If you want links to sources and extra analyses, read the blog post (with 15 footnotes, like in the good old times 🥲)

blog.janmusschoot.be/2022/09/28/ene…

blog.janmusschoot.be/2022/09/28/ene…

The video & blog contain an updated version of my earlier thread about inflation in Europe. It now includes all EU countries, plus the UK, Switzerland, Norway & Iceland.

https://twitter.com/JanMusschoot/status/1551497258666950656

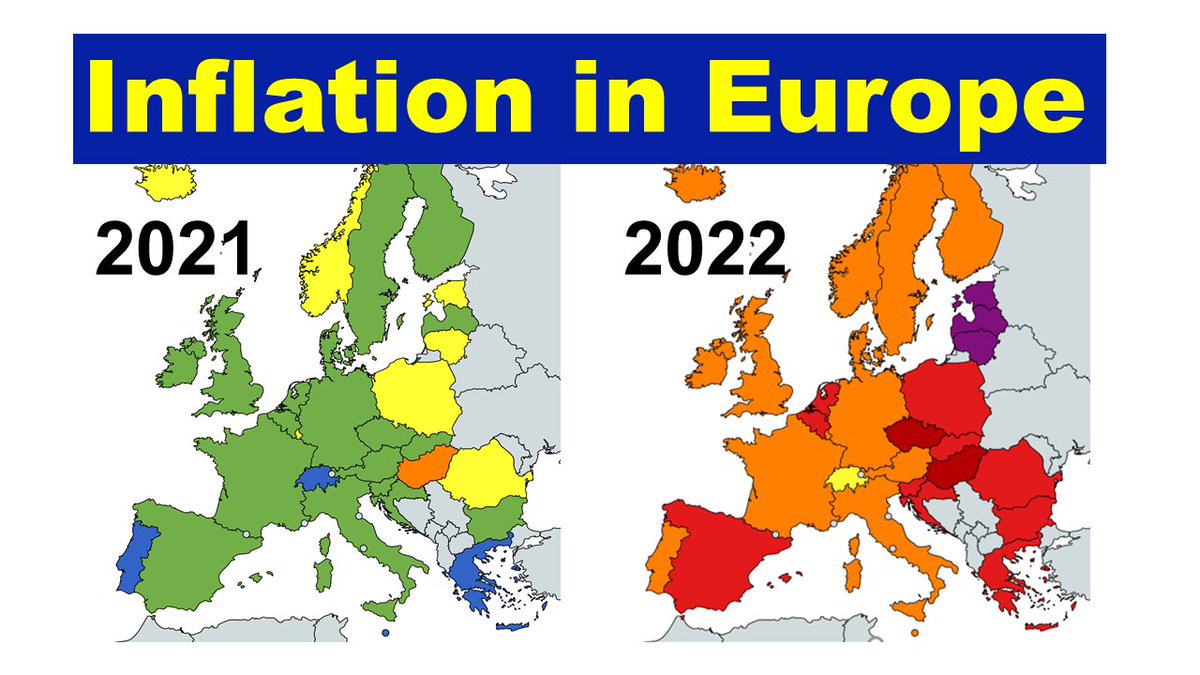

How did we get from an inflation close to 2%, with a 'inflation spread' of 6% between the highest and lowest inflation country...

As you may remember from my earlier thread, there is a strong correlation between inflation and energy intensity.

Countries that consume a lot of energy relative to their GDP, tend to experience higher inflation. Energy intensity takes into account the direct energy consumption of households, and that of businesses.

Energy intensity is highest in countries with a lower GDP per capita, so it's not surprising that inflation increased most steeply in Central & Eastern Europe.

Iceland has plenty of renewable electricity, powering aluminum plants. No fossil fuels means lower inflation #greenflation #fossilflation @Isabel_Schnabel

What's the impact of conventional factors widely believed to drive inflation?

Spain's high unemployment doesn't protect it from rising inflation, nor do we see a wage-price spiral in the data for Germany.

Countries can have very different budget deficits (2021 data), but end up with the same inflation delta.

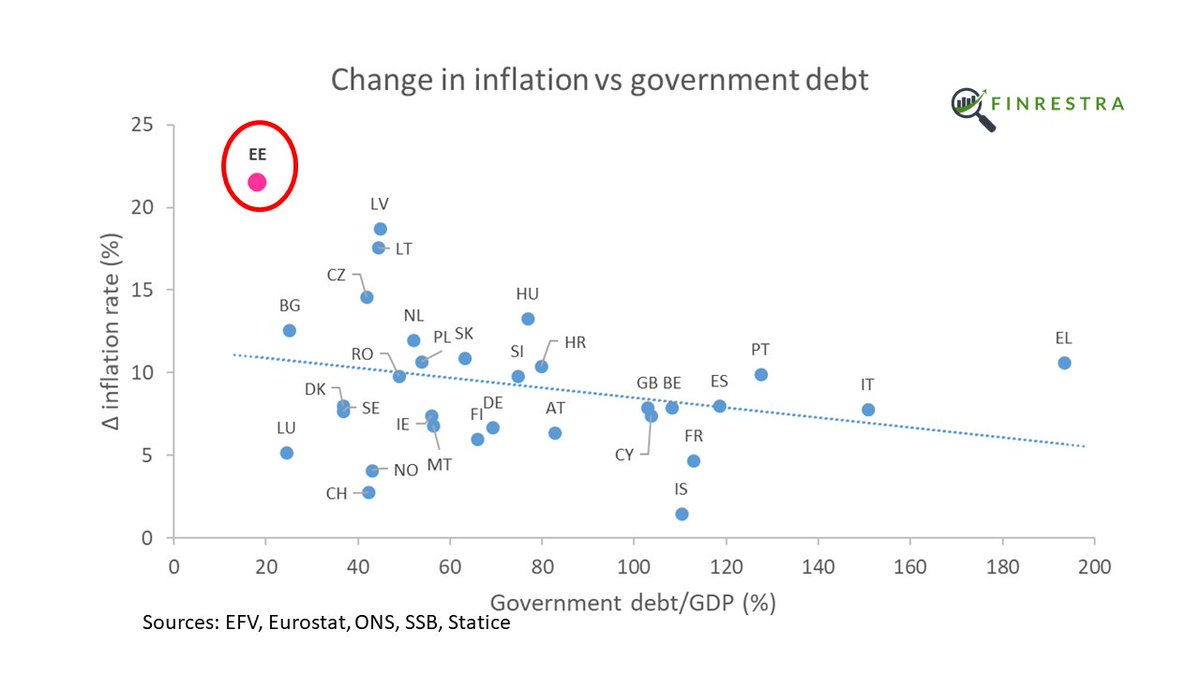

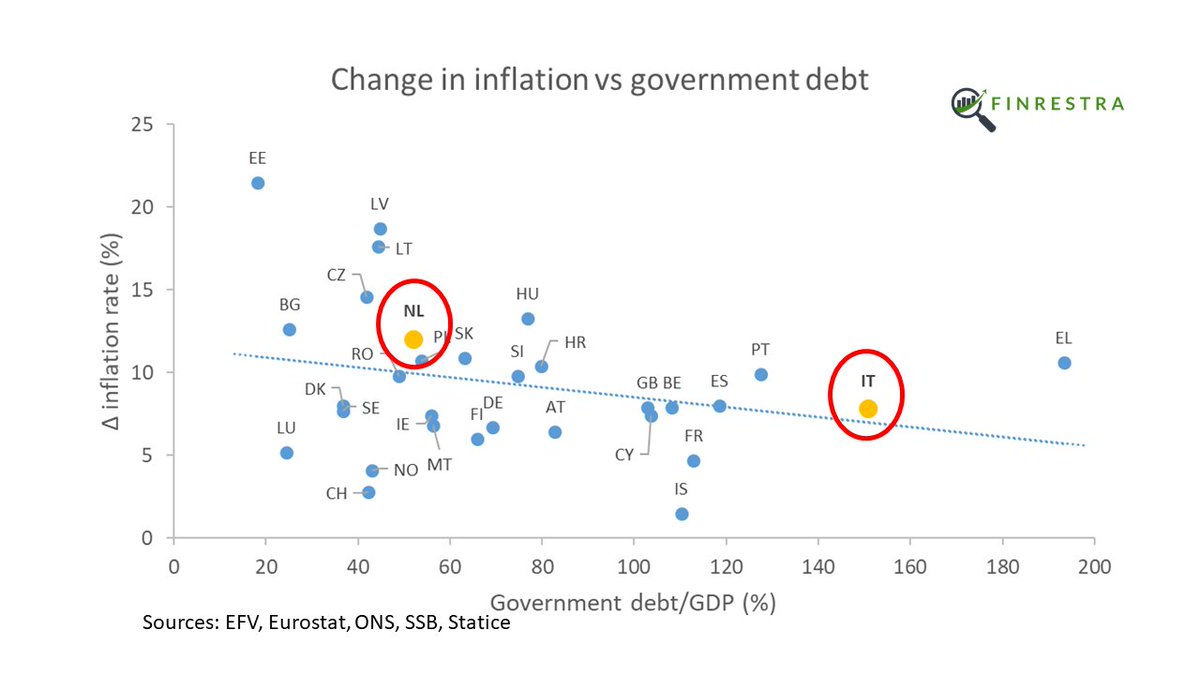

Ironically, there is a (small) negative relation between government debt-to-GDP and inflation.

The Netherlands has seen inflation rise more than Italy, despite much lower government debt.

The Netherlands has seen inflation rise more than Italy, despite much lower government debt.

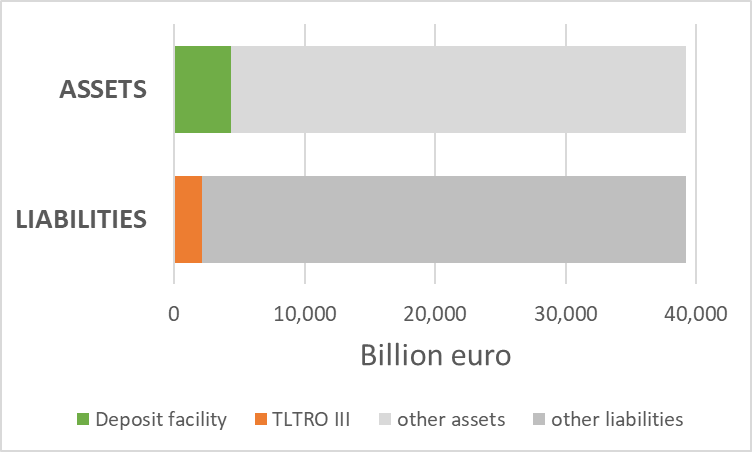

Central banks are hiking interest rates. But does this have an effect on inflation?

Slovakia (in the euro) had a negative policy rate on June 1.

But inflation in Slovakia is similar to its neigbors, where rates were already above 5%.

But inflation in Slovakia is similar to its neigbors, where rates were already above 5%.

tl;dr: watch the 7 minute video😊

Long form with extras on my blog:

blog.janmusschoot.be/2022/09/28/ene…

blog.janmusschoot.be/2022/09/28/ene…

For example, it's remarkable that energy intensity works so well, given the very different energy mix of countries (only on the blog, not in thevideo):

• • •

Missing some Tweet in this thread? You can try to

force a refresh