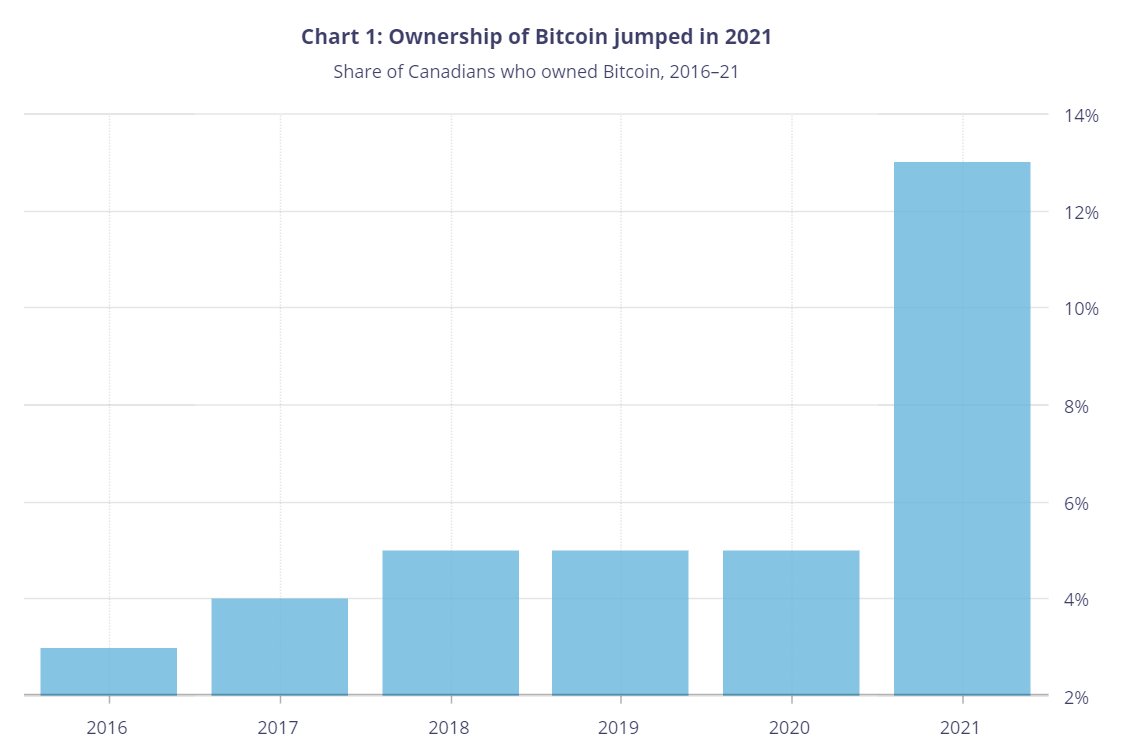

#Bitcoin ownership rose sharply in 2021 due to

- higher savings & wealth during the pandemic

- more platforms & accessible/easy options to buy Bitcoin

(not to rub it in again my US friends, but we do have multiple Bitcoin & crypto ETFs in Canada)

3/

- higher savings & wealth during the pandemic

- more platforms & accessible/easy options to buy Bitcoin

(not to rub it in again my US friends, but we do have multiple Bitcoin & crypto ETFs in Canada)

3/

I also suspect NGU technology brought in the class of 2021: we had the 2020 risk off event that dropped Bitcoin to 4k & it subsequently rose to a 69k (nice) ATH in 2021

4/

4/

Over half of all Canadian #Bitcoin owners invested in Bitcoin for the first time during the 20/21 pandemic

Investment reasons have largely driven the recent surge in #Bitcoin ownership for Canadians, esp for the class of 2020 & 2021

5/

Investment reasons have largely driven the recent surge in #Bitcoin ownership for Canadians, esp for the class of 2020 & 2021

5/

There are a few notable differences between recent investors (ie Class of 2020 & 2021) & longer-term hodlers

6/

6/

70% of Bitcoin owners held <$5000

But recent owners hold smaller amounts: CA$250 vs $2000 median value for recent vs longer term owners

(NB the value of Bitcoin holdings is higher for Bitcoiners that bought before 2020 b/c they benefited from the run-up in prices in 2020)

7/

But recent owners hold smaller amounts: CA$250 vs $2000 median value for recent vs longer term owners

(NB the value of Bitcoin holdings is higher for Bitcoiners that bought before 2020 b/c they benefited from the run-up in prices in 2020)

