#Ajax 2021/22 accounts cover a season when they won the Eredivisie, were finalists in the KNVB Cup and reached the Champions League last 16. Finances still impacted by the COVID pandemic. Some thoughts in the following thread.

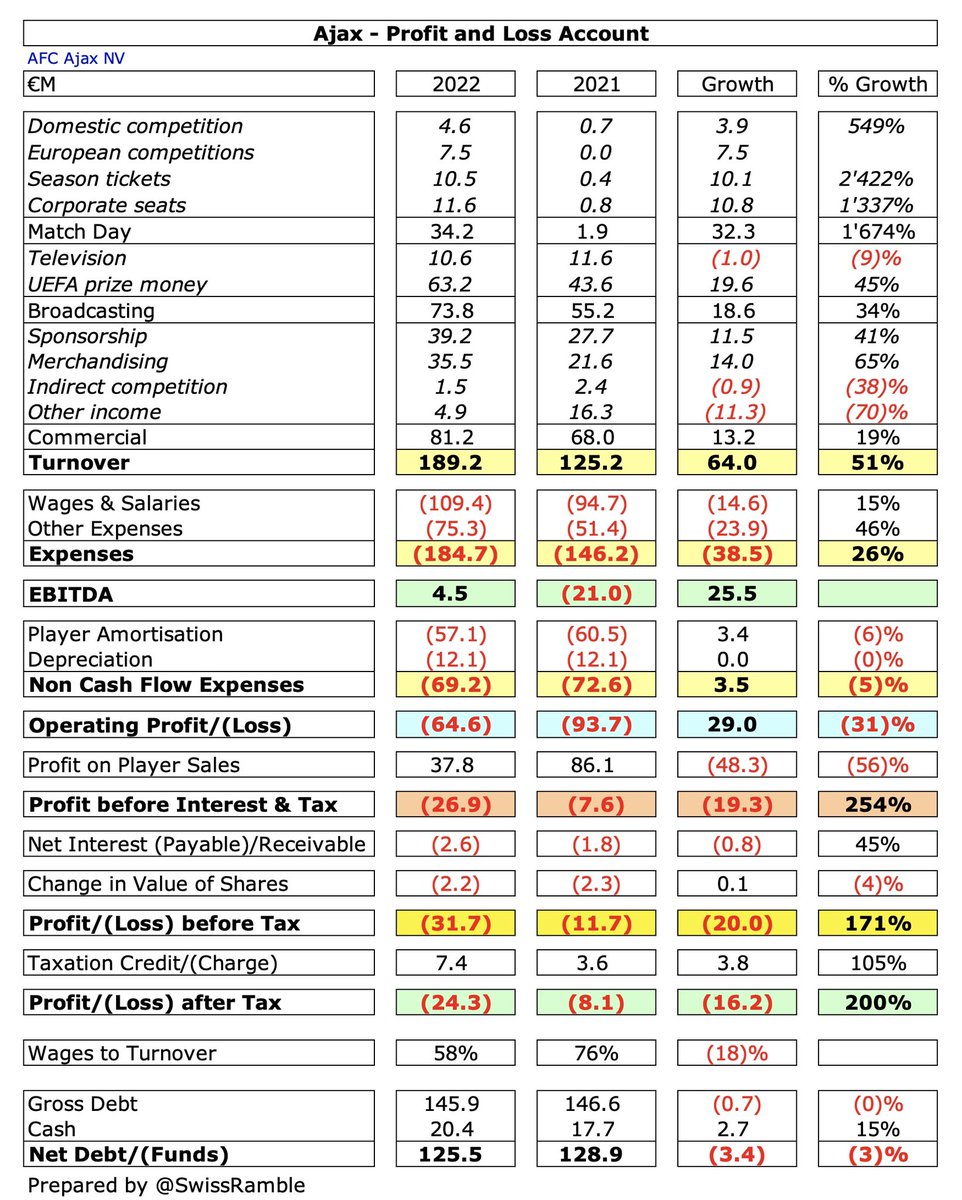

#Ajax pre-tax loss widened from €12m to €32m (€24m after tax), despite revenue rising €64m (51%) from €125m to €189m, as profit from player sales fell €48m from €86m to €38m and operating expenses increased €35m (16%).

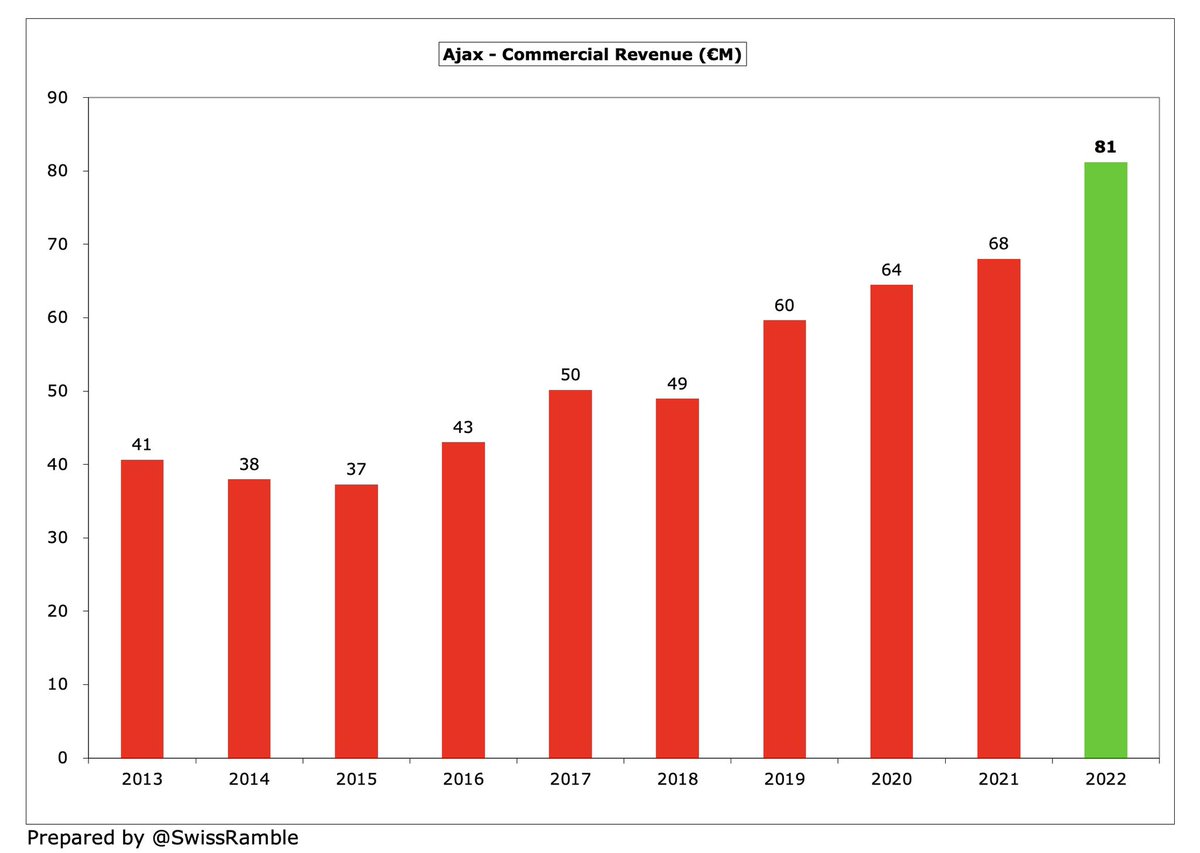

Main reason for #Ajax revenue increase was match day, which rose €32m from €2m to €34m, due to the partial return of fans to the stadium, while broadcasting was up €19m (34%) from €55m to €74m and commercial grew €13m (19%) from €68m to €81m.

#Ajax wage bill rose €15m (15%) from €94m to €109m, but player amortisation decreased €3m (6%) to €57m. Other expenses shot up €24m (46%) to €75m, mainly due to the higher costs of staging games with fans.

