If you are hearing about the blood bath in the markets for bonds and USTs but aren't 100% certain what they are or what's the difference, we got your back.

Inspired by @_joerodgers and @mcshane_writes 😉

US Treasuries & Bonds 101 🧵👇

1/15

Inspired by @_joerodgers and @mcshane_writes 😉

US Treasuries & Bonds 101 🧵👇

1/15

2/

This isn't our first thread about bonds, have a look here at a slightly different topic: bond yield curves, where we high-level explain bonds, but deep dive more on the implications of their curves' inversion:

This isn't our first thread about bonds, have a look here at a slightly different topic: bond yield curves, where we high-level explain bonds, but deep dive more on the implications of their curves' inversion:

https://twitter.com/CoinbitsApp/status/1509199799320522762?s=20&t=H6MzTOLIhLrXciCi_CRceQ

3/

What is a US Treasury?

US Treasury securities are debt instruments issued by the US Dept of Treasury to raise the money required to operate the US govt.

They are backed by "the full faith and credit of the US govt: that interest and principal payments will be paid on time."

What is a US Treasury?

US Treasury securities are debt instruments issued by the US Dept of Treasury to raise the money required to operate the US govt.

They are backed by "the full faith and credit of the US govt: that interest and principal payments will be paid on time."

3a/

for a quick detour on what "the full faith and credit of the US govt" actually implies, take a look at our thread explaining the myth of "risk free rates", then return for the continuation of Treasuries and Bonds 101.

for a quick detour on what "the full faith and credit of the US govt" actually implies, take a look at our thread explaining the myth of "risk free rates", then return for the continuation of Treasuries and Bonds 101.

https://twitter.com/CoinbitsApp/status/1509928384721305603?s=20&t=C_nsr90nJKh6xn4lMrGTIw

4/

These securities are often lumped together and just called "treasuries" but there are actually different ones:

Treasury Bills

Treasury Notes

Treasury Bonds

FRNS

TIPS and

US Savings Bonds

🤔🧐

Confusing, huh? Not an accident... let's take a look at them one by one:

These securities are often lumped together and just called "treasuries" but there are actually different ones:

Treasury Bills

Treasury Notes

Treasury Bonds

FRNS

TIPS and

US Savings Bonds

🤔🧐

Confusing, huh? Not an accident... let's take a look at them one by one:

5/

Treasury Bills -

< 1 year to maturity. Purchased for a price less than or equal to their par (face) value, then pay their par value at maturity. Interest is the difference.

e.g. if you buy a 26-week $10k T-Bill for $9750 and hold it to maturity, your interest is $250.

Treasury Bills -

< 1 year to maturity. Purchased for a price less than or equal to their par (face) value, then pay their par value at maturity. Interest is the difference.

e.g. if you buy a 26-week $10k T-Bill for $9750 and hold it to maturity, your interest is $250.

6/

Treasury notes and bonds:

securities that pay a fixed rate every 6 months until maturity, then returns their par value.

The only difference between these 2 is their length to maturity:

Notes mature in > 1 year and <10 years

Bonds mature in > 10 years from issuance.

Treasury notes and bonds:

securities that pay a fixed rate every 6 months until maturity, then returns their par value.

The only difference between these 2 is their length to maturity:

Notes mature in > 1 year and <10 years

Bonds mature in > 10 years from issuance.

7/

FRN is a security with a variable interest payment. If interest rates increase, the FRN's interest payout increases, and vice versa.

FRNs are indexed to the most recent 13-week T-bill auction High rate then enter a lockout period.

FRN is a security with a variable interest payment. If interest rates increase, the FRN's interest payout increases, and vice versa.

FRNs are indexed to the most recent 13-week T-bill auction High rate then enter a lockout period.

8/

TIPS -- Treasury Inflation-Protected Securities. These pay interest every 6 months like bonds, notes and T-bills, but their par value is adjusted to reflect CPI-U.

