#GreenpanelIndustries

Detailed 🧵🧵 with Competitive Analysis

Price ₹ 380

Like & Retweet for better reach !

Detailed 🧵🧵 with Competitive Analysis

Price ₹ 380

Like & Retweet for better reach !

1. Company Overview

Greenpanel is India’s largest manufacturer of wood panels.

The company was demerged from Greenply in 2017.

Company has manufacturing plants in Uttarakhand and Andhra Pradesh

Greenpanel is India’s largest manufacturer of wood panels.

The company was demerged from Greenply in 2017.

Company has manufacturing plants in Uttarakhand and Andhra Pradesh

It manufactures Medium Density Fibreboard (MDF), Plywood, Decorative Veneers, Flooring and Doors

Greenpanel industries is market leader in MDF segment with having 28% of market share in Indian MDF market

Greenpanel industries is market leader in MDF segment with having 28% of market share in Indian MDF market

2. Industries Overview

The wood panel industry includes plywood sheets, engineered wood panels (MDF [Medium Density Fibreboards] furniture board and particle board) and decorative surface products such as laminates.

The wood panel industry includes plywood sheets, engineered wood panels (MDF [Medium Density Fibreboards] furniture board and particle board) and decorative surface products such as laminates.

The Indian wood panel industry is estimated to be around INR 40,000 crore and is growing at the rate of 10-12% annually

MDF (Medium density fibreboards)

The general steps used to produce MDF include mechanical pulping of wood chips to fibres (refining), drying, blending fibres with resin and sometimes wax, forming the resinated material into a mat, and hot pressing.

The general steps used to produce MDF include mechanical pulping of wood chips to fibres (refining), drying, blending fibres with resin and sometimes wax, forming the resinated material into a mat, and hot pressing.

MDF market size is estimated to be around INR 4,000 Crore and is growing at the rate of 12-15% annually.

Current consumption breakup in India is 80% Plywood and 20% MDF whereas globally this is reverse. This shows a large opportunity for MDF in India.

Current consumption breakup in India is 80% Plywood and 20% MDF whereas globally this is reverse. This shows a large opportunity for MDF in India.

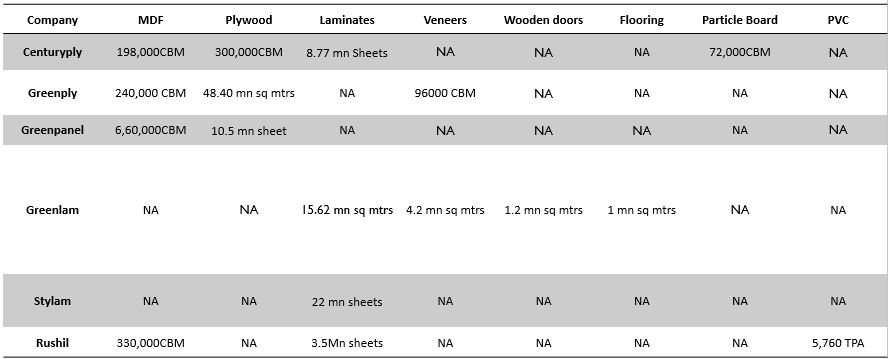

3. Impact of oversupply between 2017 and 2019

Between 2017 and 2019 the market size for MDF in India went up from less than 2,000 Cr to 3,200 Cr at peak utilisation. Greenply Industries capacity was 180,000CBM till 2018 then it demerged into Greenply and Greenpanel.

Between 2017 and 2019 the market size for MDF in India went up from less than 2,000 Cr to 3,200 Cr at peak utilisation. Greenply Industries capacity was 180,000CBM till 2018 then it demerged into Greenply and Greenpanel.

Plywood and allied products are under greenply and greenpanel will further manufacture mdf and allied products.

Greenpanel increased its capacity to 540000 CBM from 180000 CBM

Greenpanel increased its capacity to 540000 CBM from 180000 CBM

Action tesa, a private player also had a capacity of 4 lakhs cbm.

Century Ply started MDF manufacturing in 2018 with a capacity of 198000 cbm.

Rushil decor had an existing capacity of 99,000 CBM.

Century Ply started MDF manufacturing in 2018 with a capacity of 198000 cbm.

Rushil decor had an existing capacity of 99,000 CBM.

