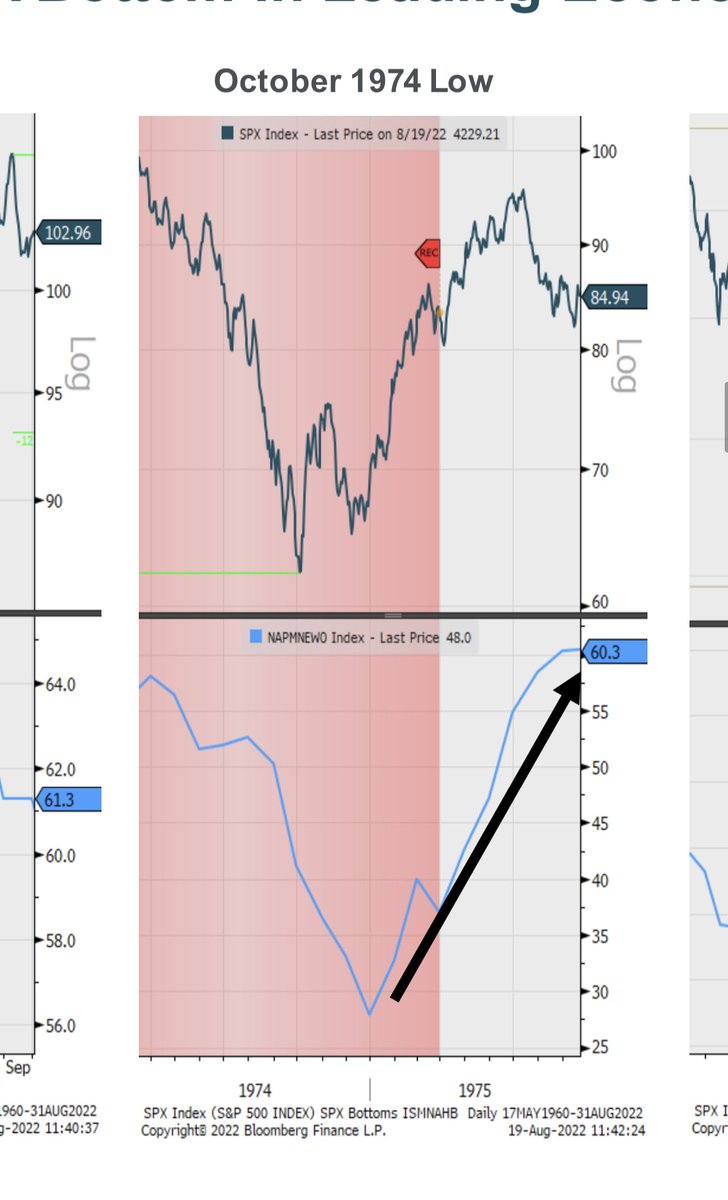

Love your stuff @AndreasSteno but I have to emphatically disagree with your conclusion here. It wasn’t peak CPI that lifted stocks, it’s was Fed rate cuts followed by a HUGE eco recovery (PMIs 🆙, claims ⬇️), as CPI happen to peak, that did it IMO. Charts (2) speak for themselves

https://twitter.com/AndreasSteno/status/1580438181643780096

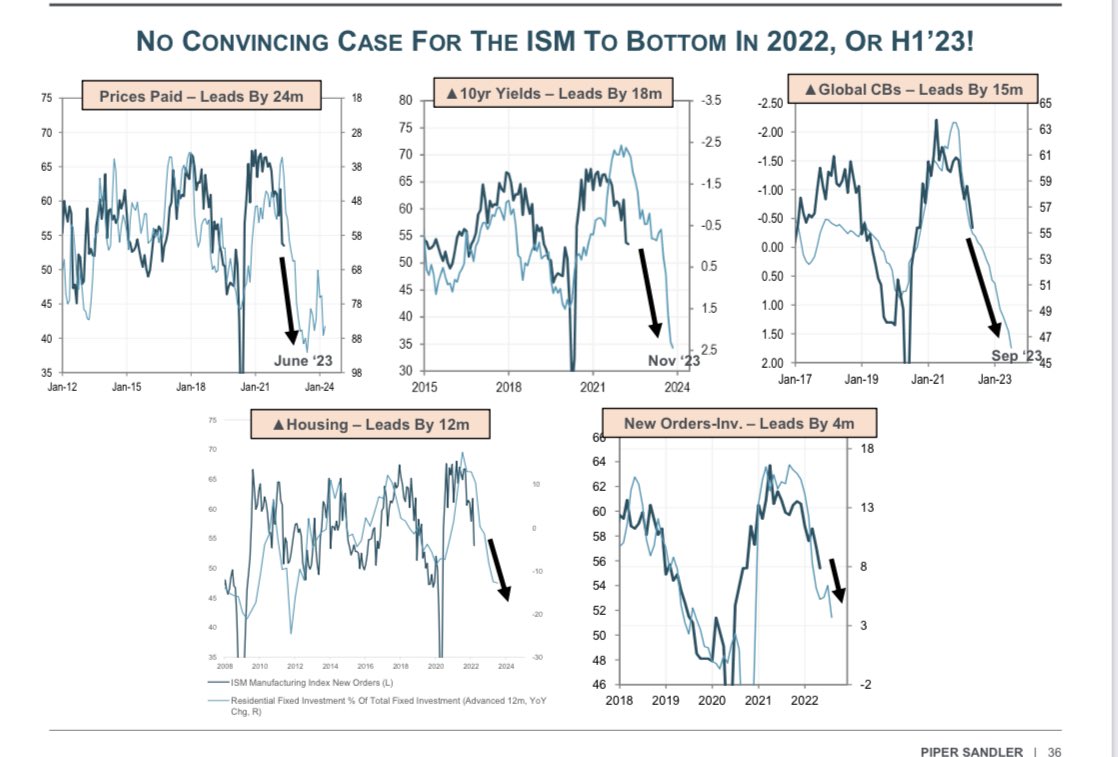

PMIs are only trending one direction for a while - same for housing. Same reasons we called BS on the market rally in August - wasn’t consistent with EVERY other market low

Just watch housing starts and ISM new orders. No new bull markets until they are rising (or about to do so). #macro $SPY

Last one - pivot did NOTHING in 1974. No rally. Why? It was too late - recession already in full swing (falling housing, PMIs, EPS and rising claims). #macro #HOPE

• • •

Missing some Tweet in this thread? You can try to

force a refresh