#highyield credit watch 👀 - cracks starting to show? "Credit stress nearing critical zone (BofA) .. Investors fled risky assets over fears of a recession, pulling $3 billion from high-yield bonds & $1.9 billion from leveraged loans in the wk ended Sept. 28"; liquidity drying up?

https://twitter.com/business/status/1575928735114592275

Investors Balk at Risky Buyout Debt - bloomberg.com/news/articles/…

Even private credit direct lenders are pulling back from market - bloomberg.com/news/articles/…

As a reminder, u/w standards this past cycle were poor, e.g. ~90% of US leveraged loan issuance is cov-lite; the trip wires to warn lenders aren't there this time - so as slowing growth + cost inflation => margin compression & declining FCF, no warnings before defaults occur

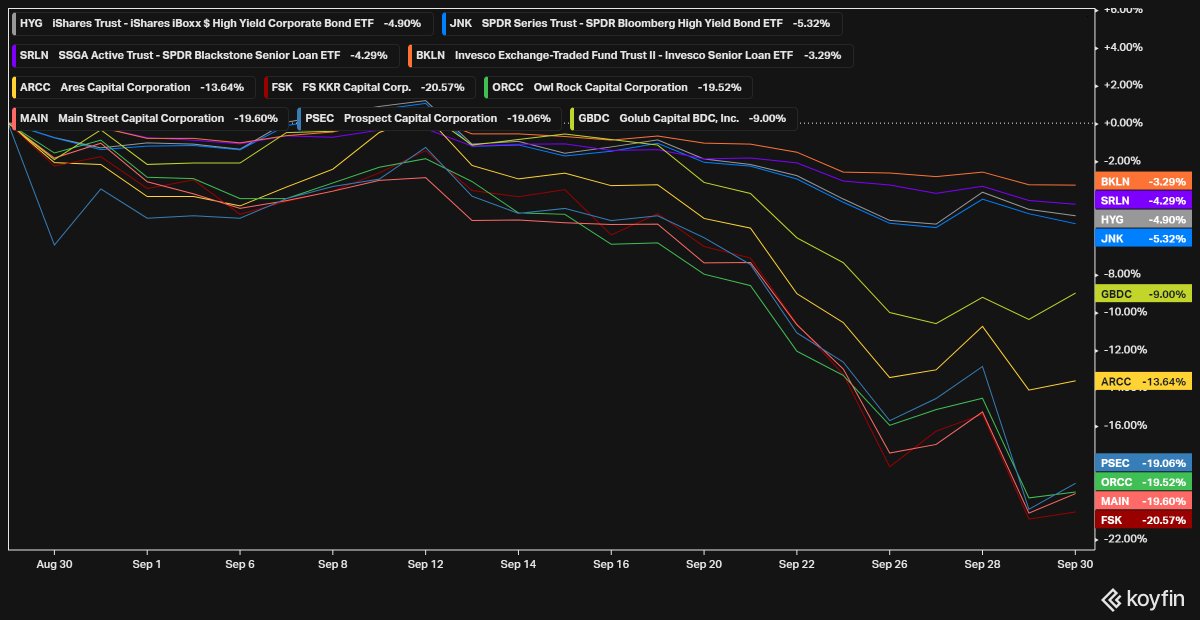

The BDCs are where some of the really problematic lending has occurred , and performance over past month as credit mkt turmoil picked up indicates as such - 6 largest BDCs down 9% - 21% over past month vs. 3% - 5% across $HYG $JNK $SRLN $BKLN -

cc: @Seawolfcap

• • •

Missing some Tweet in this thread? You can try to

force a refresh