1/14 How we identified blocks containing MEV both pre and post-merge for our submission to the Ethereum Merge Data Challenge.

🧵👇

#Ethereum #EthereumMerge #MEV

🧵👇

#Ethereum #EthereumMerge #MEV

2/14 One aspect of the merge was the introduction of Flashbots' mev-boost, this is a first implementation of proposer builder separation (PBS) and has resulted in a clearly defined and structured method for including MEV opportunities within blocks.

3/14 This has also created new methods of identifying MEV from on-chain data.

Ethereum's execution clients tend to pack transactions in blocks by ordering them by gas price and including the transactions with the highest gas price first.

Ethereum's execution clients tend to pack transactions in blocks by ordering them by gas price and including the transactions with the highest gas price first.

4/14 However, pre-merge, Flashbots had implemented a way in which bundles of transactions could be submitted to a miner to be included in a block.

5/14 This enabled "searchers" to find and extract MEV opportunities by including their own transactions along with mempool transactions in a bundle.

Miners would then include these bundles at the start of the block.

Miners would then include these bundles at the start of the block.

6/14 Therefore, pre-merge, one of the best ways to identify MEV in a block was to see if the transactions were not ordered by gas price, as this would allude to the inclusion of MEV bundles.

7/14 This method was far from perfect. False positives were caused by execution clients using different ordering methods and false negatives were missed due to alternative methods for including MEV. e.g. MEV bots tuning the gas price of their transactions in the mempool.

8/14 Post-merge, MEV "builders" collect together bundles of transactions into a block and use "relays" to transmit these blocks to the mev-boost software running on Ethereum validators’ nodes which then propose the block.

9/14 As the proposers expect payment for the inclusion of a block, builders generally include a final transaction that sends most of the block's fees and MEV to the proposer's fee recipient address.

10/14 This gives us two new methods for identifying MEV: 1) checking if the final transaction in a block is from the block's (/builder's) fee recipient address and to the proposer's fee recipient address. 2) using the relays' API which returns included blocks.

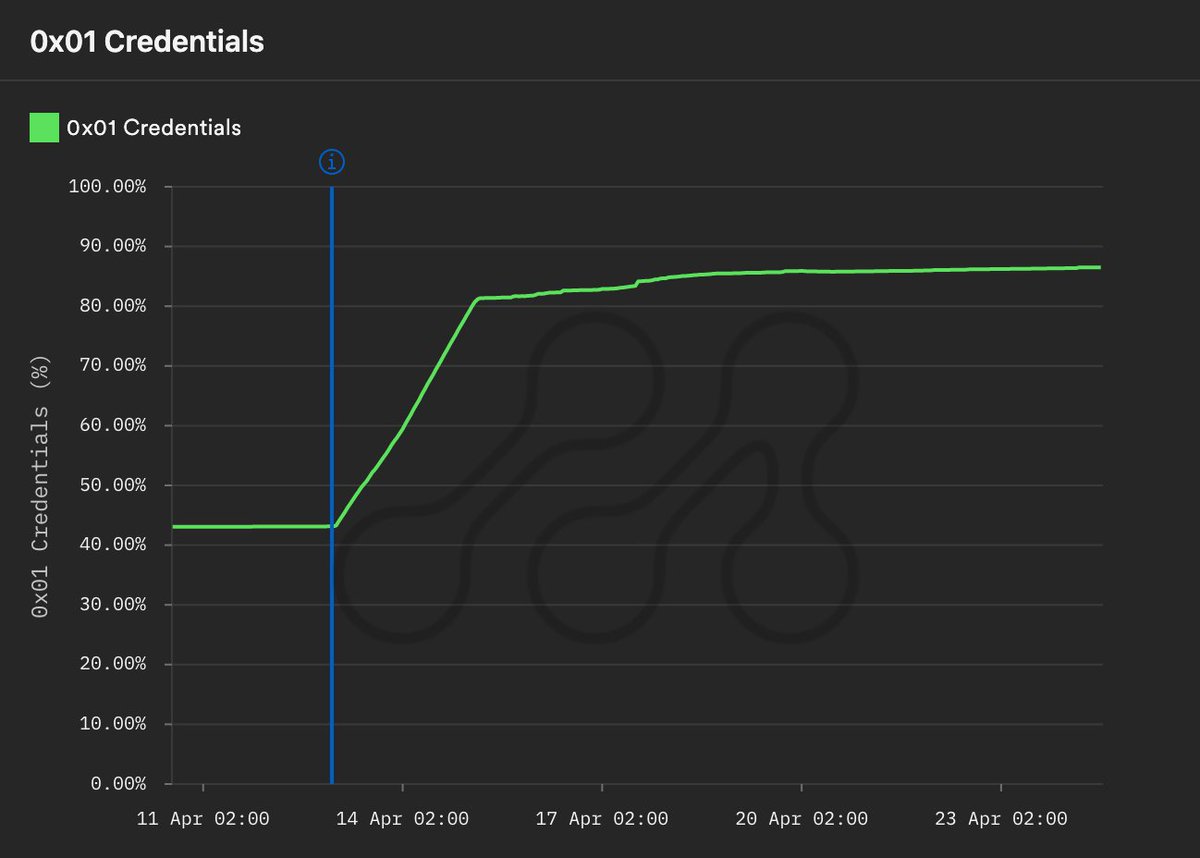

11/14 We plotted % of MEV blocks per hour against time for these three identification methods, a month either side of the merge.

12/14 The transaction ordering method showed ~80% MEV pre-merge and ~40% post-merge, increasing to ~60%. The other two post-merge methods were very closely correlated, increasing from ~20% to ~50% and beginning to converge with the transaction ordering method.

13/14 The transaction ordering method was likely higher due to the aforementioned false positives, and we hypothesized that the conversion was due to more MEV bots using MEV builders for transaction inclusion, so the other two methods captured a larger proportion of total MEV.

14/14 It's worth noting that a more accurate yet involved method for identifying MEV may be to look at the balance changes of proposers' fee recipient addresses.

@metrikaco's blog post submission for the data challenge can be found here: medium.com/@metrikaco/val…

We're also working on bringing visibility to MEV and Relays which will be out very soon. Make sure to follow us to be the first to know about it.

We're also working on bringing visibility to MEV and Relays which will be out very soon. Make sure to follow us to be the first to know about it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh