Viceroy Research is short Truecaller. Our report is now live:

viceroyresearch.org/2022/09/28/tru…

Truecaller is a Swedish adware & spyware app which feeds a public phonebook aimed at preventing spam (not a joke).

$TRUE $TRUEB #truecaller #thread 1/

viceroyresearch.org/2022/09/28/tru…

Truecaller is a Swedish adware & spyware app which feeds a public phonebook aimed at preventing spam (not a joke).

$TRUE $TRUEB #truecaller #thread 1/

The EU’s GDPR &similar legislation across the globe, threatens Truecaller’s business, which we believe is on the brink of redundancy.

It now resorts to skirting regulations and/or avoiding taxes through uncreative loopholes which we believe will be inevitably cut-off. $TRUE 2/

It now resorts to skirting regulations and/or avoiding taxes through uncreative loopholes which we believe will be inevitably cut-off. $TRUE 2/

HOW IT WORKS

Fundamentally, Truecaller builds a “phonebook” and refines its spam database by:

1. Gathering identities of users and their address books.

2. Processing user-submitted “spam” numbers.

3. Identifying numbers which have exhibited spam-like behavior

$TRUE $TRUEB 3/

Fundamentally, Truecaller builds a “phonebook” and refines its spam database by:

1. Gathering identities of users and their address books.

2. Processing user-submitted “spam” numbers.

3. Identifying numbers which have exhibited spam-like behavior

$TRUE $TRUEB 3/

The app then functions as a phone book:

- Users search phone numbers in the app, which will return names & contact details (incl. non-users).

- Flagged “spam” callers will be sometimes be identified & sometimes blocked.

- All calls are accompanied by pervasive ads.

$TRUE 4/

- Users search phone numbers in the app, which will return names & contact details (incl. non-users).

- Flagged “spam” callers will be sometimes be identified & sometimes blocked.

- All calls are accompanied by pervasive ads.

$TRUE 4/

WHAT WE TELL COMPLIANCE

GDPR threatened $TRUE spyware features. In response Truecaller moved all of its data servers and substantially all of its operations to India where management believe it is safe from legislation designed protect privacy of its customers. 5/

GDPR threatened $TRUE spyware features. In response Truecaller moved all of its data servers and substantially all of its operations to India where management believe it is safe from legislation designed protect privacy of its customers. 5/

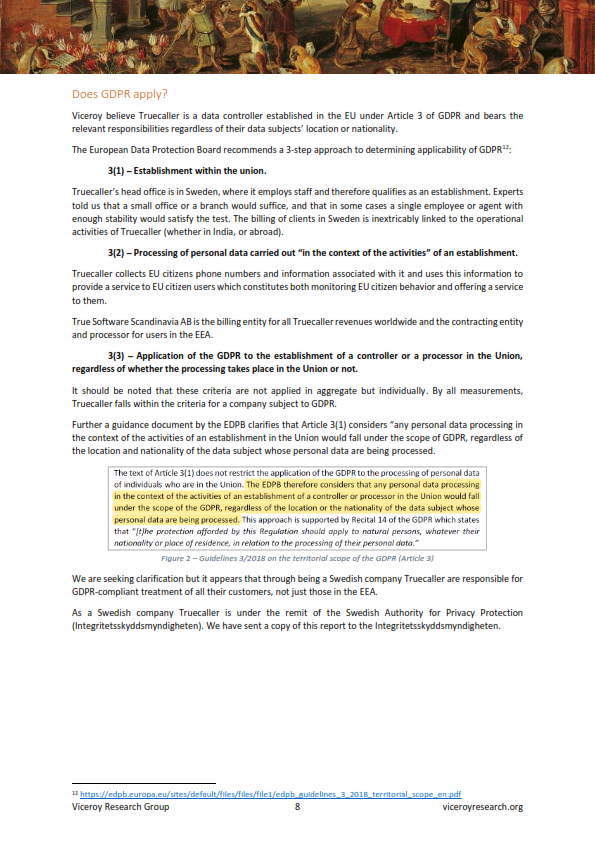

In 2017 Truecaller received a letter from the Article 29 Working Party (since replaced by the European Data Protection Board). This letter highlighted concerns of Truecaller’s processing of personal data immediately prior to the implementation date of GDPR. $TRUE 6/