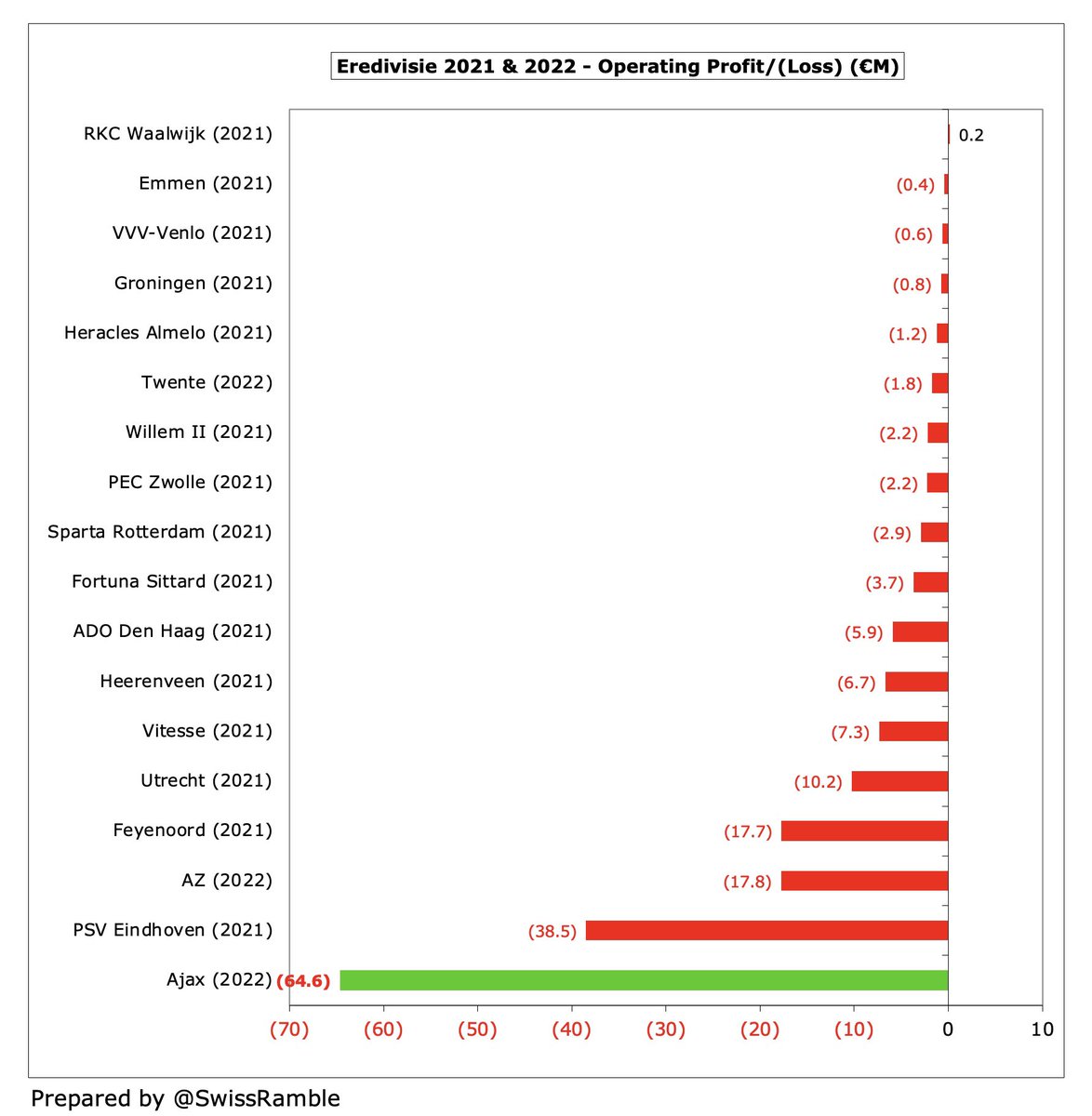

#Ajax €32m pre-tax loss is the highest in the Netherlands, even though the most recent accounts for other clubs cover the 2020/21 season, which included a full year of COVID. In 2019/20 (pre-pandemic) no fewer than 11 of the 18 Eredivisie clubs were profitable.

#Ajax explained that COVID had a “major impact” on these results, noting an operating loss of €7.6m due to playing matches in the first half of the season with no fans or limited capacity, plus a €19.3m reduction in player sales because of the deflated transfer market.

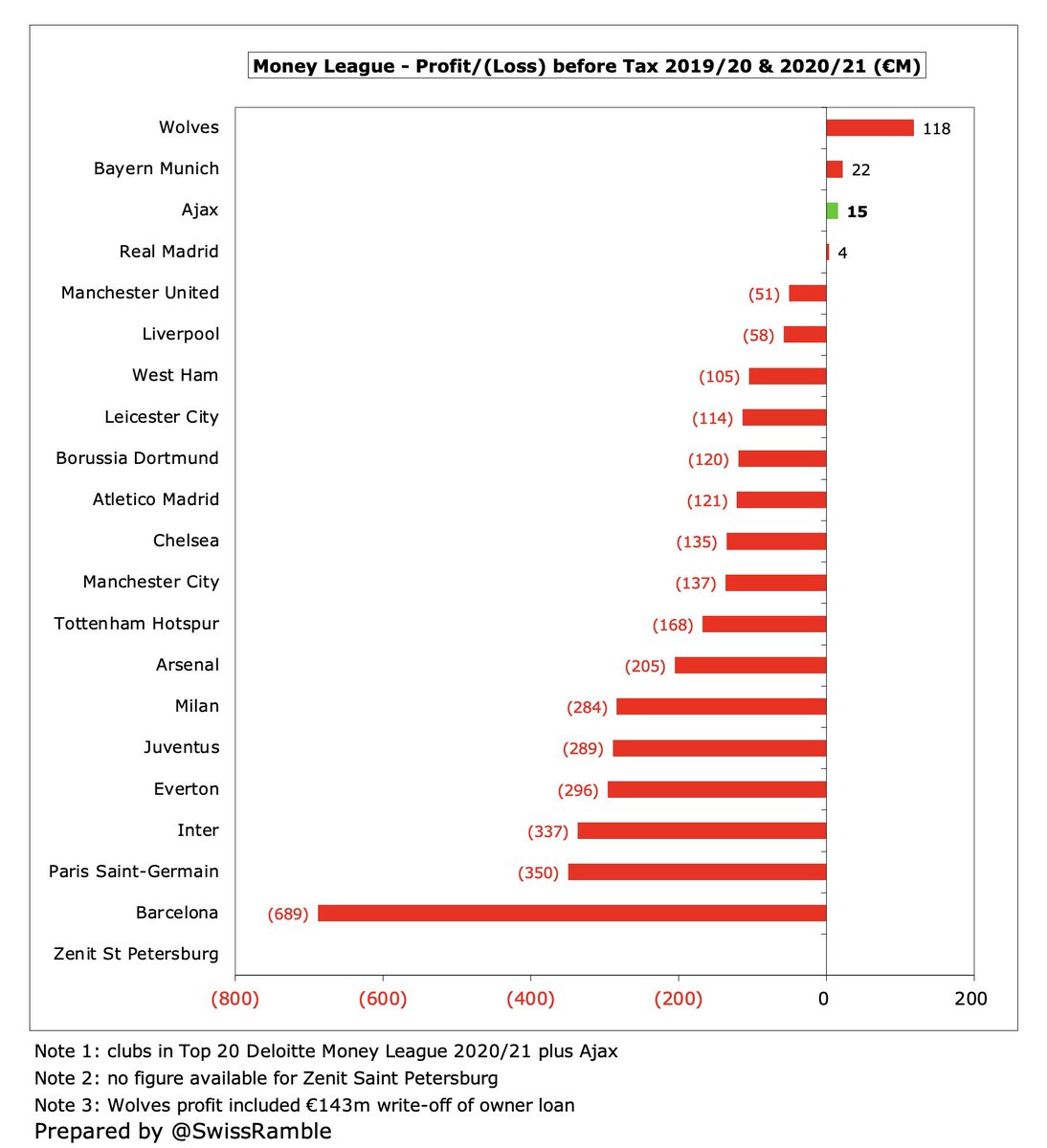

In fairness, #Ajax have done much better than other leading European clubs during the pandemic, reporting an aggregate pre-tax €15m profit for 2019/20 and 2020/21, which was significantly better than the huge losses at the likes of Barcelona €689m, PSG €350m and Inter €337m.

