How operating leverage plays out ? - A case study on #LaurusLabs 💊💊

Like & Retweet for better reach !

Like & Retweet for better reach !

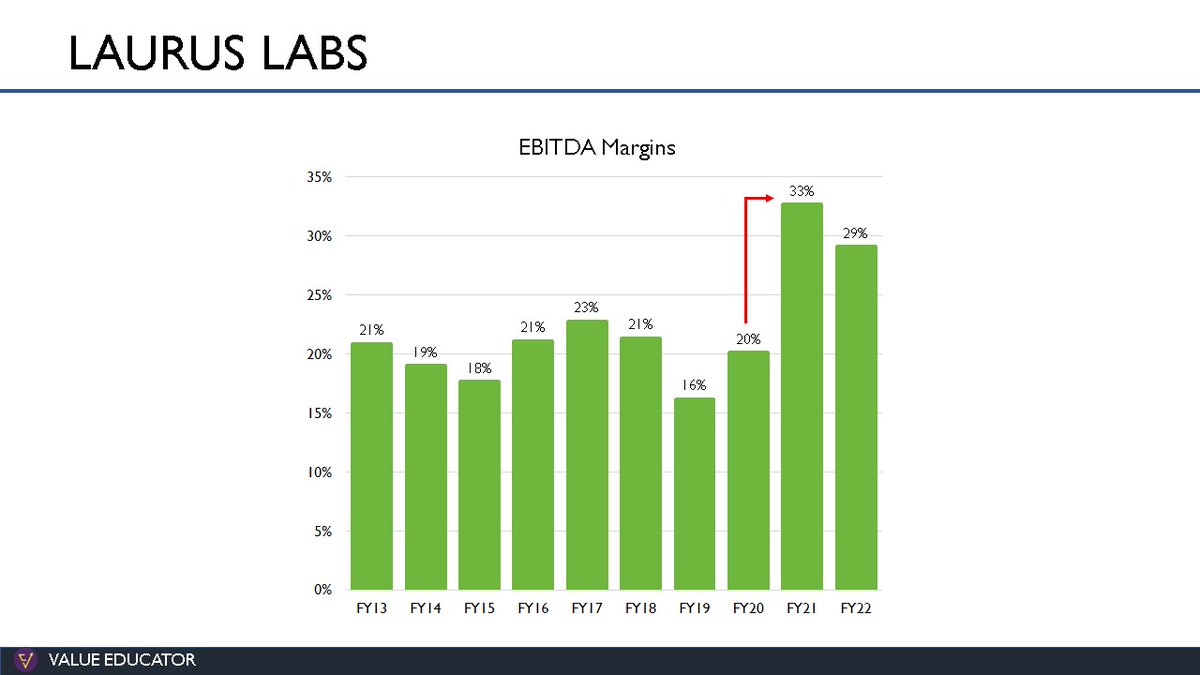

1. Laurus Labs has been one of the most talked about stocks lately. They have been able to compound their sales at 21% and their profits at 34% over the past 5 years. Meanwhile, the stock has given a return of 36% CAGR over the past 5 years

2. Through studying how they were able to do it, we can understand how operating leverage plays out and how Laurus plans to achieve $1 Billion in revenues this year.

3. In 2017, Laurus began investing into a formulation facility as a way to forward integrate their API business. While manufacturing formulations is not as big of a challenge

as manufacturing APIs in ARV drugs, the facility still has to go through regulatory approvals and customer validations which can take a lot of time.

4. While a company goes through regulatory approval and is manufacturing batches for customer validation, they are incurring the full cost of the facility while getting no revenue from it.

5. This is evidenced by the fact that in the period from FY17 to FY20, costs related to raw materials declined as a percentage of revenue but it was more than offset by the increased manufacturing costs, employee costs

as well as other expenses which caused a decline in operating margin.

6. The management indicated in a FY19 concall that almost 800 Cr worth of fixed assets were not generating any revenue at time. We can see this in the period from FY17 to FY20, depreciation costs along with gross block grew at a much faster rate than revenue and EBITDA.

7. The facility started generating revenues in FY19, but they were not enough to offset the costs being generated by the facility. As the facility ramped up utilization, margins started improving until finally in FY21,

the company was able to double its revenues from formulations which caused its EBITDA margin to increase by 13% in one year.

8. The company has invested significantly for growth in FY21 and FY22 as well. We can see here that in FY22, gross block grew by 23% while revenues stayed flat.

9. The company expects to to sweat these assets in FY23 and do a repeat of what they did in FY21. Moreover, this time their margin expansion will be aided by better product mix as the growth will be

coming from Non-ARV business, CDMO and the newly acquired Bio business. These businesses have much higher margins than the ARV business.

Like & Retweet first twit for better reach !

Like & Retweet first twit for better reach !

Micro Cap Club : valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh