IMO these are the 5 biggest macro trends driving your portfolio right now:

1. We're in WW3

2. The Fed is a weapon

3. The end of the Big Debt Cycle

4. Energy & Inflation as severe constraints

5. The global search for a new reserve asset

Explained in 5 tweets 👇

1. We're in WW3

2. The Fed is a weapon

3. The end of the Big Debt Cycle

4. Energy & Inflation as severe constraints

5. The global search for a new reserve asset

Explained in 5 tweets 👇

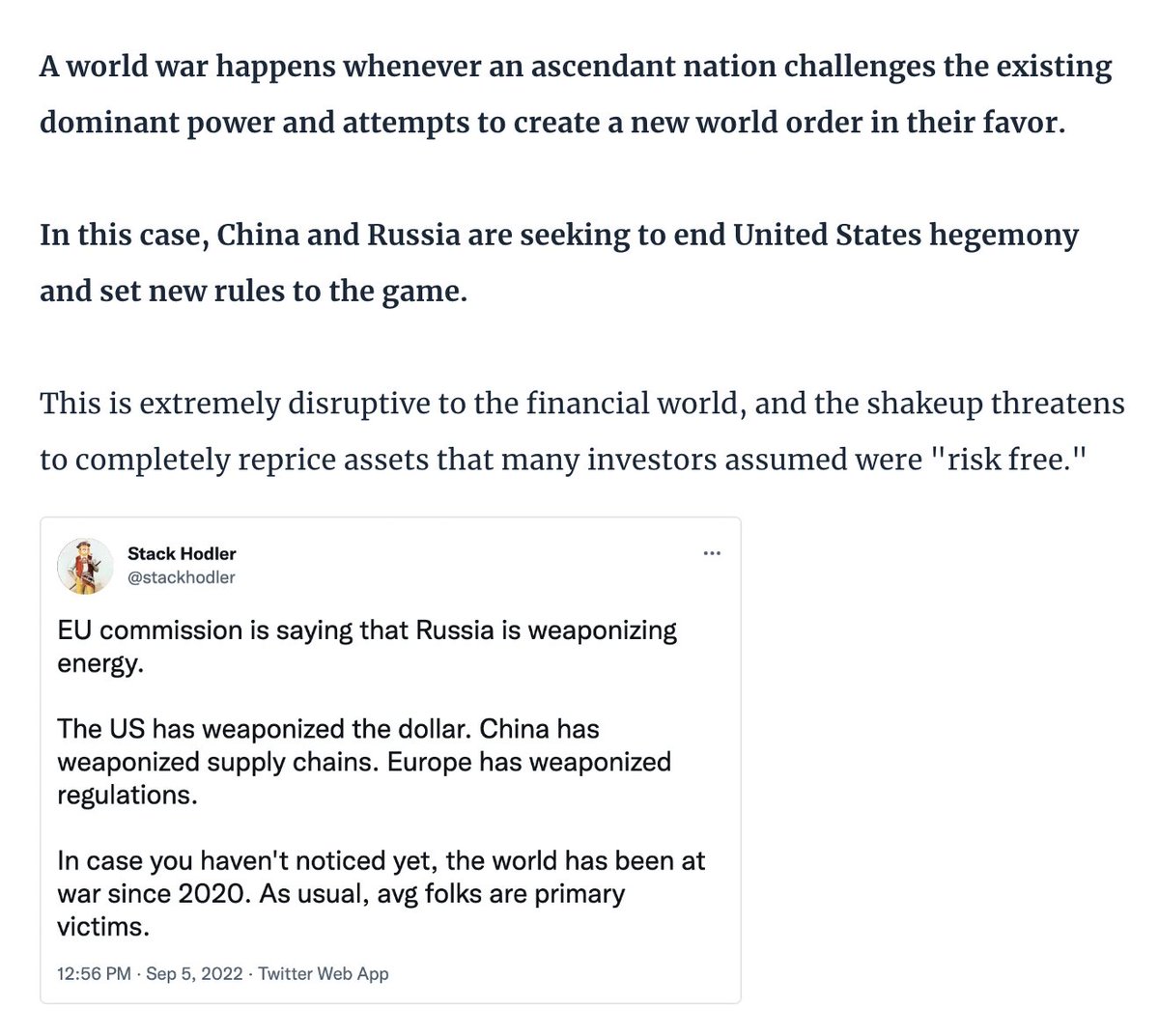

We're already in WW3.

The Dollar reserve system is under threat, and with it the United States' status as global hegemon.

Chinese and Russian actions can be viewed as a coordinated attack on the existing world order. And US & Fed policy as attempts to defend it.

The Dollar reserve system is under threat, and with it the United States' status as global hegemon.

Chinese and Russian actions can be viewed as a coordinated attack on the existing world order. And US & Fed policy as attempts to defend it.

The Fed is a weapon.

The Fed is fighting existential threats to the USD system.

Through a combo of interest rate increases, reverse repo, and QT, the Fed has withdrawn dollar liquidity and exposed dangerous economic fault lines from London to Beijing.

The Fed is fighting existential threats to the USD system.

Through a combo of interest rate increases, reverse repo, and QT, the Fed has withdrawn dollar liquidity and exposed dangerous economic fault lines from London to Beijing.

https://twitter.com/stackhodler/status/1571424461563240450

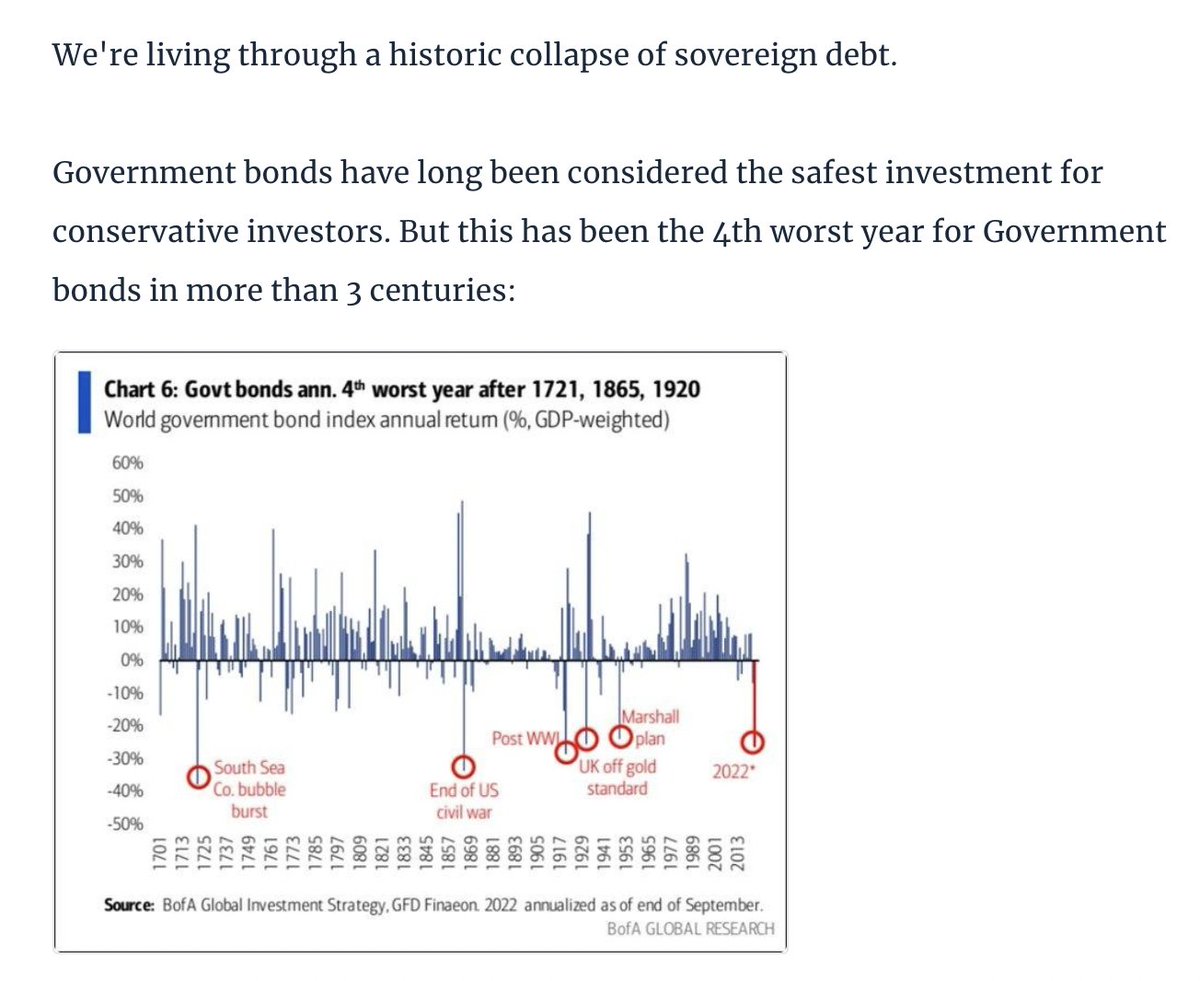

End of the Big Debt Cycle.

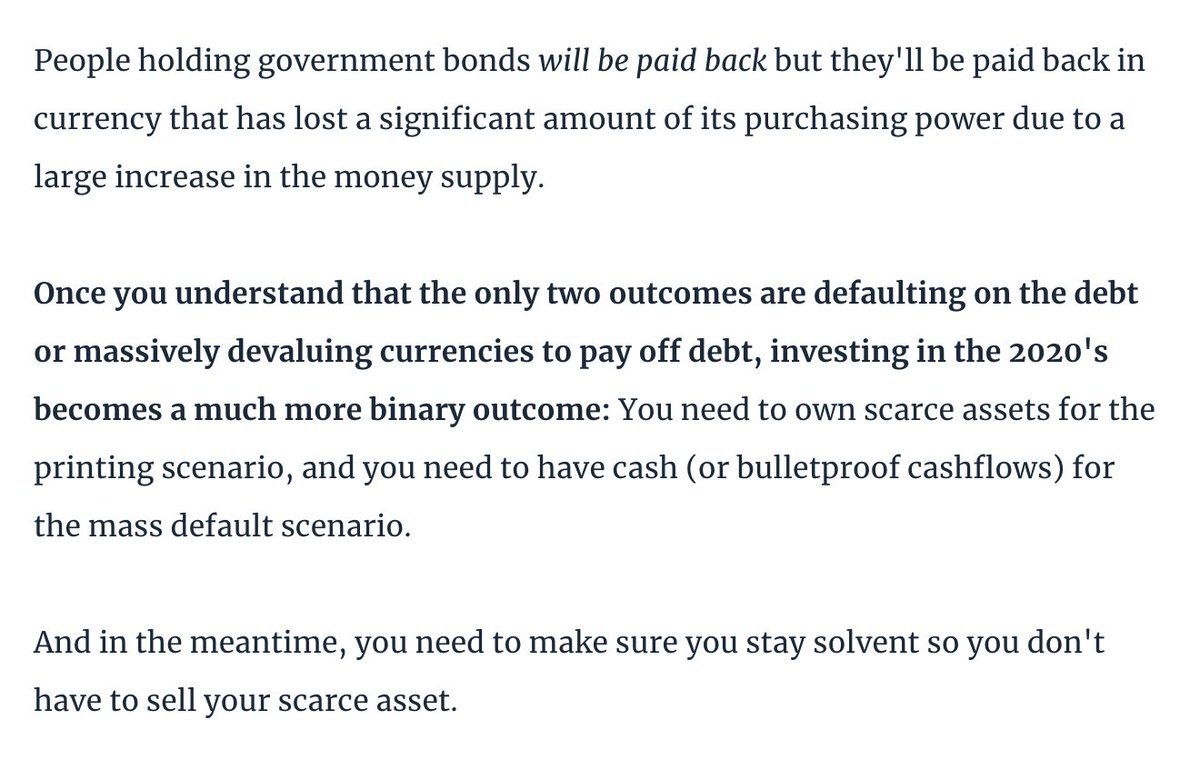

Interest rates were held at 0% for so long that the whole world racked up piles of debt.

Now that debt can only be paid back via mass default or mass money printing. And money printing for various "emergencies" is the most likely outcome.

Interest rates were held at 0% for so long that the whole world racked up piles of debt.

Now that debt can only be paid back via mass default or mass money printing. And money printing for various "emergencies" is the most likely outcome.

Energy & Inflation constraints.

Kicking the can by printing money has severe consequences when energy is scarce and inflation is high.

Central banks are trapped: They need to print to prop up debt markets, but printing worsens inflation. They're stuck in a vicious cycle.

Kicking the can by printing money has severe consequences when energy is scarce and inflation is high.

Central banks are trapped: They need to print to prop up debt markets, but printing worsens inflation. They're stuck in a vicious cycle.

