“History never repeats itself, but it does often rhyme.” - Mark Twain

A long thread on interest rates and the stock market, compared to #uranium prices and a stock.

The bull market of 2004-07 as compared to that of the current 2021-202? /1

A long thread on interest rates and the stock market, compared to #uranium prices and a stock.

The bull market of 2004-07 as compared to that of the current 2021-202? /1

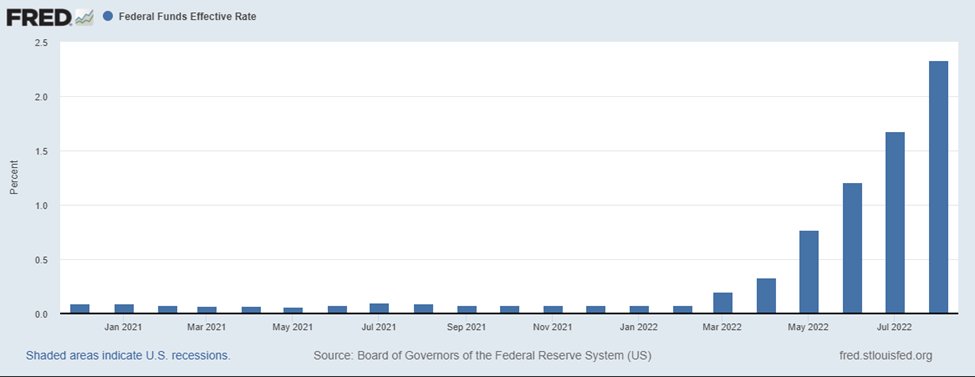

The #uranium bull market of the mid 2000s was marked by a period of rising interest rates. Between 2004 and 2006, the Federal Reserve raised interest rates 17 times from 1.0% to 5.25% to curb inflation and cool off an overheated economy./2

The stock market however continued on its merry way until mid-2007 when the financial crisis started. Meanwhile inflation in the US ranged from 3%-5.5%.

During this period the S&P returned 31% from 2004 to end of 2007./3

During this period the S&P returned 31% from 2004 to end of 2007./3

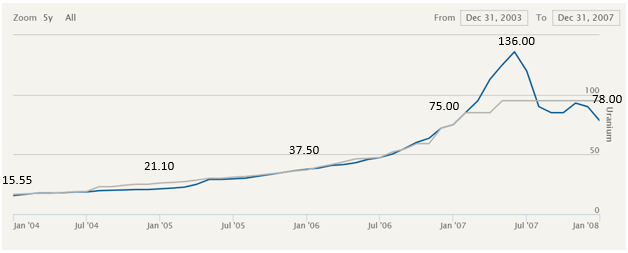

The price of uranium, as measured by spot, headed upwards at a consistent pace. While there may have been volatility on a daily basis, on a yearly note, the trend was one way ⬆️until the peak in 2007. (Chart is from Cameco) /4

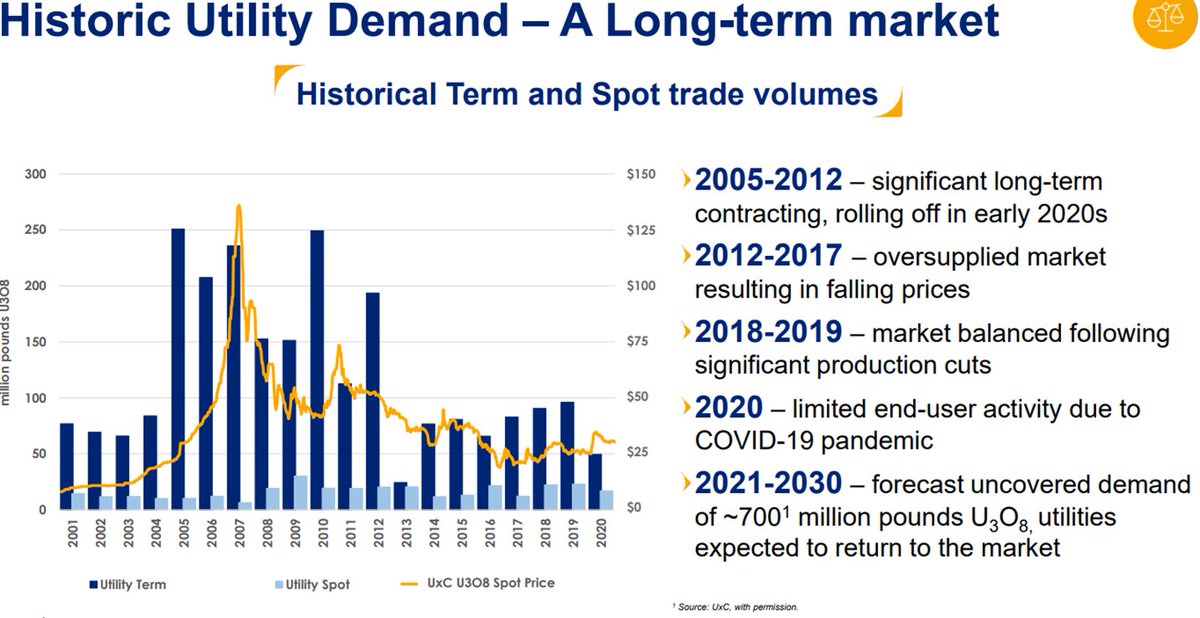

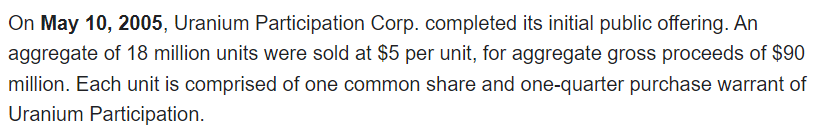

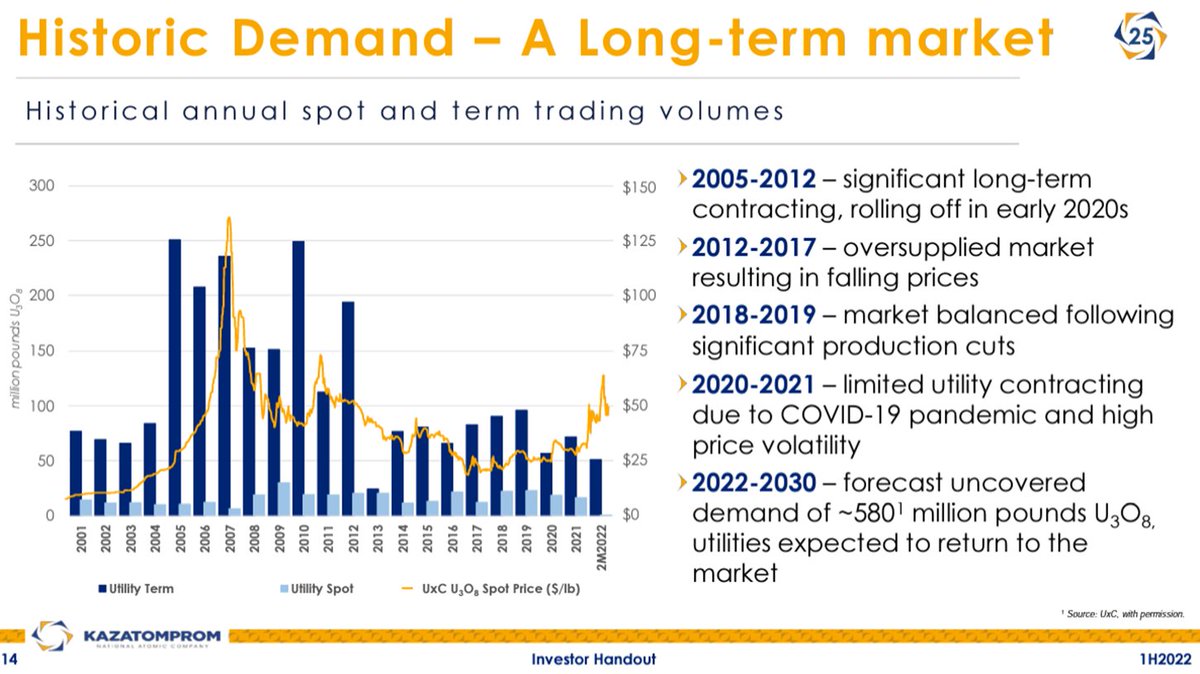

What drove the uranium price to these consistent increases were the utilities who had entered the term contract market en masse starting in 2005 to secure their needs, along with financial players such as Uranium Participation Corp (UPC)./5

While the previous data looked fairly consistent in their trend, owning a #uranium stock was very volatile, to say the least.

I selected Denison Mines to exemplify the period, as it trades today as it did then, and unlike Cameco (flooding), did not have operational issues./6

I selected Denison Mines to exemplify the period, as it trades today as it did then, and unlike Cameco (flooding), did not have operational issues./6

If you owned Denison shares at the start of 2004 your cost was $1.59 and the market cap was approx. $30 milion CAD. At the end of 2007 (not the peak) your shares would be worth $8.89 and the market cap was now $1.7 billion. The difference in multipliers was dilution./7

However, the path to these returns was not obvious. There was a particularly painful period (it may have seemed like this at the time) when the stock bottomed at $4.28 in the summer of 2006 after hitting previous highs of $5.15, $6.39, $8.15, and $7.35. (The peak was $16.57)./8

The ability to recognize the tops and bottoms in retrospect is always easy.

On the other hand,when considering history blended with a longer horizon, we can see the data as it stands today and consider what the future holds./9

On the other hand,when considering history blended with a longer horizon, we can see the data as it stands today and consider what the future holds./9

For this purpose, I started the clock on the current #uranium bull market in 2021. Some of you may agree/disagree. My principal thought is that in Dec 2020 was when these stocks collectively took off and attracted many more investors./10

When considering interest rates in this period, the Fed kept rates very low until this year. From a rate of 0.25%, with the most recent raise increased to 3.13%. Expectations are rates to top out at 4.4% to 4.6%...or until something breaks./11

The stock market, on the other hand has gone on a spectacular round trip as measured by the S&P.

Since the start of 2021 to Friday, the market is down 3%. Sentiment is very much negative as compared to the prior uranium bull market./12

Since the start of 2021 to Friday, the market is down 3%. Sentiment is very much negative as compared to the prior uranium bull market./12

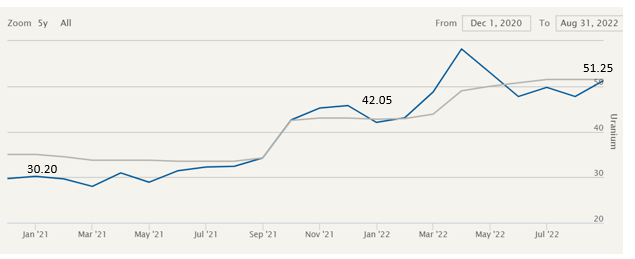

The uranium spot price continues to be consistent in its appreciation. The chart from Cameco (to August) shows a fairly consistent trajectory upward from the start. The elements are still in place for a bull run in the commodity especially on a year over year basis./13

The utilities are only now returning to the term market in size but it is still early. As noted, the return of the utilites to contracting en masse is a requirement of any uranium bull market./14

https://twitter.com/hchris999/status/1572331175938785281?s=20&t=bnVd9IWlpUVkUJhMBCKG7g

The volatility with owning a #uranium stock has not changed.

At the start of 2021 Dension's shares were trading for $0.84 and had a market cap of $570 million CAD. At Friday's close the stock was at $1.45 and had a market cap of $1.2 billion, dilution being the difference./15

At the start of 2021 Dension's shares were trading for $0.84 and had a market cap of $570 million CAD. At Friday's close the stock was at $1.45 and had a market cap of $1.2 billion, dilution being the difference./15

Once again, owning a #uranium stock is very volatile. The stock reached multiple peaks including $2.29, a low $0.79, before hitting $2.64 last fall.

2022 so far has been a series of ups and downs in excess of $1.00, in a range between $2.32 and $1.18./16

2022 so far has been a series of ups and downs in excess of $1.00, in a range between $2.32 and $1.18./16

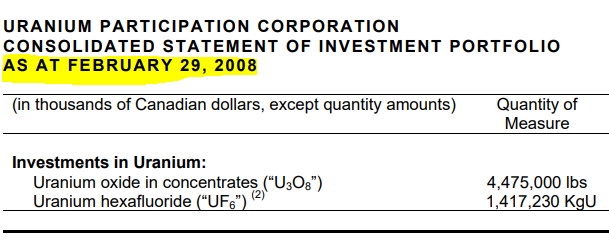

I would be remiss if I did not mention the impact of SPUT/YCA. In the prior bull market UPC (predecessor to SPUT) acquired 4.2 million lbs by the end of 2007.

In comparison, the combination of SPUT/YCA & UPC prior to SPUT's acquisition, acquired 52.1 million lbs in 2021-22./17

In comparison, the combination of SPUT/YCA & UPC prior to SPUT's acquisition, acquired 52.1 million lbs in 2021-22./17

When looking at history, the similarities between the two periods are close but there are two glaring differences I noted.

The stock market sentiment is very negative at this point.

The uranium bull market is nowhere near its end./18

The stock market sentiment is very negative at this point.

The uranium bull market is nowhere near its end./18

Interest rates on their own do not have a direct impact on the commodity.

Investor sentiment goes through extremes of optimism and pessimism, but #uranium stock valuations remain elevated in comparison to the market due to the #uranium fundamentals that matter much more./End

Investor sentiment goes through extremes of optimism and pessimism, but #uranium stock valuations remain elevated in comparison to the market due to the #uranium fundamentals that matter much more./End

• • •

Missing some Tweet in this thread? You can try to

force a refresh