#TipsFilms Recently got demerged from Tips Industries as a separately listed films business 📽️📽️

Last week they conducted the 1st concall to discuss their business model.

Following are the highlights ⭐️⭐️

Like & Retweet for better reach !

Last week they conducted the 1st concall to discuss their business model.

Following are the highlights ⭐️⭐️

Like & Retweet for better reach !

1. During FY 22 Reported revenues of 66.83 cr withe release of Movie "Bhoot Police" with PAT of 6.95 Cr. Actual profit was around 20 cr in which they had a partner for 40% of profit. Last year due to covid wave 2 tips films could not launch the films which affected the revenues.

2. Going forward tips films expects the revenue contribution as follows :

(i) Digital Rights = 30%

(ii) Domestic Theatrical Rights = 30%

(iii) Satellite Rights = 15%

(iv) Music Rights = 15%

(v) Overseas Theatrical Rights = 10%

(i) Digital Rights = 30%

(ii) Domestic Theatrical Rights = 30%

(iii) Satellite Rights = 15%

(iv) Music Rights = 15%

(v) Overseas Theatrical Rights = 10%

Music is a critical part of the movie and success of the movie depends on the music and that content has long term value.

3. Tips will be writing off the cost of the movie within 12 months, earlier tips films used to write off 60% of the cost in the first year and balance cost used to be written off in 9 years period. Management clearly stated that they want to be conservative and transparent.

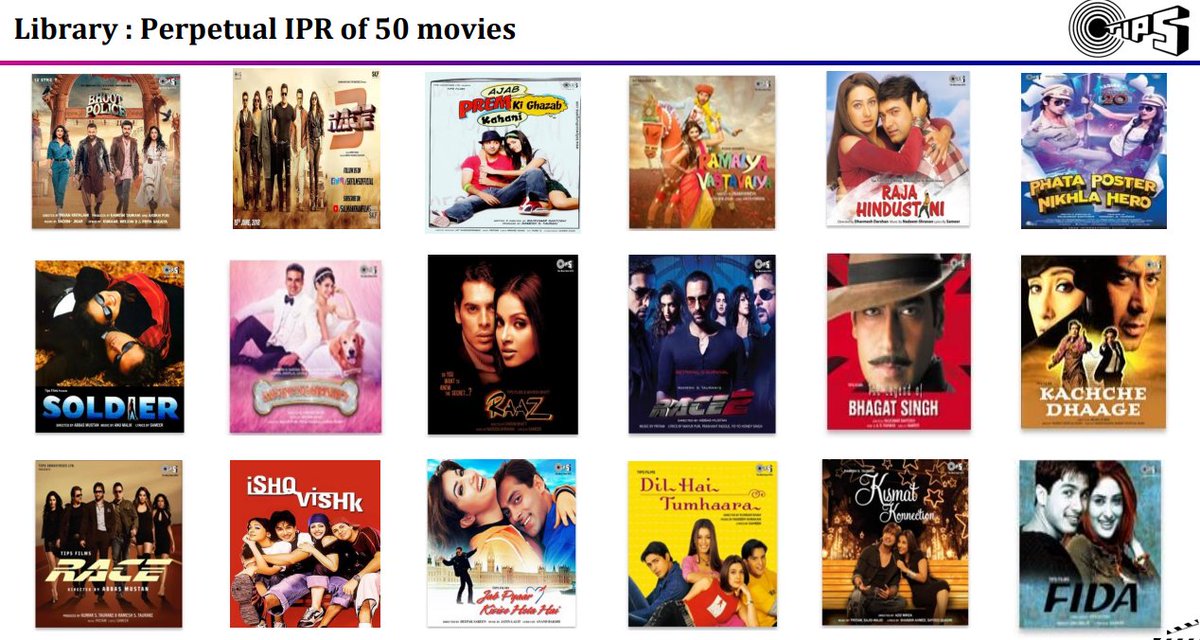

4. Currently Tips Films have the IPR of 50 Films. This year 2-3 months back they had a satellite rights deal for 17 films which includes 6 Hindi films, 5 Punjabi Films and 6 Punjabi Dubbed in Hindi Films.

This deal is for 7 years and the amount of this deal is 29.5 cr. 50% of this amount they collected and remaining collections will be done soon. These movies rights will renewed for right in 2029

5. FY 23 Guidance

Working on Merry Christmas - if that movie completes then revenues can be around 115 cr for FY23 and bottom-line would be around 30-40 cr. If Merry Christmas does not complete in this year then FY 23

Working on Merry Christmas - if that movie completes then revenues can be around 115 cr for FY23 and bottom-line would be around 30-40 cr. If Merry Christmas does not complete in this year then FY 23

revenue would be around 70 cr and bottom-line would be 15-20 cr FY 23 in 29.5 cr revenues.

6. 3 Films are currently under production. 2 will be released on the OTT platform and 1 will be a theatrical release. Tips films closed the deal for 1 film with OTT platform and in discussion for other 2 films.

7. Long term Guidance

In the beginning it will be producing 3-5 films a year but ultimately aim to release 10-12 films per year in the next 2-3 years. Budget for the films will be from 5 to 25 crs.

In the beginning it will be producing 3-5 films a year but ultimately aim to release 10-12 films per year in the next 2-3 years. Budget for the films will be from 5 to 25 crs.

Movies for which tips films already signed the deals will come again for renewal from 2026 onward till 2030.Planning to produce 100 films till 2030,which should give the regular income.

Not looking for any dilution of equity at this price. Will be going for bank loan for growth if needed. First will be building the business then do equity dilution at better valuations in 2-3 years.

Tips films will be looking for partners for the films instead of producing the whole film on its own as it reduces the risk and gives revenue visibility.

8. After demerger Tipms films got the property worth of 12 cr and cash of 50 crs and 10 cr of insurance. 43 cr is shown as other current assets which is the production costs for on-going films ( Gaslight, Merry Christmas, Ishq-Vishq Rebound)

9. Movies Business Model

Once the movie is released on box-office, movie producers have 2 rights to monetise the revenues further which are satellite and digital rights.

Producers also get paid if any shot of the film is used in other films.

Once the movie is released on box-office, movie producers have 2 rights to monetise the revenues further which are satellite and digital rights.

Producers also get paid if any shot of the film is used in other films.

Apart from this film producer also have remaking rights & sequel rights (But it's a small part of revenues)

There are 2 types of models for domestic theatrical release.

1. Advances 2. Minimum Guarantee (MG)

There are 2 types of models for domestic theatrical release.

1. Advances 2. Minimum Guarantee (MG)

It depends on the craze of the films. If there is a craze of film then that movie can be sold on Minimum Guarantee.

But most of the deals in Hindi films are done with advances model in which distributors give advances to producers and then these funds are used for

But most of the deals in Hindi films are done with advances model in which distributors give advances to producers and then these funds are used for

Theatrical digital charges. If that film earns more than advance paid then the remaining amount will be paid to the producer but if the film does not do well on box office then the producer has to pay back that funds within 3 months.

Sometimes particular movie don't do well on box office but after that it can do well on satellite rights and digital mediums(OTT). This reflects in revenues as they license the library to various players. But success at box office enhances the value of rights immediately

Generally deals for satellite and digital rights are done for 5-7 years sometimes for 10 years. Total revenues depend on the tenure of the deal.

Budgeting a movie is a critical aspect in deciding the profitability.

Tips films will be looking for regional content as well.

Budgeting a movie is a critical aspect in deciding the profitability.

Tips films will be looking for regional content as well.

Micro Cap Club : valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh