HISTORICAL THREAD🧵 $SPY $QQQ $DJIA

There's been comparisons of this #stockmarketcrash

with that of 2008

People have been saying that 2022 is not 2008

They're not wrong, but let me give you a challenge

There's been comparisons of this #stockmarketcrash

with that of 2008

People have been saying that 2022 is not 2008

They're not wrong, but let me give you a challenge

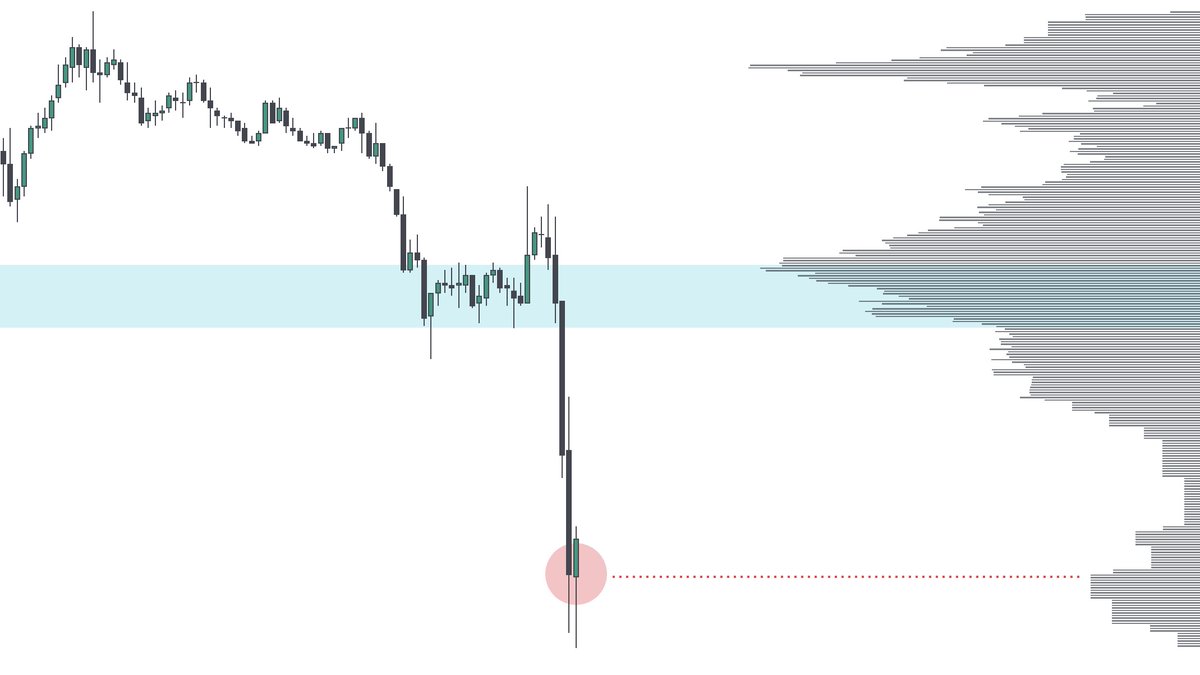

These are all weekly charts of the Dow Jones, so they're all significant bear markets and crashes. Can you tell me what year this occurred?

None of them are the Great Depression. In order, the crashes are in 1917, 1903, 1966, 1937 and 1907

The last one is 2008. Were you able to tell which year was which? Probably not.

