How to get URL link on X (Twitter) App

The Japanese CPI reading was expected to be 2.5% last month.

The Japanese CPI reading was expected to be 2.5% last month.

https://twitter.com/stackhodler/status/1635569045012357120Watch sovereign debt tomorrow.

The document concludes: "While a just cause wins its champion wide support, an unjust one condemns its pursuer to be an outcast."

The document concludes: "While a just cause wins its champion wide support, an unjust one condemns its pursuer to be an outcast."https://twitter.com/stackhodler/status/1641711724859469828

I opened a Coinbase account in 2013.

I opened a Coinbase account in 2013.

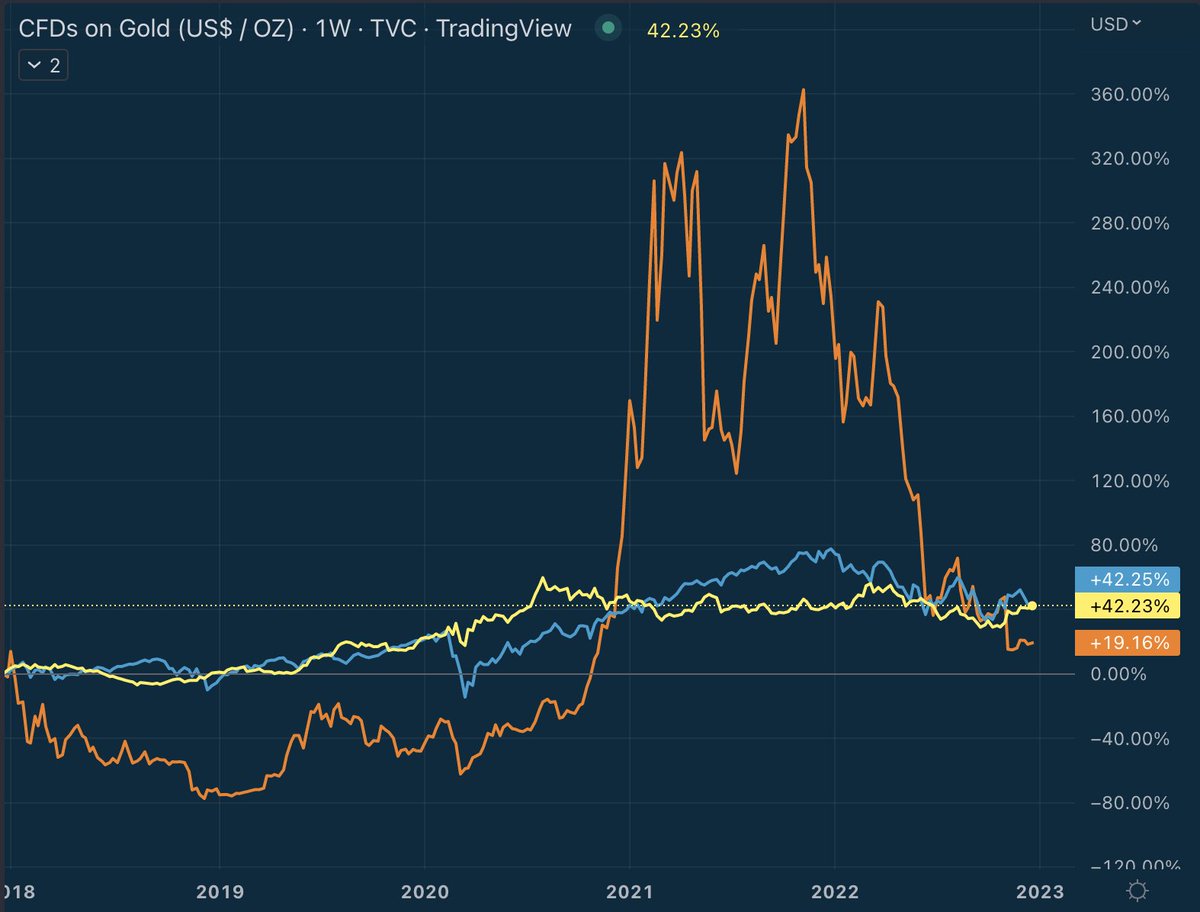

Why #Bitcoin and Gold?

Why #Bitcoin and Gold?

https://twitter.com/stackhodler/status/1584108061865938944Timiraos is well known as the designated Fed leaker.

Harvard economist Matthew Ferranti just laid out the rational case for Central Banks to stack #Bitcoin

Harvard economist Matthew Ferranti just laid out the rational case for Central Banks to stack #Bitcoin

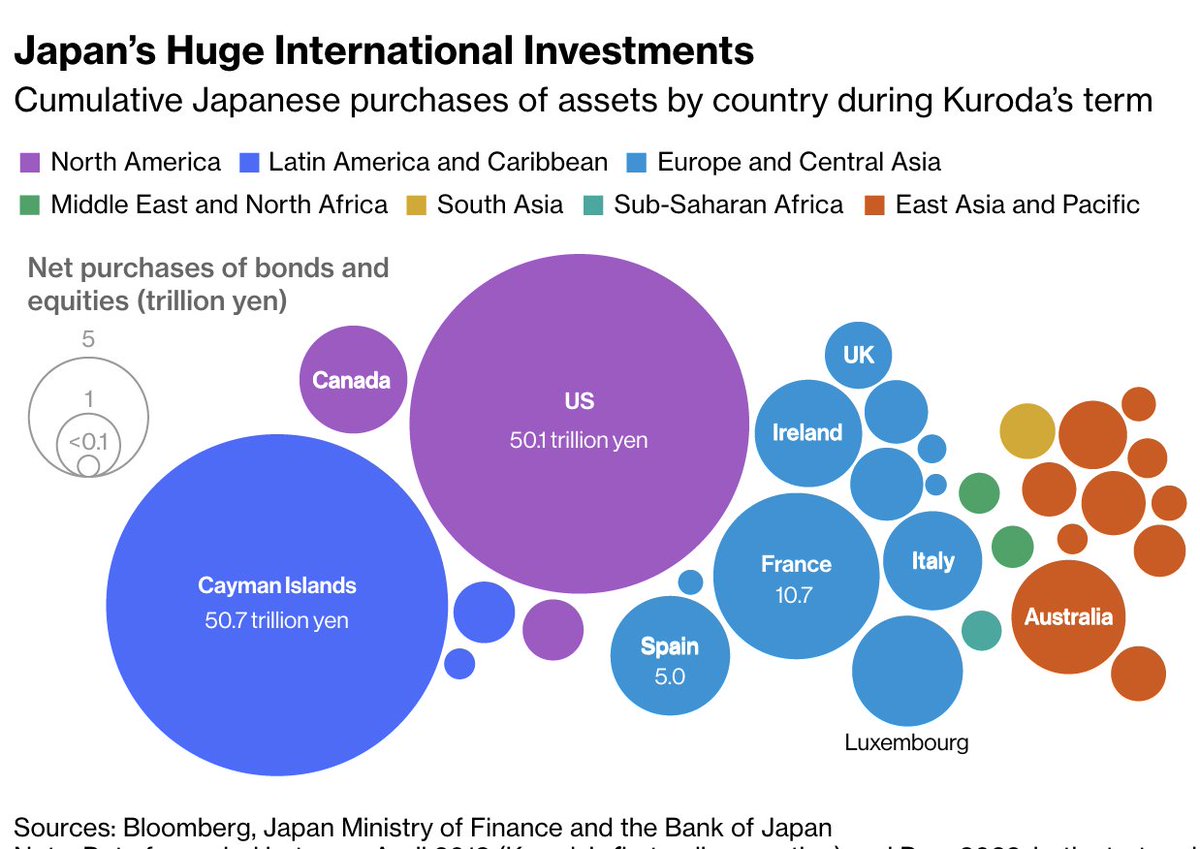

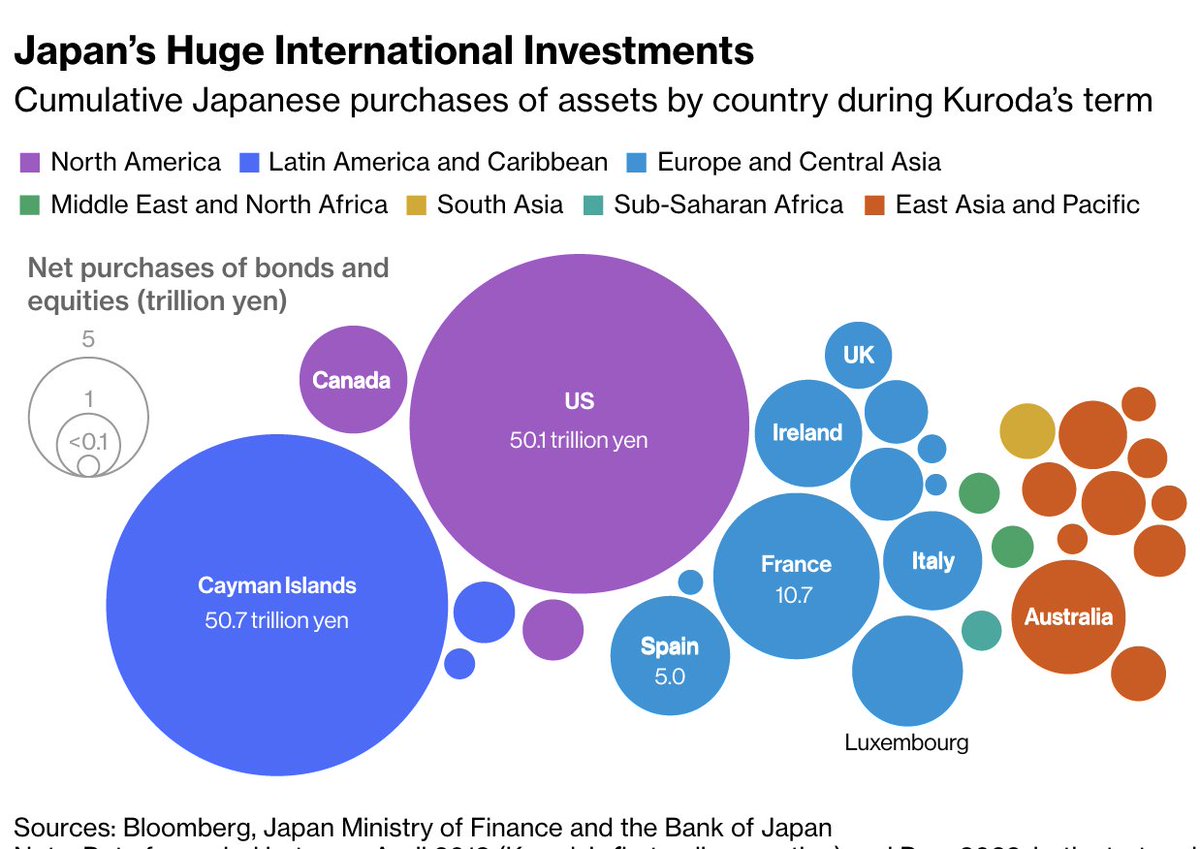

Japanese capital has propped up foreign debt and equity markets for years.

Japanese capital has propped up foreign debt and equity markets for years.

Things are looking rough for #Bitcoin in the same period.

Things are looking rough for #Bitcoin in the same period.