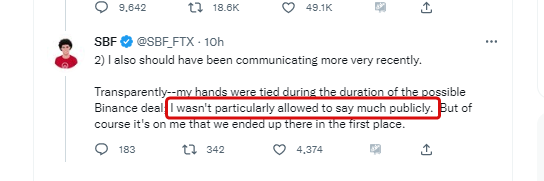

So while non-binding LOI are well non-binding they often have some binding provisions (well at least the one's I've been a party to) specifically 'confidentiality' -

something like parties agree not to make public statements without prior consent of the other parties unless required by law. it's really not great form to bitchslap the other party after they came to you on their knees begging to be saved.

tbf @sbf_ftx was more than happy to hand out a couple of limp wristed #bitchslap's from his ivory tower (e.g. #celsius $2B).

Its kinda like it was always the intention of the LOI

Its kinda like it was always the intention of the LOI

So it turns out there was a confidential #binding provision in the non-binding LOI between @FTX_Official and @binance ......but looks like only @sbf_ftx was gagged. another #rookiemistake

• • •

Missing some Tweet in this thread? You can try to

force a refresh