1/17. @AlessioUrban highlights another crazy area of the market: private lending. So the first question I ask myself is this: How big is this market?

https://twitter.com/AlessioUrban/status/1572551385400627200?s=20&t=C_1eGSSszsFX64-YNrHGJA

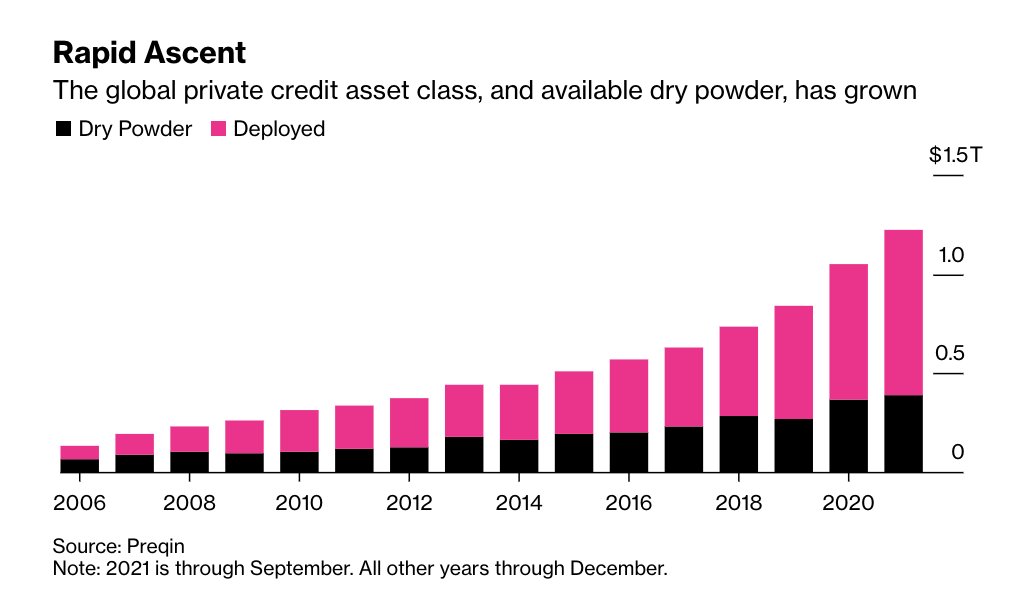

2/17. Bloomberg reports some #s out of Preqin suggesting the private lending market was $1.3 trillion for the 9 mths through Sep 2021. Some of that is dry powder, so I guestimate that actually deployed money was around $1 trillion by the end of 2021.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

3/17. By the time we get to the end of the coming recession, I estimate the losses on private lending will probably be somewhere between 30% to 50%. So around $300 billion to $500 billion. Is that a big number?

4/17. When it comes to trying to understand how big is big, I always reference the LTCM bailout in 98 orchestrated by the Fed. The received wisdom at the time was that if LTCM went down, it would have taken the entire global financial system with it.

rebellionresearch.com/what-happened-…

rebellionresearch.com/what-happened-…

5/17. After being bullied by the New York Fed President, a consortium of banks injected $360 billion into LTCM in order to prevent the systemic risk to the global financial system posed by an LTCM bankruptcy. Is that a lot of money?

6/17. $360 billion in 1998 dollars is not the same as $360 billion in 2022 dollars due to inflation, plus we need to adjust for the fact that the real US economy has grown.

7/17. We can do that by noting that, in nominal terms, the US economy was $8.9 trillion in Q1 1998 and $24.9 trillion in Q2 2022. So that's 2.8 times bigger.

fred.stlouisfed.org/series/GDP

fred.stlouisfed.org/series/GDP

8/17. In other words, the $360 billion "save the world" 1998 bailout of LTCM translates into $1 trillion now adjusted for inflation and the real growth in the economy.

9/17. So the potential $300-500 billion likely loss in private lending is a lot smaller than that. Yet, private lending is a teeny-weeny slice of our current "everything bubble".

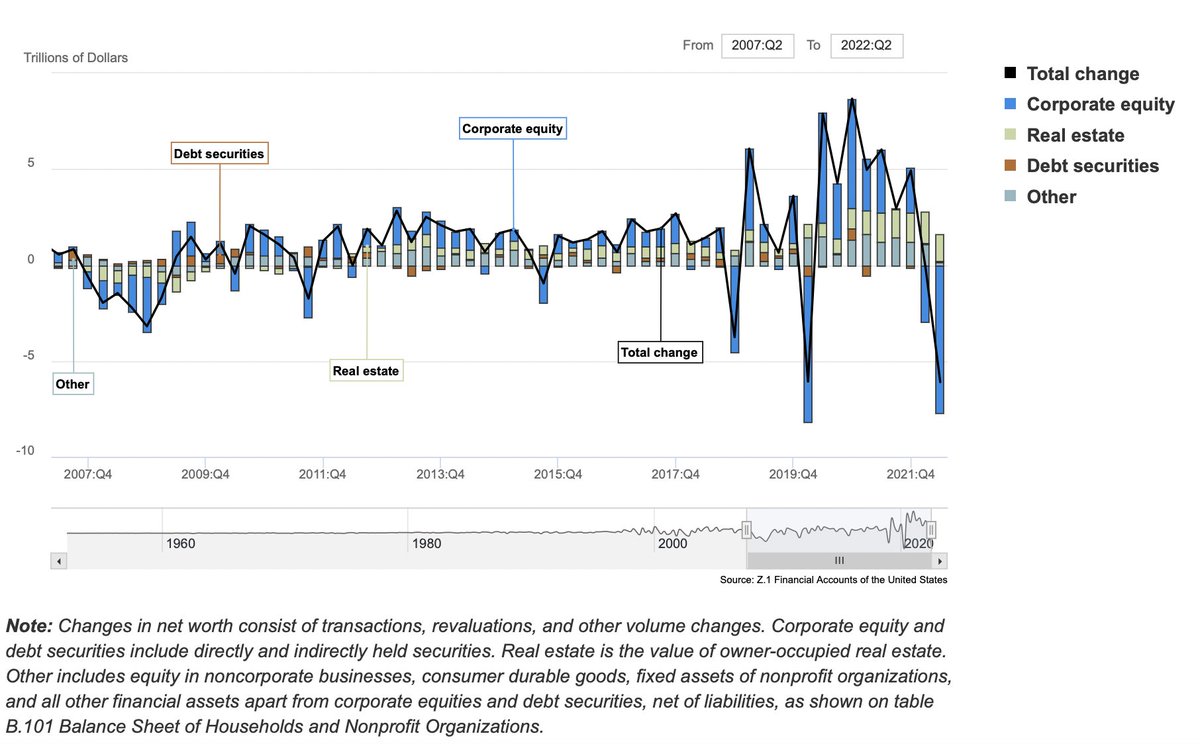

10/17. You can get a sense of that from the $6.1 trillion decline in net household wealth in Q2 2022.

federalreserve.gov/releases/z1/da…

federalreserve.gov/releases/z1/da…

11/17. Or take the entire private equity ecosystem which sums to over $9 trillion. By the time the bubble has finished popping, I expected that to have contracted by at least a third, or $3 trillion.

https://twitter.com/shortl2021/status/1525835792047915011?s=20&t=yfLlI0ulMm95nKYUK5io4g

12/17. And CoinMarketCap shows that Cryptoland is now worth around $900 billion, down over $2 trillion from its peak of over $3 trillion.

coinmarketcap.com

coinmarketcap.com

13/17. So what's my point? Well, we can think of $1 trillion as a "save the world" sized sum of money.

14/17. Senator Everett Dirksen is famously misquoted as saying "A billion here, a billion there, pretty soon it begins to add up to real money.”

15/17. Regardless of its origin, the quip needs to be updated in 2022 money to "A trillion here, a trillion there, pretty soon it begins to add up to real money.”

16/17. And on our current trajectory, we are likely to get up to the tens of trillions of dollars in losses by the time our "everything bubble" finally finishes popping.

17/17. Once, a mere trillion dollars in today's money panicked the Fed. Crash helmets and seatbelts on folks. We are going to see an-order-of-magnitude bigger loss than that :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh