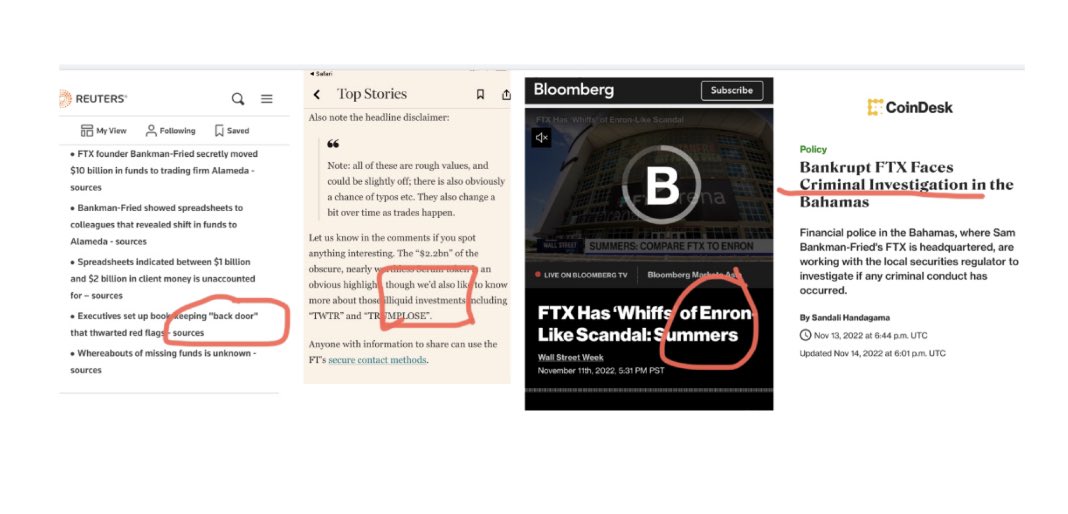

Word count NYT's puff piece on SBF:

"Fraud": 0

"Enron": 0

"Crime": 0

"Illiquid": 0

"Stolen": 0

"Hidden": 0

"Criminal": 0

"Back door": 0

"He's getting sleep": 1

"Fraud": 0

"Enron": 0

"Crime": 0

"Illiquid": 0

"Stolen": 0

"Hidden": 0

"Criminal": 0

"Back door": 0

"He's getting sleep": 1

Then the NYT puff piece ends with a note on the cryptic thread, which SBF says "I'm making it up as I go."

It may actually be a ruse -- he adds one tweet after deleting an old incriminating tweet -- so as to fool tweet bot counters:

It may actually be a ruse -- he adds one tweet after deleting an old incriminating tweet -- so as to fool tweet bot counters:

https://twitter.com/ercwl/status/1592334689335144448?s=20&t=r-3NsCKQlXNXfa8Tk1-5kw

Conversely, I started with my FTX wrap with the words “criminal financial engineering f**kery” in the 2nd paragraph.

🔗 trungphan.substack.com/p/ftx-the-32b-…

🔗 trungphan.substack.com/p/ftx-the-32b-…

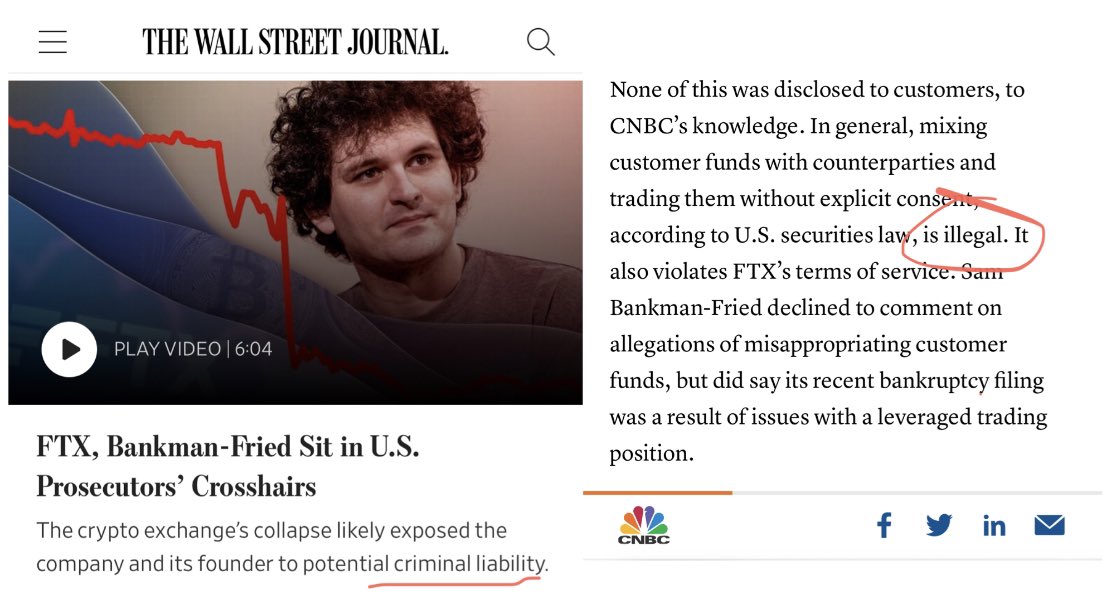

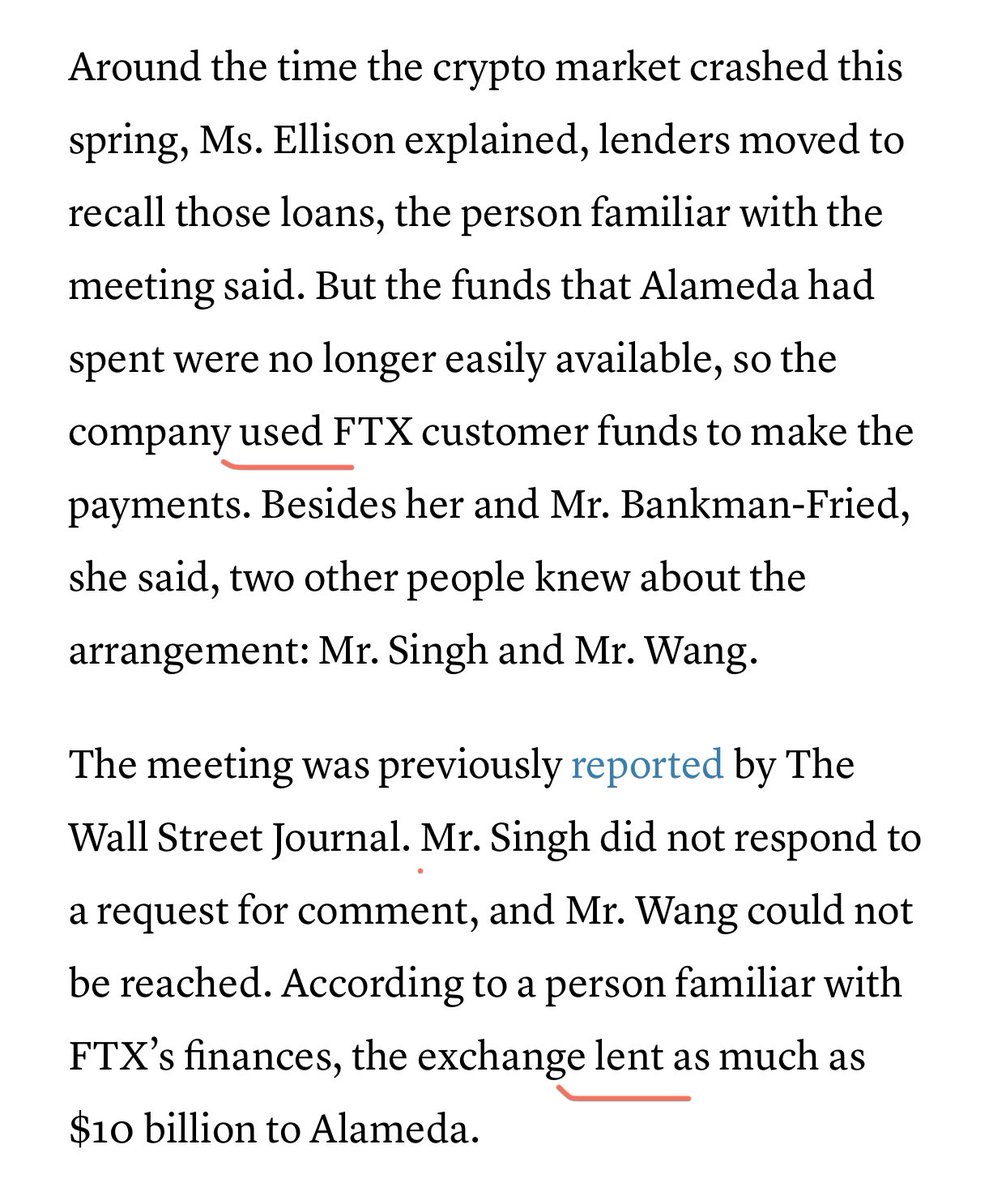

In NYT article, Alameda CEO admits to misappropriating FTX customer deposits.

Per FTX Terms of Service, the deposits are not FTX’s to use…and FTX can’t loan it.

NYT writes it up FTX “used” and “lent” deposits. Think the appropriate words are: “wire fraud”, “stole”, “theft”.

Per FTX Terms of Service, the deposits are not FTX’s to use…and FTX can’t loan it.

NYT writes it up FTX “used” and “lent” deposits. Think the appropriate words are: “wire fraud”, “stole”, “theft”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh