What is y2k? It is basically a prediction market on @arbitrum that allows users to bet on will the #stablecoin remaining in the peg within a certain timeframe.

Buying “Risk” = Earn #yield if the coin stay pegged, taking the “Hedge” pot -5% fee

Buying “Hedge” = Earn yield if the coin depegged, taking the “Risk” pot - 5% fee

Y2K is currently doing a IFO, user can deposit their “Risk”/ “Hedge” NFT position to farm Y2K

Buying “Hedge” = Earn yield if the coin depegged, taking the “Risk” pot - 5% fee

Y2K is currently doing a IFO, user can deposit their “Risk”/ “Hedge” NFT position to farm Y2K

Highlight of rules of this yield farm game

-Your payout depends on the other side’s pool size. Risk VS Hedge

-Y2K Takes a 5% fee on the winning side

-Y2K Tokens apys are calculated with FDV of 50M at 2.5USD per token

-Your payout depends on the other side’s pool size. Risk VS Hedge

-Y2K Takes a 5% fee on the winning side

-Y2K Tokens apys are calculated with FDV of 50M at 2.5USD per token

3 ways to strategically farm the Y2K

Method 1.

Depositing right before the deposit period stops. Ensuring the yield reward is justified for your ideal risk. It was about 8% for a week in ETH on the first round.The downside of is that you will lose approx 2 weeks of farming Y2K tokens with your “Risk” NFT position

Depositing right before the deposit period stops. Ensuring the yield reward is justified for your ideal risk. It was about 8% for a week in ETH on the first round.The downside of is that you will lose approx 2 weeks of farming Y2K tokens with your “Risk” NFT position

Method 2.

Buy “Risk” and start farming Y2K asap. By doing this you are assuming the stable coin won’t depeg and you are farming as much Y2K as early and as much as possible.

Y2K apy farming around 43% for "Risk"

Buy “Risk” and start farming Y2K asap. By doing this you are assuming the stable coin won’t depeg and you are farming as much Y2K as early and as much as possible.

Y2K apy farming around 43% for "Risk"

Method 3.

Buy “Hedge” and start farming Y2K asap. At the same time hedge your “Hedge” position with more and more “ Risk”. This allows you to farm as much Y2K as possible as “Hedge”’s token emission is 2x “Risk”.

Buy “Hedge” and start farming Y2K asap. At the same time hedge your “Hedge” position with more and more “ Risk”. This allows you to farm as much Y2K as possible as “Hedge”’s token emission is 2x “Risk”.

Do note that people are typically confident about stablecoin not depegging you might need a lot of ETH to hedge our ur “Hedge” position. With last week as example if you bought 1 ETH in “Hedge”, you needed 12.5ETH to fully hedge your “Hedge” position not including protocol fees.

Quick thought on Y2K’s token apy

Y2K apy =

5% fee on winning side ( “Risk” or “Hedge” ) * 30% (protocol revenue goes to veY2k) / Velocked

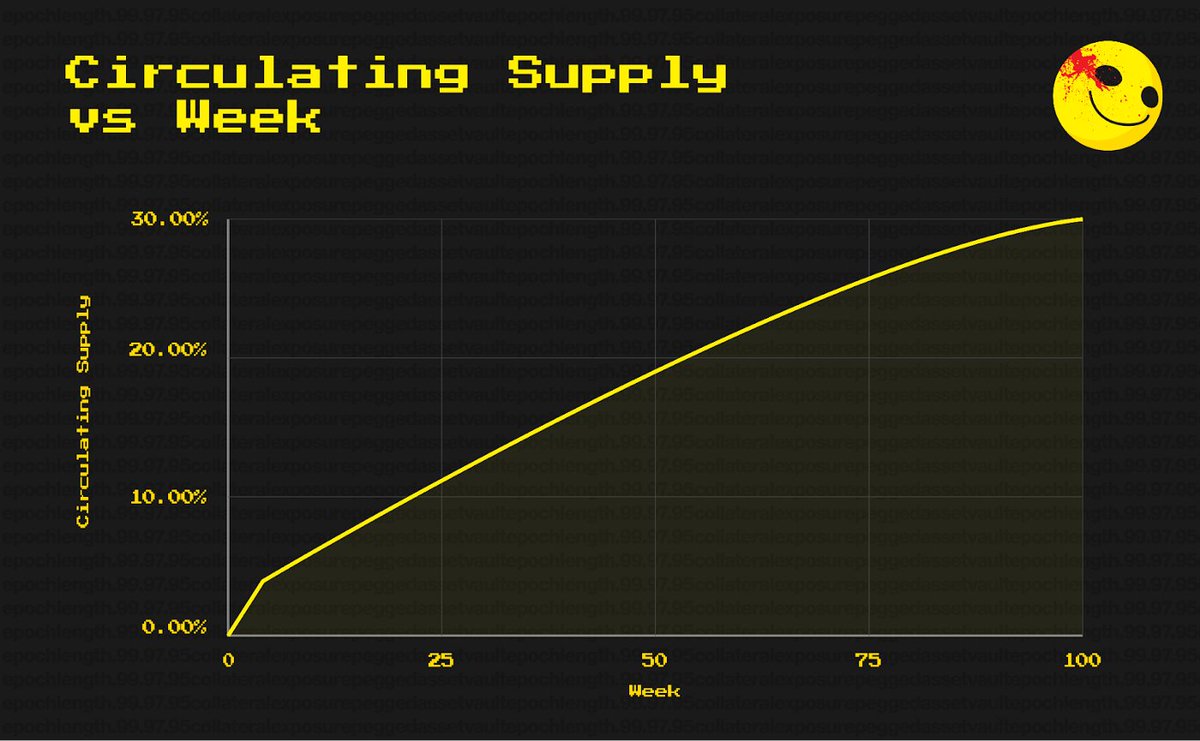

Will be interesting to see how the price of Y2K as 50FDV is high but the initial circulating supply seems low (from graph no detail yet)

Y2K apy =

5% fee on winning side ( “Risk” or “Hedge” ) * 30% (protocol revenue goes to veY2k) / Velocked

Will be interesting to see how the price of Y2K as 50FDV is high but the initial circulating supply seems low (from graph no detail yet)

Enjoy farming degens

cc

@thedefiedge

@Route2FI

@alpha_pls

@DAdvisoor

@DegenCamp

@crypto_linn

@thedailydegenhq

@DefiLlama

cc

@thedefiedge

@Route2FI

@alpha_pls

@DAdvisoor

@DegenCamp

@crypto_linn

@thedailydegenhq

@DefiLlama

• • •

Missing some Tweet in this thread? You can try to

force a refresh