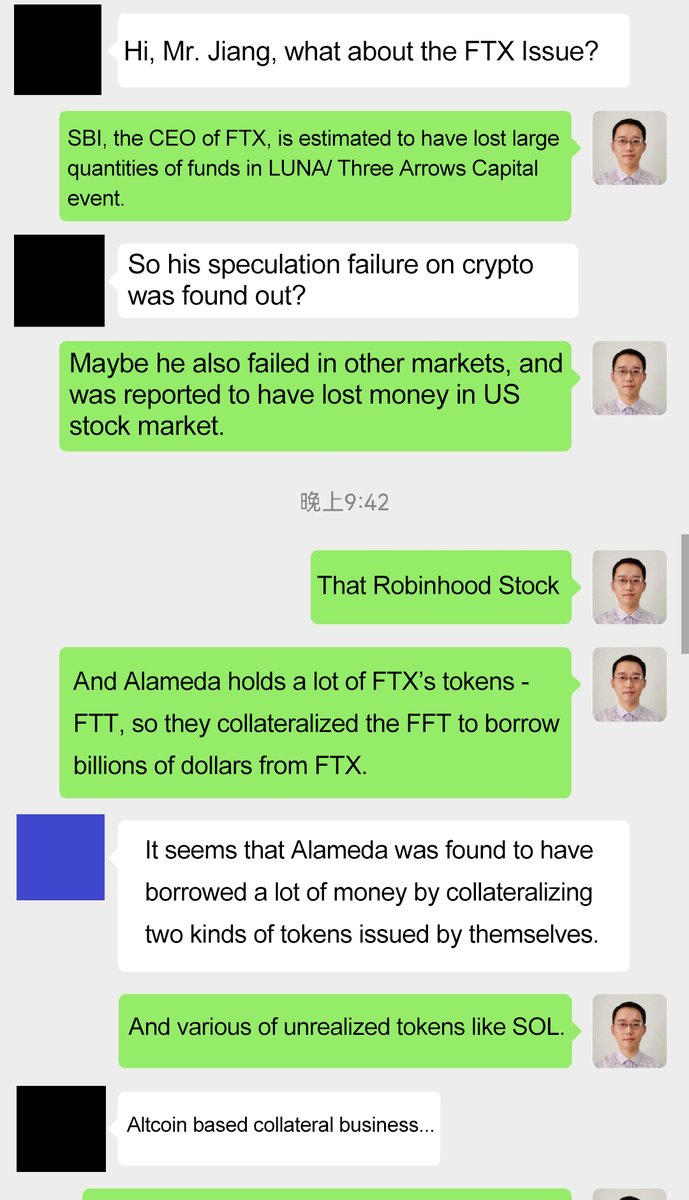

1/ I just talked to an outsider about what happened to FTX, the whole thing is very dramatic. Now let us review this event, SBF actually has a way to stay alive, $6 billion was withdrawn from the FTX within 3 days, with approximately a $6 billion hole. #FTXCRASH

2/ which means the reserve ratio of 50%, honestly, this is okay. Besides, SBF was able to raise $6 billion in 3 days, it’s not hard to wait for a longer period of time to raise more funds, and not all users may withdraw their coins.

3/ The problem with SBF is that he is a trader, not an entrepreneur, and his skills are severely biased, lacking the ability to solve real problems and face human nature. With his professional skills, a trader can be a general, but the entrepreneur is the all-around king.

5/ Assuming there is a $6 billion gap, SBF could sort from the largest clients and a few dozen of them would be sufficient for $6 billion, then delay their withdrawal by all means. For the rest of the retail investors, SBF would have 100% reserve and they can withdraw at will.

6/ Or SBF could allow some of the large clients to withdraw, delaying most of their requests. FTX generally cooperates with these large clients so SBF can solicit empathy, telling them that FTX was facing a bank run and liquidity crunch, there are enough assets to cover all .

7/ but it takes time to realize these assets and more funds are being mobilized. As the second largest exchange in the world, FTX is valued at $32 billion. It has a user-friendly product, compliant license, and a good relationship with the authorities, its future is limitless.

8/ $Ftx will certainly allow them to withdraw, on top of that, these big clients who have deposited their coins in the FTX are not prone to initiate a mutually destructive war.

9/ A few days after the bank run, when the retailers would find that all can withdraw, the panic would be over and FTX could see the inflow of coins.

This should be considered common sense in business, right?

This should be considered common sense in business, right?

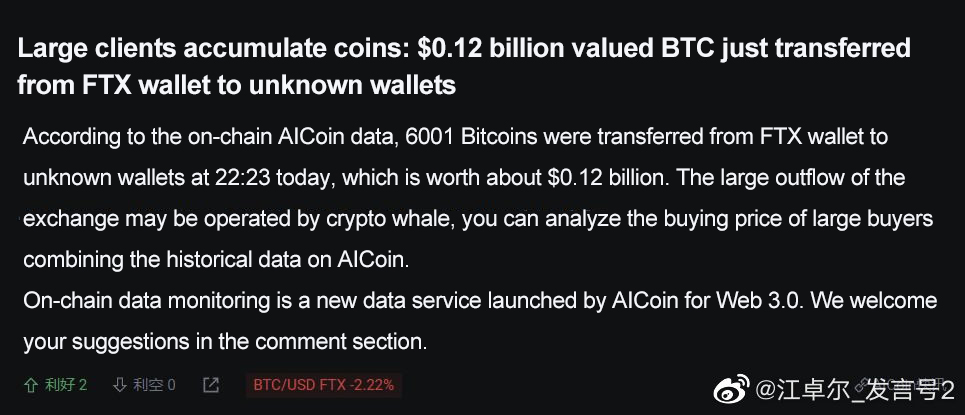

10/ Although SBF knew that the reserves were not sufficient, he allowed the withdrawal of this hundreds of millions of dollars level, what can I say, he is too young too simple, and sometimes even naive.

11/ If @justinsuntron engages in this latter, I assume that he would employ a debt-coin (equity) swaps mechanism, coupled with debt discount acquisition, he could reduce large debt to small debt, and turn small debt into nothing in the bull market.

12/ In history, @bitfinex has survived the theft of over 100K #Bitcoins by using these means. SBF is too young and was panicked, he needed a clever fox.

13/ Those who want to sell their USFT stuck in the FTX at a discount rate of 10% - 20%, there is no need to do that, as a hole of 6 billion dollars would become 1 billion dollars at 10% - 20% discount, a large number of institutions would love to acquire the FTX.

14/ Indeed, we shall not be too optimistic, firstly, everyone is aware of @justinsuntron style, he is already holding up after having acquired the Huobi, and taking FTX by force will definitely give him indigestion.

15/ When the time comes, he would also divert the assets of Huobi users to acquire FTX, then both of them crash, that would be so funny. Do not forget that @HuobiGlobal also launched a financial product with 5% APY .......

16/ Of course Justin Sun may not really want to acquire @FTX_Official, I guess it's just a case of coming in first to see what the chances are and taking a bite if he gets a chance, or getting some public attention.

17/ Secondly, as mentioned, SBF is too young too simple, and sometimes even naive. Who knows how this young man will kill himself again.

18/ Finally, the worst time has passed, as I predicted: there is no deep bear, #Etherium took 6 months to reach its lowest point and another 6-8 months to go sideways at the bottom, far less time than the historical 12 months to the bottom floor + 6-12 months to go sideways.

19/ The long night is about to be over, and the dawn is just around the corner, get ready for the new king, #Etherum to take the throne! 🚀🫅

• • •

Missing some Tweet in this thread? You can try to

force a refresh