Here is all you need to know about $GHO, a flexible and decentralized stablecoin by @AaveAave.

How does it aim to solve the stablecoin trilemma?

Let's find out 🧵👇

How does it aim to solve the stablecoin trilemma?

Let's find out 🧵👇

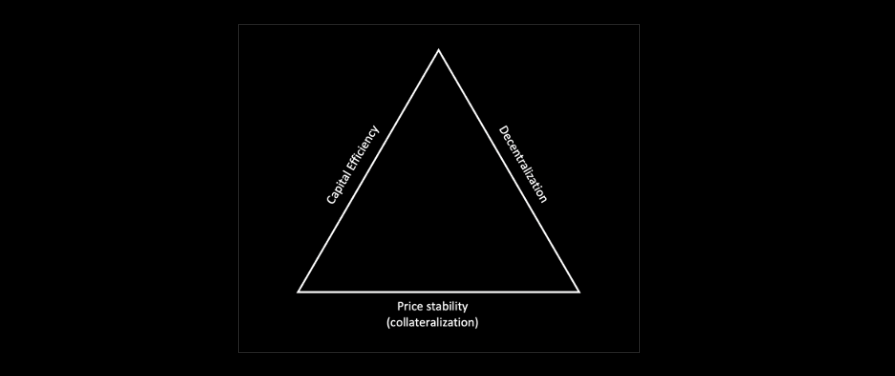

First off, the stablecoin trilemma is an attempt by which stablecoin issuers aim to find an equilibrium between

- Capital efficiency / Scalability

- Peg / Price stability

- Decentralization

More info here: stablecoins.wtf/resources/the-…

@Stablecoinswtf by @mike1third @dennis_zoma

- Capital efficiency / Scalability

- Peg / Price stability

- Decentralization

More info here: stablecoins.wtf/resources/the-…

@Stablecoinswtf by @mike1third @dennis_zoma

1) GHO aims to achieve a stable value via overcollateralization

- $GHO is minted when crypto assets in excess of the value $GHO are supplied.

- This is the mechanism used to reduce the impact of price fluctuations during high volatility events

- $GHO is minted when crypto assets in excess of the value $GHO are supplied.

- This is the mechanism used to reduce the impact of price fluctuations during high volatility events

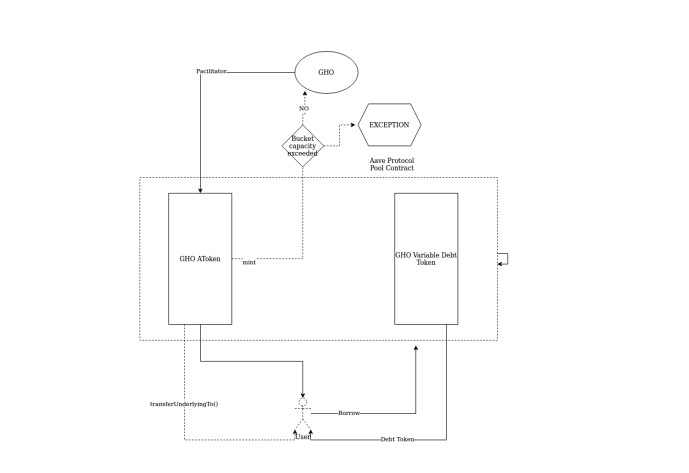

2) $GHO can only be minted/burnt by Facilitators.

For each Facilitator, Governance will approve a bucket (a representation of the upward limit of $GHO a specific facilitator can generate)

For each Facilitator, Governance will approve a bucket (a representation of the upward limit of $GHO a specific facilitator can generate)

Each Facilitator ("F") is assigned a Bucket (“B”) with a specified capacity (“C”) and, given a set of Facilitators F0, F1, ...FN − 1 each with a bucket capacity ("CB"), the max. amount available through all Facilitators is given by 👇

3) $GHO is designed to accrue interested when supplied to a liquidity protocol.

The interest rate is determined by @AaveAave governance

The @AaveAave protocol will be the first facilitator due to the amount of liquidity in Ethereum and other L1s and L2s networks

The interest rate is determined by @AaveAave governance

The @AaveAave protocol will be the first facilitator due to the amount of liquidity in Ethereum and other L1s and L2s networks

5) When $GHO is borrowed from the Ethereum market, new $GHO and $GHO Debt Tokens are minted and transferred to the user based upon the collateralization requirements

- The Bucket level for the Facilitator is updated to reflect the amount minted upon a borrow transaction

- If the amount requested exceeds the Bucket capacity of the Facilitator, the borrow action will fail

- If the amount requested exceeds the Bucket capacity of the Facilitator, the borrow action will fail

6 ) Repayments and Liquidations:

- $GHO is returned to the @AaveAave market by the user/liquidator and $GHO is burned.

- The interest repaid goes to the @AaveAave DAO treasury

- Since the original supply is burned, the Bucket level is decreased

- $GHO is returned to the @AaveAave market by the user/liquidator and $GHO is burned.

- The interest repaid goes to the @AaveAave DAO treasury

- Since the original supply is burned, the Bucket level is decreased

7) Interest rates

- $GHO contracts don't follow supply/demand dynamics 😱

- Interest rates are not set algorithmically based on utilization

- $GHO contracts don't follow supply/demand dynamics 😱

- Interest rates are not set algorithmically based on utilization

The reason is that there is no supply side, hence @AaveAave Governance will statically adjust interest rates depending on the need for the GHO supply to contract/expand

8) Borrow Discount Model (Safety Module)

The initial model aims to provide additional utililty to stkAave holders. Initially, there will be:

- Parameters set by Governance

- A maximum amount threshold

- A discount Rate

The initial model aims to provide additional utililty to stkAave holders. Initially, there will be:

- Parameters set by Governance

- A maximum amount threshold

- A discount Rate

- The threshold determines the amx. amount of $GHO that can be minted at a discount per stkAave held by the user

- The discount rate determines the discount on the borrow rate that the user will receive per discounted $GHO

- The discount rate determines the discount on the borrow rate that the user will receive per discounted $GHO

9) The Discount Accounting tracks outstanding debt via a global borrow index parameter and user-based scaled balances:

-User's outstanding debt = user's scaled balance times the global borrow index

-Upon borrowing, the initial scaled balance = principal borrowed / borrow index

-User's outstanding debt = user's scaled balance times the global borrow index

-Upon borrowing, the initial scaled balance = principal borrowed / borrow index

Each time a user's $GHO debt balance is updated, the protocols checks whether the user should receive a discount.

- If entitled to a discount, the user’s interest is accumulated and their discount is applied to their balance increase

- If entitled to a discount, the user’s interest is accumulated and their discount is applied to their balance increase

10) Price stability:

- Users can always borrow, repay and liquidate $GHO at $1.

- The @AaveAave protocol has set the the price of 1 $GHO to $1 (no market pricing via oracles)

- Users can always borrow, repay and liquidate $GHO at $1.

- The @AaveAave protocol has set the the price of 1 $GHO to $1 (no market pricing via oracles)

Since there are no market oracles, there will be arbitrage:

- When price of $GHO < $1, borrowers are incentivized to buy $GHO at a discount and repay/liquidate, earning on the difference

- When price of $GHO > $1, the incentive is to mint and sell $GHO

- When price of $GHO < $1, borrowers are incentivized to buy $GHO at a discount and repay/liquidate, earning on the difference

- When price of $GHO > $1, the incentive is to mint and sell $GHO

That's it! If you want to go more in depth, here are some resources:

- $GHO paper: governance.aave.com/uploads/short-…

- Dev update: governance.aave.com/t/gho-developm…

- Aavenomics: docs.aave.com/aavenomics/

- $GHO paper: governance.aave.com/uploads/short-…

- Dev update: governance.aave.com/t/gho-developm…

- Aavenomics: docs.aave.com/aavenomics/

For more updates pay attention to the Governance Forum at governance.aave.com and key members like @StaniKulechov and @lemiscate

Tagging some chads for visibility:

@DeFi_Dad @DAdvisoor @crypto_klay @Ceazor7 @Dynamo_Patrick @phtevenstrong @DeFiMann @ViktorDefi @thedefivillain @LouisCooper_ @0xLolin @0x_d24 @crypto_linn @DegenCamp @DegenSensei

@DeFi_Dad @DAdvisoor @crypto_klay @Ceazor7 @Dynamo_Patrick @phtevenstrong @DeFiMann @ViktorDefi @thedefivillain @LouisCooper_ @0xLolin @0x_d24 @crypto_linn @DegenCamp @DegenSensei

• • •

Missing some Tweet in this thread? You can try to

force a refresh