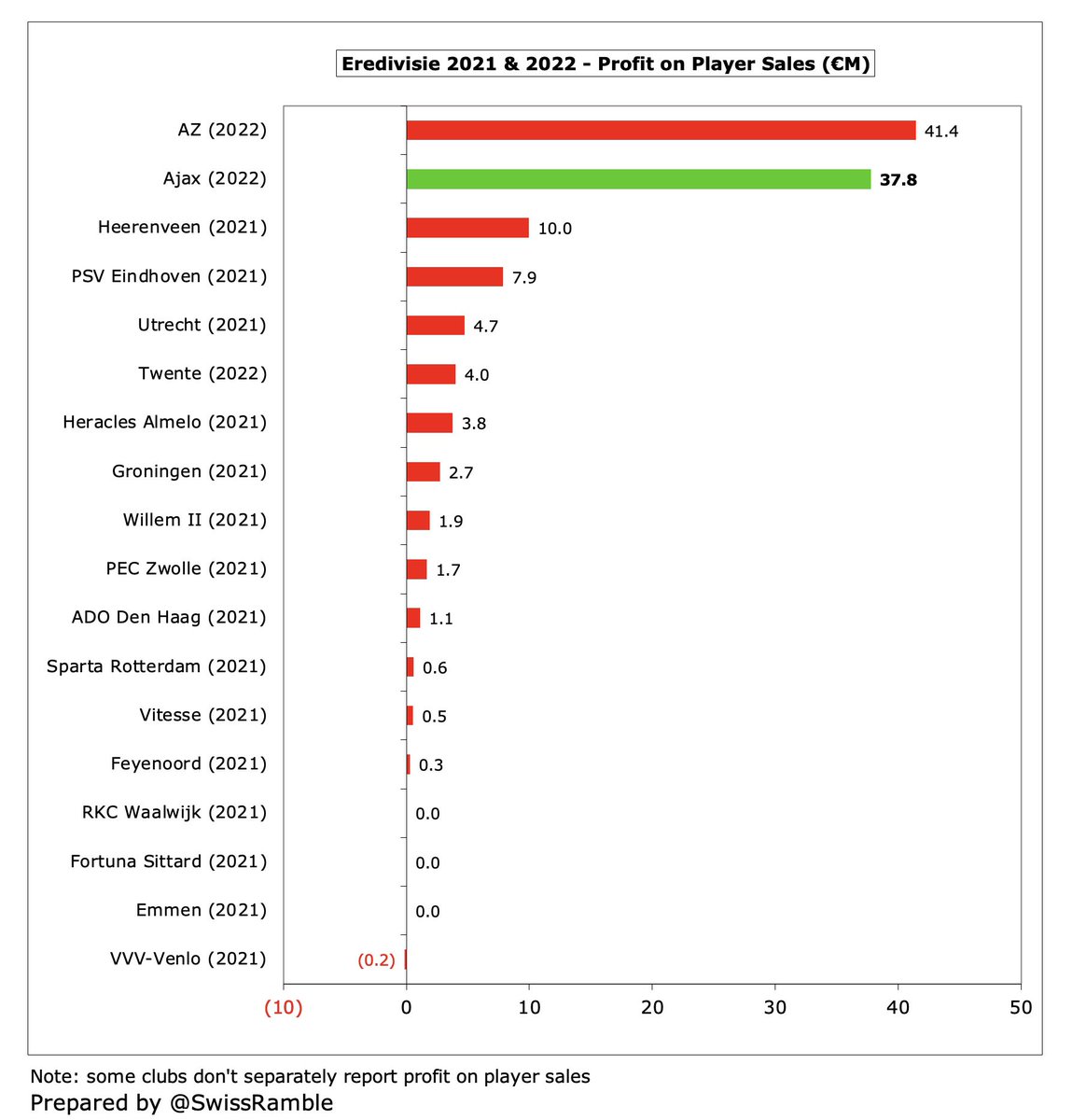

#Ajax 2021/22 figures benefited from €38m profit from player sales, though €48m lower than prior year. Mainly Ryan Gravenberch to Bayern Munich, David Neres to Shakhtar Donetsk, Kjell Scherpen to #BHAFC, Jurgen Ekkelenkamp to Hertha Berlin and Noa Lang to Club Brugge.

#Ajax normally run a sustainable business model, but they have posted losses amounting to €43m in the past two years, driven by the pandemic. In the previous eight years, they had accumulated nearly a quarter of a billion Euros profit, averaging €30m a season.

However, #Ajax are very reliant on player sales, earning nearly half a billion (€485m) from this activity in the last decade, including €281m in the last 4 years. This season’s figures will be even more impressive after sales of Antony, Martinez, Haller, Schuurs and Tagliafico.

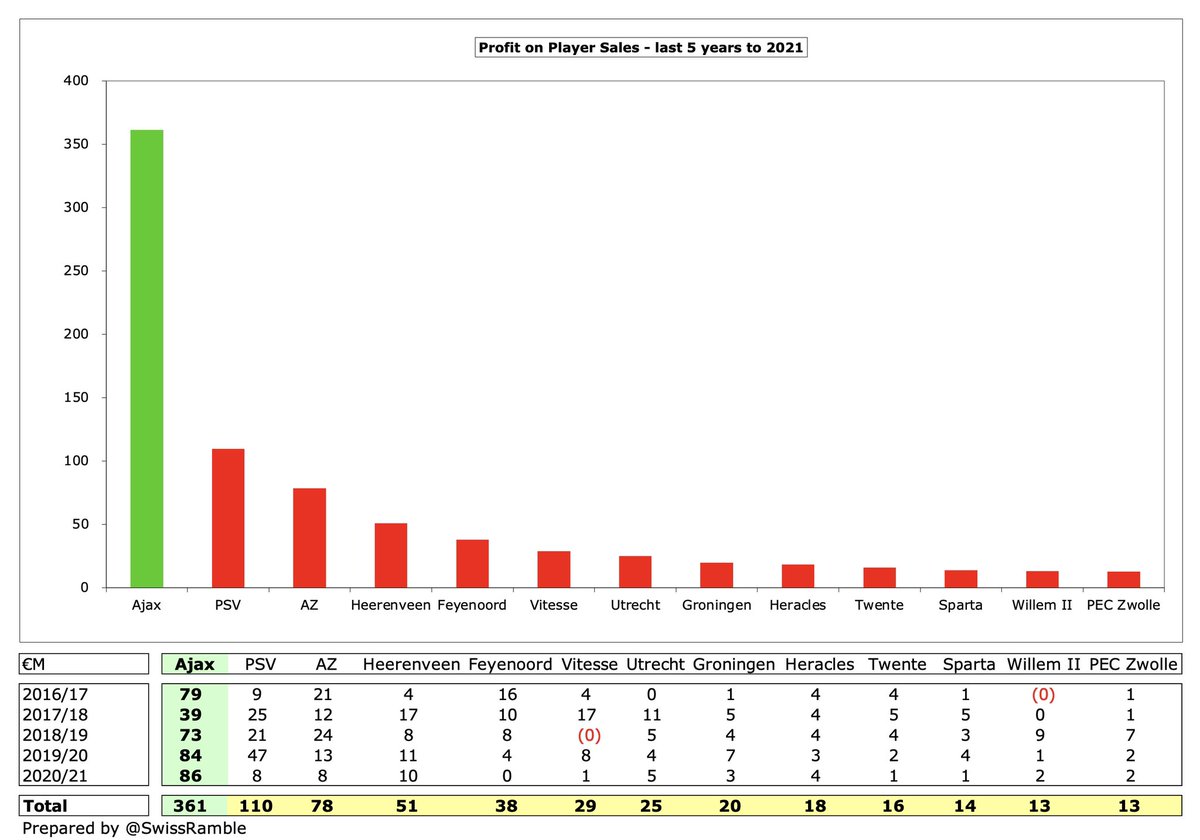

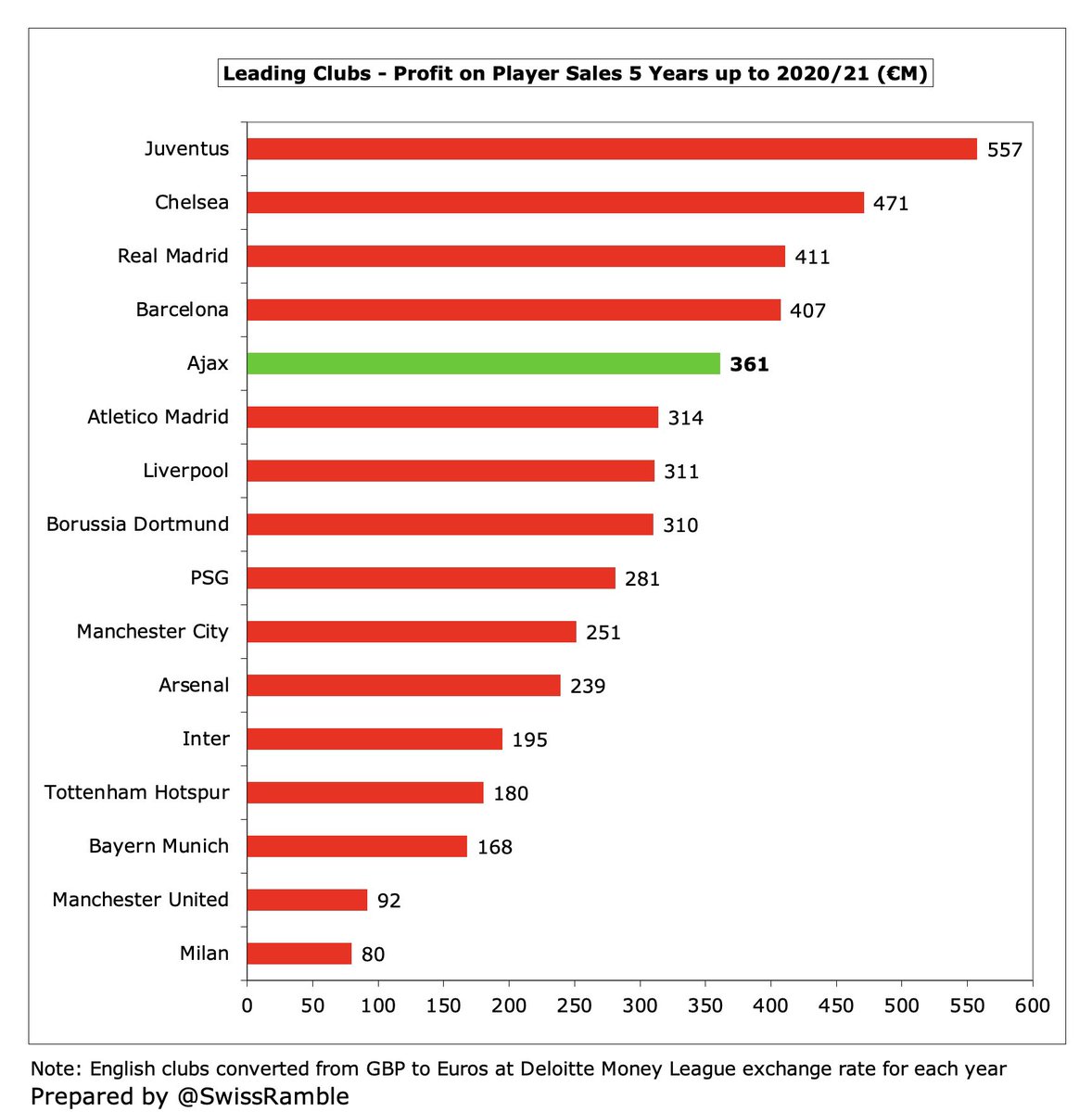

#Ajax are known for their strategy of developing and selling players, as highlighted by the €361m profit made in the 5 years up to 2021, more than three times as much as PSV €110m. In fact, they have one of the highest gains from player trading in all of Europe.

