Are we potentially facing "Austerity 2.0" in the #AutumnStatement because of the fallout from the #MiniBudget?

Or is it because of economic forces beyond the UK, such as the energy crisis and rising *global* interest rates?

Explanatory chart thread 🧵...1/

Or is it because of economic forces beyond the UK, such as the energy crisis and rising *global* interest rates?

Explanatory chart thread 🧵...1/

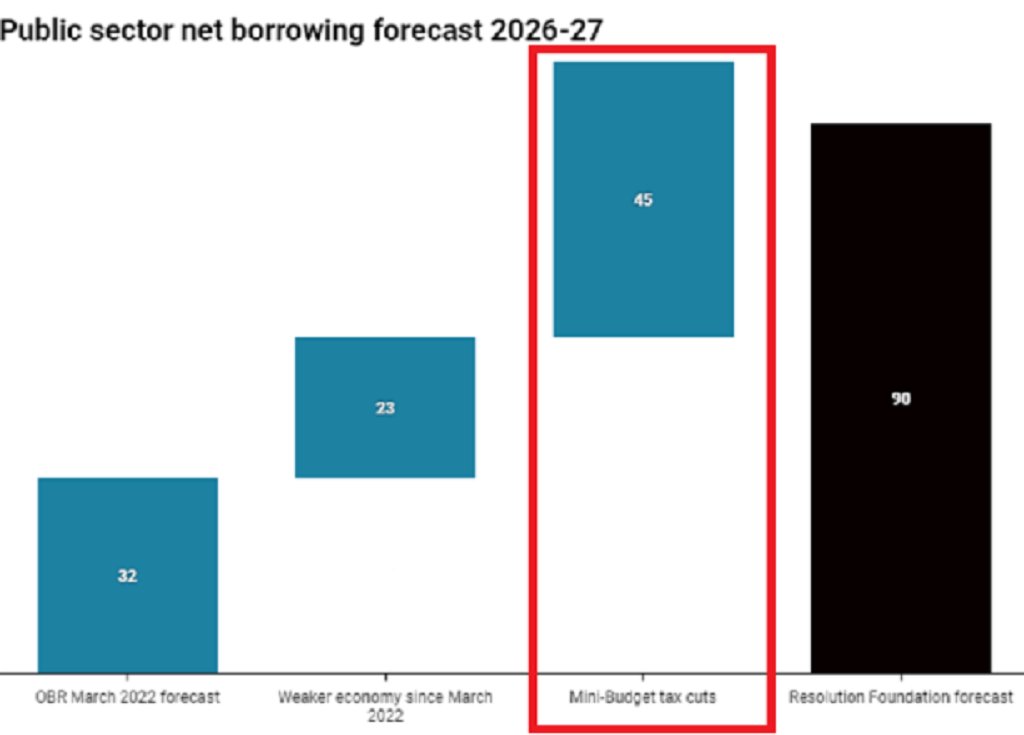

...To attempt an answer, go back to the last set of official forecasts we had from the @OBR_UK back in March.

The government was then projected to be borrowing around £32bn in 2026-27 (the final year of the forecast period) and to be *meeting* its fiscal rules...2/

The government was then projected to be borrowing around £32bn in 2026-27 (the final year of the forecast period) and to be *meeting* its fiscal rules...2/

...The @resfoundation (similar to other forecasters) now expects borrowing in that year to be around £90bn and for the government to *break* its fiscal rules.

So what’s driving that £58bn projected increase in borrowing?...3/

So what’s driving that £58bn projected increase in borrowing?...3/

...A weaker economy will add around £23bn to this borrowing - note that’s *not* related to the Mini-Budget but rather the Russian invasion of Ukraine and the inflation crisis it’s helped to unleash...4/

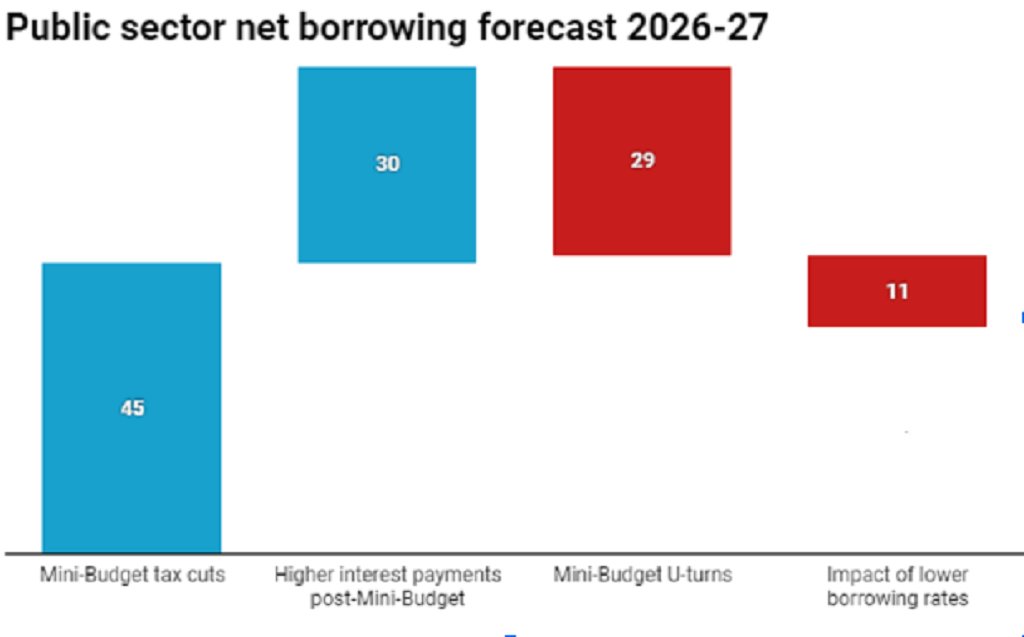

...But then we do have the projected impact of those Mini-Budget tax cuts in September, which added £45bn to projected annual borrowing in the medium term...5/

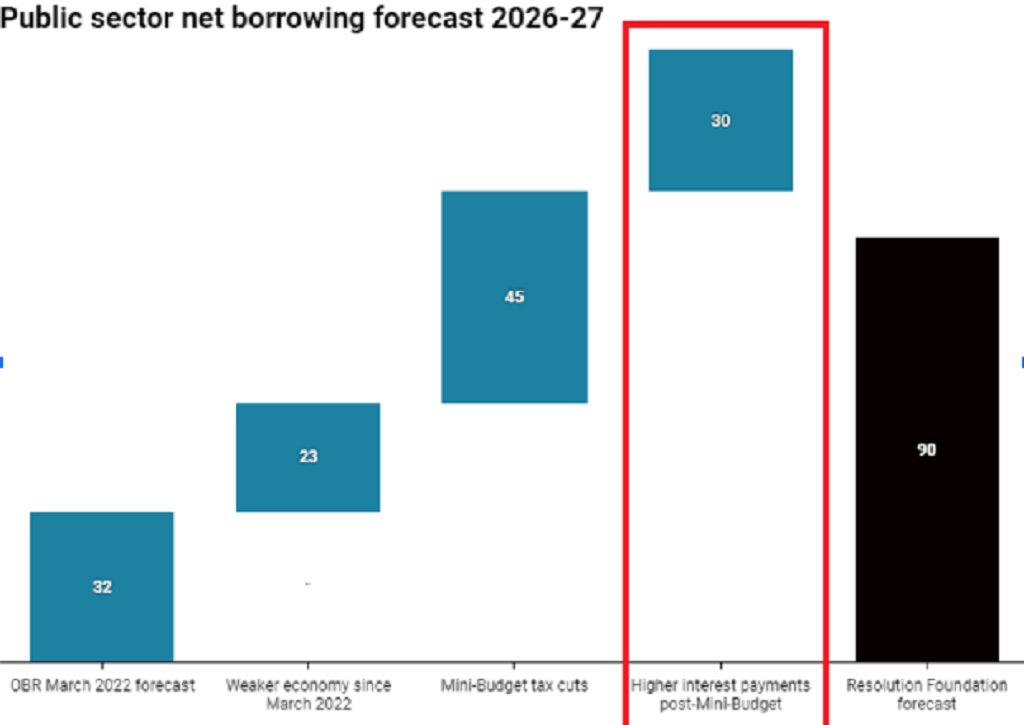

...And remember that spike in UK government market borrowing costs that followed the Mini-Budget?

