"NPAs have bottomed out"

-SBI's favorite quote

SBI just reported a spectacular set of results🤯🤯🤯

Have the NPAs bottomed out?🧐🧐

Is SBI regaining its lost Mojo?

A thread🧵analyzing each and every aspect of the result

Lets go👇

(1/15)

-SBI's favorite quote

SBI just reported a spectacular set of results🤯🤯🤯

Have the NPAs bottomed out?🧐🧐

Is SBI regaining its lost Mojo?

A thread🧵analyzing each and every aspect of the result

Lets go👇

(1/15)

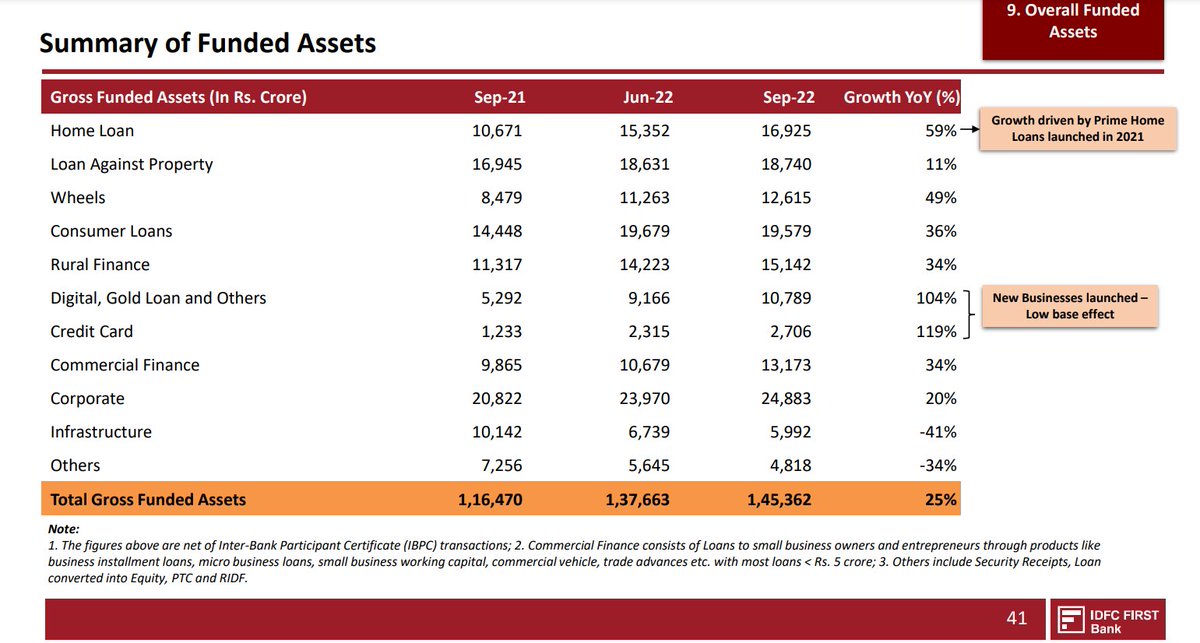

Loan Growth:-

🏦Loans grew at about 19.93%

🏦Corporate loan growth at 18%

For many years SBI has struggled to grow!

20% loan growth from the largest bank in this country is massive!

It Bodes extremely well for the Indian economy.

(2/15)

🏦Loans grew at about 19.93%

🏦Corporate loan growth at 18%

For many years SBI has struggled to grow!

20% loan growth from the largest bank in this country is massive!

It Bodes extremely well for the Indian economy.

(2/15)

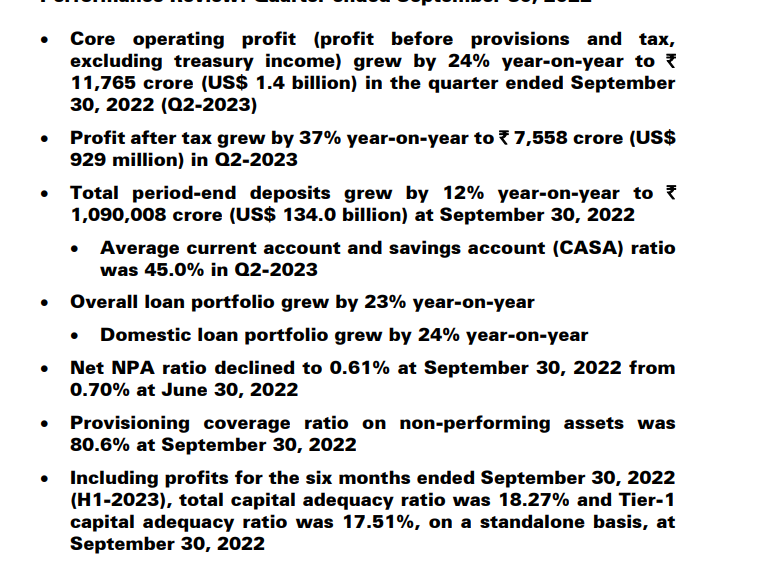

Deposit growth:-

The deposit growth at just 9.99% is a disappointment.

Makes 19% deposit growth from HDFC Bank look impressive.

Nonetheless, given the strong franchise of SBI,the deposit growth will be back

(3/15)

The deposit growth at just 9.99% is a disappointment.

Makes 19% deposit growth from HDFC Bank look impressive.

Nonetheless, given the strong franchise of SBI,the deposit growth will be back

(3/15)

Cost of funds and NIMs:-

The cost of deposits came in at 3.84%

The NIMs further expanded to 3.59%

The cost of funds is not a problem for the banks given the super-quality franchise.

(4/15)

The cost of deposits came in at 3.84%

The NIMs further expanded to 3.59%

The cost of funds is not a problem for the banks given the super-quality franchise.

(4/15)

Capital Adequacy:-

SBI has a capital adequacy of 13.51%

Tier-1 capital adequacy at 9.53%.

This is the lowest among all top banks

Given the strong loan growth,the bank will look to raise capital in the near future

(5/15)

SBI has a capital adequacy of 13.51%

Tier-1 capital adequacy at 9.53%.

This is the lowest among all top banks

Given the strong loan growth,the bank will look to raise capital in the near future

(5/15)

Asset Quality:-

🏦The Gross NPAs fell to 3.52% from 3.91%

🏦The slippages at 3000cr were down significantly.

🏦The PCR remains extremely strong at 91%

🏦The credit cost ratio came in at 0.28%(best in many quarters)

(6/15)

🏦The Gross NPAs fell to 3.52% from 3.91%

🏦The slippages at 3000cr were down significantly.

🏦The PCR remains extremely strong at 91%

🏦The credit cost ratio came in at 0.28%(best in many quarters)

(6/15)

Slippages and SMA book:-

Slippages came in at just 2399cr..Multi-quarter low.

SMA book did increase to 8497cr...however this too isn't as big to make a material impact on asset quality

(7/15)

Slippages came in at just 2399cr..Multi-quarter low.

SMA book did increase to 8497cr...however this too isn't as big to make a material impact on asset quality

(7/15)

Verdict:-

Asset quality has eased up for the bank

Covid-19 problems are now behind both bank

Slippages are at a multi-quarter low.

Bank is ready to push loan growth into the system.

(8/15)

Asset quality has eased up for the bank

Covid-19 problems are now behind both bank

Slippages are at a multi-quarter low.

Bank is ready to push loan growth into the system.

(8/15)

RoA and RoE expansion:-

For the first time in many years the RoA has gone above the 1% mark

RoE came in at a massive 16%

These are exceptional numbers from SBI.

As slippages continue to come down,the expansion of RoA and RoE is a given

(9/15)

For the first time in many years the RoA has gone above the 1% mark

RoE came in at a massive 16%

These are exceptional numbers from SBI.

As slippages continue to come down,the expansion of RoA and RoE is a given

(9/15)

Record Profits

Strong loan growth

Record low slippages

Means SBI posted a profit of nearly 14,000cr.

The best in its history.

(10/15)

Strong loan growth

Record low slippages

Means SBI posted a profit of nearly 14,000cr.

The best in its history.

(10/15)

Valuation:-

SBI is available at 1.67x P/Bx

Given the larger number of subsidiaries of SBI.

The valuation becomes even cheaper.

However the valuation is not cheap when compared with its history

(11/15)

SBI is available at 1.67x P/Bx

Given the larger number of subsidiaries of SBI.

The valuation becomes even cheaper.

However the valuation is not cheap when compared with its history

(11/15)

We are at the bottom of a credit cycle.

Credit growth is at a 50-year low.

We need strongly capitalized banks with clean balance sheets to achieve the vision of $5 trillion economy.

(12/15)

Credit growth is at a 50-year low.

We need strongly capitalized banks with clean balance sheets to achieve the vision of $5 trillion economy.

(12/15)

SBI has:-

1. Strong Balance Sheet

2. Strong Management

3. Strong capital to deploy

4. Huge physical as well as digital presence to tap growth

(13/15)

1. Strong Balance Sheet

2. Strong Management

3. Strong capital to deploy

4. Huge physical as well as digital presence to tap growth

(13/15)

The result is spectacular to say the least.

Loan growth is robust.

Asset quality is strong

And the future is bright!

(14/15)

Loan growth is robust.

Asset quality is strong

And the future is bright!

(14/15)

SBI is extremely strong and the scope of opportunity means that it can do extremely well.

Given ICICI+HDFC+SBI all have done exceptionally well

All three will lead India in the 2-3 years!

(15/15)

Given ICICI+HDFC+SBI all have done exceptionally well

All three will lead India in the 2-3 years!

(15/15)

• • •

Missing some Tweet in this thread? You can try to

force a refresh