Segment wise highlights:

Speciality Chemicals :

1. The Specialty Chemicals Business revenue grew by 63% YoY, on account of better demand across all products within the segment.

Speciality Chemicals :

1. The Specialty Chemicals Business revenue grew by 63% YoY, on account of better demand across all products within the segment.

2. Margins are impacted mainly on account of higher cost of energy due to restriction on contracted coal supplies.

3. While the company expects the coal supply to normalize soon, we also continue to explore alternate energy solutions for the future.

3. While the company expects the coal supply to normalize soon, we also continue to explore alternate energy solutions for the future.

Nutrition & Health Solution :

1. Flu situation in US and Europe is normalizing, however demand for Vitamin B3 continues to be suppressed owing to post flu impact and excess inventory across the value chain.

1. Flu situation in US and Europe is normalizing, however demand for Vitamin B3 continues to be suppressed owing to post flu impact and excess inventory across the value chain.

2. The company’s focus on niche segments like Food & Cosmetics is showing positive results and we continue to increase our revenue share in this segment.

3. The company believes that the demand challenges of Vitamin B3 are short term and it continues to improve market share in the Animal nutrition business of Vitamin B4 and other Branded Premix products.

Chemical intermediates

1. The Chemical Intermediates Business continues to witness strong demand resulting in volume growth.

2. This segment continues to improve its leadership position in Acetic Anhydride in the domestic and international market.

1. The Chemical Intermediates Business continues to witness strong demand resulting in volume growth.

2. This segment continues to improve its leadership position in Acetic Anhydride in the domestic and international market.

3. Revenue impact on YoY basis was primarily driven by lower prices of feed stock leading to lower sales prices of Ethyl Acetate and Acetic Anhydride

Capex Plans :

1. The company expects its H2 performance to be better than H1, assuming no unexpected adverse situation. The company expects overall healthy revenue growth during FY’23, led by volume growth in Specialty Chemicals & Chemical intermediate business segment.

1. The company expects its H2 performance to be better than H1, assuming no unexpected adverse situation. The company expects overall healthy revenue growth during FY’23, led by volume growth in Specialty Chemicals & Chemical intermediate business segment.

Commissioning of the new capex during H2 is likely to aid the growth.

2. The company is fully committed towards our growth aspirations and we are excited to realize the emerging opportunities through our ongoing Growth Capex plan of Rs. 2,050 Crore during FY’22 to FY’25 Period.

2. The company is fully committed towards our growth aspirations and we are excited to realize the emerging opportunities through our ongoing Growth Capex plan of Rs. 2,050 Crore during FY’22 to FY’25 Period.

3. The company continues its efforts towards improving our revenue mix of Specialty and Nutrition segments to 65% by FY’27 from 46% in FY’22 and we believe this to be a key driver for overall margin improvements.

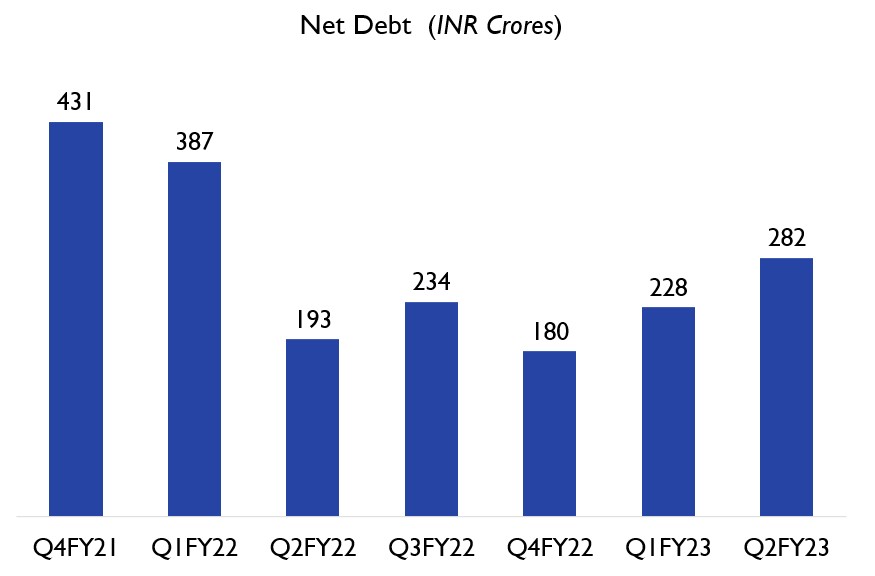

Debt Position

The company has completely paid off its high cost long term borrowing resulting into lower blended interest rate of 5.84% in Q2'FY23. Currently the company's net debt is Rs 282 crores.

The company has completely paid off its high cost long term borrowing resulting into lower blended interest rate of 5.84% in Q2'FY23. Currently the company's net debt is Rs 282 crores.

• • •

Missing some Tweet in this thread? You can try to

force a refresh