #Merge Succeeds.

messari.io/article/bi-wee…

• • •

Missing some Tweet in this thread? You can try to

force a refresh