(1/18)

About:

Incorporated in 1992, Best Agrolife Limited is engaged in the in the trading of agrochemical products such as insecticides, pesticides, herbicides, fungicides and plant nutrients.

It has almost 60+ products & 30k+ MTPA manufacturing formulation capacity.

About:

Incorporated in 1992, Best Agrolife Limited is engaged in the in the trading of agrochemical products such as insecticides, pesticides, herbicides, fungicides and plant nutrients.

It has almost 60+ products & 30k+ MTPA manufacturing formulation capacity.

(2/18)

Agro Chem Sector Overview:

India is the 4th Largest producer of agrochemicals after USA, Japan & China.

It was valued at around $5.72 bn FY21, out of which exports stood

at around $3 bn.

Further, the Indian agrochem

ind is expected to grow at a CAGR of 10% until 2025.

Agro Chem Sector Overview:

India is the 4th Largest producer of agrochemicals after USA, Japan & China.

It was valued at around $5.72 bn FY21, out of which exports stood

at around $3 bn.

Further, the Indian agrochem

ind is expected to grow at a CAGR of 10% until 2025.

(3/18)

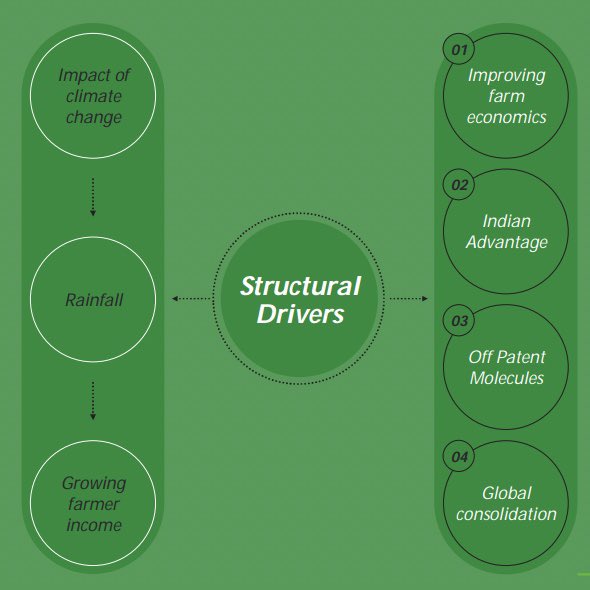

Industry Growth Drivers:

• Improving Farm Economics

• China + 1 Strategy working well

• Global Consolidation

• Agrochemicals worth ~USD6bn are going off-patent globally by 2030. This would have domestic players in country like India where R&D exp is limited

Industry Growth Drivers:

• Improving Farm Economics

• China + 1 Strategy working well

• Global Consolidation

• Agrochemicals worth ~USD6bn are going off-patent globally by 2030. This would have domestic players in country like India where R&D exp is limited

(4/18)

Capacity Details of BAL:

• 3 Manufacturing Facilities

• 37,000 MTPA Capacity

• 14,460 sqft R&D facility

• 5200+ Distributors across India

• Presence in Europe, South America, Asia and Africa

Capacity Details of BAL:

• 3 Manufacturing Facilities

• 37,000 MTPA Capacity

• 14,460 sqft R&D facility

• 5200+ Distributors across India

• Presence in Europe, South America, Asia and Africa

(5/18)

Key Clients:

• UPL

• Adama

• Syngenta

• IFFCO-MC

• Sulphur Mills Ltd

• Biostadt

• Mahindra Agri Business

• Gharda chem ltd

• Jubilant Lifesciences

• Atul

• Bharat Rasayan Ltd

• Corteva Agriscience

Key Clients:

• UPL

• Adama

• Syngenta

• IFFCO-MC

• Sulphur Mills Ltd

• Biostadt

• Mahindra Agri Business

• Gharda chem ltd

• Jubilant Lifesciences

• Atul

• Bharat Rasayan Ltd

• Corteva Agriscience

(7/18)

Diversified product portfolio:

