"There's even a slight whiff of concern about the ultimate debt sustainability [of the UK government]" says Larry Summers on #Newsnight...

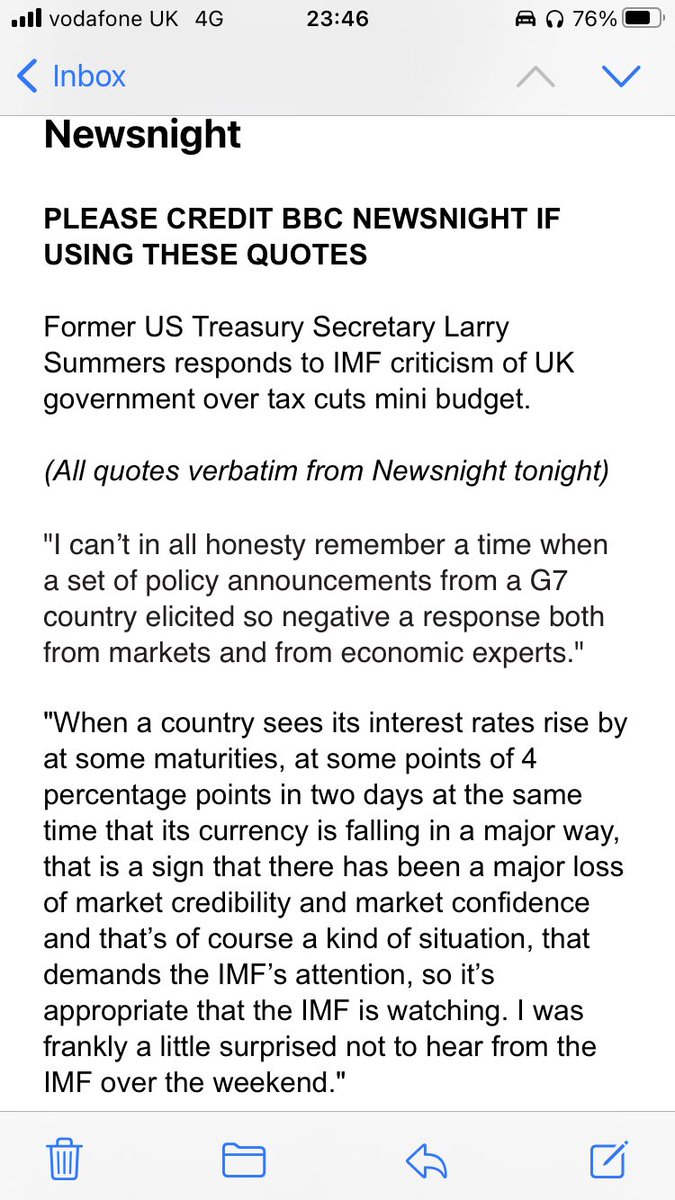

..."There's been a major loss of market credibility and market confidence...so it's appropriate that the IMF be watching"...

..."It seems an odd response to developments on Friday & raised real question of whether British authorities were grasping the reality of their situation"...

..."The combination [of dangers] that Britain is facing is very ominous and the kind of warning from the IMF is the kind of warning that comes much more frequently to emerging markets"...

..."This has the look right now of a number of unforced errors"

Full Summers quotes on #Newsnight

• • •

Missing some Tweet in this thread? You can try to

force a refresh