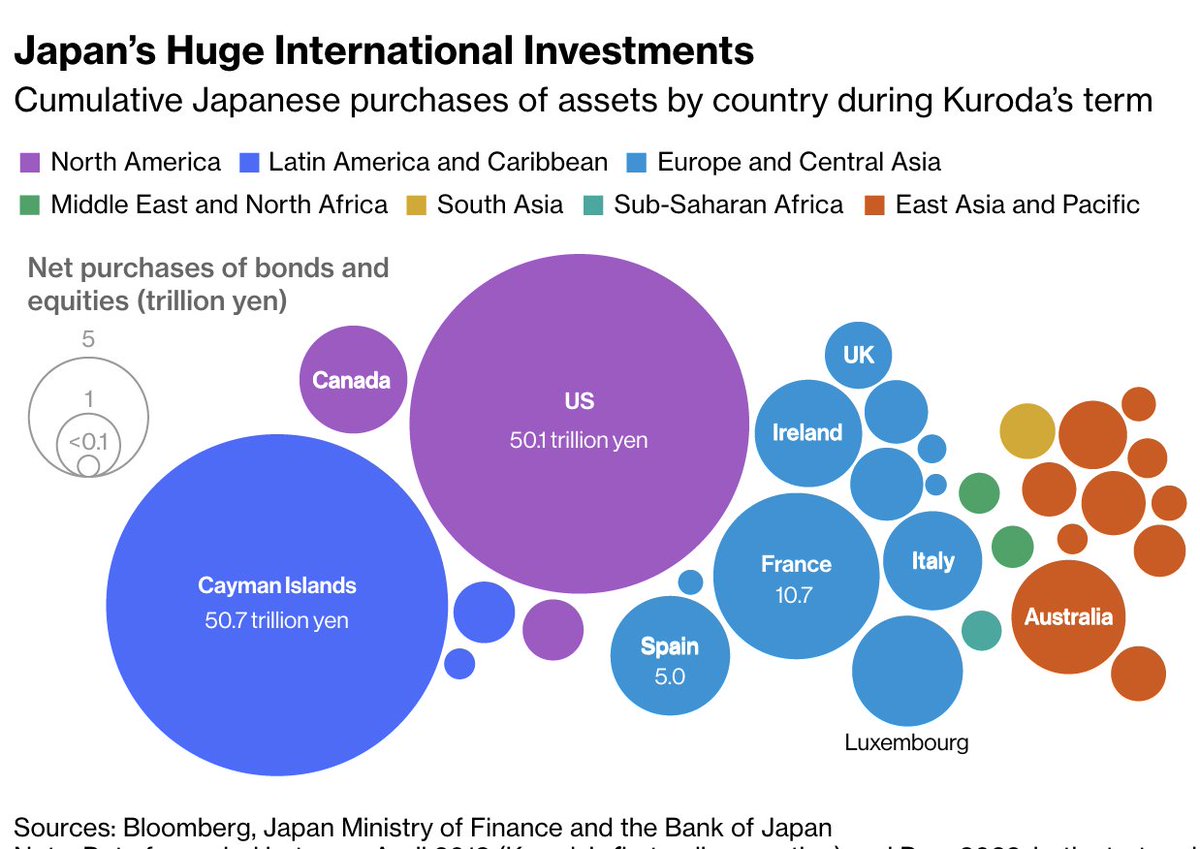

A new reserve asset.

The days of government bonds as the go-to reserve asset are over.

Countries need a new store of value that can't be debased, seized, or manipulated by any government. The search for a new reserve asset is just beginning, and the implications are staggering.

The days of government bonds as the go-to reserve asset are over.

Countries need a new store of value that can't be debased, seized, or manipulated by any government. The search for a new reserve asset is just beginning, and the implications are staggering.

Keeping the big picture trends in mind can help us maintain perspective and keep our cool through the day-to-day volatility

Hiding from volatility is not an option in the 2020s. Instead we should try to understand the big picture, and do our best to position for various outcomes

Hiding from volatility is not an option in the 2020s. Instead we should try to understand the big picture, and do our best to position for various outcomes

If you find this stuff interesting and want to develop a clear vision of the big macro picture, come join a group of likeminded investors on Stack Macro Pro:

pro.stackmacro.com/c/welcome/

pro.stackmacro.com/c/welcome/

• • •

Missing some Tweet in this thread? You can try to

force a refresh