(1/21)

About SRF:

SRF is a multi-business chemicals

conglomerate engaged in the manufacturing of industrial and specialty intermediates.

Their diversified portfolio covers Technical Textiles, Fluorochemicals, Specialty

Chemicals, Packaging Films & Engineering Plastics.

About SRF:

SRF is a multi-business chemicals

conglomerate engaged in the manufacturing of industrial and specialty intermediates.

Their diversified portfolio covers Technical Textiles, Fluorochemicals, Specialty

Chemicals, Packaging Films & Engineering Plastics.

(2/21)

Industries that SRF largely caters:

• Automobiles

• Tyres

• Air conditioners

• Refrigerators

• Pharmaceuticals

• Agrochemicals

• Mining

• Manufacturing

• Packaging industries

Industries that SRF largely caters:

• Automobiles

• Tyres

• Air conditioners

• Refrigerators

• Pharmaceuticals

• Agrochemicals

• Mining

• Manufacturing

• Packaging industries

(3/21)

Timeline:

• 2011-14: They started expanding (added maiden overseas plants in Thailand and South Africa) with an investment of ₹25 Bn.

• 2015-18 : They invested ₹32Billion and ramped up the l capacities.

They entered into pharma segment by acquiring DuPont's Dymel.

Timeline:

• 2011-14: They started expanding (added maiden overseas plants in Thailand and South Africa) with an investment of ₹25 Bn.

• 2015-18 : They invested ₹32Billion and ramped up the l capacities.

They entered into pharma segment by acquiring DuPont's Dymel.

(4/21)

• 2018-21 : Their investments in the past generated a 61% growth

in special chem business.

During 2018-21, they invested ₹53Bn in capacity augmentation.

• 2022: The company has done ₹1250 cr of capex in H1FY23, and has a target capex of ~₹3,000 cr by end of FY23

• 2018-21 : Their investments in the past generated a 61% growth

in special chem business.

During 2018-21, they invested ₹53Bn in capacity augmentation.

• 2022: The company has done ₹1250 cr of capex in H1FY23, and has a target capex of ~₹3,000 cr by end of FY23

(5/21)

SFs Revenue breakup H1FY23 & Classification:

• Chemicals : 47%

1) Industrial Chem

2) Refrigerants

3) Special Fluorochem

• Technical Textile - 14%

1) Tyre Fabrics

2) Industrial Yarn

3) Belting Fabrics

• Packaging Films - 37%

1) BOPET/BOPP films

SFs Revenue breakup H1FY23 & Classification:

• Chemicals : 47%

1) Industrial Chem

2) Refrigerants

3) Special Fluorochem

• Technical Textile - 14%

1) Tyre Fabrics

2) Industrial Yarn

3) Belting Fabrics

• Packaging Films - 37%

1) BOPET/BOPP films

(6/21)

• SFs Market Position:

Of the above mentioned sub segments, SRF is an Indian Market Leader in-

1) Industrial Chem

2) Refrigerants

3) Specialty Fluorochem

4) Industrial Yarn

5) BOPP films

• It is also globally 2nd largest in the Tyre Cord and 3rd in Belting Fabrics

• SFs Market Position:

Of the above mentioned sub segments, SRF is an Indian Market Leader in-

1) Industrial Chem

2) Refrigerants

3) Specialty Fluorochem

4) Industrial Yarn

5) BOPP films

• It is also globally 2nd largest in the Tyre Cord and 3rd in Belting Fabrics

(7/21)

The focus:

• Capex skewed towards fluoro specialty over the last decade, which contributes ~65% to the chemical segment.

Mgmt is focused on the fluorospecialty since it can be scaled given large market size with agrichem & pharma customers & gives stable profits.

The focus:

• Capex skewed towards fluoro specialty over the last decade, which contributes ~65% to the chemical segment.

Mgmt is focused on the fluorospecialty since it can be scaled given large market size with agrichem & pharma customers & gives stable profits.

(8/21)

Instance of Forward thinking my it’s Management:

Announced packaging film

capacity in Thailand and Hungry (FY18) despite capacity underutilization globally.

These capacities came into play

in FY20 and FY21.

Instance of Forward thinking my it’s Management:

Announced packaging film

capacity in Thailand and Hungry (FY18) despite capacity underutilization globally.

These capacities came into play

in FY20 and FY21.

(9/21)

Let’s look into its strengths:

• Market leadership:

SRF is the market leader in most of its business segments. Due to extensive experience in handling fluorine, it is the sole producer of some key refrigerants in India.

continued>>>

Let’s look into its strengths:

• Market leadership:

SRF is the market leader in most of its business segments. Due to extensive experience in handling fluorine, it is the sole producer of some key refrigerants in India.

continued>>>

(10/21)

In the specialty chemical segment, continuous investment in research and development (R&D), and improved manufacturing capability have made it a one-of-its-kind player, exporting products that find application in pharmaceutical and agro-based products.

In the specialty chemical segment, continuous investment in research and development (R&D), and improved manufacturing capability have made it a one-of-its-kind player, exporting products that find application in pharmaceutical and agro-based products.

(11/21)

• Diversification:

The management has successfully diversified its geographical presence through investments in the PFB segment in South Africa, Thailand & Hungary.

Diversified revenue profile protects against downswing in any one business & keeps the margin steady.

• Diversification:

The management has successfully diversified its geographical presence through investments in the PFB segment in South Africa, Thailand & Hungary.

Diversified revenue profile protects against downswing in any one business & keeps the margin steady.

(12/21)

• Financial risk profile:

The financial risk profile remains strong backed by robust tangible networth leading to a comfortable espected gearing of 0.38 time in FY23.

Cash accrual was healthy at ₹2,194 cr in FY22, resulting in comfortable debt protection metrics.

• Financial risk profile:

The financial risk profile remains strong backed by robust tangible networth leading to a comfortable espected gearing of 0.38 time in FY23.

Cash accrual was healthy at ₹2,194 cr in FY22, resulting in comfortable debt protection metrics.

(13/21)

The financial robustness is also explained by ICR which stands at 22 times & is expected to continue with net cash accruals estimated at around ₹2,500 crore for FY 23 which will be used to fund the capex requirements along with mix of debt. (Planned capex of ~₹3000 cr)

The financial robustness is also explained by ICR which stands at 22 times & is expected to continue with net cash accruals estimated at around ₹2,500 crore for FY 23 which will be used to fund the capex requirements along with mix of debt. (Planned capex of ~₹3000 cr)

(14/21)

• The chemicals division will remain a key growth driver:

(1) With more molecules moving to MP & dedicated plant

(2) Focus on improving pharma revenues. Successfully launched 1 new pharma product in H1FY23.

(3) Healthy opportunities in key markets of India and USA

• The chemicals division will remain a key growth driver:

(1) With more molecules moving to MP & dedicated plant

(2) Focus on improving pharma revenues. Successfully launched 1 new pharma product in H1FY23.

(3) Healthy opportunities in key markets of India and USA

(15/21)

• Backward Integration:

A leader in Refrigerants, It is one of the few companies having backward integration to basic building blocks, chloromethanes and anhydrous hydrogen fluoride (AHF), which enabled it to scale and expand product offerings.

• Backward Integration:

A leader in Refrigerants, It is one of the few companies having backward integration to basic building blocks, chloromethanes and anhydrous hydrogen fluoride (AHF), which enabled it to scale and expand product offerings.

(16/21)

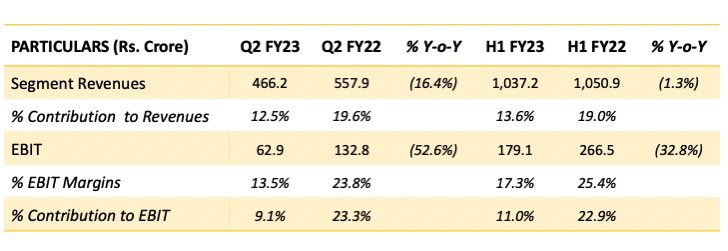

Let's look into Packaging Films Segment:

Profitability is slowing in this segment due to contraction in spreads, global demand slowdown, rising energy costs in Europe, and sharp fall in commodity prices.

Hungary plant is operating only around 25-30% of it’s capacity

Let's look into Packaging Films Segment:

Profitability is slowing in this segment due to contraction in spreads, global demand slowdown, rising energy costs in Europe, and sharp fall in commodity prices.

Hungary plant is operating only around 25-30% of it’s capacity

(18/21)

Capex:

The board has approved projects for setting up four new plants in

agrochemical space with a total capex of INR6b, thereby, adding ~4,000MT of capacity.

Showing its intent to continue focusing a lot in its special chem division.

Capex:

The board has approved projects for setting up four new plants in

agrochemical space with a total capex of INR6b, thereby, adding ~4,000MT of capacity.

Showing its intent to continue focusing a lot in its special chem division.

(19/21)

Key Ratios & Numbers

• Market Cap: ₹72,439cr

• Stock P/E: 32.9

• RoCE: 24%

• RoE: 24.5%

• PEG: 1.11

• 3 years Sales CAGR: 20.5%

• Int Coverage: 22

• Debt: ₹3,833cr

• NPM Last year: 15.2%

• OPM 5 years: 21.8%

• D/E : 0.42

Key Ratios & Numbers

• Market Cap: ₹72,439cr

• Stock P/E: 32.9

• RoCE: 24%

• RoE: 24.5%

• PEG: 1.11

• 3 years Sales CAGR: 20.5%

• Int Coverage: 22

• Debt: ₹3,833cr

• NPM Last year: 15.2%

• OPM 5 years: 21.8%

• D/E : 0.42

(20/21)

• Key Risks:

1) Project Execution Risk -

Any slowdown in capex execution will pose a risk to its earnings

2) Slowdown in Global Agrochemical Industry

3) Slower Ramp up of new Products:

Any slowdown could hurt the margin expansions

• Key Risks:

1) Project Execution Risk -

Any slowdown in capex execution will pose a risk to its earnings

2) Slowdown in Global Agrochemical Industry

3) Slower Ramp up of new Products:

Any slowdown could hurt the margin expansions

(21/21)

SRFs H2 is generally better than its H1 results.

What do you think of #SRF and it's all round growth plans?

Comment down below and don't forget to hit the retweet if you liked our analysis!

@caniravkaria @kuttrapali26 @chartmojo

SRFs H2 is generally better than its H1 results.

What do you think of #SRF and it's all round growth plans?

Comment down below and don't forget to hit the retweet if you liked our analysis!

@caniravkaria @kuttrapali26 @chartmojo

• • •

Missing some Tweet in this thread? You can try to

force a refresh