6 things we know so far about the recent stampede in South Korea. 🧵

🚨Graphic content warning.

#PrayforKorea #Stampede

🚨Graphic content warning.

#PrayforKorea #Stampede

1. More than 150 people were killed on Saturday night during a crowd surge at a Halloween event in Seoul’s popular nightlife district, Itaewon.

It is the deadliest stampede in South Korea's history.

S.Korean President Yoon Suk-yeol has declared a week of national mourning.

It is the deadliest stampede in South Korea's history.

S.Korean President Yoon Suk-yeol has declared a week of national mourning.

2. Over 100,000 people attended the event in Seoul after South Korea recently lifted its mask mandate and three years of Covid restrictions.

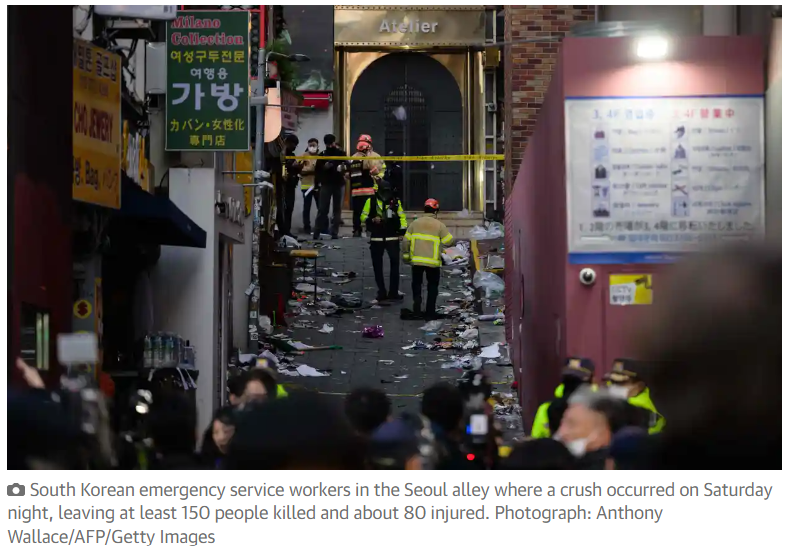

The area of the party, Itaewon, has bars located along narrow back alleys that flank the main street.

The area of the party, Itaewon, has bars located along narrow back alleys that flank the main street.

3. The crowd rush occurred when tens of thousands of people were crammed into a 3.2 metre-wide, sloped alleyway.

Witnesses said the incident was "chaos-like" and people toppled on one another like "dominos".

Witnesses said the incident was "chaos-like" and people toppled on one another like "dominos".

4. People started suffocating, and many victims suffered cardiac arrests.

The first responders on the scene struggled to reach victims in the tight alleyways.

Emergency aid arrived 30 minutes later, but it was too late.

The first responders on the scene struggled to reach victims in the tight alleyways.

Emergency aid arrived 30 minutes later, but it was too late.

5. The cause of the crush is still being investigated.

It was not caused by drunk people or a "famous celebrity" attending the event.

Many criticize the absence of planning by the police force and a lack of emergency responders on the scene.

It was not caused by drunk people or a "famous celebrity" attending the event.

Many criticize the absence of planning by the police force and a lack of emergency responders on the scene.

6. At least 153 people were killed, including 20 foreigners.

82 others were injured, with 19 currently in serious condition.

So far, no Malaysians were involved in the stampede incident, our foreign minister said.

82 others were injured, with 19 currently in serious condition.

So far, no Malaysians were involved in the stampede incident, our foreign minister said.

Our deepest condolences go to the victims and affected families of the stampede.

We wish for a speedy recovery to those who are injured.

#PrayForKorea

We wish for a speedy recovery to those who are injured.

#PrayForKorea

Sources:

i) theguardian.com/world/2022/oct…

ii) nytimes.com/live/2022/10/2….

iii) worldofbuzz.com/south-koreas-d…

iv) aa.com.tr/en/asia-pacifi…

i) theguardian.com/world/2022/oct…

ii) nytimes.com/live/2022/10/2….

iii) worldofbuzz.com/south-koreas-d…

iv) aa.com.tr/en/asia-pacifi…

More about the stampede:

https://twitter.com/NewsBFM/status/1586538421472104450?s=20&t=wNt8vvrU-s0toD_cbfAG1g

• • •

Missing some Tweet in this thread? You can try to

force a refresh