#JubilantIngrevia vs #LaxmiOrganics 🧪🧪

A clash of organic vs inorganic growth strategies

Detailed Thread 🧵🧵

Like & Retweet for better reach !

A clash of organic vs inorganic growth strategies

Detailed Thread 🧵🧵

Like & Retweet for better reach !

About Jubilant Ingrevia

1. The company is a global provider of integrated life science products and innovative solutions that meet the highest quality standards to serve the pharmaceutical, nutrition, agrochemical, consumer and consumer goods industries

1. The company is a global provider of integrated life science products and innovative solutions that meet the highest quality standards to serve the pharmaceutical, nutrition, agrochemical, consumer and consumer goods industries

2. With over 40 years of chemical experience and an integrated practice, The company specializes in specialty chemicals, advanced stage complex chemical solutions, nutritional supplements, and pure nutritional ingredients such as vitamin B3 for

animal and human nutrition. It offers over 350 products including premixed solutions, pyridines and picolines. The extensive Acetyl product range serves more than 1400 of the company’s customers worldwide.

3. The Life Science Intermediates business was part of the Jubilant Pharmova Limited group. In February 2021.the LSI business of Jubilant Pharmova Ltd was demerged and transferred to Jubilant Ingrevia.

The purpose of this demerger was to realize growth and unlock shareholder value as a separate entity

Business verticals

As shown in the image, The company has 3 business verticals which are as follows:

1)Specialty Chemicals

2)Nutrition and Health Solutions

Business verticals

As shown in the image, The company has 3 business verticals which are as follows:

1)Specialty Chemicals

2)Nutrition and Health Solutions

3)Chemical Intermediates

The Specialty Chemicals division comprises of Pyridines and Picolines,Fine Chemicals,Crop Protection Chemicals and CDMO.The company is the largest manufacturer of Pyridine and it’s derivatives globally

The Specialty Chemicals division comprises of Pyridines and Picolines,Fine Chemicals,Crop Protection Chemicals and CDMO.The company is the largest manufacturer of Pyridine and it’s derivatives globally

and has over 30 years of experience in Pyridine chemistry. With acetaldehyde as a raw material, The company offers more than 240 value added products in this segment

The Nutrition and Health Solutions division has 3 main products which are Vitamin-B3,Zinc Picolinate and Riboflavin phosphate sodium(RPS).These products form the important constituents in the brand offerings the company provides for

the Animal and Human Nutrition and Health solutions

The Chemical Intermediates division has 3 main products which are Acetic Anhydride,Ethyl Acetate and Ethanol.The company is among the top 2 global market suppliers for Acetic Anhydride and the largest supplier in India

The Chemical Intermediates division has 3 main products which are Acetic Anhydride,Ethyl Acetate and Ethanol.The company is among the top 2 global market suppliers for Acetic Anhydride and the largest supplier in India

Acetic anhydride is used in high-growth user sectors such as pharmaceutical APIs (Paracetamol, Ibuprofen, Aspirin, Prazoles, etc.), agrochemicals, vitamins, speciality polymers, food ingredients, aromatics, dyes and other industrial uses.

Ethyl Acetate is an environment-friendly solvent, which is used by the pharmaceutical, packaging, coatings and ink industries. The company uses ethanol for captive consumption as well as for the Government Ethanol Blending Program

About #LaxmiOrganics

1. Incorporated in 1989, Laxmi Organic Industries is a leading manufacturer of acetyl and specialty intermediates.

1. Incorporated in 1989, Laxmi Organic Industries is a leading manufacturer of acetyl and specialty intermediates.

2. It is currently among the largest manufacturers of ethyl acetate in India with a market share of ~30% of the Indian ethyl acetate market

3. In 2010, It commenced manufacturing the specialty intermediates by acquiring Clariant’s diketene business. It is the only manufacturer of diketene derivatives in India with a market share of ~55% of the Indian diketene derivatives market.

Business verticals

The company has two main business verticals:

1)Acetyl intermediates

2)Specialty Intermediates

The company has two main business verticals:

1)Acetyl intermediates

2)Specialty Intermediates

The Acetyl intermediates segment includes ethyl acetate, acetaldehyde, fuel-grade ethanol and other proprietary solvents, while the specialty intermediates comprises of diketene derivatives such as Esters,Acetic anhydride,Amides,arylides and others.

The company has a strong portfolio of more than 34 diketene derivatives and a market share of around 55% in the Indian diketene derivatives market

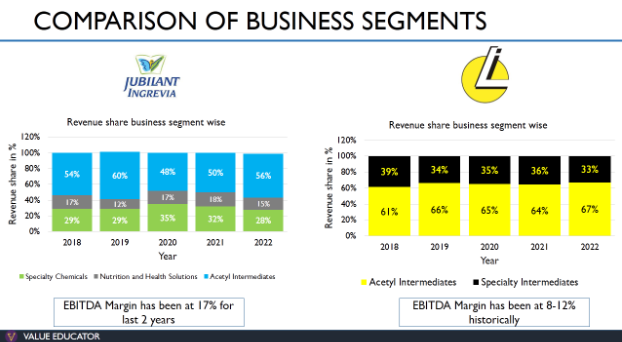

Comparison of business segments of Jubilant Ingrevia and Laxmi Organics

As you can see from both the charts shows in the image, The acetyl intermediates business has been the major contributor to the revenues of both Jubilant Ingrevia and Laxmi Organics from 2018 to 2022

As you can see from both the charts shows in the image, The acetyl intermediates business has been the major contributor to the revenues of both Jubilant Ingrevia and Laxmi Organics from 2018 to 2022

The key raw material for the acetyls intermediate business is Acetic acid and hence the profitability of the company is affected by the fluctuations in the prices of acetic acid.

Since,the major revenues come from the acetyls business which is a commodity business the EBITDA margin of Jubilant Ingrevia has been at 17% for the last 2 years and for Laxmi it has been at 8-12% historically

Organic growth strategy of Jubilant Ingrevia

On the Diketene side,Ingrevia plans to enter with a capacity of 8000 tons and 14 products out of which 6 are commodity and 8 are value added.

On the Diketene side,Ingrevia plans to enter with a capacity of 8000 tons and 14 products out of which 6 are commodity and 8 are value added.

Jubilant has commissioned the Phase-I of their diketene capex which has a capacity of 6000 tons and will be for commodity products. Their Phase-II capex which is of 2000 tons is for value added products and is under progress.

The company already had a presence in ketene chemistry and decided to enter diketene chemistry when one of their foreign competitors shut down their plant.

They plan to substitute diketene imports in India which are to the tune of 4000-5000 tons with the help of their Phase-I capacity

(Continued...... )

(Continued...... )

Jubilant Ingrevia has an experience of more than 30 years in pyridine chemistry and using this experience,they are planning to enter fluorination chemistry with fluorinated derivatives of Pyridine such as Fluoroxypyr.

Inorganic growth strategy of Laxmi Organics

Before 2010,the company was manufacturing products which were on the Acetyl Intermediates side. In 2010,the company started the manufacturing of Specialty Intermediates by acquiring Clariant Chemicals’ diketene business

Before 2010,the company was manufacturing products which were on the Acetyl Intermediates side. In 2010,the company started the manufacturing of Specialty Intermediates by acquiring Clariant Chemicals’ diketene business

which included the technology and know-how of 18 products out of which Laxmi was producing 14 products then.Through constant R&D efforts,in addition to the products acquired from Clariant,the company added 20 new products to their Specialty intermediates portfolio

over the last decade.The company now is the largest manufacturer of Diketene derivatives in India with a portfolio of more than 30 products and a market share of around 55%

In 2020,the company had a production capacity of 1,61,320 MTPA on the acetyls intermediate side. At that time,It decided to acquire YCPL which was in the production of ethyl acetate and acetaldehyde with capacities of 29,200 MTPA and 10,500 MTPA. In October 2021,

the company successfully completed the acquisition of YCPL which increased the total capacity of the company’s AI business to 2,01,020 MTPA. Post this acquisition, the company has become the largest producer of Ethyl Acetate in India

with a capacity of 1,88,000 MTPA and is now among the top 7 producers in the world

The company has entered the fluorination chemistry through acquisition of assets of Miteni SPA,which is an Italian company engaged in the manufacturing of organic fluorospecialties

The company has entered the fluorination chemistry through acquisition of assets of Miteni SPA,which is an Italian company engaged in the manufacturing of organic fluorospecialties

and electrochemical fluorination products.The acquisition was done at a consideration amount of € 4.63 million.This acquisition gave the company,an access to the technology,equipments and a library of more than 100 products including products in R&D and scale-up stages with

14 patents, 41 REACH registrations, formulations, production and R&D data.The project is currently at an advanced stage of implementation with multiple teams involved in dismantling and relocating the facility to the new site at Lote Parshuram, Maharashtra, absorbing

and transferring knowledge and technology and establishing an R&D and Kilo lab facility in Italy to help the company with the technology transfer.The R&D kilo lab in India has commenced with several trial runs completed and samples for 8-10 products approved by customers.

They have planned a capex of Rs 400-450 crores for fluorinated products which will be a part of their new fluorospecialty vertical with a capacity of 13,820 TPA.They expect to commission this capex by Q3 FY23

Similarity in Objectives

As both the companies are getting major revenues from the acetyl business which is a commodity business,they are planning to shift from commodity to specialty products

As both the companies are getting major revenues from the acetyl business which is a commodity business,they are planning to shift from commodity to specialty products

As shown in the above image,Jubilant Ingrevia has planned a capex worth Rs 2050 cr during the period of FY22 to FY25.Once,this capex is materialized the company expects to improve the revenue mix of Specialty and Nutrition segments together to 65% by FY26 from 46% in FY22

Laxmi Organics has planned a capex of Rs 300-330 cr in it’s specialty intermediates side as mentioned in their Q1 FY23 concall.They have spent a total of Rs 180 cr till now and will spend the remaining Rs 120 to Rs 150 cr eventually.

They have planned a capex of Rs 400-450 cr on the Fluorospecialty Intermediate side

Thus,both the companies have done major capexes in the specialty side which indicates their plan to shift from commodity to specialty products going forward

Thus,both the companies have done major capexes in the specialty side which indicates their plan to shift from commodity to specialty products going forward

Micro Cap Club : valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh