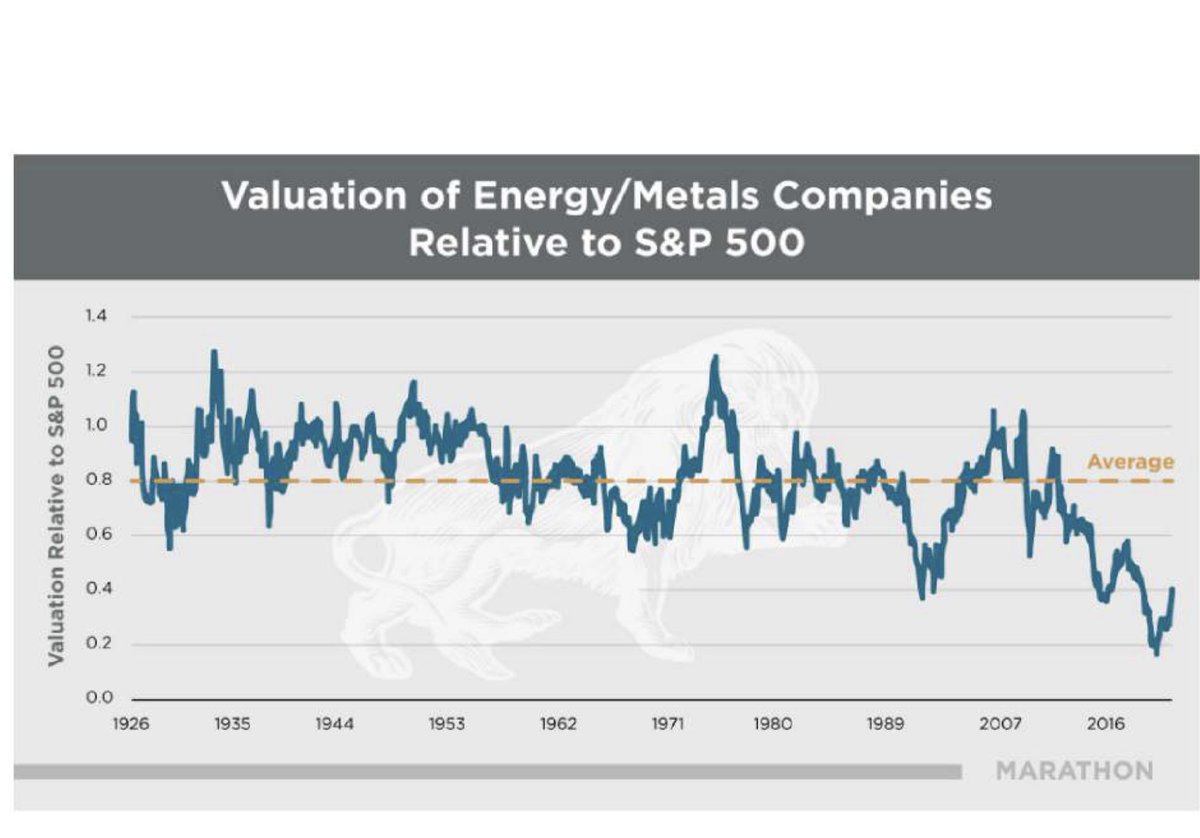

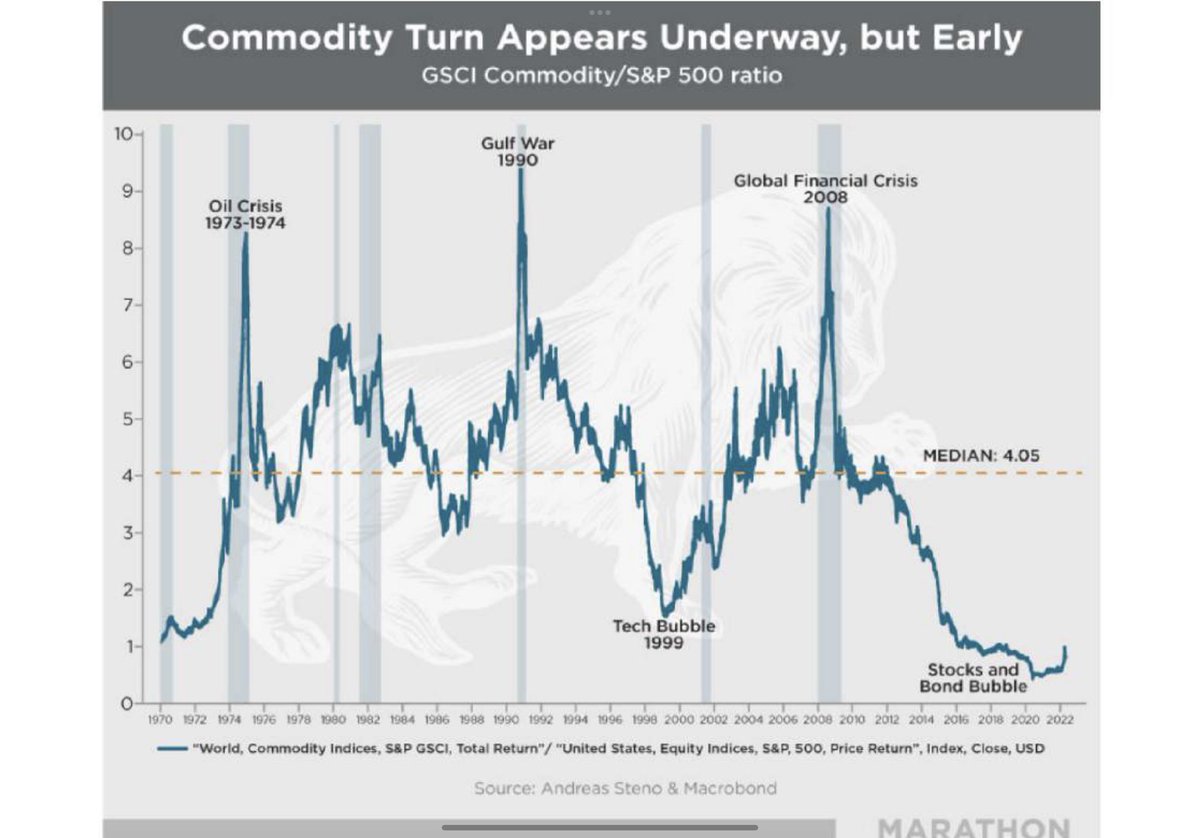

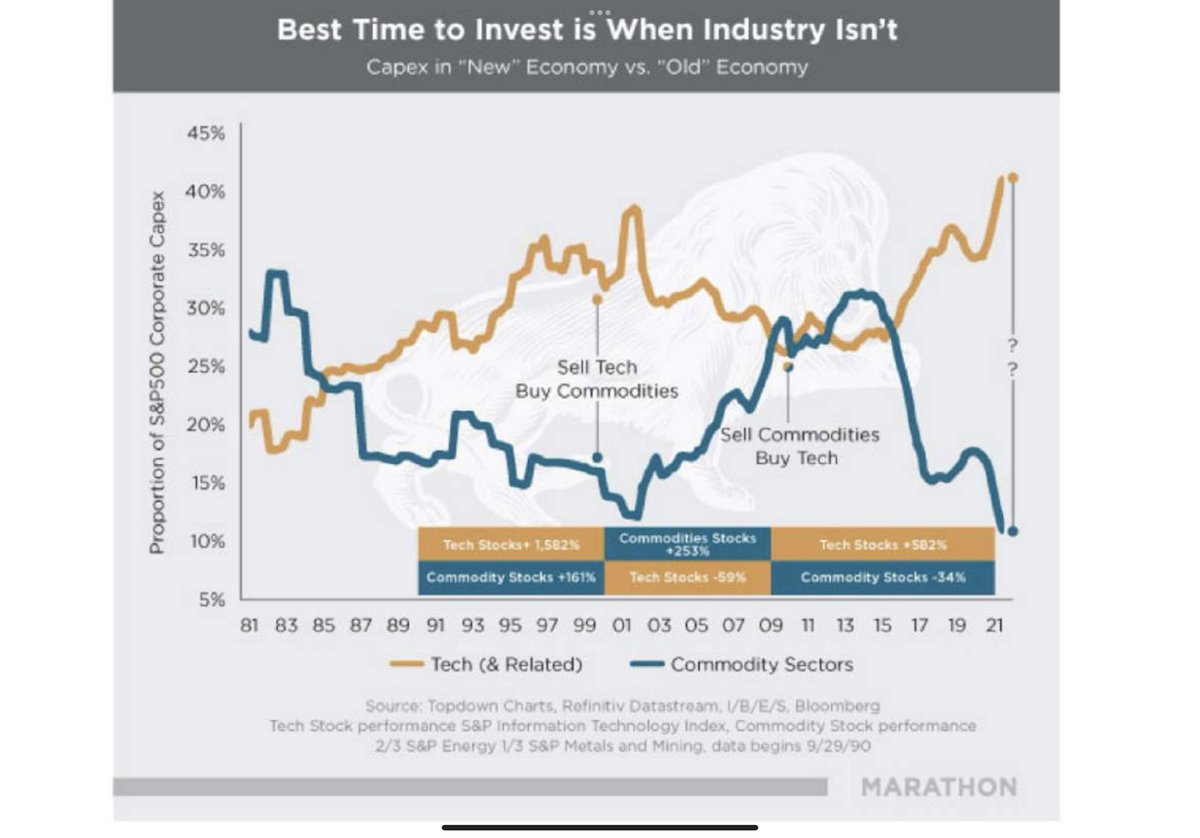

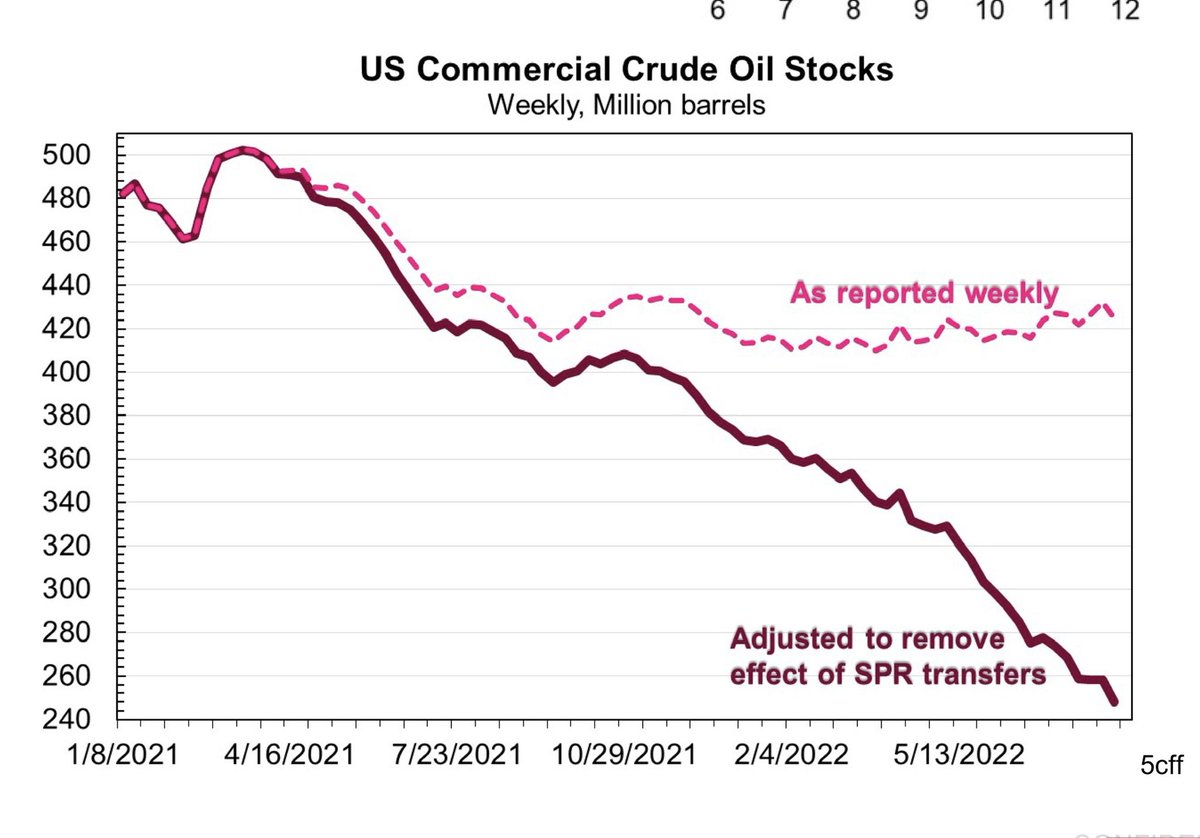

$XLE #oil $panr. The market is being incredibly myopic worrying about recession fears and thinking oil will collapse even though a # of catalysts ive highlighted repeatedly will soon end. 1. SPR sales go from sales to purchases 2. Rig count in US and Non opec not really rising.

https://twitter.com/LowAlphaHighVol/status/1572503439082688517

3 oil demand is still resilient despite China being in lockdown. I wont address the first 2 as they are relatively self explanatory (and many smarter folks have posted those charts). I want to address the fact that 0 covid is IMHO nothing more than a ruse for Xi to get re-elected

Without a ton of protests (chinese protests were really going up significantly in 2019 prior to covid). HK just announced today an end to all quarantines and now were hearing that Sing will see a big influx in Nov. So what happens to oil demand with chinese oil demand growing -

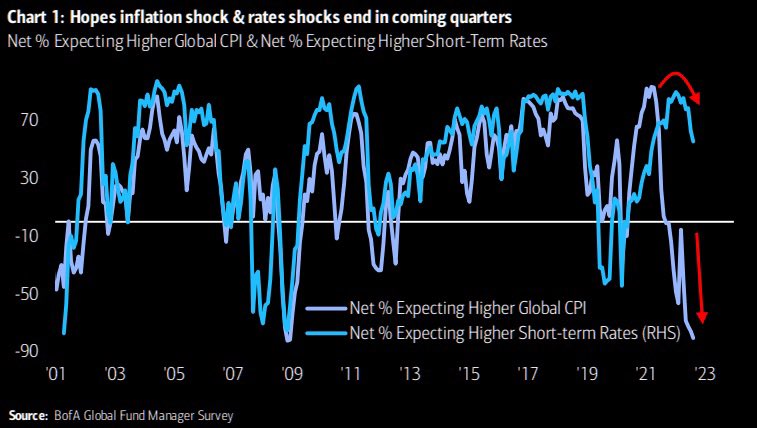

Esp with much pent up demand (similar to what we saw in the US?). Yup oil ain’t going lower and will further complicate the inflation expectations argument that its falling. This will be a death knell for tech that will see declining margins, sales and rising discount rates. To

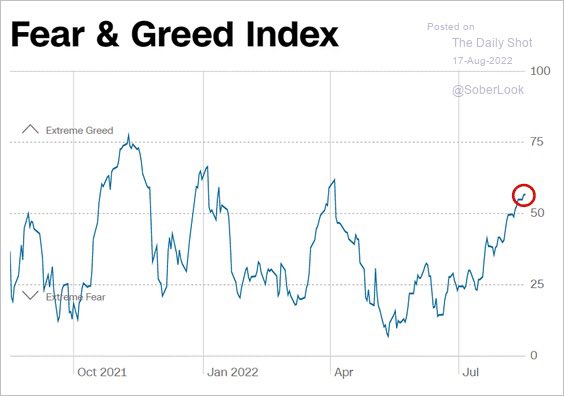

The extent the market as @Go_Rozen discussed in a recent podcast -everyone’s playing oil as the recession trade that view will need to be revised and im taking advantage of the over blown reaction to $panr insider sales (discussed yesterday) to add to my pile of $panr cherries.

• • •

Missing some Tweet in this thread? You can try to

force a refresh