In 2018, Truecaller moved its entire operations and data servers to India, believing this move will be sufficient at keeping EU regulators at bay. Viceroy consulted GDPR specialists on Territorial Scope (Article 3) of GDPR, and note the following. $TRUE 7/

India’s own data protection bill is in draft and is expected to be published for consultation in the short term . We expect that regulations, if passed, would pose similar problems for Truecaller as GDPR. $TRUE 8/

WHAT WE TELL THE ACCOUNTANTS

When the taxman comes knocking, $TRUE is a proud Swedish company. $TRUE bills almost exclusively from Sweden despite India operations. We believe Truecaller failed to adhere to transfer pricing principles and is avoiding larger tax rates in India. 9/

When the taxman comes knocking, $TRUE is a proud Swedish company. $TRUE bills almost exclusively from Sweden despite India operations. We believe Truecaller failed to adhere to transfer pricing principles and is avoiding larger tax rates in India. 9/

$TRUE's Indian auditors include an EOM in their audit opinion: “The management is in the process of seeking necessary approvals and taking appropriate steps thereof for the [transfer pricing transactions] under the Reserve Bank of India guidelines and GST tax laws” 10/

Truecaller reported a loss in India for the local financial year ended March 2021, despite posting large consolidated profits for the same period. Truecaller paid no income tax in India in the most recent financial year. $TRUE 11/

The Indian market comprises almost 80% of $TRUE's revenues and over 70% of daily active users. 63% of Truecaller’s workforce is based in India. Truecaller’s user terms of service outside the EEA is specifically with “Truecaller International LLP”: an Indian subsidiary. 12/

THE CATCH 22

$TRUE is an Indian company when subject to GDPR and conducts almost all its operations in India. It’s transfer pricing method is reserved almost exclusively for undifferentiated services which don’t bear risk. 13/

$TRUE is an Indian company when subject to GDPR and conducts almost all its operations in India. It’s transfer pricing method is reserved almost exclusively for undifferentiated services which don’t bear risk. 13/

$TRUE is a Swedish company when it’s time to lodge its tax filings. It pays taxes almost exclusively in Sweden. This is despite all processing risk and operations being carried out in India. 14/

FINANCIALS

$TRUE operates a India-centric ad-based revenue model evolved from various unsuccessful, outdated, or (now) illegal models, and finally landed on something that makes money on good margins. Management no doubt want to cash-in while they can. It won't last. 15/

$TRUE operates a India-centric ad-based revenue model evolved from various unsuccessful, outdated, or (now) illegal models, and finally landed on something that makes money on good margins. Management no doubt want to cash-in while they can. It won't last. 15/

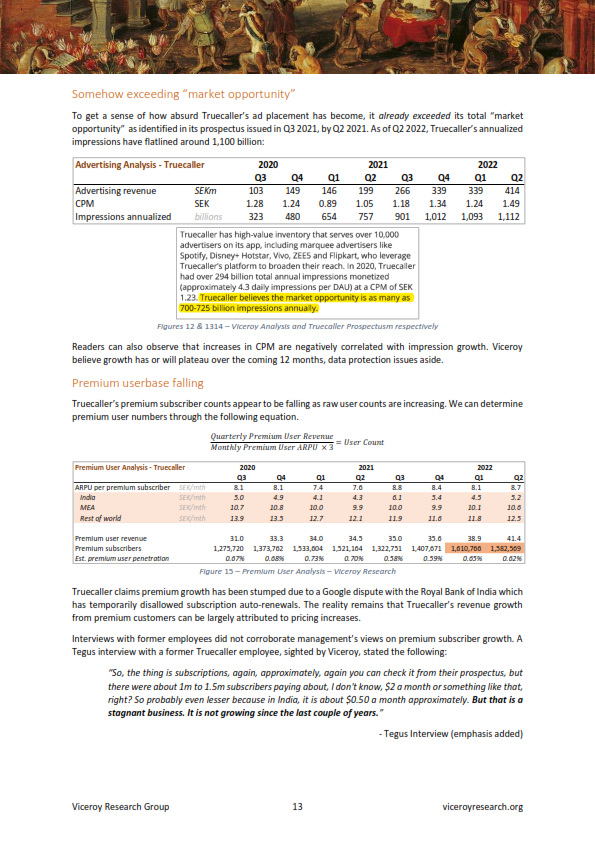

$TRUE huge top-line growth since IPO was a one-time boost resulting from, ironically, spamming their users with more ads. 16/

The $TRUE app advertisements historically were only pushed when unknown numbers called their users. Now ads are pushed to users on every call, including their known contacts, this boosted ad impressions by 4x, completely void of fundamentals. 17/

$TRUE has pushed so many ads, that it’s impressions now vastly exceed its market opportunity estimates from its 2021 prospectus, barely a year old.

Truecaller’s premium user base, previously stagnant, now appears to be falling. 18/

Truecaller’s premium user base, previously stagnant, now appears to be falling. 18/

$TRUE management and key stakeholders have taken every opportunity to sell their stock and move on. Don’t be fooled: management and backers have all already taken cash off the table. 19/

PRIVACY CONCERNS & THIRD-PARTY POLICY BREACHES

Viceroy believes that $TRUE is in violation of Google’s Privacy Policy, which states: “We don't allow unauthorized publishing or disclosure of people's non-public contacts.” This appears to be a blanket statement. 20/

Viceroy believes that $TRUE is in violation of Google’s Privacy Policy, which states: “We don't allow unauthorized publishing or disclosure of people's non-public contacts.” This appears to be a blanket statement. 20/

$TRUE's app does not allow for an “enhanced search” if downloaded from the Play Store. Truecaller thinks that by enticing users into signing-in on its website (via Google accounts), it can then “Enhance Search” contacts by circumventing the app store. 22/

Many phones in India are sold with $TRUE pre-installed, and the app is available for download directly from the company website. These are not subject to Google Play rules, according to Truecaller. 23/

Accordingly: $TRUE database absolutely allows for search of non-user numbers and names without their consent. Viceroy have consequently been able to search EU people by name and have their numbers returned without their approval. 24/

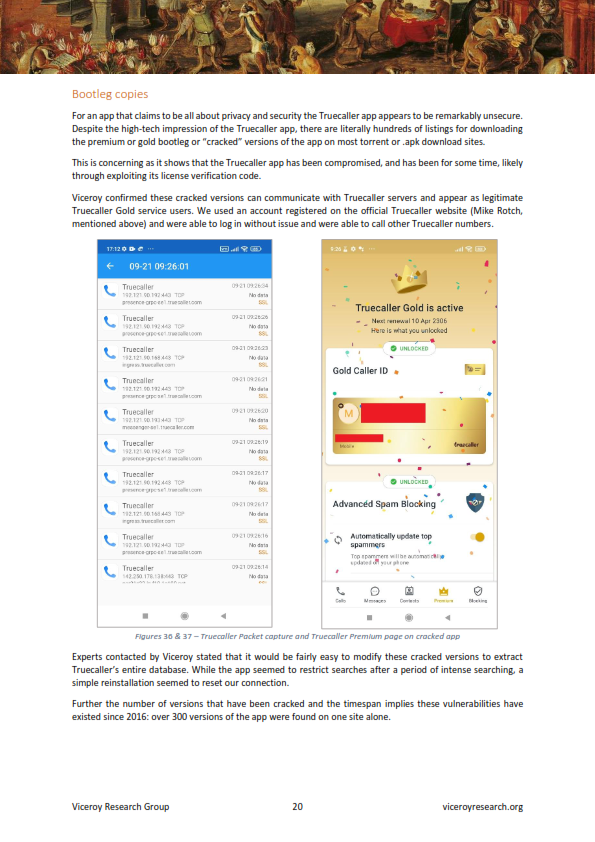

Freely available bootleg copies of $TRUE's app are available with “premium enabled”. These likely contain malware, do not push ads to free users, and can still directly communicate with Truecaller’s data. 25/

FUNDAMENTAL SHORT

Most developed countries/regions have network spam filters operated by telecommunications agencies. These network filters now threaten underdeveloped markets where Truecaller thrive and will rapidly limit Truecaller’s TAM. $TRUE $TRUEB 26/

Most developed countries/regions have network spam filters operated by telecommunications agencies. These network filters now threaten underdeveloped markets where Truecaller thrive and will rapidly limit Truecaller’s TAM. $TRUE $TRUEB 26/

Truecaller has claimed in various press pieces that Government regulation has not impacted their business in other geographies. This is because Truecaller has almost no business in geographies with spam filters. $TRUE 27/

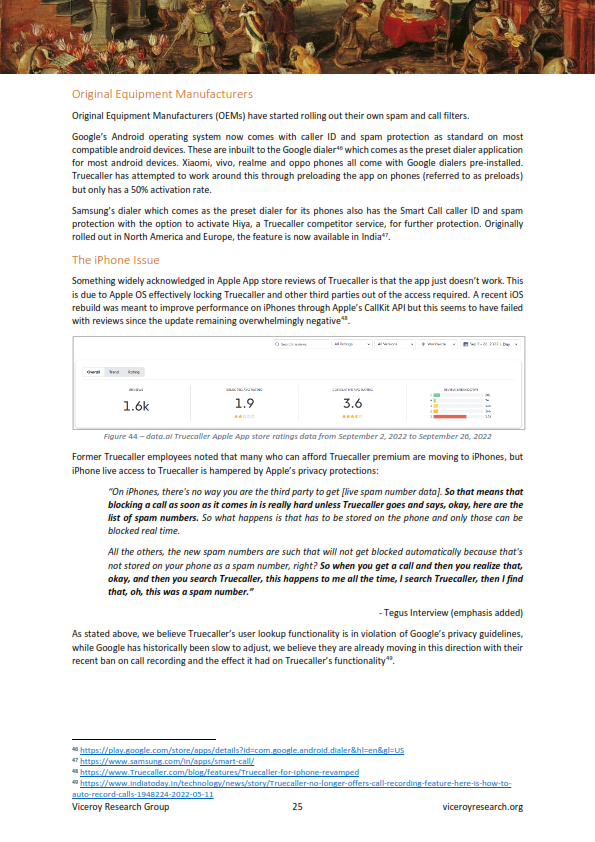

WhatsApp has integrated many business functions with tech players and is due to arrive in India in the short term. Original equipment manufacturers such as Apple, Google, Xiami & Samsung all have in-house spam filtering software, and capacity to wipe out Truecaller. $TRUE 28/

THE SIDESHOW

Truecaller’s constant breaches & data security failures are met with constant denial from management, and are a spectacle to behold. Regulators in Truecaller target growth regions have cracked down on Truecaller out for privacy breaches. $TRUE 29/

Truecaller’s constant breaches & data security failures are met with constant denial from management, and are a spectacle to behold. Regulators in Truecaller target growth regions have cracked down on Truecaller out for privacy breaches. $TRUE 29/

We believe $TRUE have evolved from many different failed shapes onto something that finally makes money. Unfortunately this shape appears to be non-compliant.

We do not assign a target price for Truecaller but see significant short & medium term downside. 30/end $TRUEB

We do not assign a target price for Truecaller but see significant short & medium term downside. 30/end $TRUEB

• • •

Missing some Tweet in this thread? You can try to

force a refresh