7/

Recent owners are less likely to use use #Bitcoin for purchases than longer-term owners (55% vs 29%)

They're also less likely to use BTC for p2p tx (65% vs 40%)

(Unsurprising given: they're less knowledgeable, the rise of ETFs, & some platforms didn't allow withdrawals)

8/

They're also less likely to use BTC for p2p tx (65% vs 40%)

(Unsurprising given: they're less knowledgeable, the rise of ETFs, & some platforms didn't allow withdrawals)

8/

Bitcoin businesses take note: mobile apps leads how Canadians buy #Bitcoin (53%)

It's so beautiful to see that 23% of Canadian bitcoiners mine as a way to stack sats

9/

It's so beautiful to see that 23% of Canadian bitcoiners mine as a way to stack sats

9/

Longer-term Bitcoin owners are more likely to mine, use BTMs, & conduct p2p deals to acquire sats (perhaps they value privacy more than recent investors)

10/

10/

This is interesting...

Canadian #Bitcoin owners hold substantially higher amounts of cash than non-owners

And longer-term Bitcoin investors tend to hold more cash than recent investors

Have hodlers cashed out? Are they timing the market?

11/

Canadian #Bitcoin owners hold substantially higher amounts of cash than non-owners

And longer-term Bitcoin investors tend to hold more cash than recent investors

Have hodlers cashed out? Are they timing the market?

11/

Canadians have seen their share of lost keys, ICO scams, problems w/ transactions, stolen funds, exchange hacks, & data breaches by 2021

But large price corrections are the most common adverse "incident" reported by Bitcoin / crypto owners (we all suffer the bear🐻)

12/

But large price corrections are the most common adverse "incident" reported by Bitcoin / crypto owners (we all suffer the bear🐻)

12/

89% of Canadians have heard of Bitcoin in 2021 - BC leads & Quebec lags

Notably, Bitcoin awareness among women increased

the most, from 54% in 2016 to 87% in 2021 🔥

13/

Notably, Bitcoin awareness among women increased

the most, from 54% in 2016 to 87% in 2021 🔥

13/

Oof, class of 2021 showed a showed a low level of Bitcoin knowledge vs prev years - e.g., they thought that Bitcoin is backed by a gov

Unsurprisingly nocoiners also had a low level of understanding how Bitcoin works

14/

Unsurprisingly nocoiners also had a low level of understanding how Bitcoin works

14/

The @bankofcanada found 16% of Canadians owned at least one crypto (i.e., #Bitcoin or an altcoin)

10% owned both Bitcoin & alts, & 6% owned alts exclusively

Politicians take note: an anti-crypto stance could alienate 16% of your voter base! And likely more in 2022 #canpoli

15/

10% owned both Bitcoin & alts, & 6% owned alts exclusively

Politicians take note: an anti-crypto stance could alienate 16% of your voter base! And likely more in 2022 #canpoli

15/

The most popular altcoin was Ether, owned by around 7% of Canadians

Dogecoin (the Elon effect?) & Bitcoin Cash (really??) were next at 4%

16/

Dogecoin (the Elon effect?) & Bitcoin Cash (really??) were next at 4%

16/

The Bank of Canada observes higher ownership of altcoins for long-term crypto holders. Recent owners are more likely to buy Bitcoin 😎

I suspect awareness & Bitcoin name recognition plays into this

17/

I suspect awareness & Bitcoin name recognition plays into this

17/

Canadian #Bitcoin owners in 2021 were more likely to be: male, aged 18 to 34 years old, with a university degree or high income (no surprises here)

BC leads Canada for ownership (west coast, best coast!)

BUT...

18/

BC leads Canada for ownership (west coast, best coast!)

BUT...

18/

👀 Canadian Bitcoin ownership:

high & low financial literacy > midwit

19/

high & low financial literacy > midwit

https://twitter.com/VanBitcoiners/status/1580709296592932864?s=20&t=AYLe9moLIwKLxGeZk4ZqkQ

19/

It's amazing to get annual Bitcoin ownership stats from the @bankofcanada & their research scope is growing

Such studies can help policy makers make better policy & businesses can use it to inform products & services. I'd love other countries do the same w/ more participants

20/

Such studies can help policy makers make better policy & businesses can use it to inform products & services. I'd love other countries do the same w/ more participants

20/

The full study on Canadian #Bitcoin ownership can be found here: bankofcanada.ca/wp-content/upl…

end/

end/

• • •

Missing some Tweet in this thread? You can try to

force a refresh