It includes insecticides, pesticides, herbicides, plant-growth regulators

(PGR) and biocides. Sales from top-5 generic agrochem stood at 11.64% of total sales while that from hybrid agro-chemicals stood at 17.72% of total sales during FY22

Diversified product portfolio:

It includes insecticides, pesticides, herbicides, plant-growth regulators

(PGR) and biocides. Sales from top-5 generic agrochem stood at 11.64% of total sales while that from hybrid agro-chemicals stood at 17.72% of total sales during FY22

(8/18)

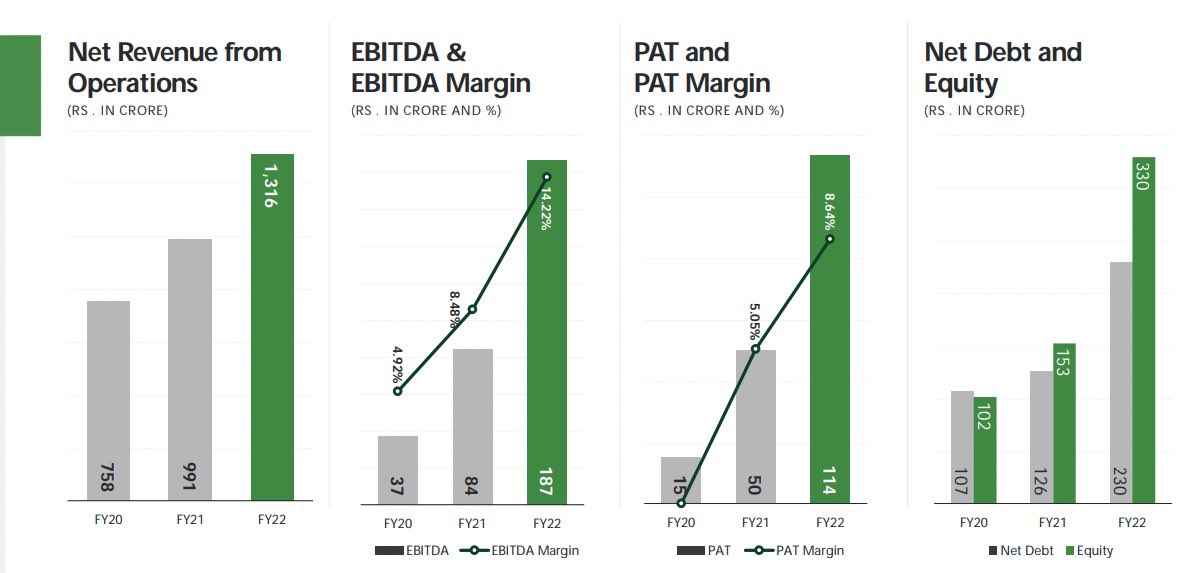

• Consistent growth in scale of operations along with improvement in profitability margins:

The company started expanding from FY18 onwards and its scale of operations has been on an increasing trend with a growth

of ~23% CAGR over the past 4 years.

• Consistent growth in scale of operations along with improvement in profitability margins:

The company started expanding from FY18 onwards and its scale of operations has been on an increasing trend with a growth

of ~23% CAGR over the past 4 years.

(9/18)

• Comfortable capital structure:

The capital structure of the company is comfortable as marked by low overall gearing of 0.91x as on March 31, 2022 improving

from 1.12x as on March 31, 2021 mainly on account of increase in net worth base of the company.

• Comfortable capital structure:

The capital structure of the company is comfortable as marked by low overall gearing of 0.91x as on March 31, 2022 improving

from 1.12x as on March 31, 2021 mainly on account of increase in net worth base of the company.

(10/18)

Increase in inventory:

The Cash conversation cycle had a jump from 48 days to 152 days in March 22 (YoY) . This was due to the increase in inventory as the company has set up a new manufacturing unit in Surajpur, Noida for which the company needs to maintain inventory.

Increase in inventory:

The Cash conversation cycle had a jump from 48 days to 152 days in March 22 (YoY) . This was due to the increase in inventory as the company has set up a new manufacturing unit in Surajpur, Noida for which the company needs to maintain inventory.

(11/18)

• The interest coverage ratio

remains comfortable at 10.99x for FY22 (PY: 12.14x) due to low interest cost and high operating profit.

• Total debt by GCA has jumped to 2.36x as on March 31, 2022, deteriorating from 0.86x the previous year.

Debt stands at ₹473cr.

• The interest coverage ratio

remains comfortable at 10.99x for FY22 (PY: 12.14x) due to low interest cost and high operating profit.

• Total debt by GCA has jumped to 2.36x as on March 31, 2022, deteriorating from 0.86x the previous year.

Debt stands at ₹473cr.

(12/18)

• Exposure to agro-climatic conditions:

The pesticide industry derives its sales from the agri sector which is highly dependent upon monsoons as well as incidence of fungal/pest attack on crops.

The sales depends largely on the prevalent agro-climatic conditions.

• Exposure to agro-climatic conditions:

The pesticide industry derives its sales from the agri sector which is highly dependent upon monsoons as well as incidence of fungal/pest attack on crops.

The sales depends largely on the prevalent agro-climatic conditions.

(13/18)

• Highly competitive nature of agro-chemicals industry:

The government has propagated the development of the

agricultural sector with the recent proposals under the 'Aatmanirbhar Bharat' package.

This has led to entry of many players in the sector.

• Highly competitive nature of agro-chemicals industry:

The government has propagated the development of the

agricultural sector with the recent proposals under the 'Aatmanirbhar Bharat' package.

This has led to entry of many players in the sector.

(14/18)

• Liquidity:

The liquidity of the company is comfortable marked by cash equivalent of ₹149 crore as on sept 31, 2022.

The company has repayment obligation of Rs 21.59 crore against projected GCA of Rs 134.54 crore in FY23.

• Liquidity:

The liquidity of the company is comfortable marked by cash equivalent of ₹149 crore as on sept 31, 2022.

The company has repayment obligation of Rs 21.59 crore against projected GCA of Rs 134.54 crore in FY23.

(15/18)

Shareholding Pattern:

• Promoters: 47.30% vs 40.78% YoY

• FIIs: 11.27% vs 11.22% YoY

• DIIs: 2.57% vs 0.23% YoY

• Public: 38.86% vs 47.44% YoY

Shareholding Pattern:

• Promoters: 47.30% vs 40.78% YoY

• FIIs: 11.27% vs 11.22% YoY

• DIIs: 2.57% vs 0.23% YoY

• Public: 38.86% vs 47.44% YoY

(16/18)

Performance Highlights:

• EBITDA improved by 574 basis

points in FY22 & 701 basis points in H1 FY23

• PAT improved by 366 basis points

in FY22 & 596 basis points in H1 FY23

Performance Highlights:

• EBITDA improved by 574 basis

points in FY22 & 701 basis points in H1 FY23

• PAT improved by 366 basis points

in FY22 & 596 basis points in H1 FY23

(17/18)

Ratios & Numbers:

• Market Cap: ₹3,686 cr

• Stock P/E: 16.5%

• RoCE: 40.7%

• RoE: 45.4%

• Price to Sales: 2.17

• Debt to Equity: 0.96

• NPM last year: 8.62%

• Int Coverage: 11.2

• OPM: 26%

• EPS: ₹54.9 vs ₹11.43 YoY

• Cash conversion cycle : 152 vs 48 YoY

Ratios & Numbers:

• Market Cap: ₹3,686 cr

• Stock P/E: 16.5%

• RoCE: 40.7%

• RoE: 45.4%

• Price to Sales: 2.17

• Debt to Equity: 0.96

• NPM last year: 8.62%

• Int Coverage: 11.2

• OPM: 26%

• EPS: ₹54.9 vs ₹11.43 YoY

• Cash conversion cycle : 152 vs 48 YoY

(18/18)

If you like our content kindly, Like and Hit Retweet for better reach!

@caniravkaria @kuttrapali26 @chartmojo

If you like our content kindly, Like and Hit Retweet for better reach!

@caniravkaria @kuttrapali26 @chartmojo

• • •

Missing some Tweet in this thread? You can try to

force a refresh