1/25 #TheGreatHeadFake: Why we’ll look back at this market correction & conclude that it was a huge head fake. Mark my words, we’re entering a multiyear bull market for forgotten growth+value stocks. Fundamentals to take centerstage. #Thread

2/25 Takes me back to Peter Lynch opining on sticking to fundamentals as he resisted the temptation of investing in internet stocks during his retirement."In spite of the instant gratification that surrounds me,I’ve continued to invest the old-fashioned way. I own stocks where👇

3/25 To be clear, the head fake is not referring to stocks with insane valuations coming back down to earth, or as Chris Lahiji (@theLDMicro) coined it “the Great Flushing” - in a convo with Mark Gomes (@PipelineDataLLC). I’m talking about pullbacks in quality, undervalued Cos.

4/25 Even if off on timing, a bet is reasonable. Valuations of many stocks are on par or below levels vs. the 2000 Bubble & 2008 Apocalypse. The world isn't ending. Wages are up & Cos are adjusting to the new normal. Markets evolve.The strong will survive & the weak will perish.

5/25 Tobias (@Greenbackd), talks about the degree of undervaluation in certain areas of the current market, referencing the 2001 tech bubble, stating that patient investors will be rewarded.

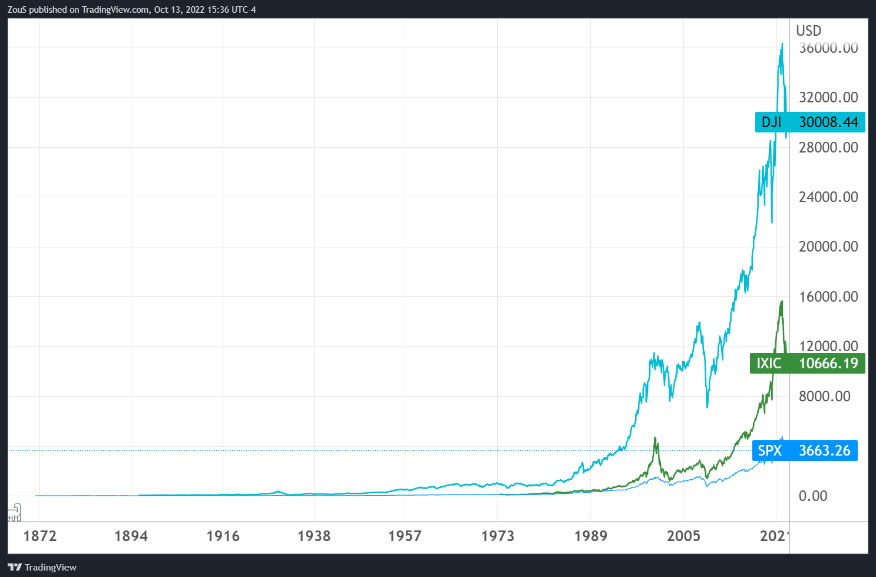

6/25 Knowing that stocks go up over time, you will make more money by taking a half glass full approach to investing in bear markets vs. fixating on pessimism.

7/25 Don’t end up being part of the statistic that shows how badly individual investors underperform the market as highlighted in this video clip referencing Peter Lynch from a March 2017 presentation by @LCTempleton. Transcript w/ slides available here: geoinvesting.com/investing-temp…

8/25 This tweet thread by @KennethLFisher and article by @TimothyHerbert1 highlight that the market usually rises after rate hikes.

hfgllc.com/blog/rising-ra…

https://twitter.com/kennethlfisher/status/1483585498593566723?s=46&t=g8DEfaCoxHslfJ-zlHvwdw

hfgllc.com/blog/rising-ra…

9/25 And this tweet by @giovfranchi Shows that despite the pain we go through in drawdowns, you’ll do just fine hanging in there:

https://twitter.com/giovfranchi/status/1577239363267985408

10/25 As of 10/14, there are 2,194 stocks that are up YTD. If you look hard enough, there are a good amount of stocks trading at valuations we can research. (Based on 11,584 stocks in @Sentieo database)

11/25 Based on a Screener I’m building with @JanSvenda to identify Tier 1 Quality stocks, 232 U.S. OTC microcaps meet 7 out of 7 quantitative criteria & 1K meet 6. To learn more about #InfoArb screens I’m building please go here: eepurl.com/ibua95 @MicroCapHound

12/25 You don’t have to be a growth or a value investor. You can be a growth+value investor by looking for companies with good growth prospects that are undervalued or reasonably valued. It’s really that simple. Some would call this GARP, growth at a reasonable price.

13/25 GARP Essentially means that you’re looking for companies that are growing and not selling at pie in the sky valuations (no room for disappointment) or at extremely low valuations (since this may incorporate hidden risks).

14/25 Over the last 15 years, GARP took a backseat to investing in companies aggressively growing sales and in “story” stocks with little regard to the value or earnings part of the equation. GAAP: Growth at any price.

15/25 Now, It just makes sense that the new riskier environment we are in will reward stock pickers and punish those who invest in companies that can’t make money as we exit an everything goes up investment era.

16/25 That doesn’t mean speculative & high multiple fast rev growth Cos won’t rise. It just means more investors will place greater emphasis on valuing stocks based on earnings, cash flow & balance sheets vs solely on sales & pipe dreams, a marked divergence from the last 15 yrs

17/25 Furthermore, there will be a huge upward revision in the price to earnings multiples of #GARP style stocks. Why? More money flow into them will naturally lead to premium valuations.

18/25 Peter Lynch’s formula will work like a charm: geoinvesting.com/peter-lynch-st…

Trailing P/E<25

Forward P/E<15

Debt to Equity Ratio <35%

EPS Growth >15% to <30%

PEG Ratio (PE/EPS Growth Rate) <1.2

Market Cap < $5 Billion

Trailing P/E<25

Forward P/E<15

Debt to Equity Ratio <35%

EPS Growth >15% to <30%

PEG Ratio (PE/EPS Growth Rate) <1.2

Market Cap < $5 Billion

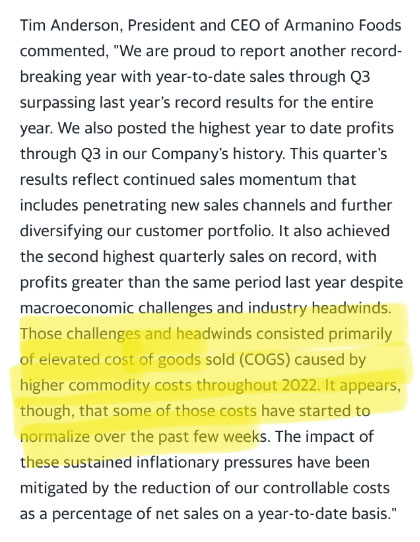

19/25 For example, $AMNF is a stock we (@GeoInvesting) are extremely interested in that meets some of Peter Lynch’s requirements. Sales are increasing rapidly, surpassing historical highs by 50%. EPS could follow suit as management sees inflation pressure on gross margins abating