When so much supply comes on board within a short span of time, all players are under pressure to increase volumes and improve utilisation to break even on the new capacity. This resulted in fall in MDF prices from about 25000 per cbm to around 19000 cbm

5. Management

Shiv Prakash Mittal (Chairman)

Shiv Prakash Mittal has a bachelor‘s degree in science from the University of Calcutta. He is one of the founders of GREENPLY Industries Limited.

Shiv Prakash Mittal (Chairman)

Shiv Prakash Mittal has a bachelor‘s degree in science from the University of Calcutta. He is one of the founders of GREENPLY Industries Limited.

He was also associated with KITPLY Industries Limited for 21 years. He has over thirty years of experience in the fields of production and marketing in plywood, laminates and allied products

Shobhan Mittal (MD & CEO)

He holds a Bachelor’s degree in Business Administration and was Joint Managing Director & CEO of Greenply Industries Ltd. He possesses over 10 years of experience in Business Administration and Marketing Strategy.

He holds a Bachelor’s degree in Business Administration and was Joint Managing Director & CEO of Greenply Industries Ltd. He possesses over 10 years of experience in Business Administration and Marketing Strategy.

He was instrumental in the setting up of the MDF units of the Company at Pantnagar and Chittoor. After successfully streamlining the Pantnagar unit, he was involved in streamlining operations at the Chittoor unit.

6. Products

Club Hdf

Greenpanel Club HDF is a new class of wood-based panel product and a perfect substitute for local plywood. The high-performance board has excellent water resistance, high density, durability and exceptional dimensional stability.

Club Hdf

Greenpanel Club HDF is a new class of wood-based panel product and a perfect substitute for local plywood. The high-performance board has excellent water resistance, high density, durability and exceptional dimensional stability.

6. Products

MDF (Medium Density FiberBoard)

Medium Density FiberBoard is an Engineered wood, manufactured with hardwood fibres, bonded together under high pressures and temperature up to 240 degrees Celsius, by synthetic resin and wax

MDF (Medium Density FiberBoard)

Medium Density FiberBoard is an Engineered wood, manufactured with hardwood fibres, bonded together under high pressures and temperature up to 240 degrees Celsius, by synthetic resin and wax

Plywood

Plywood is a material manufactured from thin layers or “plies” of Wood veneer that are glued together with adjacent layers having their wood grain rotated up to 90 degrees to one another

Plywood is a material manufactured from thin layers or “plies” of Wood veneer that are glued together with adjacent layers having their wood grain rotated up to 90 degrees to one another

Decorative veneers

Wood veneer is a natural wood sliced from logs of trees that have intrinsic marking and patterns based on geographic location, soil composition, and the condition.

Wood veneer is a natural wood sliced from logs of trees that have intrinsic marking and patterns based on geographic location, soil composition, and the condition.

A slice of natural wood is attached, through glueing or pressing on to a panel. Greenpanel veneer face is imported from Europe and Burma

Floorings

Greenpanel flooring is made for Indian conditions. They offer superior protection against dust, scratches and extreme climatic changes. Greenpanel flooring is produced using technology like the Perma Click.

Greenpanel flooring is made for Indian conditions. They offer superior protection against dust, scratches and extreme climatic changes. Greenpanel flooring is produced using technology like the Perma Click.

Doors

Greenpanel Doors have high dimensional accuracy and stability, even in varying humidity. The core is made using Quadra Pro Technology and thicker glue. Solid wood filler gives these doors superior screw-holding capacity, and makes them resistant to shock and buckling.

Greenpanel Doors have high dimensional accuracy and stability, even in varying humidity. The core is made using Quadra Pro Technology and thicker glue. Solid wood filler gives these doors superior screw-holding capacity, and makes them resistant to shock and buckling.

The doors have wider frames, and feature rails and stiles made with imported wood

(Continued...)

(Continued...)

7. Revenue Mix

The company earns its majority of its revenues from the MDF segment which has been above 70 to 80 % historically in the years 2020 to 2022.

The company earns its majority of its revenues from the MDF segment which has been above 70 to 80 % historically in the years 2020 to 2022.

8. Raw Materials

Timber fibres- Lumber, also known as timber, is wood that has been processed into beams and planks, a stage in the process of wood production. Lumber is mainly used for construction framing, as well as finishing. Lumber has many uses beyond home building

Timber fibres- Lumber, also known as timber, is wood that has been processed into beams and planks, a stage in the process of wood production. Lumber is mainly used for construction framing, as well as finishing. Lumber has many uses beyond home building

Urea- Formaldehyde resin glue Urea-formaldehyde, also known as urea-methanal, so named for its common synthesis pathway and overall structure, is a non-transparent thermosetting resin or polymer. It is produced from urea and formaldehyde.

These resins are used in adhesives, plywood, particleboard, medium-density fibreboard, and moulded objects

Petroleum based waxes are naturally hydrophobic and thus offer a cost effective way to impart moisture barrier properties in OSB, MDF, and other materials. Aside from providing moisture barriers,

petroleum based wax products can provide dimensional integrity while facilitating better resin distribution in the boards

They import Veneers from Burma and Europe. Majorly raw materials are sourced locally, although some of the raw materials from which the raw materials are manufactured, could be imported. Like formaldehyde, which again is produced from methanol and methanol is produced from crude.

Timber and wood fibre make up the majority of the raw materials used to make MDF. The company plants saplings at their facility and gives them to farmers within a 100- to 150-kilometer radius.

So they are providing the sapling to farmers at company cost basically which means that the farmers are able to procure it from the company at 50% of the market cost.

So that is a step the company is taking to improve the availability of raw materials primarily wood. And wood constitutes almost 65% of the raw material cost in MDF, and approximately 80% in plywood.

9. Distribution

The sales through the channel, which is dealers, retailers, is about 70%-71% of the volume and the balance 30% is to the OEM furniture fabricators.

Greenpanel has 2535 distributors pan India who Distribute their products to 12500+ Retailers.

The sales through the channel, which is dealers, retailers, is about 70%-71% of the volume and the balance 30% is to the OEM furniture fabricators.

Greenpanel has 2535 distributors pan India who Distribute their products to 12500+ Retailers.

The company is also planning to add more than 500 distributors within 2 years.

10. Manufacturing Plants

Greenpanel has a total manufacturing capacity of 660,000CBM per annum in MDF and has 10.5 mn sq mtrs pa in plywood. Company has 2 manufacturing plants. One in Rudrapur, Uttarakhand and another in Chittoor, Andhra Pradesh.

Greenpanel has a total manufacturing capacity of 660,000CBM per annum in MDF and has 10.5 mn sq mtrs pa in plywood. Company has 2 manufacturing plants. One in Rudrapur, Uttarakhand and another in Chittoor, Andhra Pradesh.

11. Marketing

Greenpanel had spent 18+ crore in various marketing and branding building activities to improve the brand recall. The company engages with first-level product influencers (carpenters, contractors and architects),

Greenpanel had spent 18+ crore in various marketing and branding building activities to improve the brand recall. The company engages with first-level product influencers (carpenters, contractors and architects),

showcasing product capability and the quality standards. They also organise exhibitions where architects are likely to be present, and the company introduces to them their innovative mix of products. Greenpanel also enhanced magazine advertising

to enhance visibility among architects and channel partners. They had also done Retail branding and brand building on exterior walls along national highways, also enhanced in shop displays at outlets, especially in untapped tier 2 and 3 cities.

13. Company’s Key Focus Area :

1. Focusing on increasing the distributors and retailers to increase product reach.

2. Creating premium grade plywood.

3. Developing more value-added products.

4. Company expects to be net debt free

1. Focusing on increasing the distributors and retailers to increase product reach.

2. Creating premium grade plywood.

3. Developing more value-added products.

4. Company expects to be net debt free

14. Future Capex

The company is increasing their manufacturing capacity in MDF. Board has approved capital expenditure project for expansion of MDF capacity at Andhra Pradesh by 2,31,000 CBM.

The company is increasing their manufacturing capacity in MDF. Board has approved capital expenditure project for expansion of MDF capacity at Andhra Pradesh by 2,31,000 CBM.

The additional capacity will increase MDF production capacity of the company from 660,000 CBM per annum to 891,000 CBM per annum, an increase of 35% (appx.) over existing capacity.

The estimated project cost is INR 600.00 crores. The capex is expected to generate 770 crores in FY 24.