WTF is CPI-U? Learn more about it here (tweet 8):

TIPS -- Treasury Inflation-Protected Securities. These pay interest every 6 months like bonds, notes and T-bills, but their par value is adjusted to reflect CPI-U.

WTF is CPI-U? Learn more about it here (tweet 8):

https://twitter.com/CoinbitsApp/status/1557343734555201537?s=20&t=H6MzTOLIhLrXciCi_CRceQ

9/

US Savings Bonds: same as Treasury Bonds (above) only they're registered to a specific person and are only payable to that person: they cannot be bought or sold in securities markets, unlike the rest. They are redeemable after 1 year, and earn interest for up to 30 years.

US Savings Bonds: same as Treasury Bonds (above) only they're registered to a specific person and are only payable to that person: they cannot be bought or sold in securities markets, unlike the rest. They are redeemable after 1 year, and earn interest for up to 30 years.

10/

All these securities originate at a Treasury Auction, and can then be bought and sold on securities marketplaces, once the successful bidders obtain them. Press releases are issued to announce when auctions are going to be held, and what securities will be offered.

All these securities originate at a Treasury Auction, and can then be bought and sold on securities marketplaces, once the successful bidders obtain them. Press releases are issued to announce when auctions are going to be held, and what securities will be offered.

11/

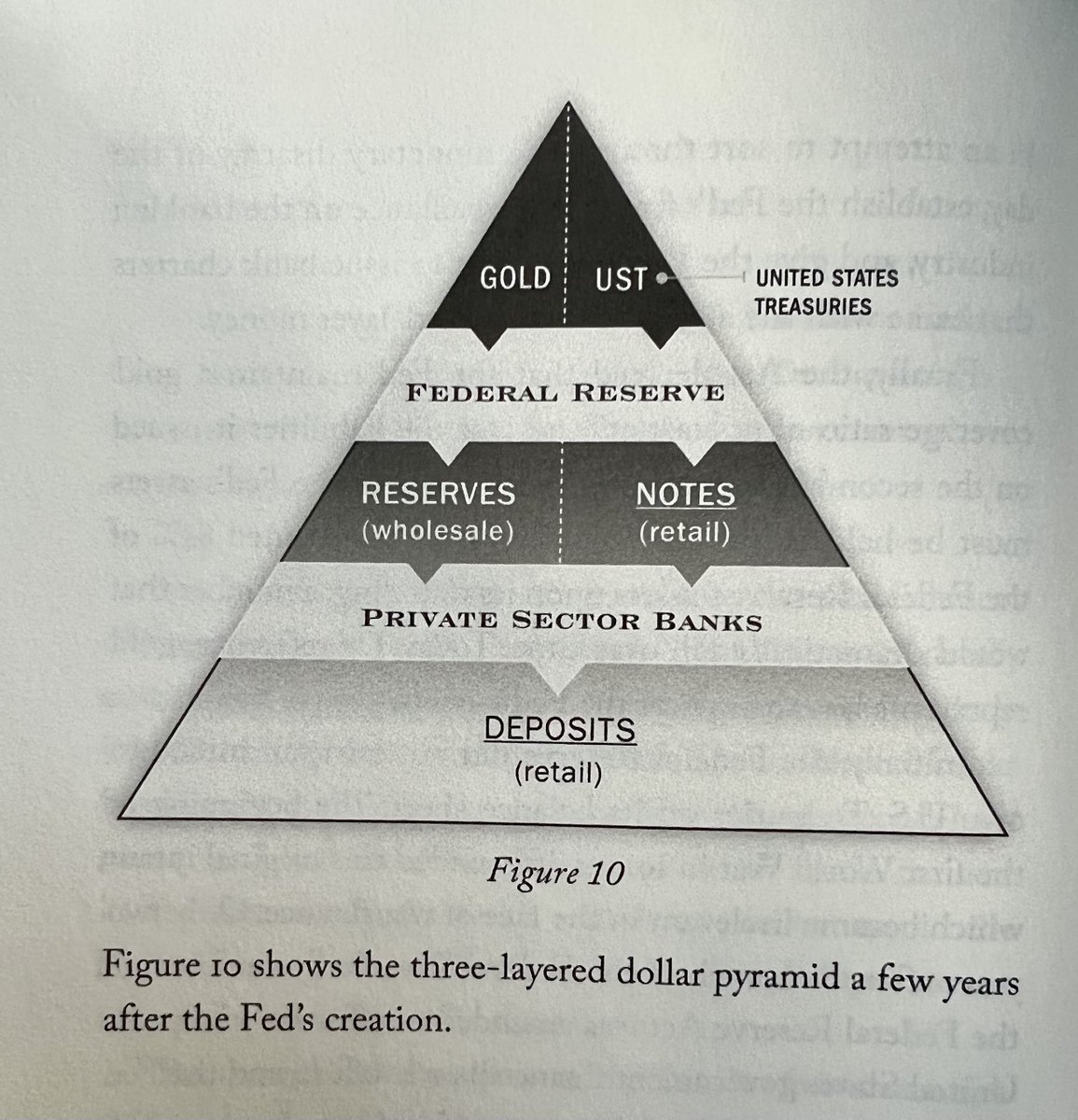

US Treasuries are meant to be the most "pristine" asset to hold, since it is the primary component of the Federal Reserve's balance sheet, which ultimately underlies all financial activity.

Gold historically had this role as @timevalueofbtc describes in Layered Money:

US Treasuries are meant to be the most "pristine" asset to hold, since it is the primary component of the Federal Reserve's balance sheet, which ultimately underlies all financial activity.

Gold historically had this role as @timevalueofbtc describes in Layered Money:

12/

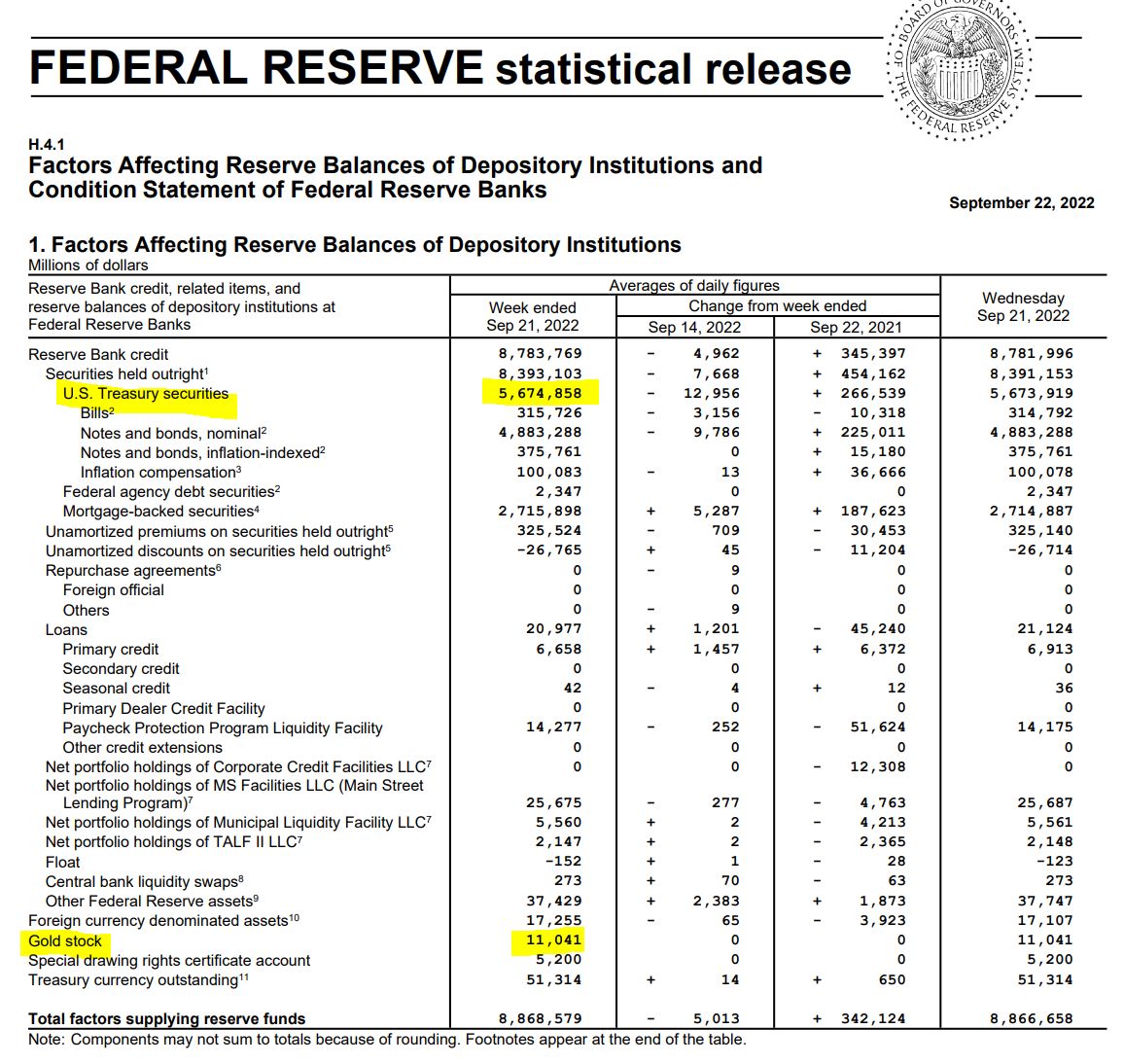

It wasn't always this way. The Fed Act of 1913 "decreed that the Fed maintain a gold-coverage ratio of at least 35%... meaning at least 35% of the Fed's assets must be held in gold... Gold represented 84% of the Fed's assets upon its founding"

Today:

64% UST

0.12% Gold😬

It wasn't always this way. The Fed Act of 1913 "decreed that the Fed maintain a gold-coverage ratio of at least 35%... meaning at least 35% of the Fed's assets must be held in gold... Gold represented 84% of the Fed's assets upon its founding"

Today:

64% UST

0.12% Gold😬

12a/

When the Fed refers to "open market operations" they are actually buying and selling these assets above. Learn more about this here:

When the Fed refers to "open market operations" they are actually buying and selling these assets above. Learn more about this here:

https://twitter.com/CoinbitsApp/status/1552287853580656640?s=20&t=C_nsr90nJKh6xn4lMrGTIw

13/

To summarize: US Treasuries and bonds have, over time, taken over the role of gold as the de facto base money of the world, since the Fed can purchase them with money created out of thin air, even though they are all promises to pay back in the future, backed only by "faith".

To summarize: US Treasuries and bonds have, over time, taken over the role of gold as the de facto base money of the world, since the Fed can purchase them with money created out of thin air, even though they are all promises to pay back in the future, backed only by "faith".

14/

#Bitcoin fixes this.

Like gold, bitcoin is just money. No interest-payout (like USTs) is required to back it.

No bajillion different securities/financial instruments required to make it appealing.

No "full faith and credit" required.

Just math.

Just code.

Just base money.

#Bitcoin fixes this.

Like gold, bitcoin is just money. No interest-payout (like USTs) is required to back it.

No bajillion different securities/financial instruments required to make it appealing.

No "full faith and credit" required.

Just math.

Just code.

Just base money.

15/15

Thank you for reading!

If you’ve learned something from this thread, give us a follow!

And help us spread the knowledge by retweeting our educational threads:

Thank you for reading!

If you’ve learned something from this thread, give us a follow!

And help us spread the knowledge by retweeting our educational threads:

https://twitter.com/CoinbitsApp/status/1569178869244076037?s=20&t=C_nsr90nJKh6xn4lMrGTIw

• • •

Missing some Tweet in this thread? You can try to

force a refresh