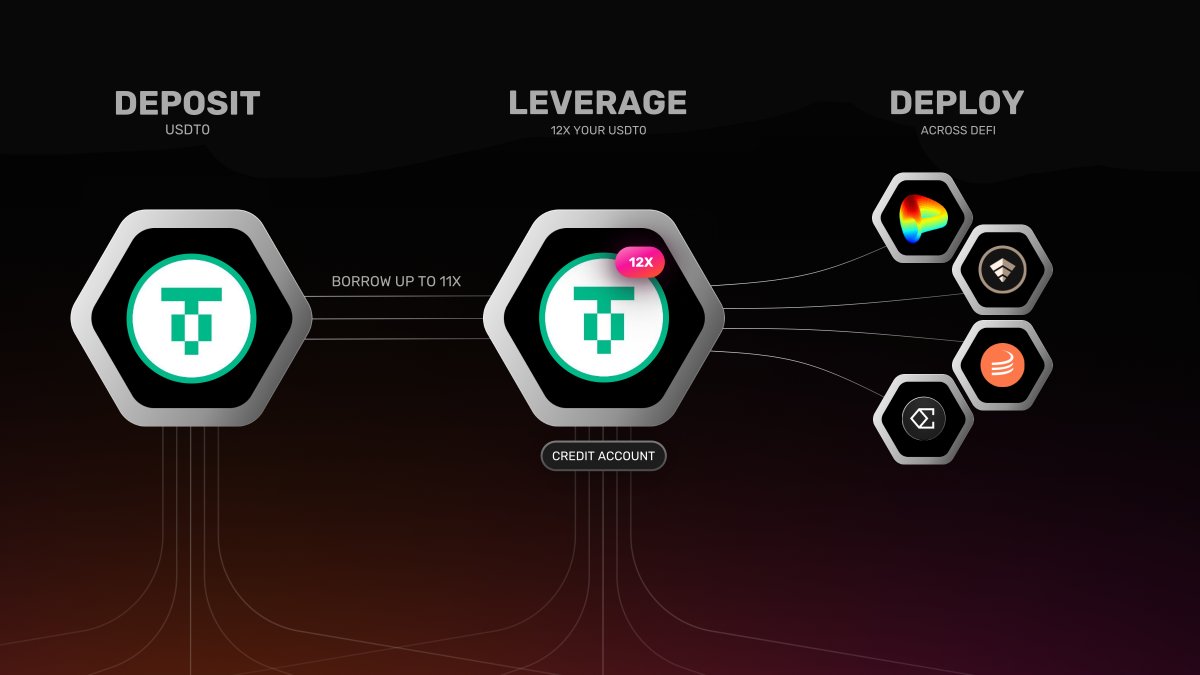

Lending reimagined ✨ Building a permissionless credit layer for everyone to enjoy. Access 10x credit across DeFi or earn passive yields: https://t.co/Ad0LNr8gpY

How to get URL link on X (Twitter) App

@CurveFinance @maplefinance @Ethena_Eco @StreamDefi @USDai_Official ❔ How

@CurveFinance @maplefinance @Ethena_Eco @StreamDefi @USDai_Official ❔ How

Since Gearbox launched in 2021, DeFi has seen new segments like fixed-income protocols, basis-yield derivatives, restaking and more surface.

Since Gearbox launched in 2021, DeFi has seen new segments like fixed-income protocols, basis-yield derivatives, restaking and more surface.

stETH has been the fastest growing asset on Gearbox, rising from 1K ETH to 8K ETH in TVL. Leverage stETH and earn

stETH has been the fastest growing asset on Gearbox, rising from 1K ETH to 8K ETH in TVL. Leverage stETH and earn

⚙️ With borrowings at $62M, the utilization is at almost the optimum levels leading to organic borrow rates on stables at ±2% and WETH at ±2.6%. The Lend APYs have been further boosted with $GEAR rewards. LP in to earn the below APYs: app.gearbox.fi/pools/

⚙️ With borrowings at $62M, the utilization is at almost the optimum levels leading to organic borrow rates on stables at ±2% and WETH at ±2.6%. The Lend APYs have been further boosted with $GEAR rewards. LP in to earn the below APYs: app.gearbox.fi/pools/

1⃣ Credit Accounts open: 90

1⃣ Credit Accounts open: 90

First of all, total TVL is capital in pools + borrowed + collateral of leverage users. As such, total number is actually > $115M at the moment. 🦙s are on the case to fix it! Anyway, TVL is amazing, but now the question is "why is that liquidity even there, what's the point"...

First of all, total TVL is capital in pools + borrowed + collateral of leverage users. As such, total number is actually > $115M at the moment. 🦙s are on the case to fix it! Anyway, TVL is amazing, but now the question is "why is that liquidity even there, what's the point"...

First of all, we are back from the radio silence! A lot of work has been happening behind the scenes with v2 audits starting up, research for new protocols’ adapters, and onboarding contributors to Gearbox DAO. All that you can find in the next monthly community update...

First of all, we are back from the radio silence! A lot of work has been happening behind the scenes with v2 audits starting up, research for new protocols’ adapters, and onboarding contributors to Gearbox DAO. All that you can find in the next monthly community update...