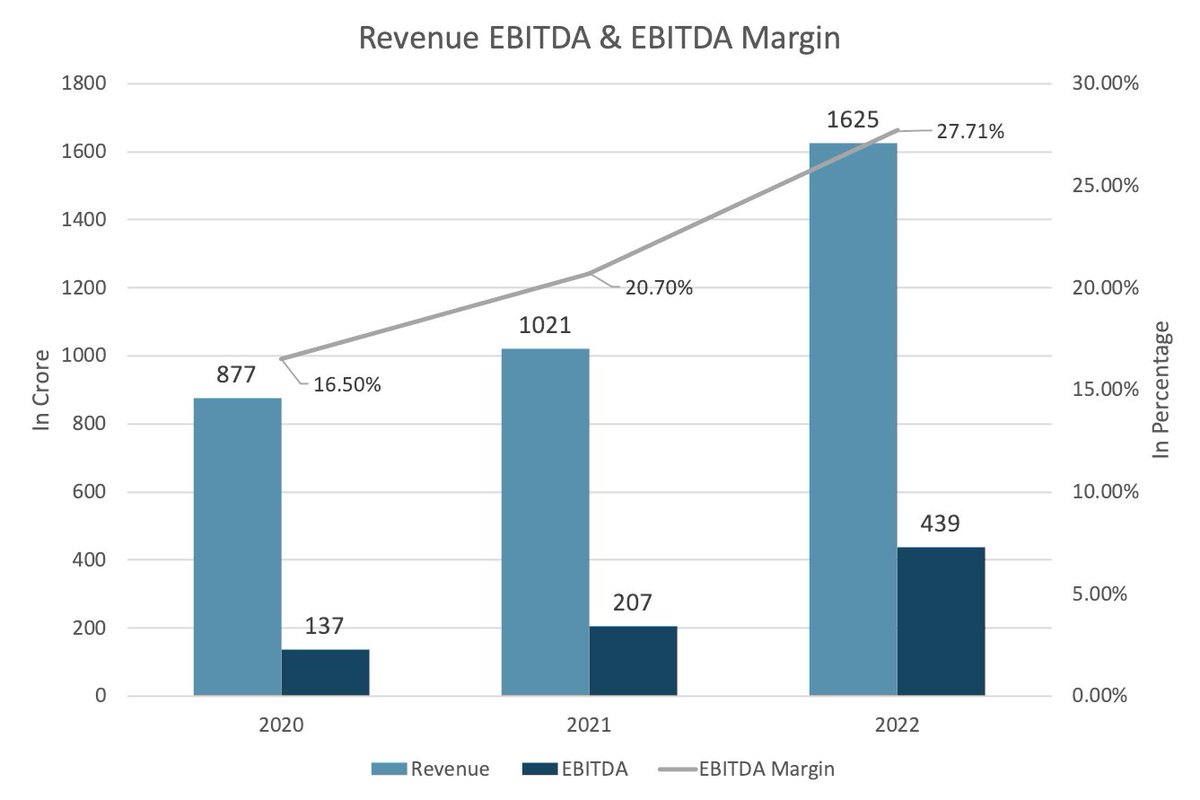

15. Financials

Company’s revenue has increased from 847.10cr to 1585.74cr in the past 3 years . Company’s EBITDA has grown from 140 cr to 439.39 cr in 3 years.

Company’s revenue has increased from 847.10cr to 1585.74cr in the past 3 years . Company’s EBITDA has grown from 140 cr to 439.39 cr in 3 years.

EBITDA margin has also improved from 16.53% to 27.71%. Operating margins increased due to superior product mix, price improvement, cost optimization and operational leverage.

Company is expecting 30-35% volume growth in MDF and 9% in Plywood in the next 5 years (with good real estate

16. Recent Developments

Export Promotion Capital Goods (EPCG) Scheme. The objective of the Export Promotion Capital Goods (EPCG) Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India's manufacturing competitiveness.

Export Promotion Capital Goods (EPCG) Scheme. The objective of the Export Promotion Capital Goods (EPCG) Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India's manufacturing competitiveness.

The company lost the EPCG benefit because they have completed the export obligations in March.EPCG benefit which contributed about 2.17% to the margins in Q4 last year, s

Lost EPCG Benefit (Concall Q1 23)

Like & Retweet first tweet for better reach !

Lost EPCG Benefit (Concall Q1 23)

Like & Retweet first tweet for better reach !

• • •

Missing some Tweet in this thread? You can try to

force a refresh