September 22, 2022: Lender's Game💳🦈

How On-Chain Lending Protocols Thrive

+ @VendorFi Deep Dive

curve.substack.com/p/sept-22-2022…

🧵1/13

How On-Chain Lending Protocols Thrive

+ @VendorFi Deep Dive

curve.substack.com/p/sept-22-2022…

🧵1/13

🧵2/13

As Reverse Human Technical Indicator @jimcramer is fond of saying: "There's always a bull market somewhere."

In our down only economy, it's a bull market for good ole' fashioned debt!

As Reverse Human Technical Indicator @jimcramer is fond of saying: "There's always a bull market somewhere."

In our down only economy, it's a bull market for good ole' fashioned debt!

https://twitter.com/AutismCapital/status/1572633557415362563

🧵3/13

On-chain debt protocols are also thriving. You can even lend your jpegs!

Though on-chain hasn't solved under-collateralized debt, we're still seeing some big innovations to the experience. Notably:

* 0% INTEREST

* 0 LIQUIDATIONS

On-chain debt protocols are also thriving. You can even lend your jpegs!

https://twitter.com/0xngmi/status/1571924401817526272

Though on-chain hasn't solved under-collateralized debt, we're still seeing some big innovations to the experience. Notably:

* 0% INTEREST

* 0 LIQUIDATIONS

🧵4/13

0% INTEREST is of course popular.

If interest on your loan is compounding you'd better be earning even more to stay above water.

The problem is high yields are ephemeral and risky. Less risky #DeFi these days can yield worse than treasury bonds.

0% INTEREST is of course popular.

If interest on your loan is compounding you'd better be earning even more to stay above water.

The problem is high yields are ephemeral and risky. Less risky #DeFi these days can yield worse than treasury bonds.

https://twitter.com/AutismCapital/status/1572720466879713281

🧵5/13

@LiquityProtocol features 0% interest, instead charging variable fees on borrowing/redemption depending on demand.

They've used these mechanics to build out the textbook example of well-decentralized stablecoin.

Worth checking out their newest:

@LiquityProtocol features 0% interest, instead charging variable fees on borrowing/redemption depending on demand.

They've used these mechanics to build out the textbook example of well-decentralized stablecoin.

Worth checking out their newest:

https://twitter.com/LiquityProtocol/status/1572635235107614720

🧵6/13

@QiDaoProtocol also features 0% interest, along with just a fixed redemption fee.

They've honed their formula on sidechains, and just launched onto mainnet with some crazy, sure-to-fall yields.

@QiDaoProtocol also features 0% interest, along with just a fixed redemption fee.

They've honed their formula on sidechains, and just launched onto mainnet with some crazy, sure-to-fall yields.

https://twitter.com/QiDaoProtocol/status/1572754234583711745

🧵7/13

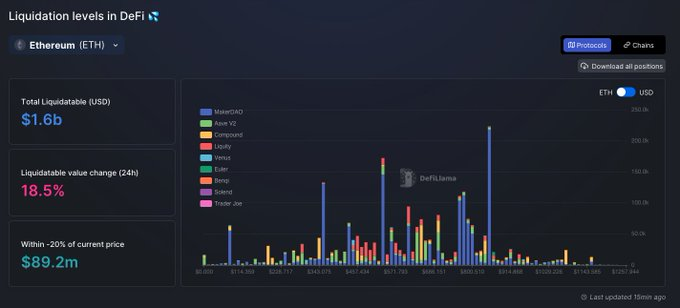

NO LIQUIDATIONS is also understandably popular.

Crypto prices can wick down suddenly 24/7. During these wicks, gas prices also tend to spike, making it expensive to try to add collateral and improve your loan health.

NO LIQUIDATIONS is also understandably popular.

Crypto prices can wick down suddenly 24/7. During these wicks, gas prices also tend to spike, making it expensive to try to add collateral and improve your loan health.

🧵8/13

@AlchemixFi popularized the "no liquidations" via their self-repaying loans. Extremely user-friendly, just wait for yields to catch up.

@0xC_Lever extended this concept to @ConvexFinance bribes.

@AlchemixFi popularized the "no liquidations" via their self-repaying loans. Extremely user-friendly, just wait for yields to catch up.

@0xC_Lever extended this concept to @ConvexFinance bribes.

https://twitter.com/DeFi_Dad/status/1569660032798846977

🧵9/13

CLever has had a productive bear market, accumulating more $CVX as intended:

They recently added @fraxfinance pools:

They're also gearing up to release $CLEV: medium.com/@0xC_Lever/a-c…

CLever has had a productive bear market, accumulating more $CVX as intended:

https://twitter.com/0xC_Lever/status/1572900337446719488

They recently added @fraxfinance pools:

https://twitter.com/0xC_Lever/status/1567899078658523142

They're also gearing up to release $CLEV: medium.com/@0xC_Lever/a-c…

🧵10/13

@LendFlareOffic also launched into the bear with an interesting no-liquidation model.

All borrowing occurs between like kind assets, ie 3CRV -> USDC.

They focus on Curve LP tokens, and we're pleased to see they've lived long enough to release v2

@LendFlareOffic also launched into the bear with an interesting no-liquidation model.

All borrowing occurs between like kind assets, ie 3CRV -> USDC.

They focus on Curve LP tokens, and we're pleased to see they've lived long enough to release v2

https://twitter.com/LendFlareOffic/status/1534893721392537600

🧵11/13

@VendorFi launched on @arbitrum this month with another strategy to avoid liquidations.

Lenders set a fixed term and fixed (or decaying) interest. Default if you don't repay, but no liquidations due to price

@VendorFi launched on @arbitrum this month with another strategy to avoid liquidations.

Lenders set a fixed term and fixed (or decaying) interest. Default if you don't repay, but no liquidations due to price

https://twitter.com/NakamotoThe3rd/status/1566796865462476801

https://twitter.com/YettyWapp/status/1572744220594634752

🧵12/13

What lenders absorb in risk, they gain in flexibility to set the terms.

Vendor allows lenders to create terms permissionlessly against whitelisted assets (ie $WBTC, $WETH, $CRV, stables), opening up some opportunities:

What lenders absorb in risk, they gain in flexibility to set the terms.

Vendor allows lenders to create terms permissionlessly against whitelisted assets (ie $WBTC, $WETH, $CRV, stables), opening up some opportunities:

https://twitter.com/crypto_condom/status/1567157863310565376

https://twitter.com/0xWenMoon/status/1567541038859829250

🧵13/13

Remember that lending, particularly with leverage, is dangerous! Don't take our advice (which is not financial) and do your own research!

If you enjoyed, please like/share/comment/follow to help us get past the censors: curve.substack.com/p/sept-22-2022…

Remember that lending, particularly with leverage, is dangerous! Don't take our advice (which is not financial) and do your own research!

If you enjoyed, please like/share/comment/follow to help us get past the censors: curve.substack.com/p/sept-22-2022…

• • •

Missing some Tweet in this thread? You can try to

force a refresh