🧐So… are high natural gas prices over in Europe? #TTF

🌞Warm weather in Europe along with the increment in #LNG imports have diminished the natural gas prices in Europe

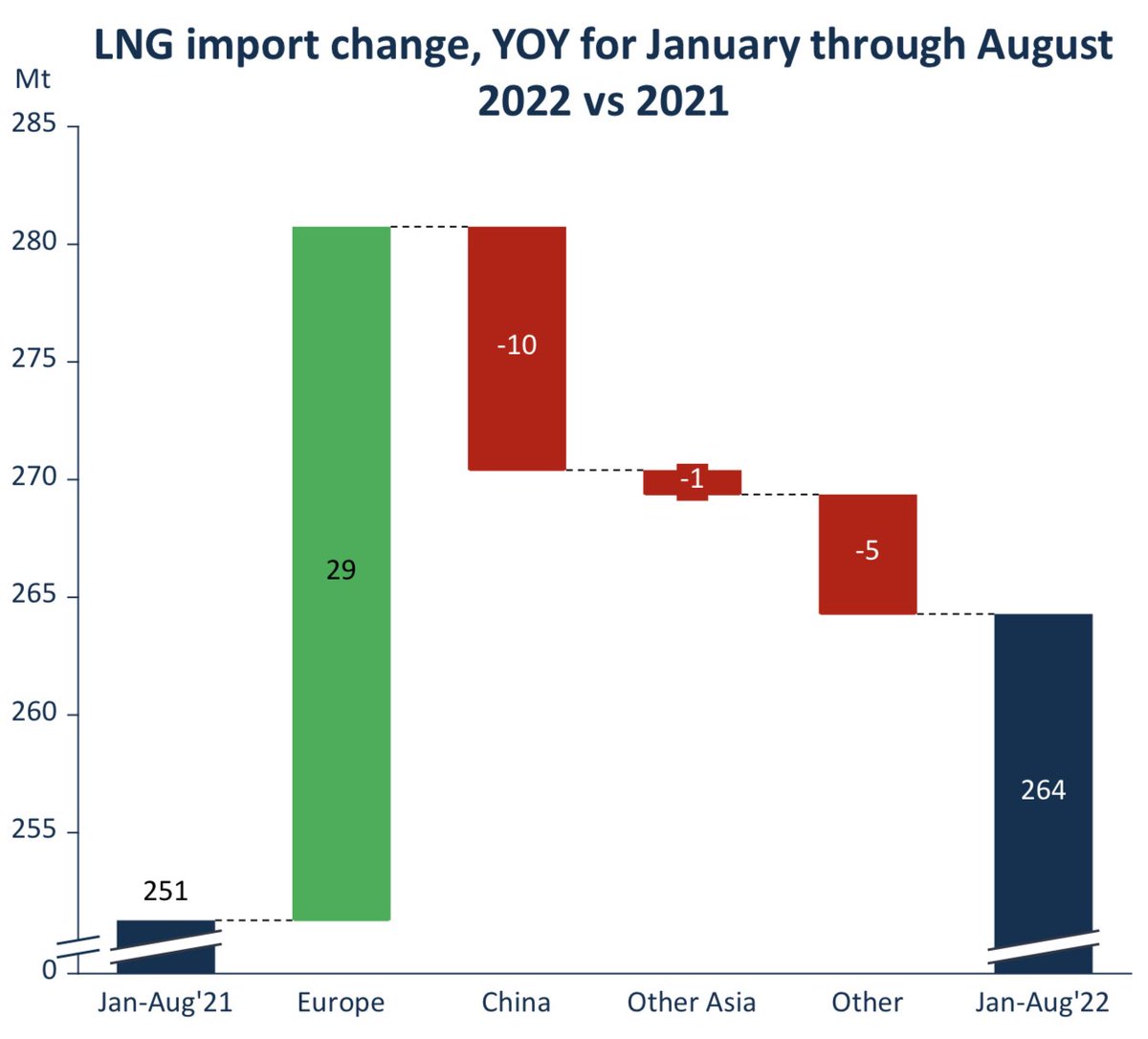

⛵️70% of US LNG exports went to Europe in 3Q22 compared to 30% in 3Q21

🌞Warm weather in Europe along with the increment in #LNG imports have diminished the natural gas prices in Europe

⛵️70% of US LNG exports went to Europe in 3Q22 compared to 30% in 3Q21

🇪🇺natural gas inventories are at 95% capacity and Day Ahead prices have plunged ~90% from Aug

As a consequence, there are > 30 LNG carriers waiting to unload in Europe as it is more profitable for them to wait for colder temperatures ➡️ Day Ahead prices recover (Contango)

As a consequence, there are > 30 LNG carriers waiting to unload in Europe as it is more profitable for them to wait for colder temperatures ➡️ Day Ahead prices recover (Contango)

So..are high nat gas prices over?

Well, we as 🇪🇺 have been lucky of the 🌞we had in Oct. But, situation changes from now on as ❄️ arrives & the 95% capacity figure is a bit tricky

👉🏽It only covers 20% of yearly demand and is designed to receive nat gas from 🇷🇺 during winter

Well, we as 🇪🇺 have been lucky of the 🌞we had in Oct. But, situation changes from now on as ❄️ arrives & the 95% capacity figure is a bit tricky

👉🏽It only covers 20% of yearly demand and is designed to receive nat gas from 🇷🇺 during winter

Therefore, inventories are expected to fall quicker than in the past,so 🇪🇺 needs an extra effort to replenish them in‘23. And here is where the problems arrive..

🧐The fact that 70% of LNG went to 🇪🇺in‘22 makes the RoW to have low inventories & the urgent need to replenish them

🧐The fact that 70% of LNG went to 🇪🇺in‘22 makes the RoW to have low inventories & the urgent need to replenish them

Furthermore, the current 🇨🇳 zero-Covid policy, which have restricted the amount of LNG imported by China, is anticipated to end in the coming months

👉🏽Consequently, the demand from China is expected to bounce back strong diverting a considerable size of the LNG fleet

👉🏽Consequently, the demand from China is expected to bounce back strong diverting a considerable size of the LNG fleet

👉🏽The European natural gas situation is expected to remain tight at least until the new liquefaction capacity arrives in 2025

🔸It is expected that global gas prices (#TTF, #NBP, #JKM,..) bounce back soon & remain high for the next 2 years, making the industry hugely profitable

🔸It is expected that global gas prices (#TTF, #NBP, #JKM,..) bounce back soon & remain high for the next 2 years, making the industry hugely profitable

• • •

Missing some Tweet in this thread? You can try to

force a refresh