CIO (Chief Intern Office) @ipor_io | 1 whitepaper a day keeps the bears away | My boss calls me ser | In it for the memes

3 subscribers

How to get URL link on X (Twitter) App

Let's start off from first principles:

Let's start off from first principles:

A while ago it announced the token migration from $MATIC to $POL at a 1:1 ratio. This is required to ensure the transition to the Polygon zkEVM

A while ago it announced the token migration from $MATIC to $POL at a 1:1 ratio. This is required to ensure the transition to the Polygon zkEVM

1) Your position is loaded into the LLAMMA market making algorithm, which will assign the specific price bands at which the collateral will be swapped back and forth

1) Your position is loaded into the LLAMMA market making algorithm, which will assign the specific price bands at which the collateral will be swapped back and forth

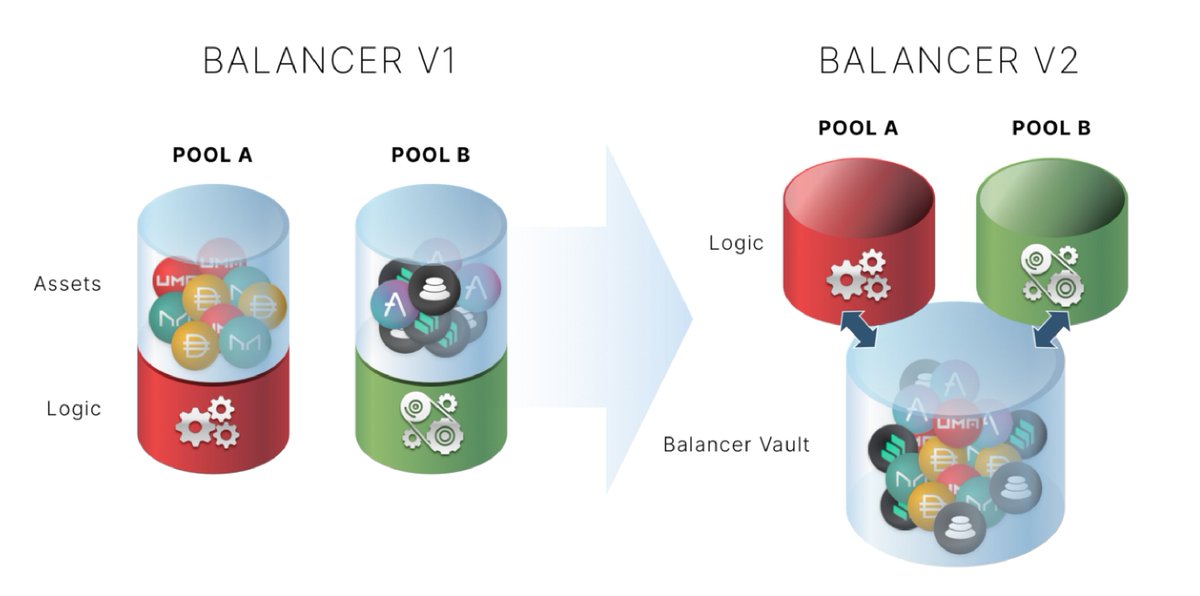

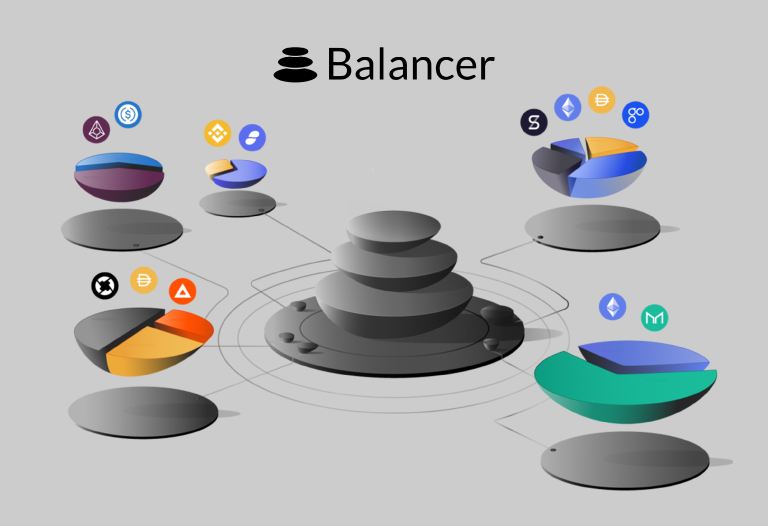

With @Balancer 's weighted pools, users and protocols can choose their desired levels of exposure to certain assets while still maintaining the ability to provide liquidity.

With @Balancer 's weighted pools, users and protocols can choose their desired levels of exposure to certain assets while still maintaining the ability to provide liquidity.

An order-book Dex for trading options (and perps) is a big value proposition and massive improvement over the current DOV strategies, which are way too inflexible for pro traders (like my intern)

An order-book Dex for trading options (and perps) is a big value proposition and massive improvement over the current DOV strategies, which are way too inflexible for pro traders (like my intern)

https://twitter.com/tztokchad/status/1637539854480297987Dopex offers a series of DeFi primitives in the form of Single Staking Options Vaults (SSOVs), Liquidity Pool Options (LPOs), Atlantic Options (ACs & APs), bonds... that can be used for a variety of use cases, such as insured perps, no liquidation borrowing...

https://twitter.com/gabavineb/status/1632756061424988160Yield trading is all about coming up with strategies that will increase or decrease your exposure to an underlying yield.

The Balancer Vault is the core of the protocol.

The Balancer Vault is the core of the protocol.

Step 1: solve liquidations

Step 1: solve liquidations

First off, this is not a solution for impermanent loss

First off, this is not a solution for impermanent loss

In the past we had no choice but to suffer from impermanent loss.

In the past we had no choice but to suffer from impermanent loss.

Epic music by the way...

Epic music by the way...

If Satoshi Nakamoto had designed a decentralized money market, it would likely resemble @ajnafi: a peer-to-peer borrow-lending platform where users do not have to trust external oracles or even care about protocol governance.

If Satoshi Nakamoto had designed a decentralized money market, it would likely resemble @ajnafi: a peer-to-peer borrow-lending platform where users do not have to trust external oracles or even care about protocol governance.

First, we can observe a quick uptick in TVL, but also a fairly balanced distribution of liquidity across pools ($DAI, $USDT, $USDC)

First, we can observe a quick uptick in TVL, but also a fairly balanced distribution of liquidity across pools ($DAI, $USDT, $USDC)

https://twitter.com/tapioca_dao/status/1615971544274014211First, twAML stands for Time Weighted Average Magnitude Lock

https://twitter.com/jediblocmates/status/1601248129835114496

Most DeFi users understand that there is no such thing as "perfect" when it comes to protection against oracle attacks

Most DeFi users understand that there is no such thing as "perfect" when it comes to protection against oracle attacks

https://twitter.com/StaniKulechov/status/1606357768339800064OG, IPFS and open source frontend, peak liquidity at $30B, credit delegation, flash loans... Aave has set an industry standard and a foundational layer for what a decentralized money market looks like, and there is a reason for that

https://twitter.com/kamikaz_ETH/status/1610575532177121280