Crypto scams are dime a dozen.

FTX, Alameda and the 134 entities that it took down with it. Another thread 🧵 on this👇

FTX, Alameda and the 134 entities that it took down with it. Another thread 🧵 on this👇

A prior thread on crypto scams

https://twitter.com/deepbluecrypto/status/1591095551835394048

Who remembers this ad in Super Bowl

https://twitter.com/giseleofficial/status/1435953787240390659/video/1

#Bitcoin & chill

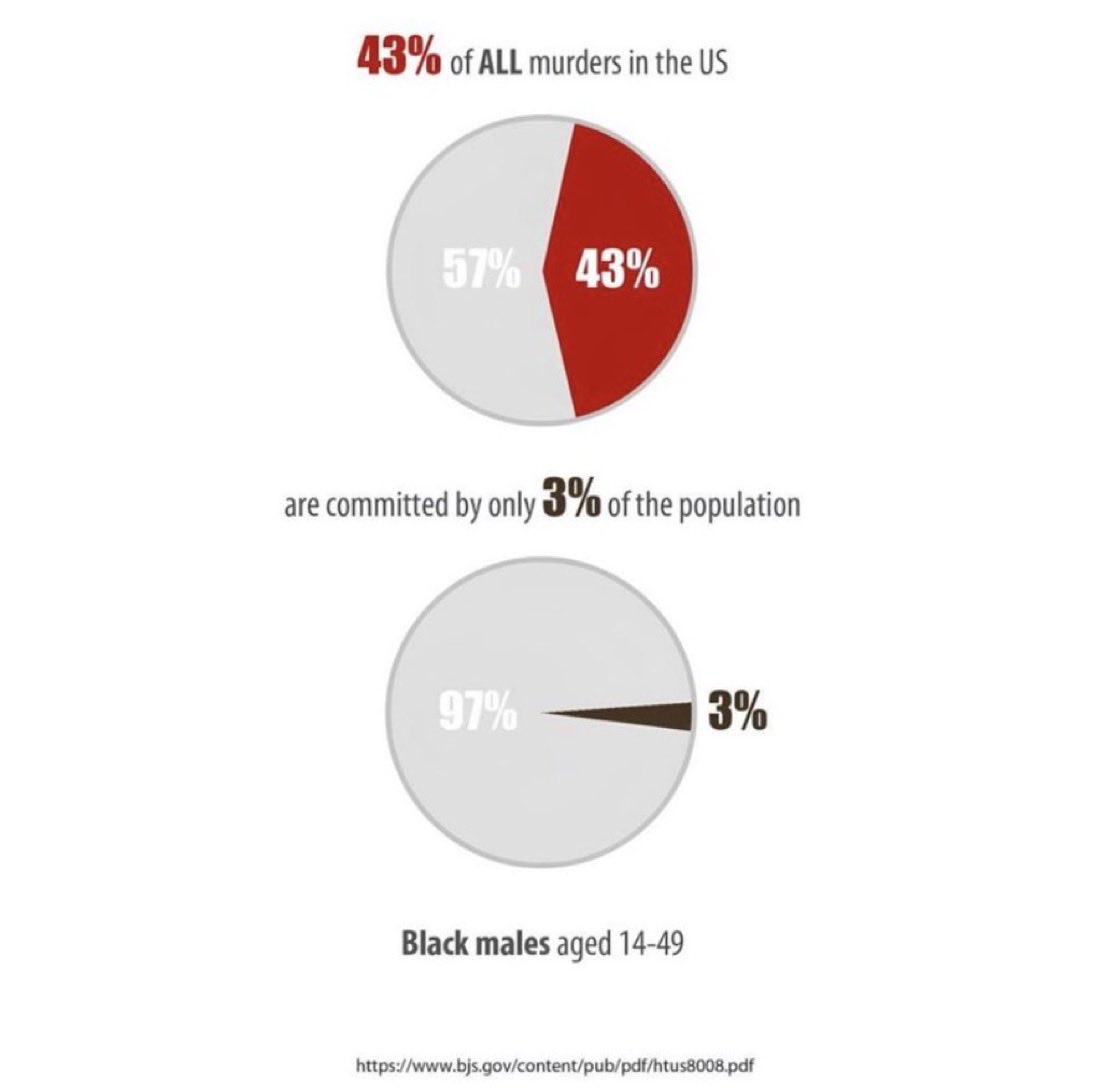

Crypto space without Terra Luna, Celsius, 3AC, Voyager, FTX, Alameda and 1000s of other Ponzi’s and scams

Hey @VitalikButerin can you please comment on this shady business

https://twitter.com/BoringSleuth/status/1591277325512937472

Thanks to all the FTX whistleblowers who came together and helped the crypto community. There will be a dark Netflix movie out of FTX & SBF

Tom Brady’s yet another FTX ad

Expect them to be deleted soon 😂

Expect them to be deleted soon 😂

https://twitter.com/TomBrady/status/1543965253523881986/video/1

cc: @ErikVoorhees

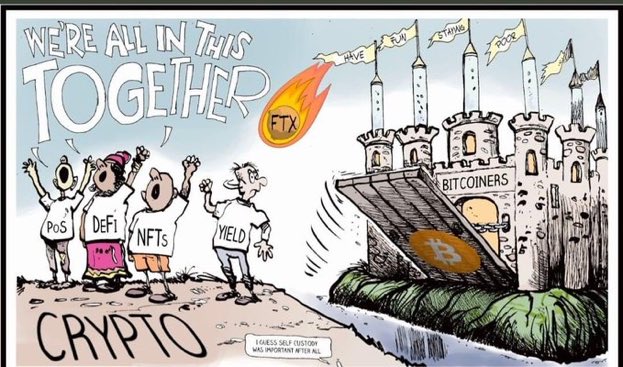

Caroline (CEO of Alameda Research) has a tumblr account called "worldoptimization."

Her kink is men who control most major world governments, low risk aversion, responsible for important scientific discoveries

No kidding 😂

Her kink is men who control most major world governments, low risk aversion, responsible for important scientific discoveries

No kidding 😂

FTX had $1.4bn in BTC liabilities (~80k BTC) but didn't own a single #Bitcoin on their balance.

Yet, the BTC they "issued" absorbed buying pressure from real BTC as people trusted them, essentially expanding the M2 supply of BTC. FTX was a crypto central bank.

Yet, the BTC they "issued" absorbed buying pressure from real BTC as people trusted them, essentially expanding the M2 supply of BTC. FTX was a crypto central bank.

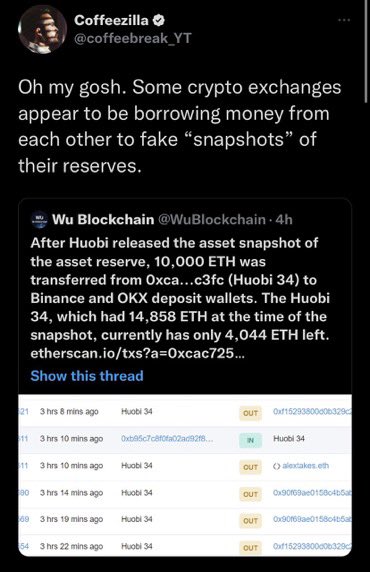

Essentially what’s needed going forward is #ProofOfReserves from every centralized crypto exchange or a crypto fund. If they don’t show their reserves, just treat them as scammers & fraudsters. There’s no more second chances in crypto.

Sam from FTX made a global impact for good alright… he woke every one in the world to take #ProofOfReserves seriously. If there is any centralized entity with out it, it’s a fraud 🤷♂️

WTH is going on with FTX withdrawals

https://twitter.com/scbgov_bs/status/1591577646005379074

Warren Buffett & Charlie Munger on crypto currencies in 2018.

Crypto attracts a lot of charlatans trading currencies and starting exchanges… it will end badly

Who knew… they were right 🤷♂️

Crypto attracts a lot of charlatans trading currencies and starting exchanges… it will end badly

Who knew… they were right 🤷♂️

#ProofOfReserves is a must for centralized entities handling crypto going forward. Even with proof of reserves, there are shady things happening behind the scenes like once you get a snapshot, moving funds to other exchanges for double counting.

#FractionalReserveBanking

#FractionalReserveBanking

Watch and learn from @CaitlinLong_

She’s a Wall Street veteran and knows exactly what leverage and fractional reserve banking does to crypto

cnbc.com/video/2022/11/…

She’s a Wall Street veteran and knows exactly what leverage and fractional reserve banking does to crypto

cnbc.com/video/2022/11/…

More crypto exchanges in trouble 🤷♂️

Hong Kong based AAX crypto exchange today suddenly announced the suspension of all operations, including trading, withdrawals, etc - promise that they will try to restart everything in 7-10 days.

Hong Kong based AAX crypto exchange today suddenly announced the suspension of all operations, including trading, withdrawals, etc - promise that they will try to restart everything in 7-10 days.

How come all the corrupt scumbags care about the planet & humanity so much that they guard against pandemics, hurricanes to save y’all 😂

https://twitter.com/brucefenton/status/1591855558927187968

Bank run happening in “crypto . com”

Take your funds out if you have some left that platform. Soon they’ll be stopping access to that as well 🤷♂️

Take your funds out if you have some left that platform. Soon they’ll be stopping access to that as well 🤷♂️

A hit movie #BigShort2 coming

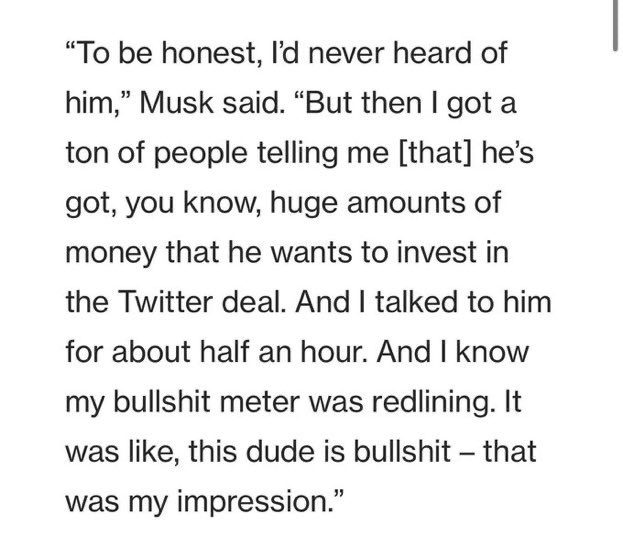

SBF approached @chamath for funding and when he asked for a few changes, they responded…

“Go F Yourself”

Sounds like a great company TBH 😂

“Go F Yourself”

Sounds like a great company TBH 😂

Sam's penthouse "The Orchid" in the Albany exclusive community is now listed on the market for sale -- $39,500,000

• • •

Missing some Tweet in this thread? You can try to

force a refresh