That initially added another £30bn to projected borrowing...6/

That initially added another £30bn to projected borrowing...6/

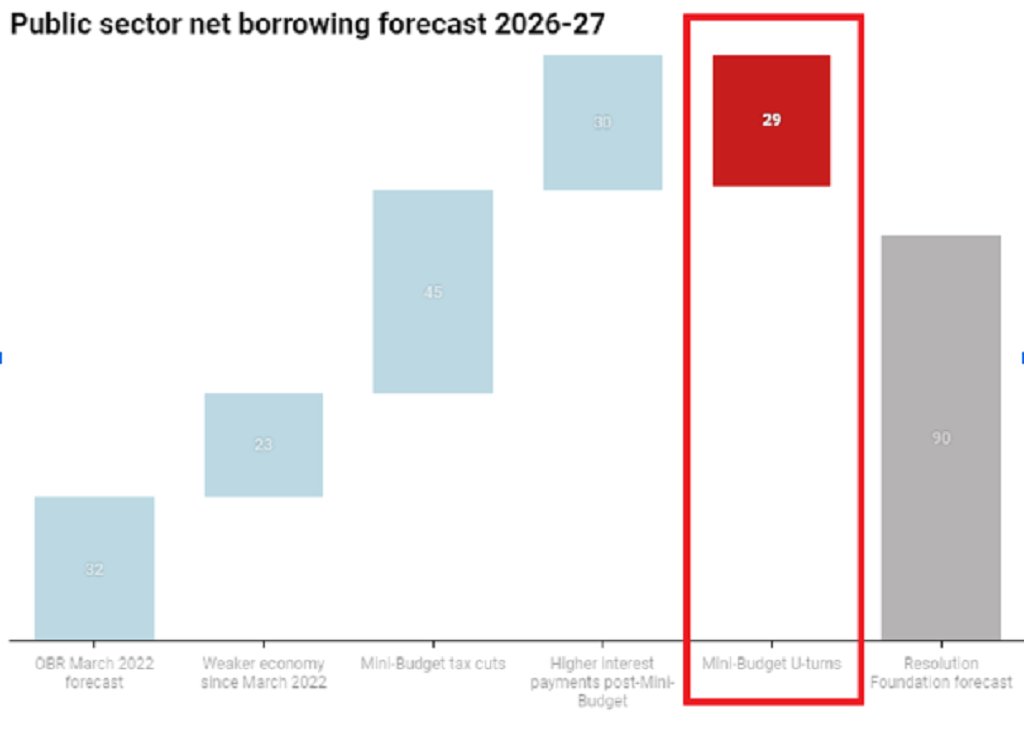

...Of course, we’ve since had U-turns on most, though not all, of those Mini-Budget tax cuts.

Around £29bn of the £45bn total has been cancelled...7/

Around £29bn of the £45bn total has been cancelled...7/

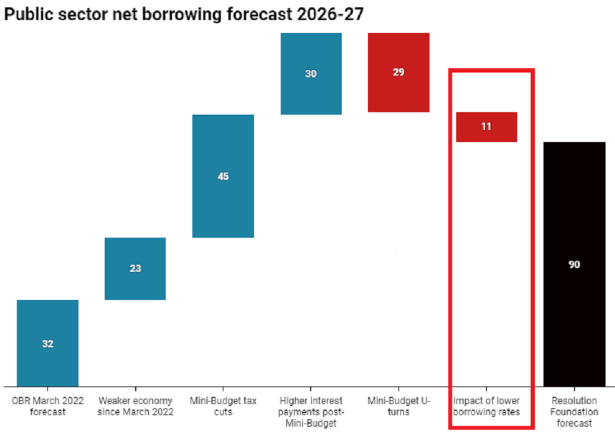

...And market borrowing costs have fallen, taking around £11bn of projected government borrowing in that year.

Which leaves us with the final £90bn borrowing projection...8/

Which leaves us with the final £90bn borrowing projection...8/

...Let’s drill down and try and see if we can isolate the Mini-Budget impact on the extra borrowing.

We can see here the positive fiscal impact of the tax cuts and the initial impact on borrowing costs…9/

We can see here the positive fiscal impact of the tax cuts and the initial impact on borrowing costs…9/

...and then the negative fiscal impact of the tax cut U-turns and the fall in market borrowing costs...10/

...Which leaves an estimated impact on additional borrowing in 2026-27 of around £35bn roughly attributed (by some) to the Mini-Budget...11/

...And this is in the context of £50-60bn/year of spending cuts/tax rises which the Treasury has indicated it is planning for in the #AutumnStatement...12/

ft.com/content/133589…

ft.com/content/133589…

...Now, this is just one estimate based on various assumptions and projections which analysts disagree over.

For instance, some argue UK market borrowing costs were likely to rise dramatically anyway, even if there had been no #MiniBudget...

capx.co/is-liz-truss-r…

13/

For instance, some argue UK market borrowing costs were likely to rise dramatically anyway, even if there had been no #MiniBudget...

capx.co/is-liz-truss-r…

13/

...And, remember, the #AutumnStatement decisions are being driven by the Government’s chosen fiscal rules for borrowing to be falling as a share of GDP in five years’ time - it could potentially choose a different rule... 14/

https://twitter.com/BenChu_/status/1591050032660492288?s=20&t=OrE4P1PS74gDKr6P94kmsg

...Yet the big picture is that, while we can debate the precise figures, the UK’s public finances are weaker, at least partly, as a result of the Mini-Budget - and making them stronger - over whatever time period - will come at a price...15/

...And, perhaps the key point is that the violent market reaction to the Mini-Budget (see below) is making the Government - rightly or wrongly - feel it must act decisively now to put the public finances on a sustainable trajectory in order to retain market credibility...16/

#Newsnight explainer here 👇

https://twitter.com/BBCNewsnight/status/1592515172953772032?s=20&t=K9Hg6IYc3E67HuF0y8jglQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh