#CelticFC 2021/22 accounts cover a season when they regained the Scottish Premiership title under new manager Ange Postecoglou and also won the League Cup, but were eliminated from the Europa League after the group stage.

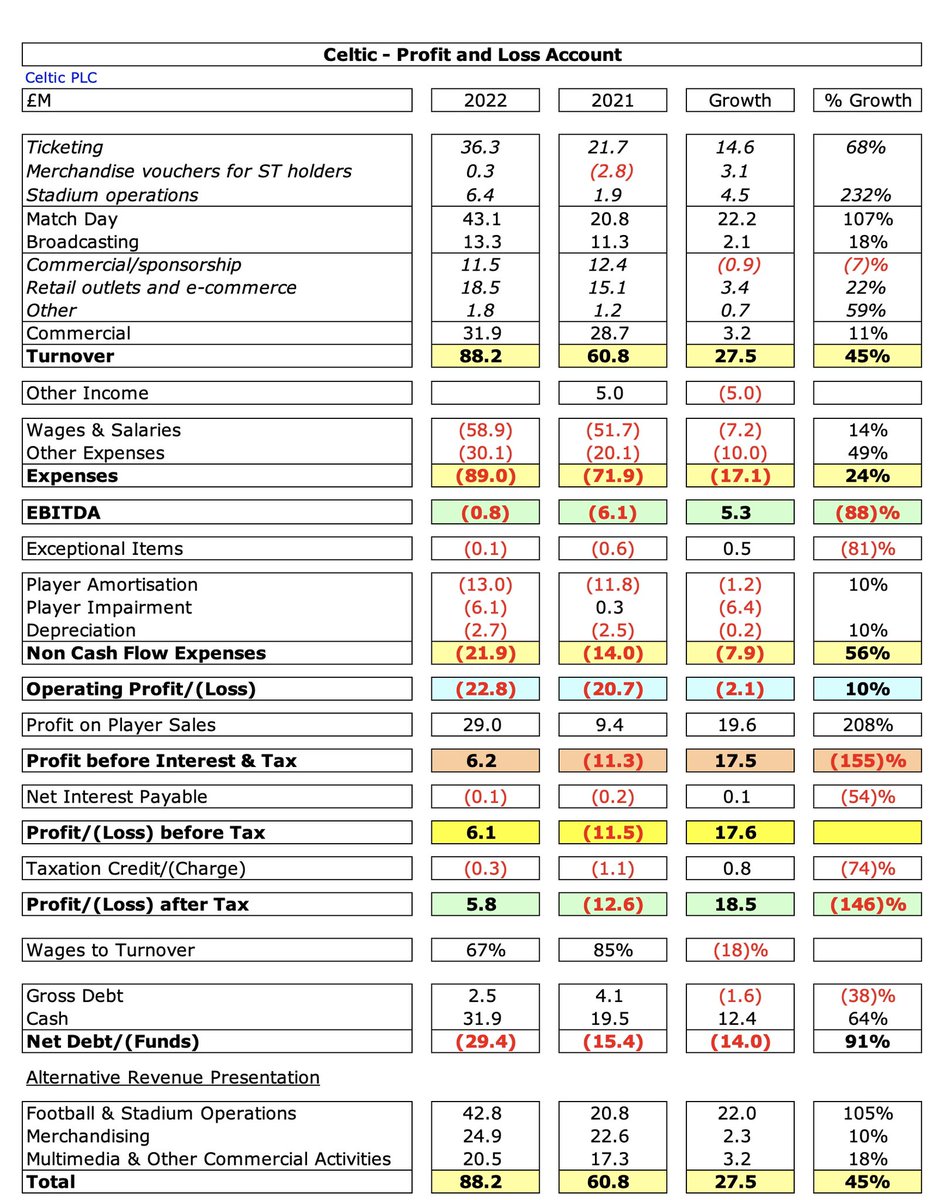

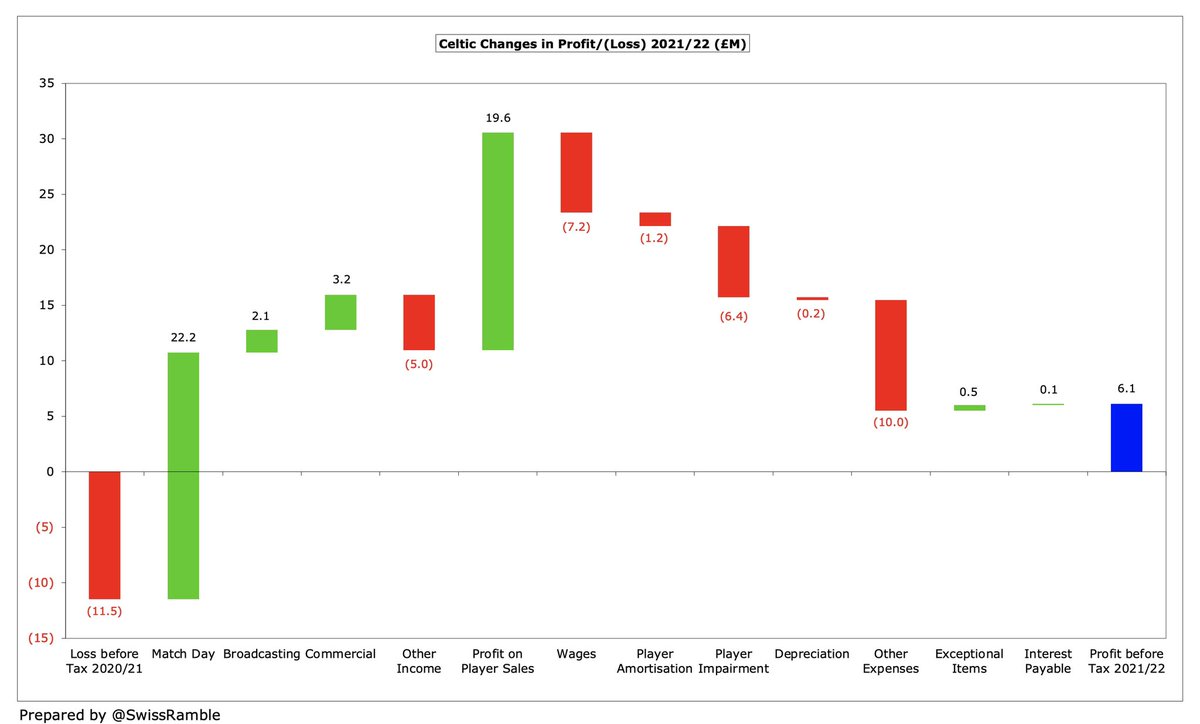

#CelticFC swung from £11.5m pre-tax loss to £6.1m profit (£5.8m after tax), as revenue rose £27m (45%) from £61m to £88m and profit on player sales increased £20m from £9m to club record £29m, partly offset by £25m (29%) higher operating expenses and no repeat of £5m insurance.

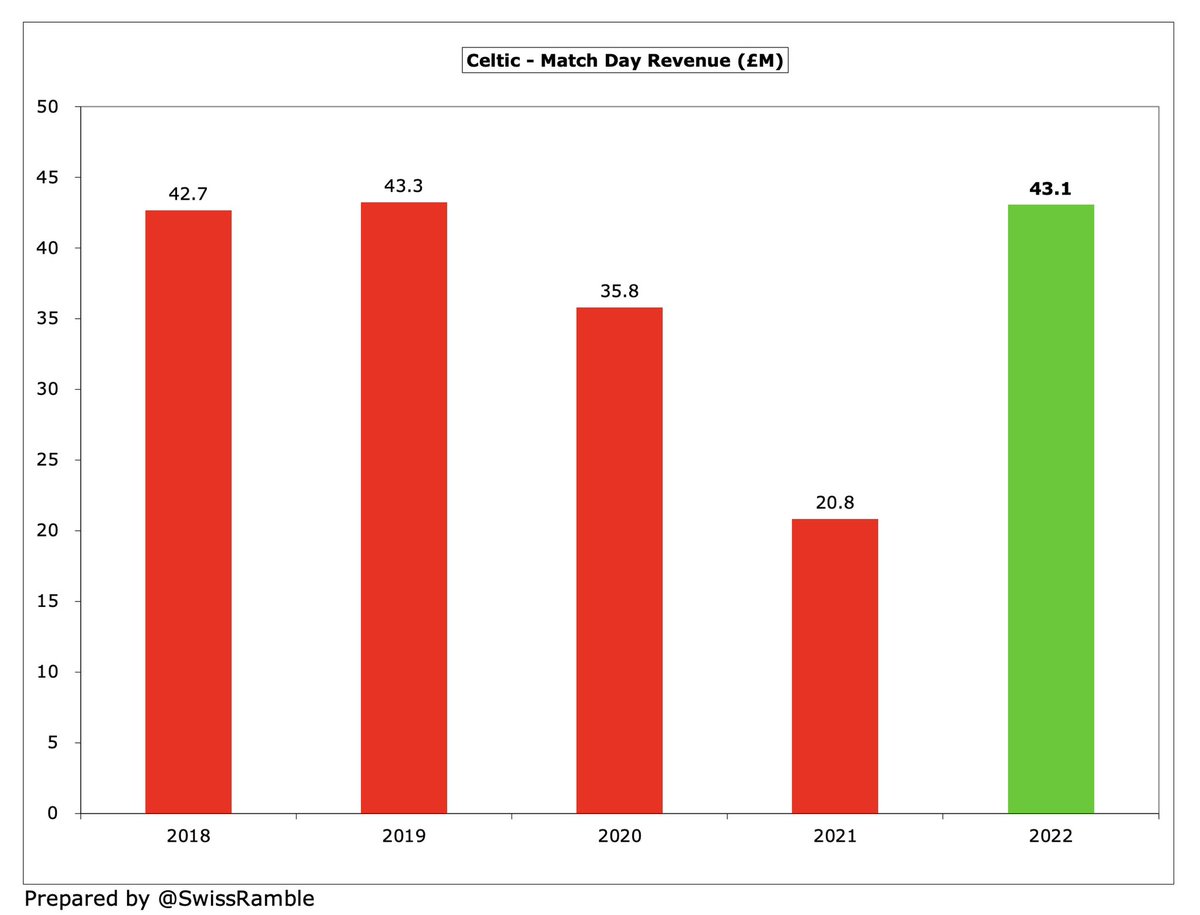

Main reason for #CelticFC revenue increase was match day, which rose £22m (107%) from £21m to £43m, due to the return of fans to the stadium, while commercial grew £3m (11%) to £32m in a more normalised trading environment and broadcasting was up £2m (18%) to £13m.

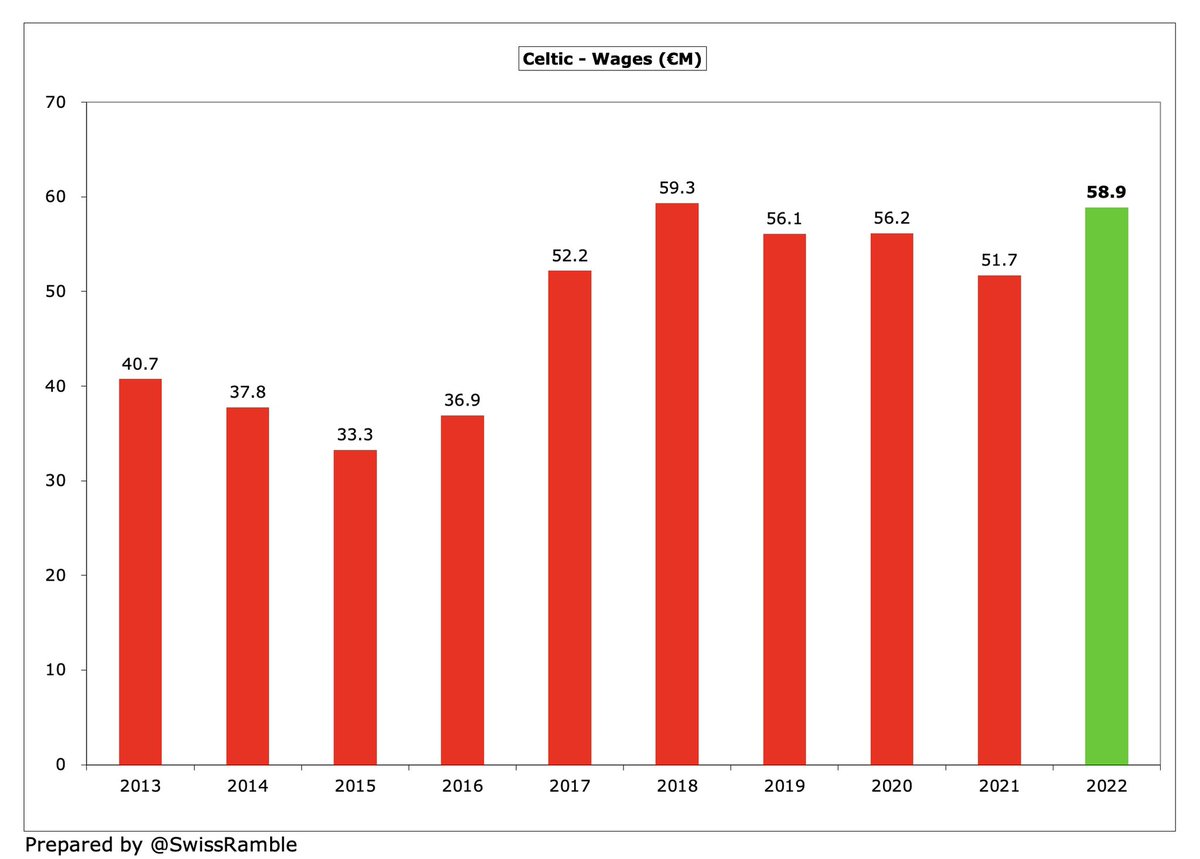

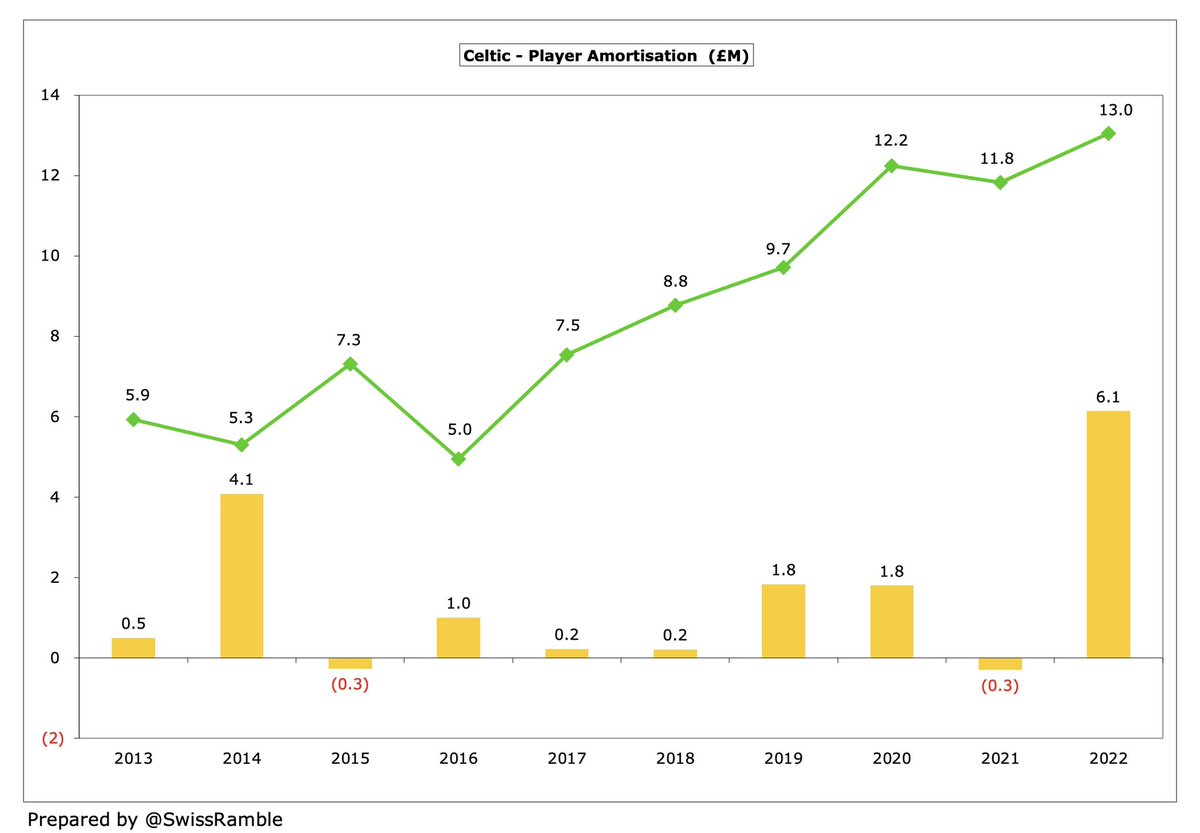

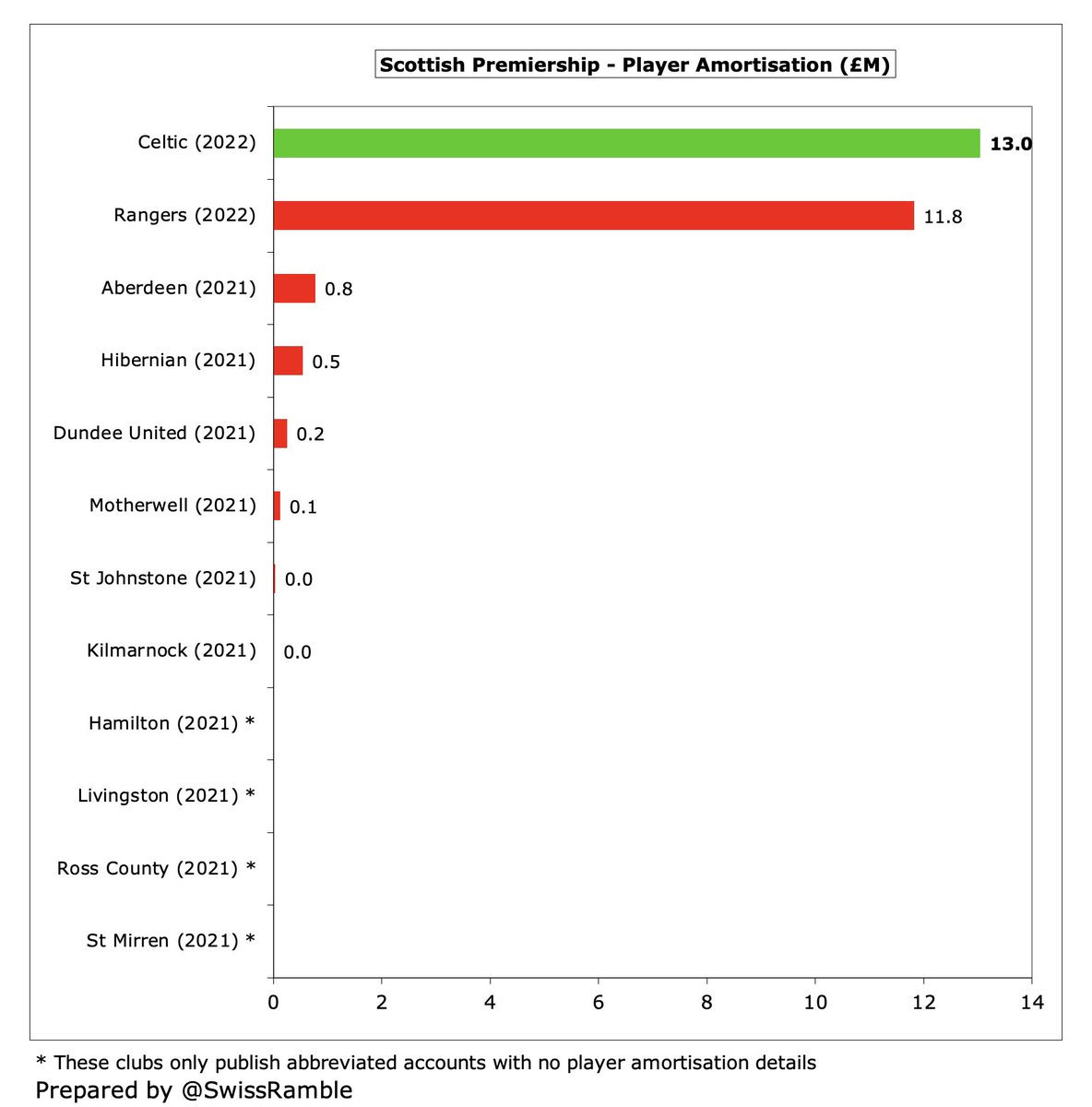

#CelticFC wage bill rose £7m (14%) from £52m to £59m, player amortisation increased £1m (10%) to £13m, while there was £6m player impairment. Other expenses shot up £10m (49%) to £30m, mainly due to the higher costs of staging games with fans.

#CelticFC £6m profit after tax is the best financial result in Scotland, compared to Rangers’ £2m loss. As a rule, Scottish clubs run a tight ship, so even in the COVID-impacted 2020/21 season the losses were relatively small.

#CelticFC £6m profit is one of the best performances of the leading European clubs that have reported 2021/22 figures to date. In stark contrast, large losses have been posted almost everywhere else, e.g. PSG £327m, Juventus £225m and Barcelona £157m (excluding economic levers).

#CelticFC benefited from the emergence from COVID-19, which I estimate caused them a £25m revenue loss in the previous two seasons. This was not too bad compared to the huge shortfalls elsewhere, demonstrating “the importance of maintaining a sustainable business model”.

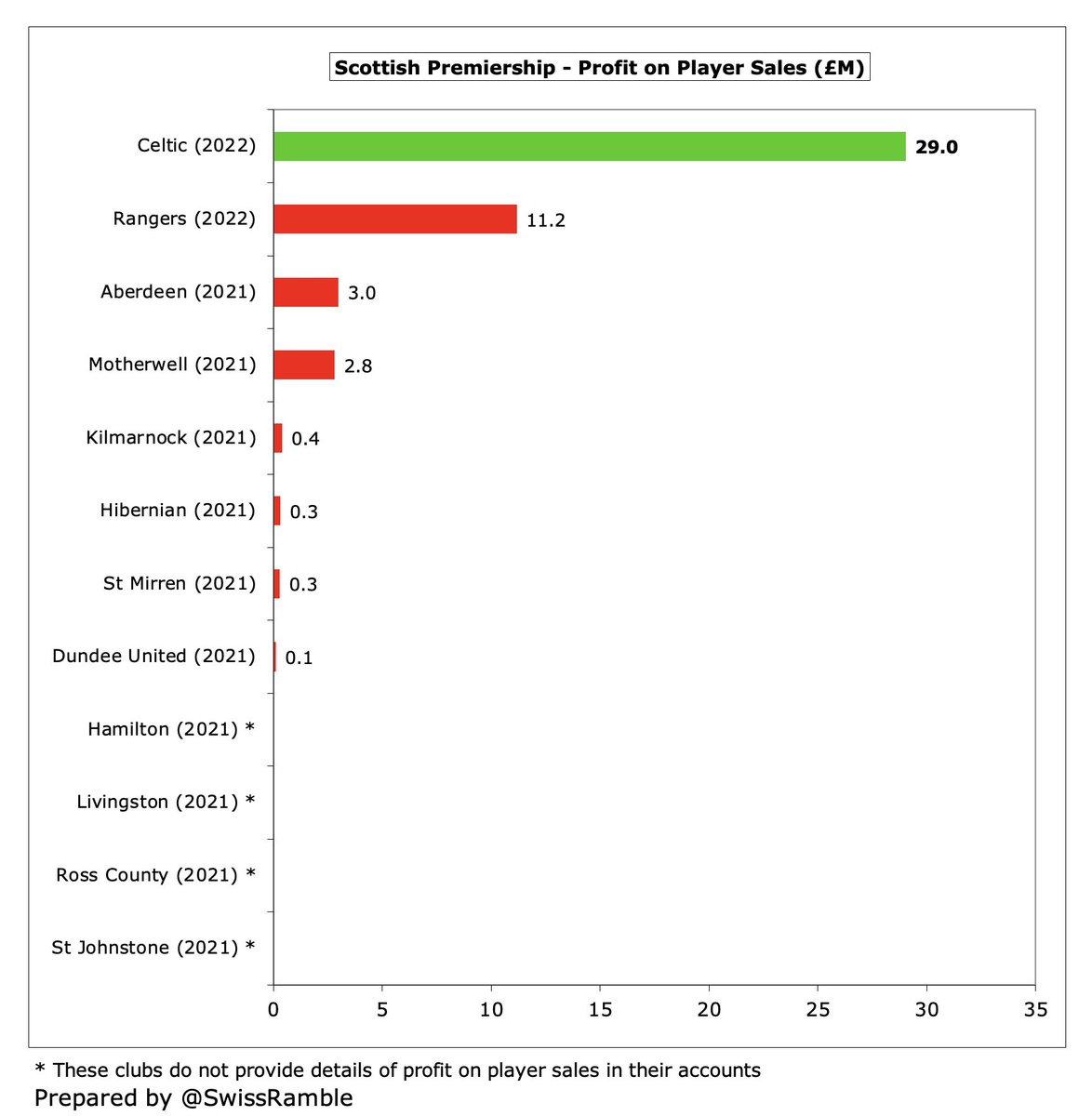

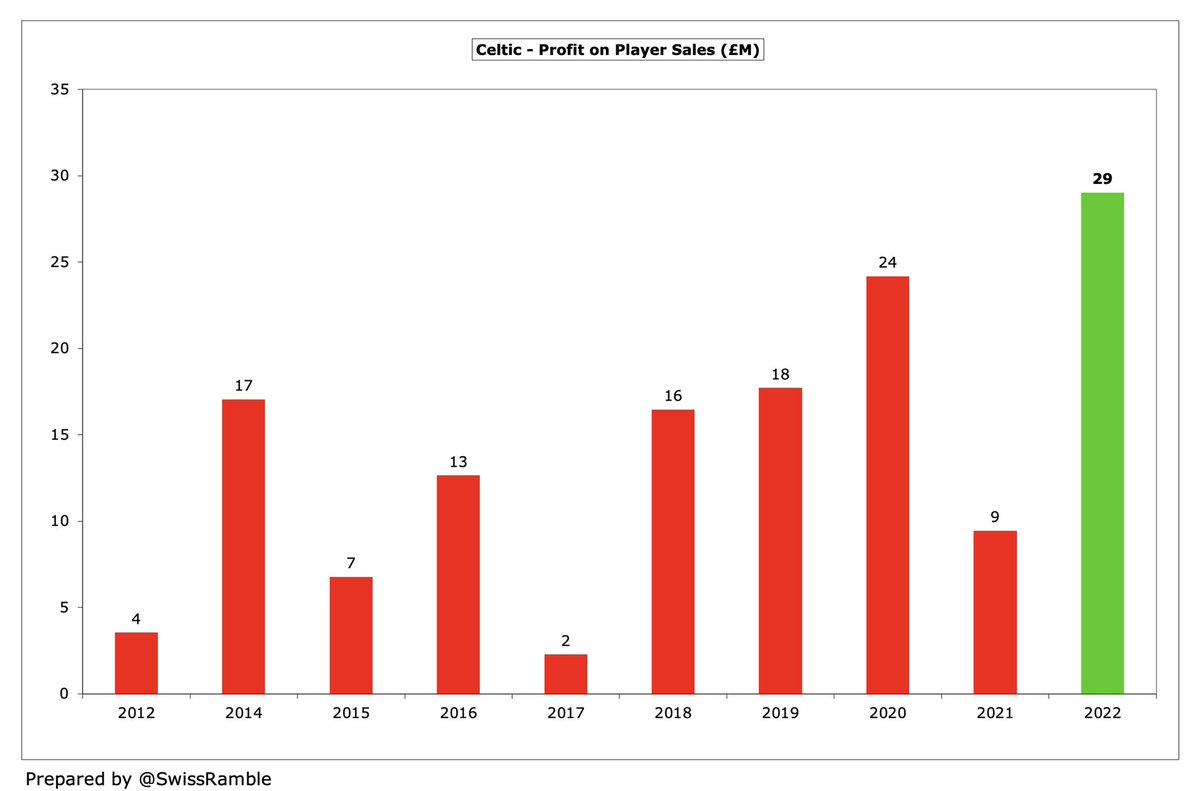

#CelticFC were also boosted by club record £29m profit on player sales, up from £9m, mainly Odsonne Eduoard to #CPFC, Kristoffer Ajer to Brentford and Ryan Christie to #AFCB. Nearly three times as much as Rangers £11m.

#CelticFC have posted profits six times in the last seven years, the one exception being the COVID-impacted loss in 2020/21. Over the last decade they have generated £48m profits.

#CelticFC player trading is “fundamental” to their self-sustaining business model with an impressive £97m profits delivered in the last five years. As Postecoglou noted, this is “part of the process of bridging the financial gap that exists with other clubs.”

#CelticFC have made their largest ever player sales in the last five years, including Kieran Tierney to #AFC £24m and Moussa Dembelé to Olympique Lyonnais £20m. That said, very few big money sales have been made this season.

Profits from player sales have made a big difference to #CelticFC bottom line. As a result, in the last 10 years they have generated £141m profit from player trading, compared to just £19m in the same period for Rangers.

#CelticFC operating loss (i.e. excluding player sales) widened from £21m to £23m, the worst in Scotland, and more than four times as much as Rangers £5m. The last time that Celtic managed to post an operating profit was 2018 – and that was only £2m.

#CelticFC revenue has fallen £13m (13%) from the £102m peak four years ago, though 2021/22 £88m is the club’s second highest ever. The decline is due to failing to qualify for the Champions League, partly offset by commercial growth.

#CelticFC have enjoyed a substantial revenue advantage over their rivals Rangers in recent times, but the gap has narrowed over the last five years from £69m in 2018 to just £1m in 2022 (Celtic £88m vs. Rangers £87m).

Of course, the big two Glasgow clubs generate significantly more revenue than the rest of the Scottish Premiership. So #CelticFC £88m and Rangers £87m are miles higher than third highest Aberdeen £11m, followed by Hibernian £9m and St Mirren £4m (impacted by COVID in 2021).

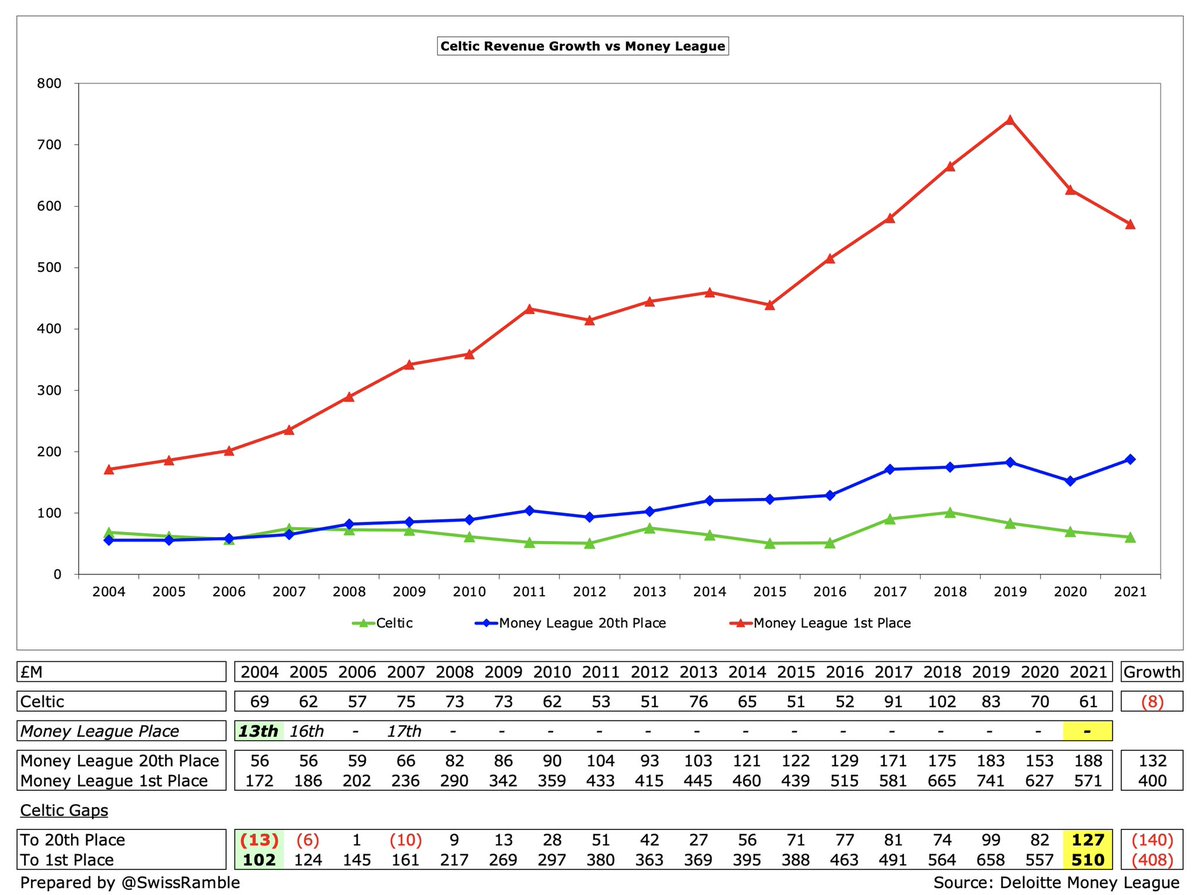

However, as Postecoglou said, “The reality in the Scottish Premiership is we’ll never have the finances to compete with teams in the Champions League.” This is highlighted by their £61m revenue in 2020/21 being far below the £145m required to be in Deloitte Money League Top 30.

This might seem like a spurious comparison, but the fact is that in 2004 #CelticFC were placed as high as 13th in the Money League. Since then, their revenue has hardly moved, while the club in 20th place has increased by £132m and the top club by £400m (higher pre-COVID).

To further emphasise the point, Norwich City, the club that finished last in the Premier League, had £134m revenue, £46m more than #CelticFC £88m, even though they were behind in both match day and commercial, as they received £102m from the lucrative PL broadcasting deal.

#CelticFC broadcasting revenue increased £2m (18%) from £11m to £13m, due to better performance in the Scottish Premiership and higher prize money in the Europa League. However, this was a lot lower than the club’s £34m peak in 2018 and Rangers £24m last season.

The SPFL has not published details of TV distributions for 2021/22, but #CelticFC only received £5m for winning the title according to various media reports. The current Sky Sports TV deal is only worth around £29m a year (including Cinch sponsorship).

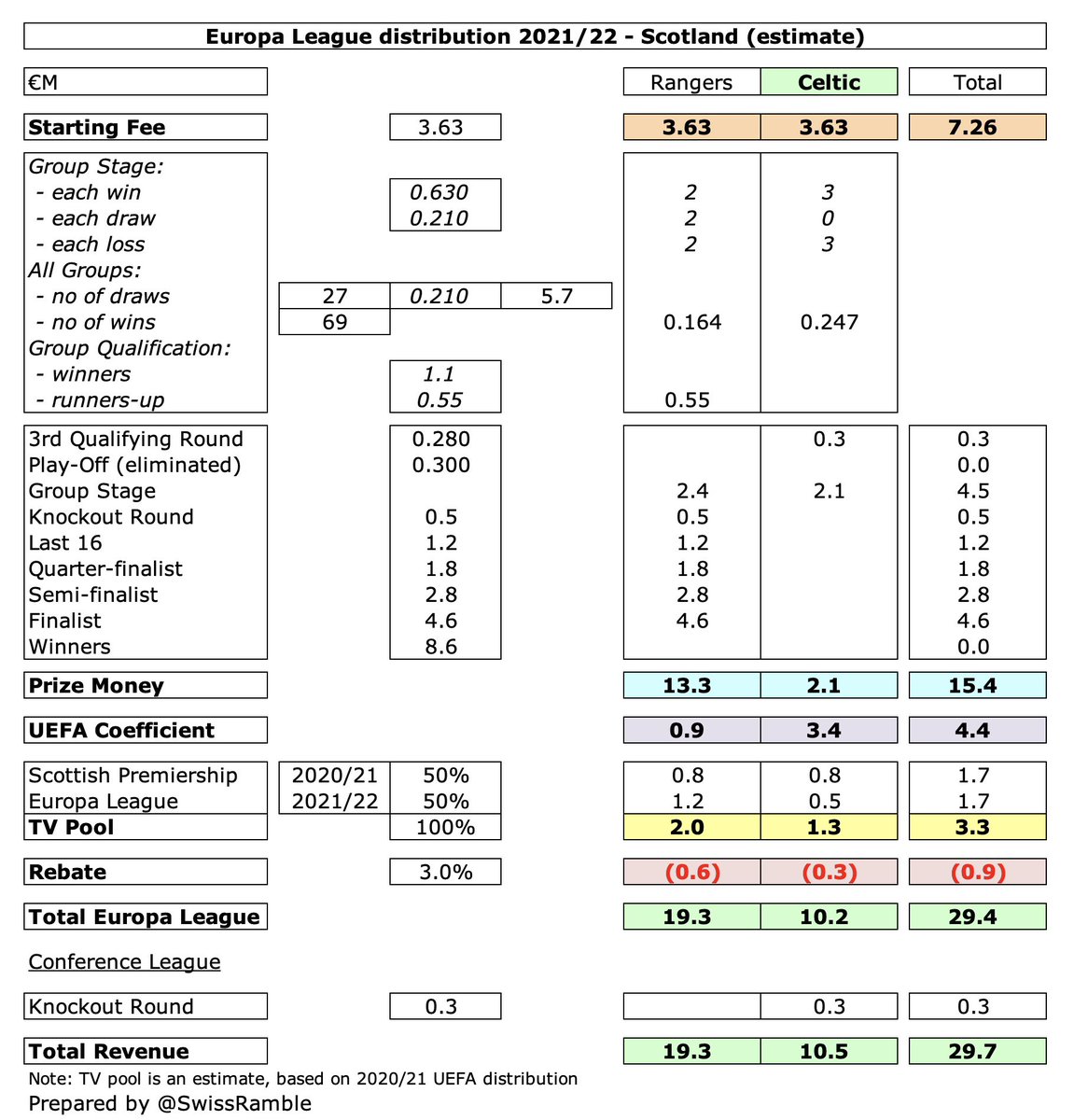

Based on my estimate, #CelticFC earned €10.9m from Europe in 2022: €10.2m from Europa League group stage, €0.4m Champions League qualifying and €0.3m Europa Conference. This was €2.3m more than prior season €8.6m, due to the new UEFA TV deal.

European qualification is extremely important for #CelticFC, who have earned €75m from Europe in last 5 years, which is €27m more than Rangers, though their rivals have earned more in each of the last 2 seasons (including reaching the Europa League final in 2021/22).

The Champions League is the real differentiator with Celtic receiving an estimated €29m in 2022/23, which was €9m more than Rangers €20m, largely due to a better UEFA coefficient, €9.1m vs €2.3m, based on performances in Europe over last 10 years.

The good news is that the improvement in Scotland’s UEFA coefficient means that the Premiership champions automatically qualify for the Champions League group stage. The expansion of the competition to 36 teams in 2024/25 will also help #CelticFC prospects.

#CelticFC match day income more than doubled from £21m to £43m, as stadium returned to full capacity for all but 5 matches where crowd restrictions remained. All games were played behind closed doors in the previous season, though fans’ generosity limited the damage.

#CelticFC £43m match day income was just above Rangers £42m and has returned to the levels before the pandemic struck. In a normal season (excluding COVID impact) the next highest in Scotland would be only around £5-6m.

#CelticFC average attendance in 2021/22 was 56,177, nearly 11,000 more than Rangers 45,314, followed by Hearts 15,723, Hibernian 15,043 and Aberdeen 11,608. The 52,000 season ticket sales “exceeded all expectations”, given uncertainty about stadium attendance.

Match day income is particularly important for Scottish clubs, given the low TV deal, accounting for nearly half (49%) of #CelticFC revenue. This is in stark contrast to English clubs, e.g. we can again compare with Norwich City, where match day was only worth 8%.

#CelticFC commercial revenue rose £3m (11%) to club record £32m, mainly due to higher retail sales, thanks to a “more normalised trading environment”. By far the highest in Scotland, well ahead of Rangers £20m, though they report their merchandising sales net of costs.

#CelticFC 5-year kit deal with Adidas started in July 2020 and is reportedly worth £5-6m a year. The Dafabet shirt sponsorship, described as “the most lucrative sponsorship agreement in Scottish football history”, has been extended to June 2025.

#CelticFC did not have any Other Operating Income, unlike the previous year, when they included £5m for Business Interruption coverage, i.e. compensation for matches played behind closed doors. Rangers £5.2m includes £4.3m compensation for Steven Gerrard’s move to #AVFC.

#CelticFC wage bill rose £7m (14%) from £52m to £59m, only slightly lower than the club’s high in 2018. Wages have remained in a relatively narrow range of £52m to £59m over the last six years.

#CelticFC wage bill rose £7m (14%) from £52m to £59m, only slightly lower than the club’s high in 2018. Wages have remained in a relatively narrow range of £52m to £59m over the last six years.

#CelticFC wages to turnover ratio decreased (improved) from 85% to 67%, but still higher than 58% in 2018. However, this is still better than Rangers 77%. Other clubs’ ratios are from 2020/21, so were inflated by the impact of COVID on revenue.

#CelticFC player amortisation, the annual cost of writing-off transfer fees, increased by £1m (10%) to £13m, so has nearly tripled in six years from £5m in 2016. This is just above Rangers £12m, while all other clubs less than £1m. Also booked £6m player impairment.

#CelticFC spent £38m on player purchases in 2021/22 after Postecoglou’s arrival, easily a club record, including Jota, Carter-Vickers, Furuhashi, Starfelt, Bernabei, Abada, Juranovic, Giakoumakis, O’Riley, Hatate and Hart. The gross outlay in the last 5 years was £95m.

As a result, #CelticFC £38m player purchases in 2021/22 were far higher than Rangers £8m, though both clubs spent significantly more than the rest of the Premiership combined. However, few acquisitions this season with Haksabanovic being the main arrival.

#CelticFC gross debt decreased from £4.1m to £2.5m, comprising £1.7m Co-operative bank loans (LIBOR + 3%) plus £0.9m finance leases. Club has a revolving credit facility of £13m as a buffer, but that had not been utilised at the date of the accounts.

#CelticFC £2.5m debt is small, even by Scottish standards, and is a long way below Rangers £16.9m, which would have been even higher without them converting £66m of loans into shares in the last four seasons. Note: Celtic’s figure excludes £4.2m convertible preference shares.

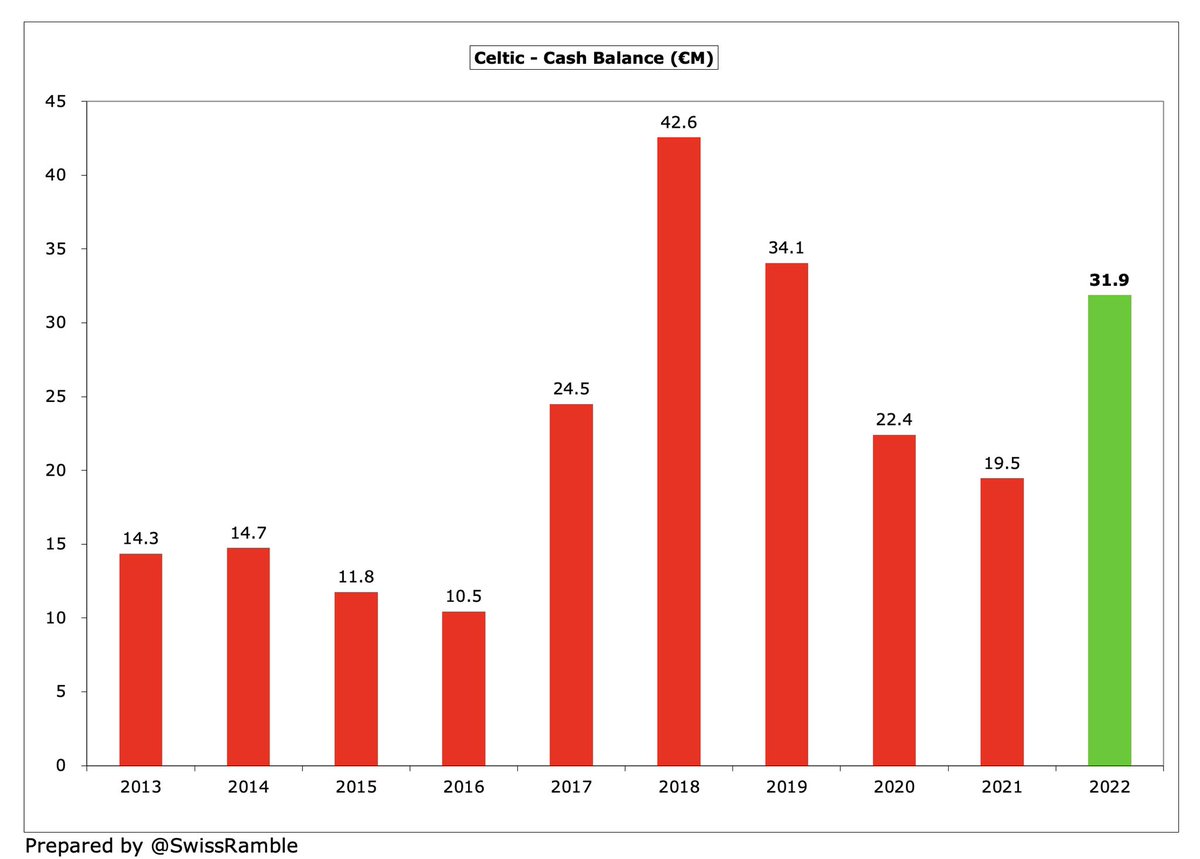

After adding back non-cash items and working capital movements, #CelticFC had £10m operating cash flow, boosted by £26m player sales. Club then spent £21m on player purchases and £1m on infrastructure, repaid £2m loans and paid £0.5m dividends.

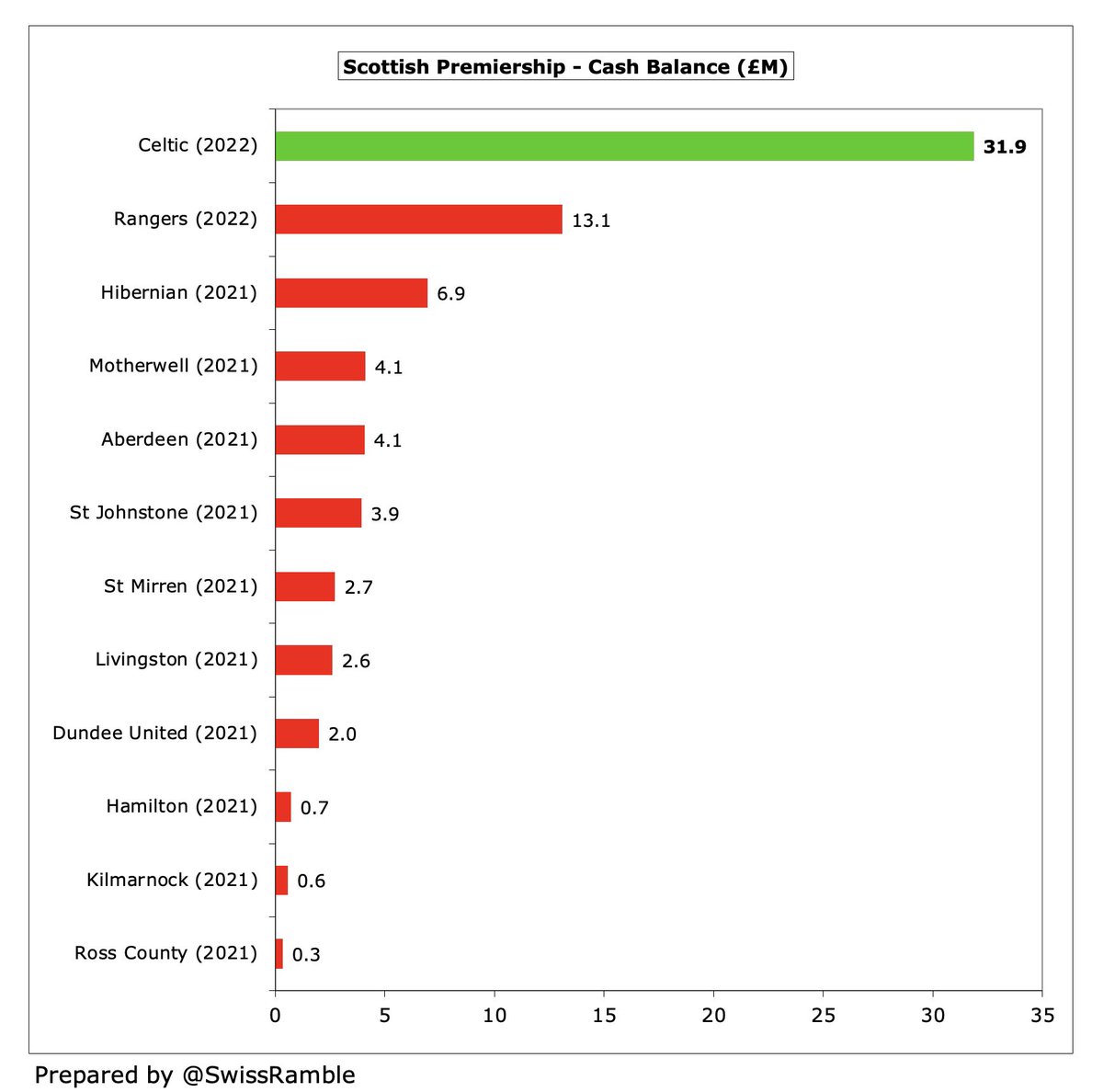

As a result, #CelticFC had £12.4m net cash inflow, so cash balance rose from £19.5m to £31.9m, though largely due to the late timing of season ticket sales in the summer of 2021. By far the highest in Scotland, a long way above Rangers £13.1m.

Over the last 10 years #CelticFC have had £64m available cash, entirely generated from their operations and net player sales. Highest expenditure: infrastructure £20m, debt repayment £12m, dividends £5m, tax £4m and interest £1m. Bank balance increased by £24m.

Comparing #CelticFC cash flow with Rangers in the last 10 years, we can see a big difference in approach. Celtic have made much more money from operations and player sales, which Rangers nearly matched via £78m loans and £38m share capital.

#CelticFC are in good shape financially, despite the pandemic, thanks to their sustainable approach, though this owes a lot to their player trading model. Champions League qualification is also important, so the expanded format should help future prospects.

• • •

Missing some Tweet in this thread? You can try to

force a refresh