1/ #RippleSwell läuft in vollen Touren & es dreht sich mal wieder alles nur um #XRP 😉👀

Folgende Neuigkeiten wurden heute veröffentlicht:

• $30 Milliarden Bezahlungen durchgeführt (#RippleNet–Fiat+#Crypto)

• #ODL/#XRP Partnerschaft mit @MFS_Africa ($2,7 Billionen Markt 🤯)

Folgende Neuigkeiten wurden heute veröffentlicht:

• $30 Milliarden Bezahlungen durchgeführt (#RippleNet–Fiat+#Crypto)

• #ODL/#XRP Partnerschaft mit @MFS_Africa ($2,7 Billionen Markt 🤯)

https://twitter.com/bgarlinghouse/status/1592922300252585984

2/

• 90% des FX/#Forex-Markts (#Devisenmarkt) sind mittlerweile mit #OLD/#XRP abgedeckt

• 19+ Partner/Kunden sind von Fiat ("xCurrent") auf ODL geupgraded/umgestiegen

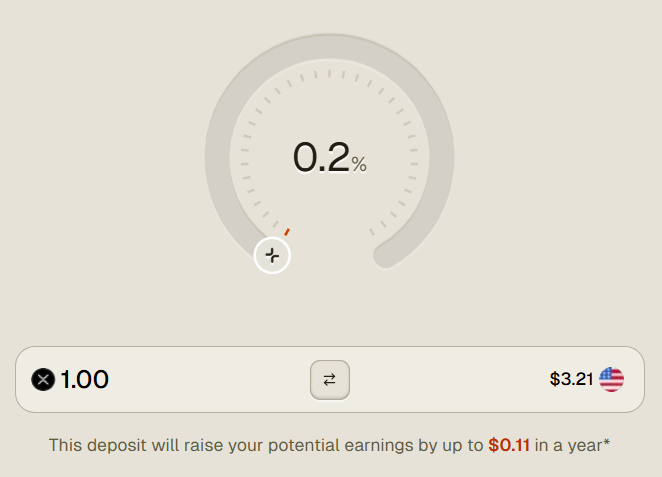

• @realsupermojo nutzt Liquidity Hub um ETH zu beschaffen

... Was? ...

🔥🔥 LIQUIDITY HUB IST LIVE! 🔥🔥

• 90% des FX/#Forex-Markts (#Devisenmarkt) sind mittlerweile mit #OLD/#XRP abgedeckt

• 19+ Partner/Kunden sind von Fiat ("xCurrent") auf ODL geupgraded/umgestiegen

• @realsupermojo nutzt Liquidity Hub um ETH zu beschaffen

... Was? ...

🔥🔥 LIQUIDITY HUB IST LIVE! 🔥🔥

$2,7 Billionen sind $2.700.000.000.000 🤯

• • •

Missing some Tweet in this thread? You can try to

force a refresh