What I learned at IMF/WB meetings

1. No consensus on monetary policy. Most policy makers want to keep hiking aggressively, most market participants want central banks to slow. Best quote I heard: "When I drive into fog, I slow down." There's massive global uncertainty. Slow down!

1. No consensus on monetary policy. Most policy makers want to keep hiking aggressively, most market participants want central banks to slow. Best quote I heard: "When I drive into fog, I slow down." There's massive global uncertainty. Slow down!

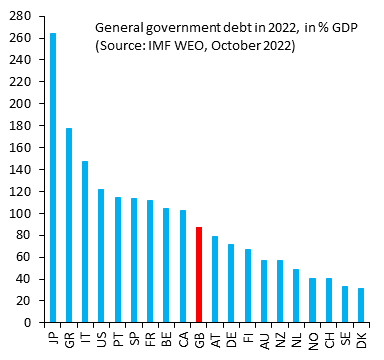

2. Debt-to-GDP ratios are back! Many G10 countries have gov't debt that's higher than the UK (GB). Market focus is now squarely on them. #MMT is seen as totally discredited, by the rise in global inflation, by the collapse of the Yen and - most recently - by the UK experience...

3. Most think Ukraine will win and take back ALL its territory from Russia. Some even expect the war to end within a few months. No one thinks the war can drag on for a long time, i.e. Ukraine may be the new "transitory." Few are aware how precarious Ukraine's finances are...

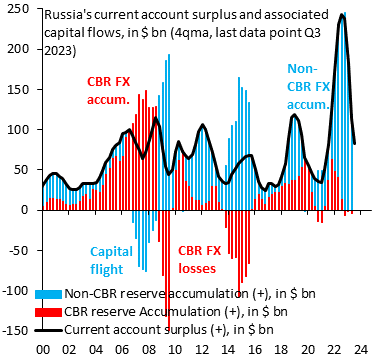

4. Russia's invasion of Ukraine is a total game changer for global capital flows. Front and center is China, where anecdotal evidence that new money is no longer being put to work by foreign investors lines up with our flows going flat. Saudi Arabia is also under scrutiny...

5. Lots of focus on deteriorating market liquidity. This is attributed to market makers at their risk limits due to volatile commodity prices. It's also linked to high uncertainty (Ukraine, Taiwan) and hawkish central banks who seem determined to hike until something breaks...

6. German deindustrialization. Focus on Germany is intense. Worries of energy rationing are fading, given growing evidence that energy consumption is falling. Instead, there is growing focus on the medium-term, with manufacturing leaving Germany for locations with cheap energy...

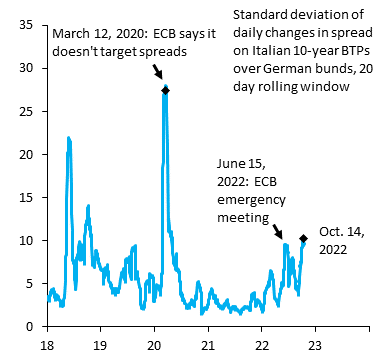

7. Growing dismay over de facto Euro zone spread control. Wide-spread consternation that the volatility of Italy's spread was near all-time lows into the Sep. 25 election. Spread control is seen as unsustainable in a global rising rate environment. Lots of skepticism of ECB TPI.

• • •

Missing some Tweet in this thread? You can try to

force a refresh