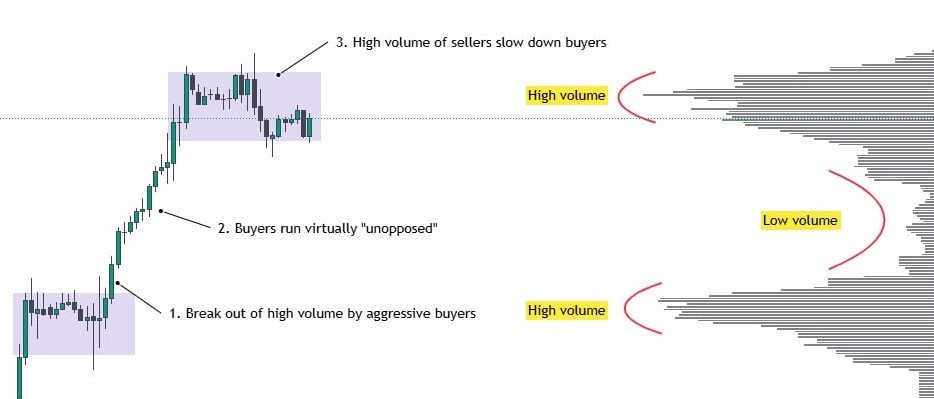

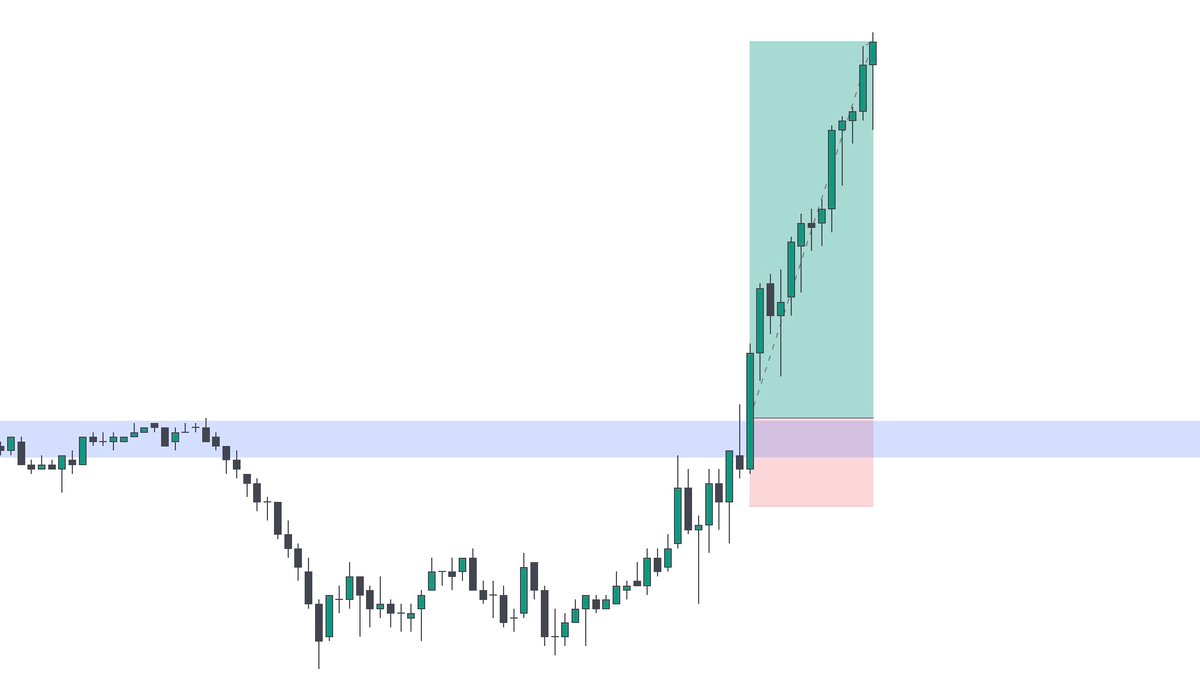

The markets are a reflection of human nature and they tend to move in similar patterns over time

The last one is 2008. Were you able to tell which year was which? Probably not.

The markets are a reflection of human nature and they tend to move in similar patterns over time

When fear steps into the picture, it doesn't matter what year it is or what's going on in the world

What we need to look at is how the market is reacting to it and how we can take advantage

When a stampede is coming your way, it doesn't matter if a lion scared them or a mouse

What we need to look at is how the market is reacting to it and how we can take advantage

When a stampede is coming your way, it doesn't matter if a lion scared them or a mouse

• • •

Missing some Tweet in this thread? You can try to

force a refresh