Credit Suisse and Deutsche Bank are on the verge of collapse.

A thread on the ongoing crisis at DB and CS as per my limited understanding. 🧵

(/1)

#deutsche #CreditSuisse

A thread on the ongoing crisis at DB and CS as per my limited understanding. 🧵

(/1)

#deutsche #CreditSuisse

The combined asset base of the two banks is nearly $2 Trillion which is 3x the asset base of Lehman Brothers at the time of its collapse.

(/2)

#deutsche #CreditSuisse #LehmanBrothers

(/2)

#deutsche #CreditSuisse #LehmanBrothers

On 15 September 2008, Lehman Brothers, a bank considered 'too big to fail' filed for insolvency. It was the single largest bankruptcy filing in the history of the US.

At the time, the bank had $639 billion in assets and $619 billion in debt.

(/3)

At the time, the bank had $639 billion in assets and $619 billion in debt.

(/3)

Both Credit Suisse and Deutsche Bank are designated as systemically important financial institutions (SIFI): i.e. they are "too big to fail".

Remember the times when they labeled Lehman Brothers as "TBTF"?

Source - FSB

(/4)

Remember the times when they labeled Lehman Brothers as "TBTF"?

Source - FSB

(/4)

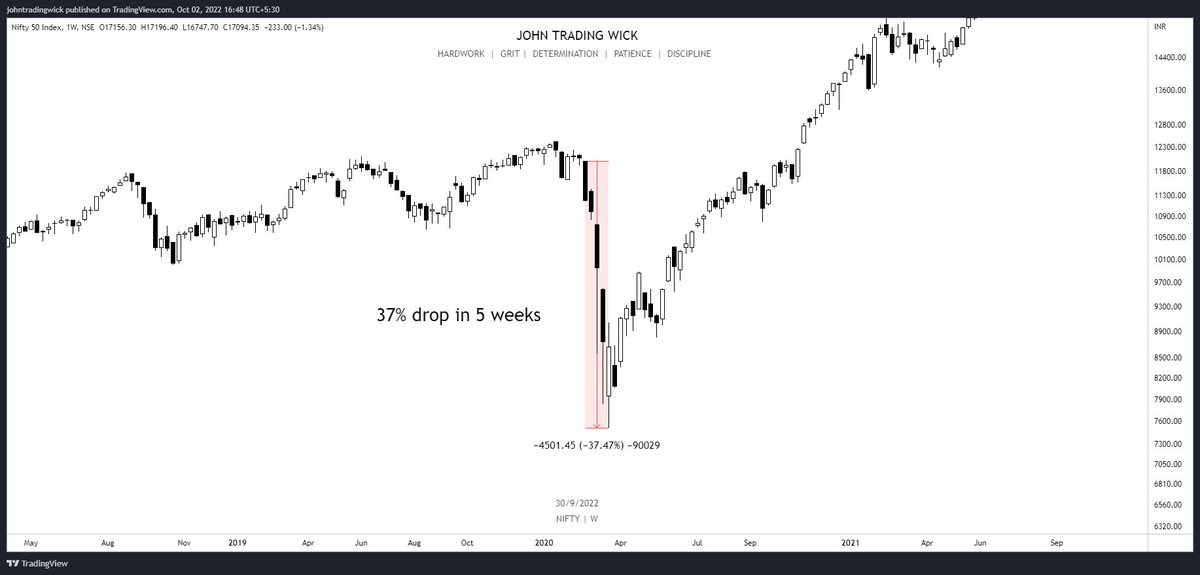

The stocks of Deutsche and Credit Suisse have been slowly bleeding out since 2009 and both are down ~90% from 2009 high.

(/5)

#deutsche #CreditSuisse @in_tradingview

(/5)

#deutsche #CreditSuisse @in_tradingview

The credit default swaps (CDS) for Credit Suisse are going absolutely vertical and are now approaching the highs of the great financial crisis of 2008. Higher CDS = Stronger market-wide belief that CS is going to fail.

Chart courtesy: @FossGregfoss

(/6)

#CDS

Chart courtesy: @FossGregfoss

(/6)

#CDS

A CDS is a derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse them if the borrower defaults.

(/7)

(/7)

What does this crisis mean in layman's terms?

1. If the banks can't pay off their debts i.e. they become insolvent and have to sell off their assets.

2. If the prices of these assets fall below a certain level, the other banks too will have to start selling to avoid...

(/8)

1. If the banks can't pay off their debts i.e. they become insolvent and have to sell off their assets.

2. If the prices of these assets fall below a certain level, the other banks too will have to start selling to avoid...

(/8)

the forceful margin calls on their positions.

3. This massive deleveraging event will create a domino effect due to mass selling and this economic crisis will spread from one market/region to another, known as Contagion.

(/9)

3. This massive deleveraging event will create a domino effect due to mass selling and this economic crisis will spread from one market/region to another, known as Contagion.

(/9)

Though there is a good chance that the German government will go all out to save Deutsche because it's the biggest bank in Germany. But the size of the bailout is a matter of concern.

(/10)

#deutschebank #CreditSuisse

(/10)

#deutschebank #CreditSuisse

No one really knows when the system will start collapsing. But when it does, it will be extremely brutal. It's a ticking time bomb.

FYI this thread is based on my limited knowledge and I reserve the right to be wrong.

Take care and stay safe! ♥️

(11/11)

FYI this thread is based on my limited knowledge and I reserve the right to be wrong.

Take care and stay safe! ♥️

(11/11)

• • •

Missing some Tweet in this thread? You can try to

force a refresh