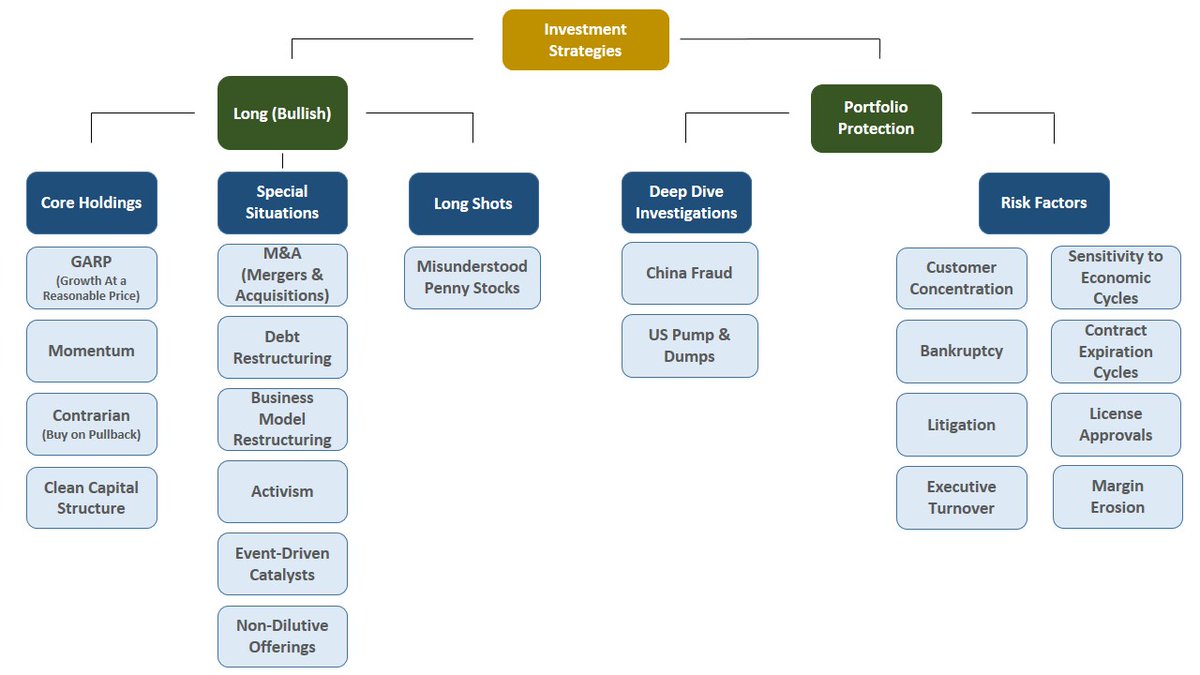

20/25 Here are some strategy buckets I use to find multi-baggers backed by fundamentals and understanding risk.

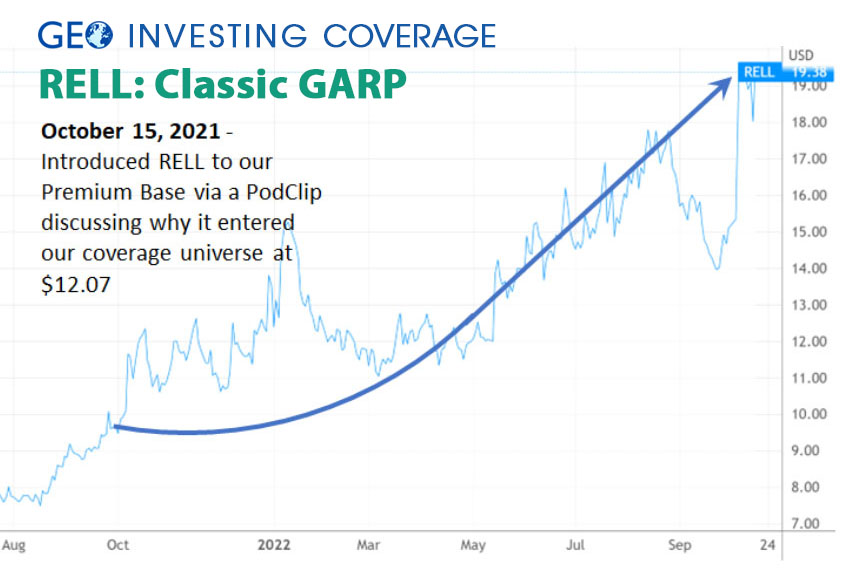

21/25 The shift to growth+value is already happening.

$RELL: 9 straight quarters of sales & EPS growth combined with low P/E propelled shares 400% since May 2020

$RCMT: Low P/E, where turnaround plan inflected. Stock triples in 2 Months

$RELL: 9 straight quarters of sales & EPS growth combined with low P/E propelled shares 400% since May 2020

$RCMT: Low P/E, where turnaround plan inflected. Stock triples in 2 Months

22/25 Names to follow where GARP investing is a focus:

@_GARPInvestor_

@AJButton2

@caustin34

@FoolJeffFischer

@AsifSuria

@mavix_leon

@NestBetter

@MicroCapClub

@smallcapdisc

See more here:

@_GARPInvestor_

@AJButton2

@caustin34

@FoolJeffFischer

@AsifSuria

@mavix_leon

@NestBetter

@MicroCapClub

@smallcapdisc

See more here:

https://twitter.com/majgeoinvesting/status/1582803856387284993?s=20&t=esDjhj9OznqcSGfZ00-ZSg

23/25 I would also recommend that Investors follow @hkuppy. While some of you may only think of Kuppy as an oil and energy guy, he's also a GARP investor when it comes to looking for a good deal of his potential multibaggers.

24/25 One last thing: Time horizon is not a mutually exclusive decision. You can make money in the short term by finding boring GARP companies about to experience new catalysts or a period of elevated growth.

25/25 If these thoughts on the current market environment and GARP investing align with your investment strategy, join @GeoInvesting. We’re preparing our community for the next bull market in high-quality microcap GARP stocks: geoinvesting.com/free-trial/

• • •

Missing some Tweet in this thread? You can try to

force a refresh