GEARBOX V2 ⚙️🧰 LIVE

Oeef, 6 hours of social madness & constant monitoring! But things are normalizing now, so we can write a thread on what all the fuss is about... "OK $100M+ TVL, who cares, why is it even there, what can I do, where is alpha and who are Ninjas?!"

Let's go 🧵

Oeef, 6 hours of social madness & constant monitoring! But things are normalizing now, so we can write a thread on what all the fuss is about... "OK $100M+ TVL, who cares, why is it even there, what can I do, where is alpha and who are Ninjas?!"

Let's go 🧵

First of all, total TVL is capital in pools + borrowed + collateral of leverage users. As such, total number is actually > $115M at the moment. 🦙s are on the case to fix it! Anyway, TVL is amazing, but now the question is "why is that liquidity even there, what's the point"...

Before we begin, if you missed the "what is in V2 and what is Gearbox Protocol doing" - here is one for you. It contains market perspective, technical changes, code, audits, DAO updates, and product improvements ⚙️🧰 Very-very elaborate:

https://twitter.com/GearboxProtocol/status/1585259595320393729

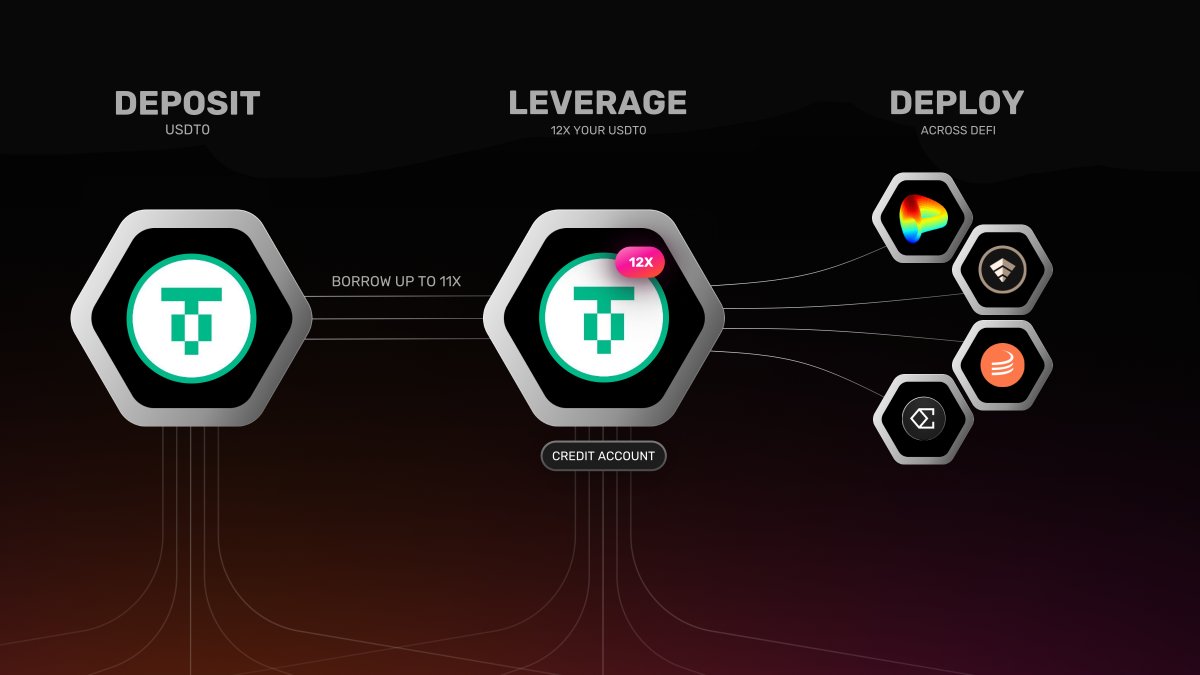

So... In a very nutshell way, the protocol has two sides to it: passive liquidity providers who earn low-risk APY by providing single-asset liquidity; and active farmers or even other protocols who borrow those assets to trade or farm with ~x10 leverage: docs.gearbox.finance

That's what the last few days were about... With two-sided marketplaces, you need to kick off usage somewhere. DAO members decided that it likely would need to be on passive side first. So, a $GEAR LM proposal was structured & 5 assets were voted on: medium.com/gearbox-protoc…

And that ended up working well so far! You can see for yourself in app.gearbox.fi/pools. It's fairly straight-forward GEAR per block distribution while the APY% are counted based on organic APY + DAO-voted GEAR FDV rewards. All about that is here:

https://twitter.com/ivangbi_/status/1585194928606695424.

The numbers per pool can be reshuffled as per DAO voting. Think of these assets as debt. This is what leverage takers trade "against" when borrowing them. They take it as debt and they need to beat borrow fees + that asset relative price compared to the positions they are taking.

Now onto the leverage side. "What can you do there?" - anything. Anything as long as it's within the security parameters. There are no forced strategies or choices. YOU decide leverage factor, debt, farm, trade, etc. All of it. Gearbox is your leveraged #DeFi wallet ❤ x4-x15!

Coming back to the assets. For instance, $wstETH is currently yielding more in vanilla staking than stETHcrv or other avenues (first time ever?)... Thus it's natural that utilization is none for now. This debt asset is too "expensive"! Maybe rewards should be readjusted...

But what are the things you can make $$ on? This is not financial advice, genuinely, also because variable rates change, duh. Gearbox "just" provides you with a leveraged DeFi wallet - YOU decide where to source yields. Here is a proper complex overview: docs.gearbox.finance/traders-and-fa…

It's all on-chain. Max leverage is not a made up factor, it's a product of LTVs. Correlated debt to position? Can do high leverage while staying fairly "safe". just do your homework and understand how these things work! Again, here is the PRO user bible: docs.gearbox.finance/traders-and-fa…

There is also a Strategies page. These are cool new multicalls that make open CA -> swap -> deposit -> stake operations for YOU incredibly easy in one transaction! From "I have some $USDC" to "Stake to Convex strategy" in one click! See for yourself: app.gearbox.fi/accounts/strat…

But! Those yields are a little bit "too high" because they count *current* borrow rates which are "too low". So you should price in what could be expected at normal utilization of pools based on protocol parameters: 2.1$ for stables, 3.5% for $ETH $WBTC, and sub-1% for $wstETH 💡

🔥 with some $GEAR rewards for Credit Accounts starting this Friday, the calculations can become potentially even better! Keep an eye on that soon...

What is doable with Gearbox leverage? It's all in the docs & in the interface... You can "expect" 10% on stables & 20% on ETH given the rates discussed above & current yields. And that's without going too degen, you can stay fairly O-K.

Just do the math!

docs.gearbox.finance/traders-and-fa…

Just do the math!

docs.gearbox.finance/traders-and-fa…

Leverage:

- Farming $FRAX in 3crv & $USDC pool on @CurveFinance

- Farming $WETH in @iearnfinance

- All the $stETH staking farming variations

- Farming $LUSD $GUSD $sUSD in @ConvexFinance

And more... check the interface! We'll dive into these strategies in the coming days...

- Farming $FRAX in 3crv & $USDC pool on @CurveFinance

- Farming $WETH in @iearnfinance

- All the $stETH staking farming variations

- Farming $LUSD $GUSD $sUSD in @ConvexFinance

And more... check the interface! We'll dive into these strategies in the coming days...

🔥 ALPHA 🔥

Just do the math! If @iearnfinance deposit rate for $yvWETH is 4.93% & borrow rate on Gearbox is 3.5%... you make 1.43% difference on every x leverage factor! And get + $GEAR... Same goes for other strategies, like. Understand risks & be careful of liquidations tho.

Just do the math! If @iearnfinance deposit rate for $yvWETH is 4.93% & borrow rate on Gearbox is 3.5%... you make 1.43% difference on every x leverage factor! And get + $GEAR... Same goes for other strategies, like. Understand risks & be careful of liquidations tho.

How to get access? Be a Ninja 🥷 Either DM one of the contributors on Discord, or post on forum. You don't need to ddox as long as your address has some history and funds on it. Fairly easy & quick.

On that note, do jump into Discord and ask anything! discord.com/channels/84120…

On that note, do jump into Discord and ask anything! discord.com/channels/84120…

🥷 new wave of Ninjas is expected in a few hours! Once you get in the new merkle, you need to spend a couple minutes in game.gearbox.fi to mint an #SBT which is your access pass to V2 contracts. 1 SBT = 1 Credit Account. Close CA, and is gone - then you can get a new one.

PS: if you spent hours trying to jump over the bridge... sorry to tell you, but you physically can't do it. You need to be a 🥷

• • •

Missing some Tweet in this thread? You can try to

force a refresh