#Ajax operating loss reduced from €94m to €65m, though this was the worst in Eredivisie. The business model is to offset operating losses with profits from player sales. Not possible in last 2 years due to COVID, but will return to profit in 2022/23 thanks to high player sales.

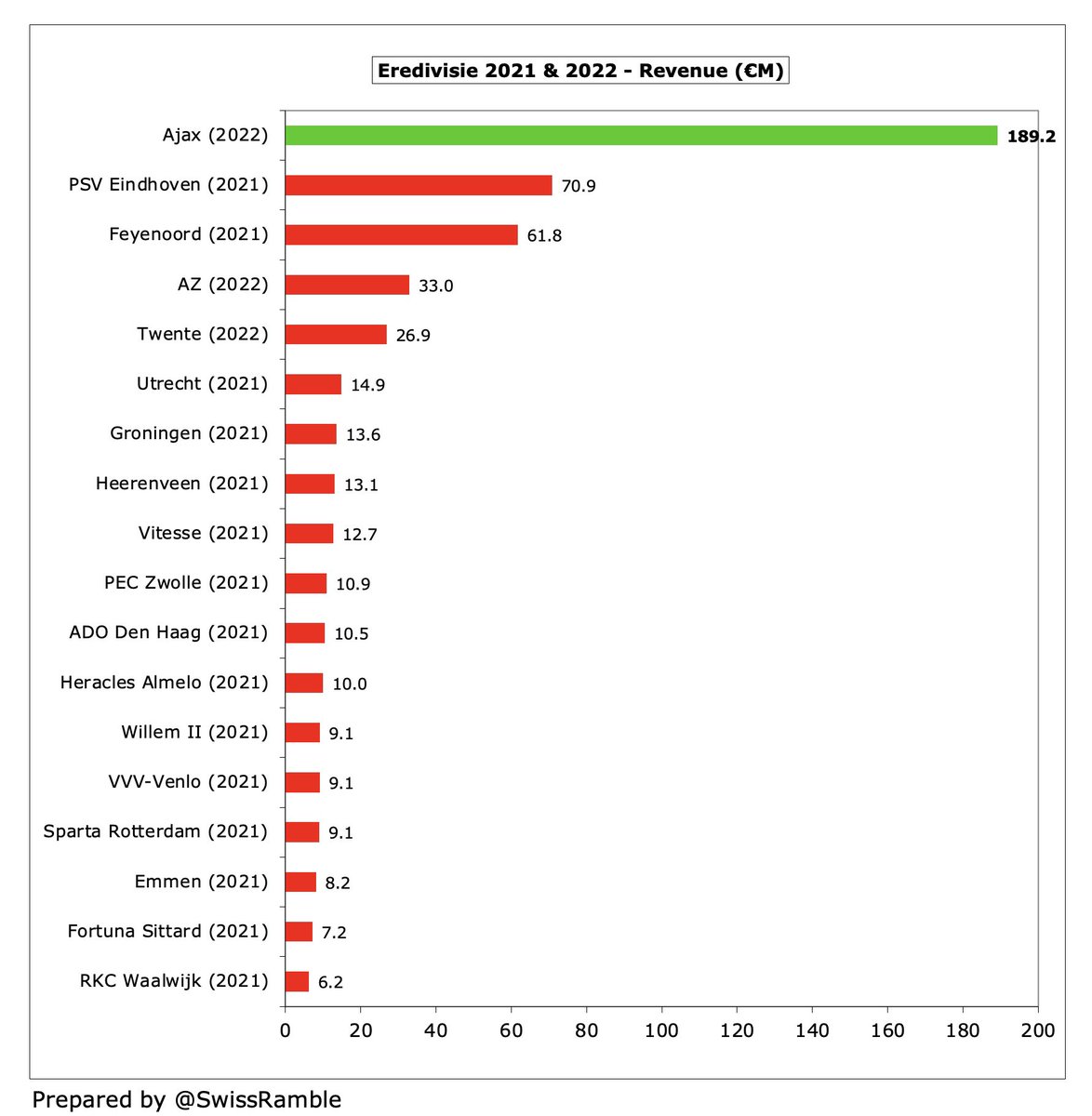

Following last year’s growth, #Ajax €189m revenue is only €10m (5%) less than the club’s €199m peak in 2019, when they reached the Champions League semi-finals. Lower match day (due to COVID restrictions) and broadcasting have been largely offset by higher commercial.

#Ajax €189m revenue is by far the highest in Netherlands, well ahead of PSV €71m and Feyenoord €62m, though their rivals’ figures are from the 2020/21 season when games were played without fans and 13 of the 18 Eredivisie clubs had revenue lower than €15m.

In 2021 #Ajax dropped out of the Deloitte Money League with their €125m revenue being a long way below 30th placed Lazio €164m, having been as high as 23rd in 2019. This highlights that their revenue is far below the European elite, which is why Ajax are a selling club.

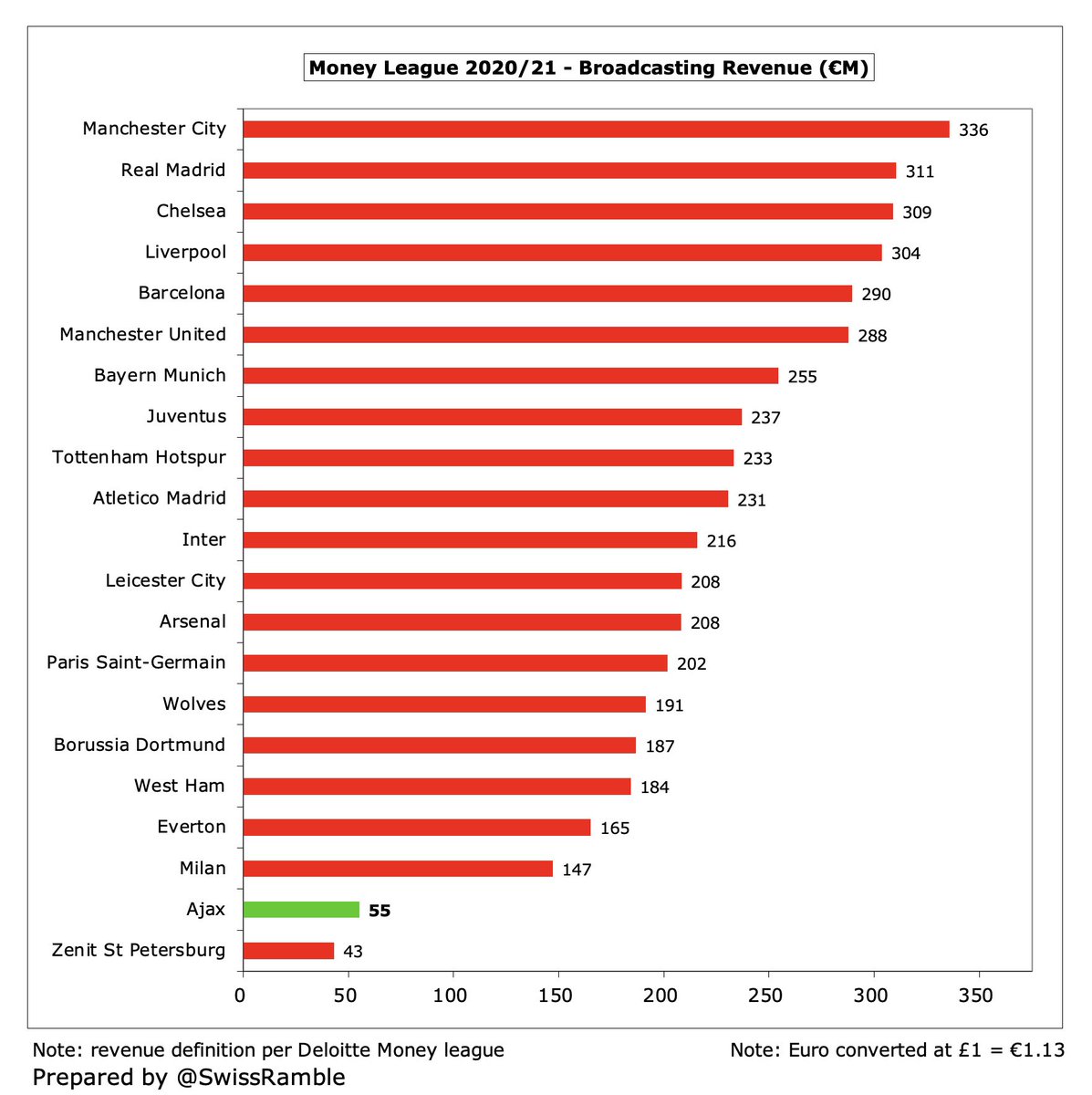

#Ajax broadcasting revenue rose €19m (34%) from €55m to €74m, which was highest in Netherlands by far, way ahead of PSV €20m (2020/21), but by the same token well below other leading European clubs. The €89m peak in 2019 was boosted by reaching Champions League semi-finals.

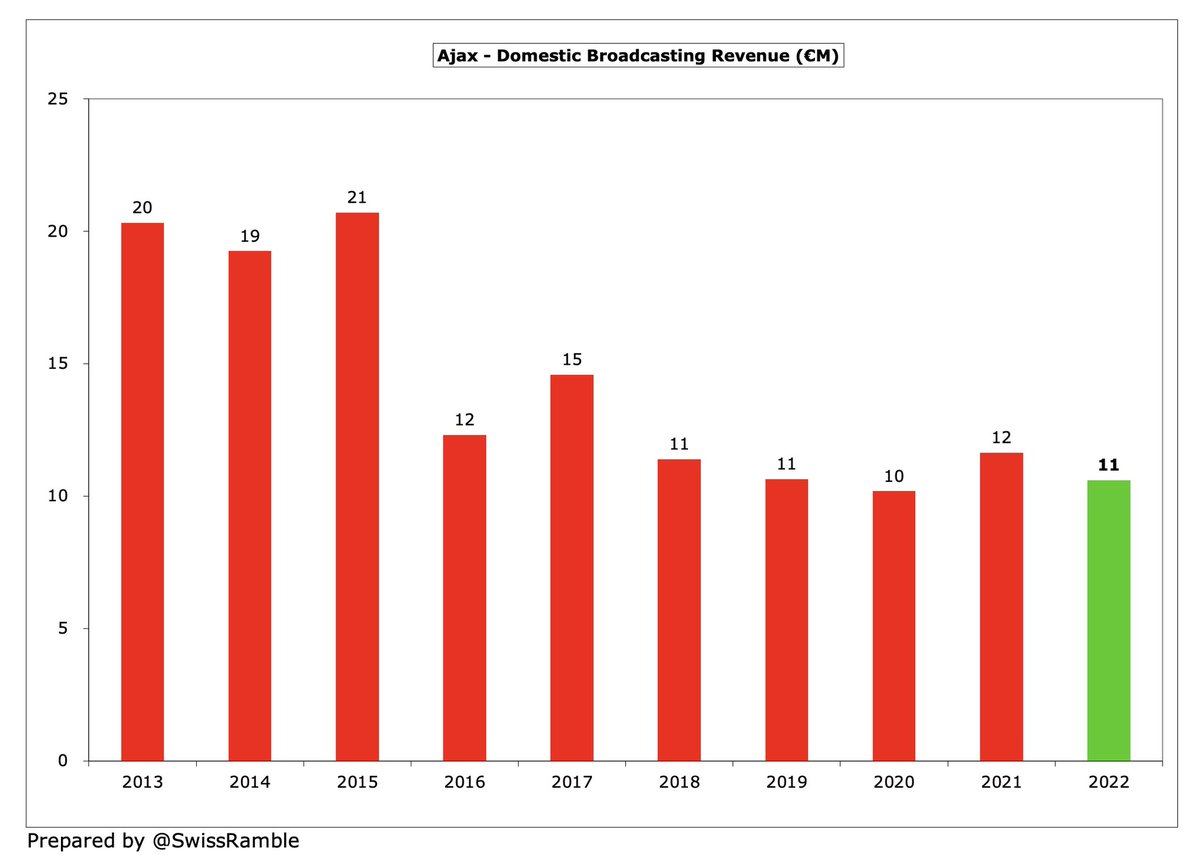

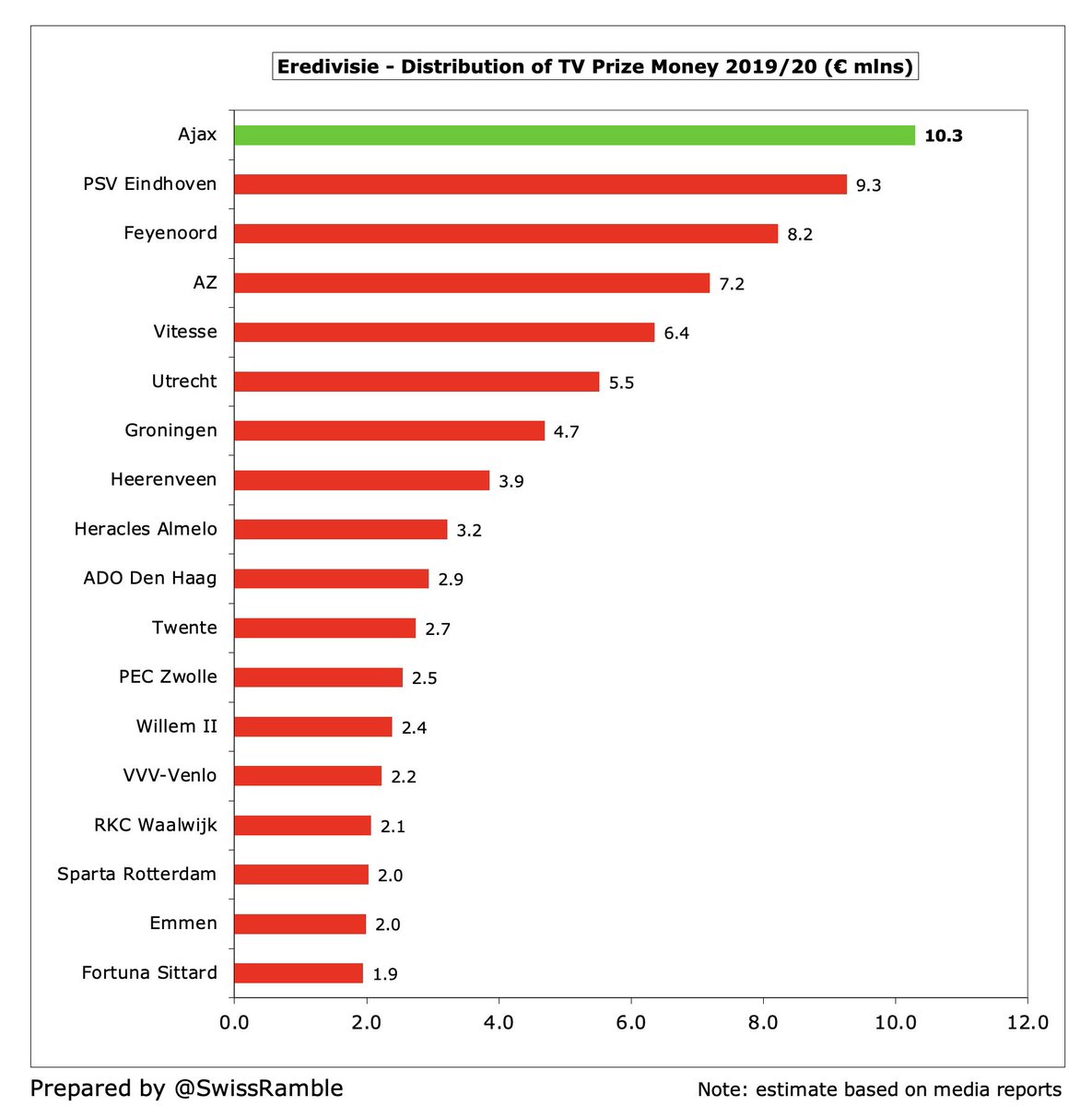

#Ajax received €11m TV money from the Eredivisie, which signed a 12-year deal with Fox starting in the 2013/14 season. Distribution is based on a club’s historical performance (results over the previous 10 years), so Ajax get the most, followed by PSV and Feyenoord.

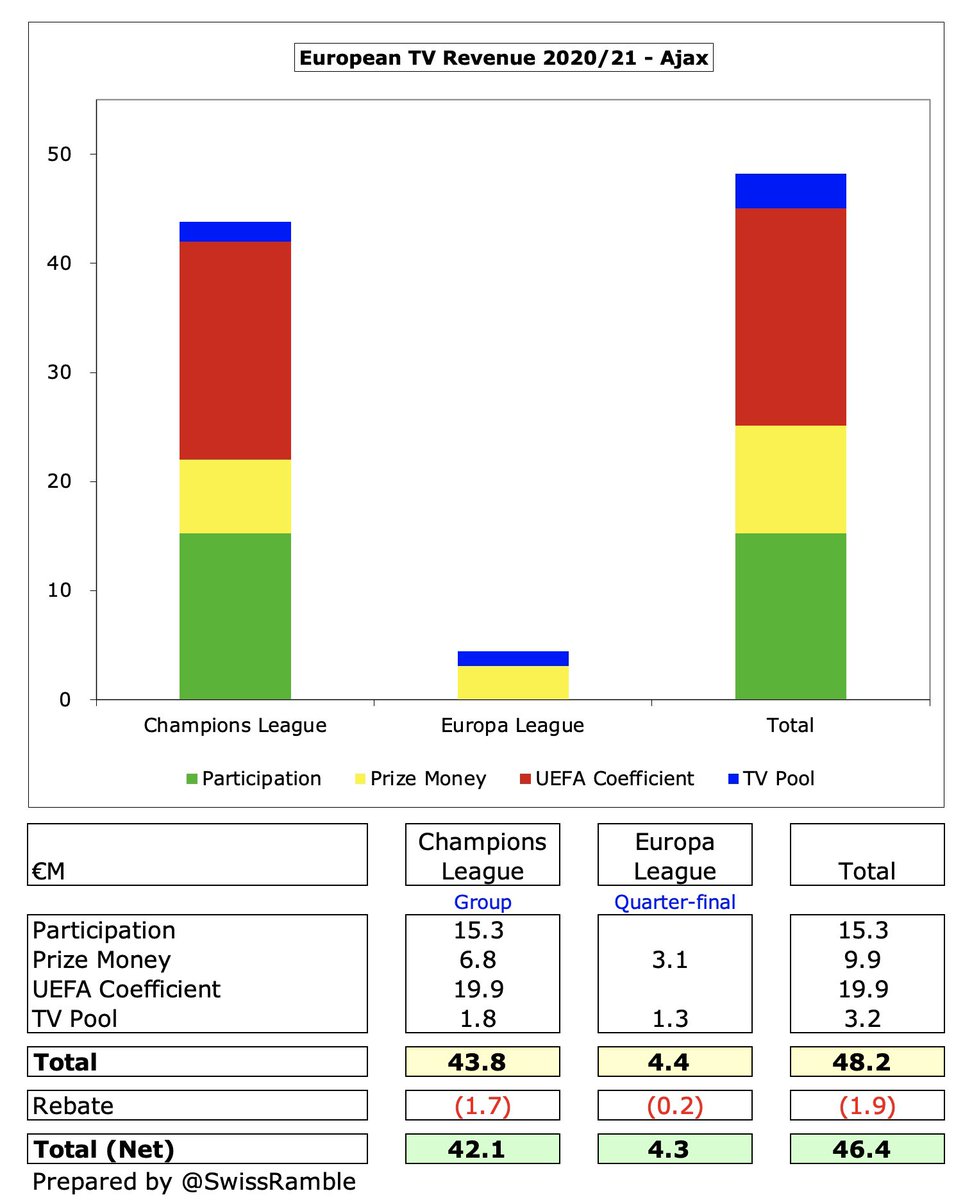

#Ajax earned €63m from Europe in 2021/22 after reaching Champions League last 16. This was €17m more than prior year’s €46m when they were eliminated in the Champions League group stage, followed by making the Europa League quarter-finals.

A large part of #Ajax European money comes from the UEFA coefficient payment (based on performances over 10 years), where they were ranked 15th in the Champions League, thus receiving €20m. This distribution methodology rewards the club’s good record in Europe.

#Ajax have earned a hefty €237m from European competition in the last 5 years, which is even more impressive considering that they did not reach the group stage of the Champions League or the Europa League in 2018.

The importance of Champions League qualification to the #Ajax business model cannot be over-stated with their €237m European TV money in last 5 years being considerably more than PSV €62m and Feyenoord €52m and much higher than the domestic TV deal.

#Ajax match day income rose €32m from €2m to €34m, due to the return of fans to the stadium, though many games were either played behind closed doors or with restricted capacity. This revenue stream was as high as €51m pre-COVID.

#Ajax average attendance was down to 35,500 in 2021/22, due to the capacity restrictions imposed by the authorities. However, before COVID struck, Ajax enjoyed crowds of 52,300, the highest in the Eredivisie, and 10,000 more than Feyenoord 42,200.

#Ajax commercial income rose €13m (19%) from €68m to €81m, thanks to new partnerships driving sponsorship up from €28m to €39m and merchandising rising €14m to €36m mainly due to iconic new “Bob Marley” kit. Other income down €11m (prior year government COVID subsidy).

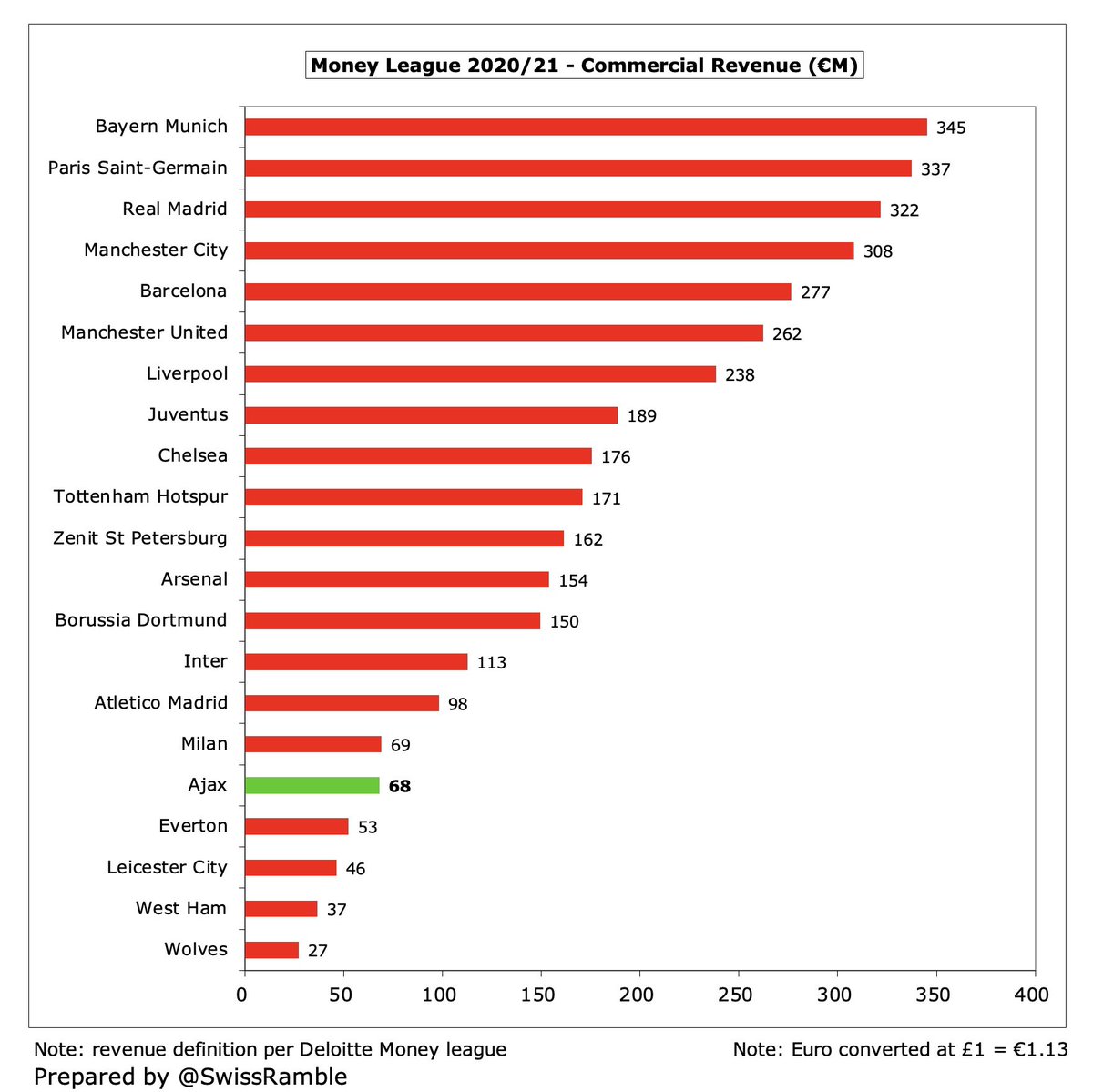

As a result, #Ajax €81m commercial revenue is the highest in the Eredivisie, well ahead of PSV €49m and Feyenoord €47m, but it is still a lot less than the elite European clubs, four of whom generate more than €300m a year.

#Ajax have extended their two main sponsorship deals: (a) shirt sponsor Ziggo, a telecoms provider, to June 2025, worth around €9m a year; (b) kit supplier Adidas, who have been with the club since 2000, have a 6-year deal worth around €8m a year until June 2025.

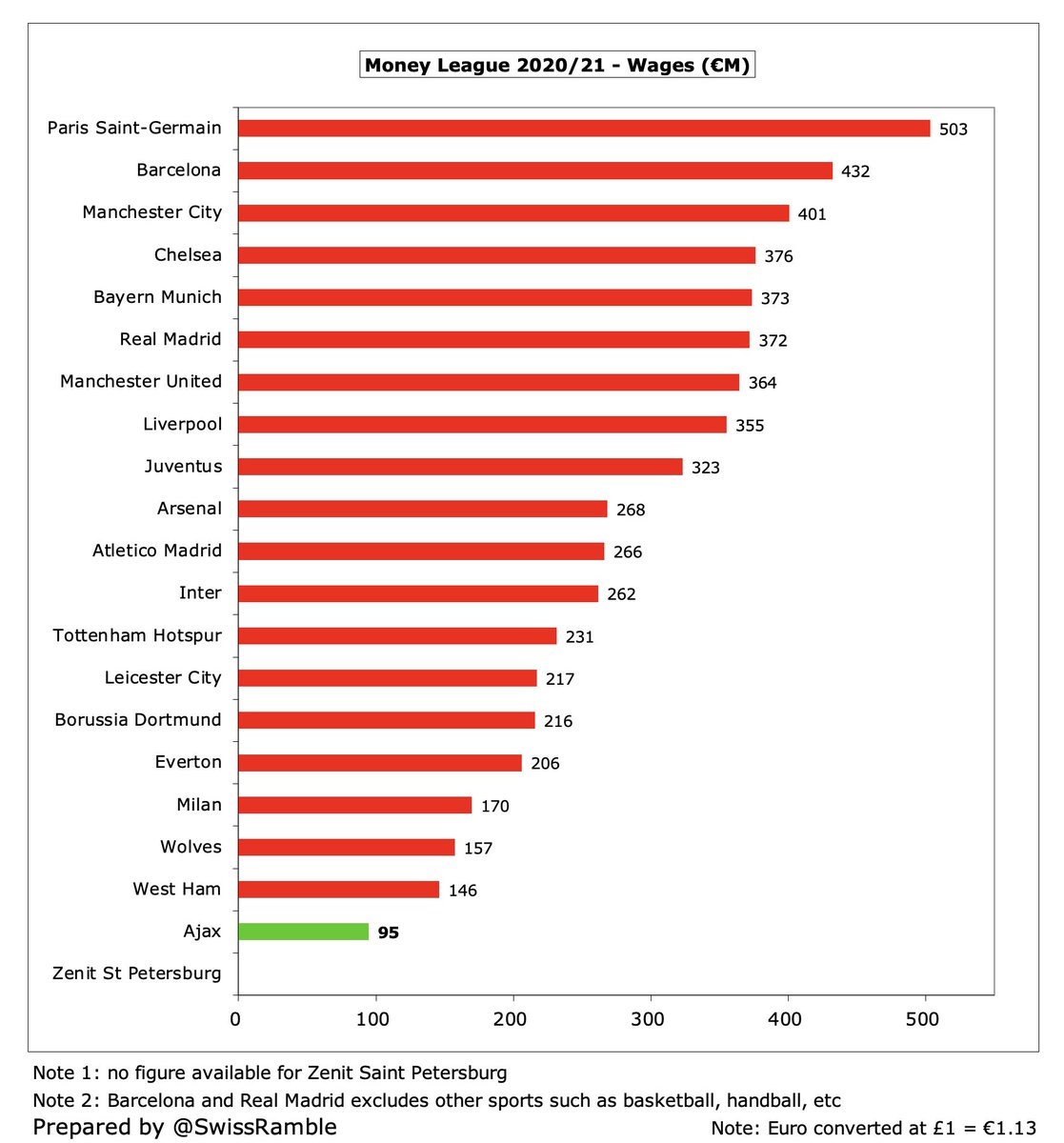

#Ajax wage bill rose €14m (15%) from €95m to €109m, due to higher bonuses, player signings and contract extensions. Far more than Dutch rivals, e.g. in 2020/21 PSV €47m and Feyenoord €37m, and actually the highest ever in the Eredivisie.

However, for #Ajax it is a case of being “a big fish in a small pond”, as their €95m wage bill in 2020/21 was significantly lower than top clubs in the major leagues, e.g. less than 20% of PSG €503m. This makes it fairly inevitable that their young stars will move abroad.

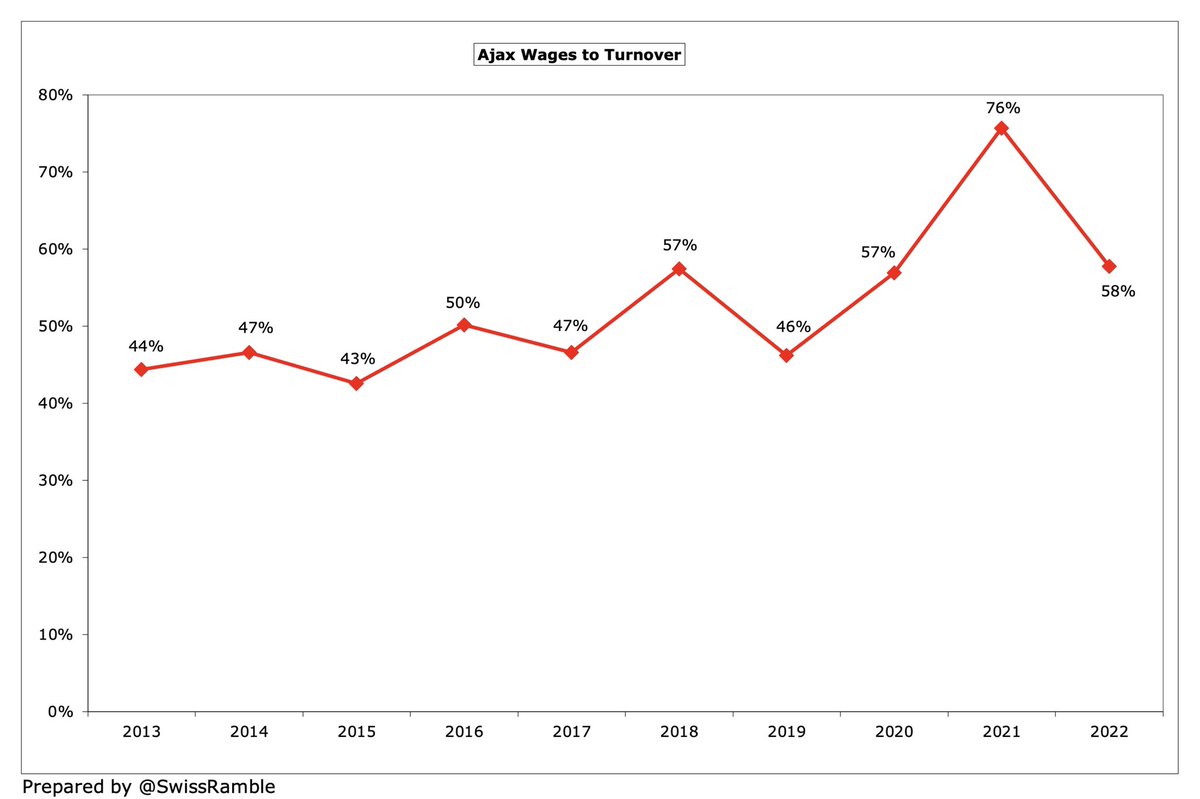

Following the increase in revenue, #Ajax wages to turnover ratio improved from 76% to 58%, which was one of the lowest (best) in the Eredivisie, though most other clubs’ ratios were adversely impacted in 2020/21 by COVID.

#Ajax other expenses increased €24m (46%) from €51m to €75m, mainly due to the higher cost of staging games with fans, though these also included write-offs of irrecoverable COVID claims plus a settlement for the desperately unfortunate Appie Nouri.

#Ajax player amortisation, the annual charge to write-off transfer fees, fell €4m (6%) from €61m to €57m, though this expense has still nearly quadrupled since 2015, reflecting significant investment in the squad. Highest in the Eredivisie, around twice as much as PSV €29m.

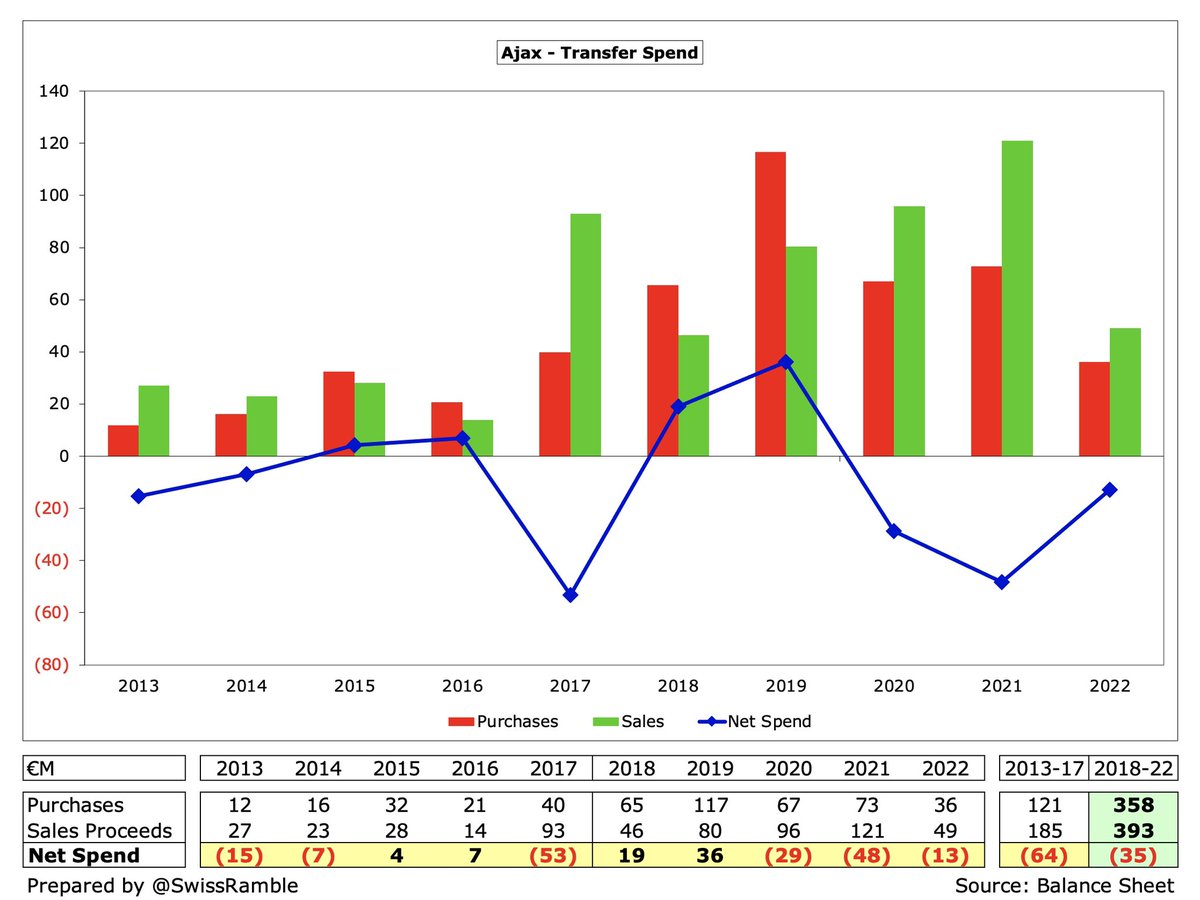

#Ajax have been a selling club for many years, as their financial constraints make it virtually impossible to keep top talent. In fact, in the last 5 years they had €35m net sales, though this disguises purchases rising to €358m, with sales up to €393m.

Indeed, two of #Ajax four highest ever player sales were made this summer with Antony €95m and Lisandro Martinez €57m rejoining former coach Erik ten der Hag at #MUFC. The club’s top 30 transfers have generated an incredible €871m.

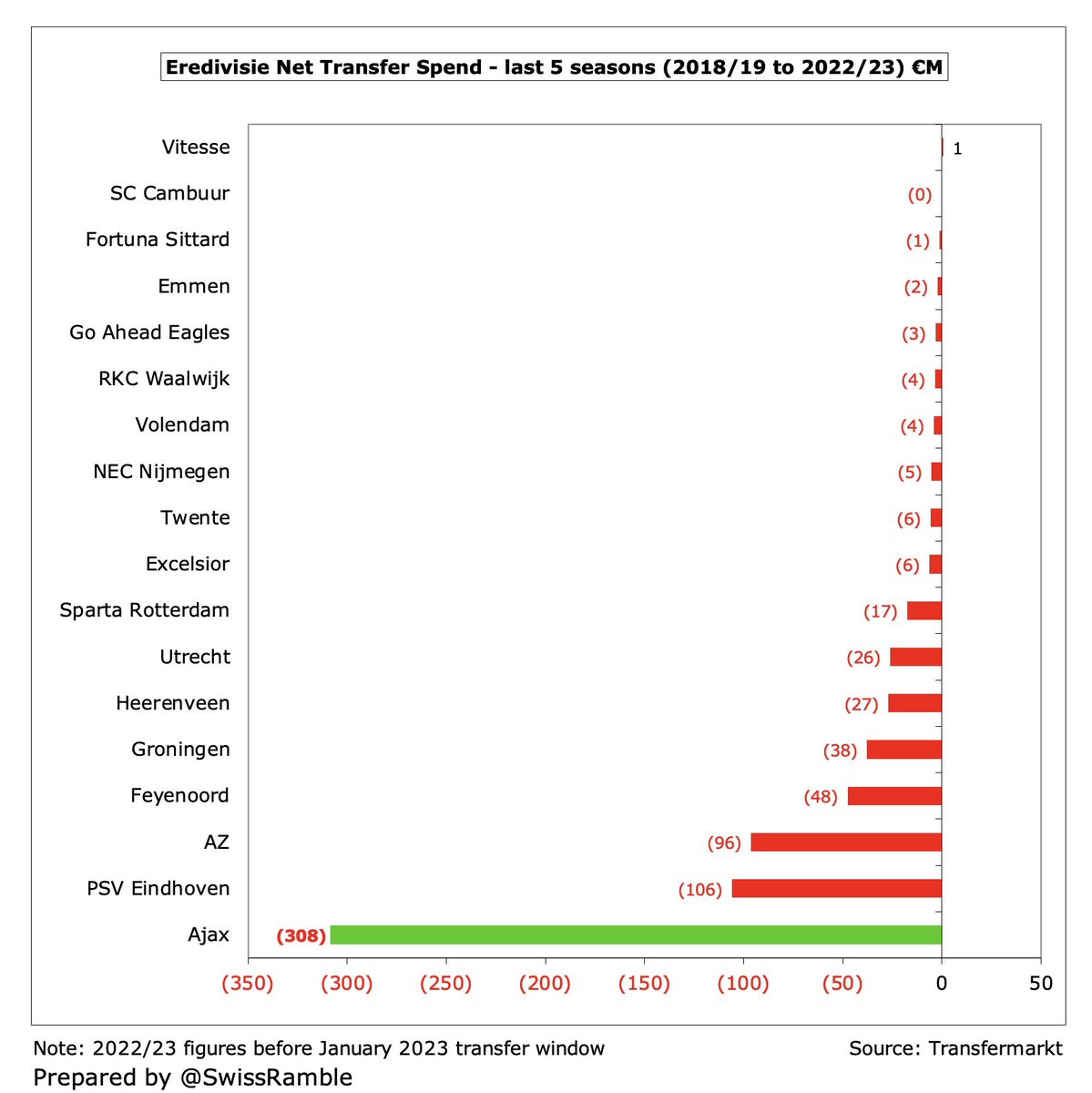

All but one Eredivisie club had net player sales over last 5 seasons, as another indicator of Dutch football’s financial status, though #Ajax €308m is highest figure by far. However, they also had the highest gross spend of €299m, more than the rest of the league combined.

#Ajax have zero financial debt, though 2019/20 saw a technical increase for the inclusion of financial lease obligations as a result of IFRS 16 implementation, now amounting to €146m. Before that, the club had enjoyed surplus net funds for many years.

As a result, #Ajax €146m debt is highest in the Eredivisie followed by PSV €31m, Twente €22m and Feyenoord €10m. However, they are a long way below other European clubs, e.g. #CFC €1.7 bln, #THFC €964m, #MUFC €599m, Real Madrid €581m and Barcelona €533m.

#Ajax did manage to reduce transfer debt from €39m to €23m, down from €65m in 2019. Very low by European standards, e.g. Juventus €265m and Barcelona €231m. Indeed, on a net basis, Ajax have €29m receivables, as other clubs owe them €52m.

After adding back €69m non-cash items and €1m working capital movements, #Ajax had €6m operating cash flow in 2021/22, which was boosted by €58m player sales. Spent €49m on player purchases, lease payments €8m, capex €2m and interest €2m.

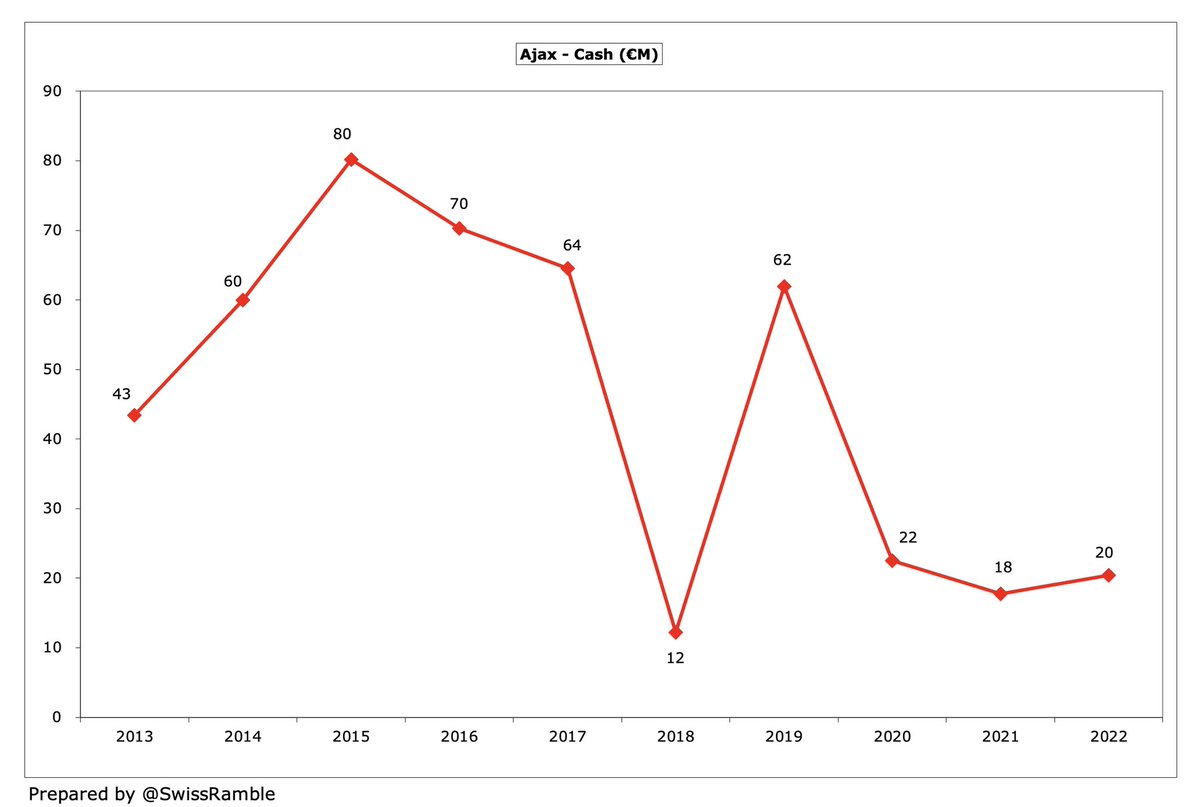

As a result, #Ajax cash balance increased €3m to €20m. This was on the low side for the club, though obviously has been hit by the impact of COVID. However, it was still the highest cash balance in the Eredivisie.

For the second year in a row, #Ajax did not pay a dividend to shareholders, due to losses caused by COVID and restrictions imposed by the government grant. They have paid €3.1m in dividends in the last 11 years, including €1.2m in both 2018 and 2020.

#Ajax are a well-run club, but their business model is very reliant on 2 factors: (a) qualification for the Champions League; (b) profitable player sales. They clearly have the best financial resources in the Eredivisie, but are still far behind their elite European rivals.

#Ajax ability to make money from player trading is striking, thanks to their strong academy, allied to good recruitment. However, it can be a double-edged sword with their coach pointing to this summer’s upheaval as one reason for the recent 6-1 home defeat by Napoli in the CL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh